Types of Insurance

advertisement

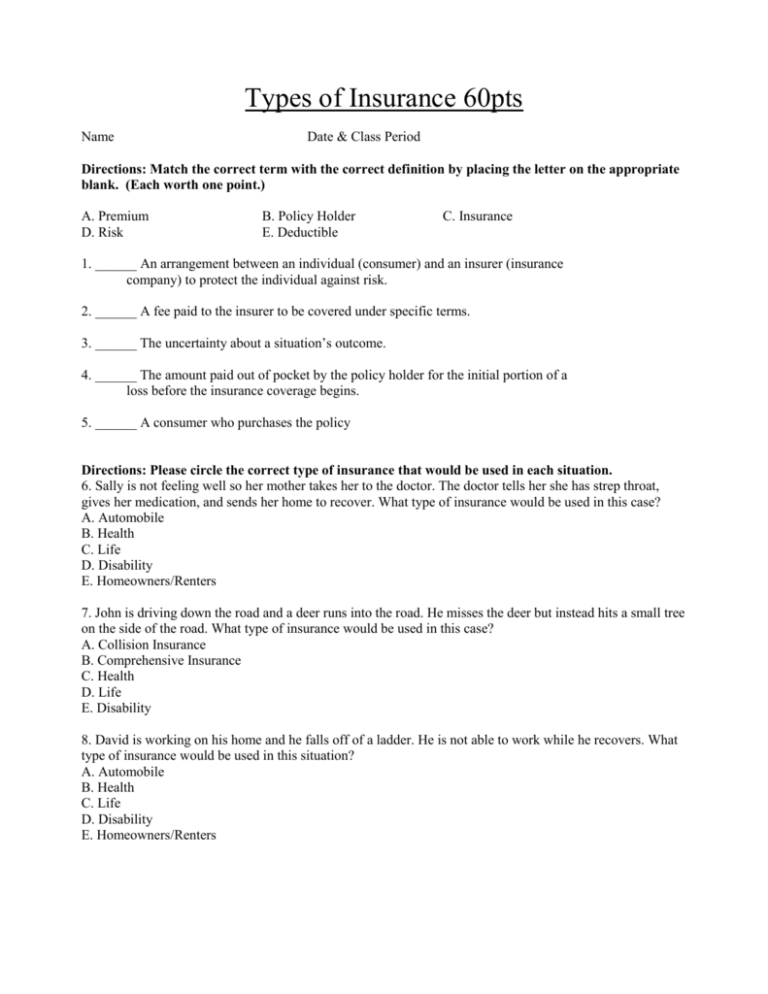

Types of Insurance 60pts Name Date & Class Period Directions: Match the correct term with the correct definition by placing the letter on the appropriate blank. (Each worth one point.) A. Premium D. Risk B. Policy Holder E. Deductible C. Insurance 1. ______ An arrangement between an individual (consumer) and an insurer (insurance company) to protect the individual against risk. 2. ______ A fee paid to the insurer to be covered under specific terms. 3. ______ The uncertainty about a situation’s outcome. 4. ______ The amount paid out of pocket by the policy holder for the initial portion of a loss before the insurance coverage begins. 5. ______ A consumer who purchases the policy Directions: Please circle the correct type of insurance that would be used in each situation. 6. Sally is not feeling well so her mother takes her to the doctor. The doctor tells her she has strep throat, gives her medication, and sends her home to recover. What type of insurance would be used in this case? A. Automobile B. Health C. Life D. Disability E. Homeowners/Renters 7. John is driving down the road and a deer runs into the road. He misses the deer but instead hits a small tree on the side of the road. What type of insurance would be used in this case? A. Collision Insurance B. Comprehensive Insurance C. Health D. Life E. Disability 8. David is working on his home and he falls off of a ladder. He is not able to work while he recovers. What type of insurance would be used in this situation? A. Automobile B. Health C. Life D. Disability E. Homeowners/Renters Directions: Answer the following questions by writing a short answer. 9. Explain the difference between collision and comprehensive automobile insurance and give an example when each would be used. (6 points) 10. When is life insurance necessary? (2 point) 11. Explain the difference between homeowner’s insurance and renter’s insurance and identify when each would be used. (8 points) 12. Is insurance important? Support your answer with at least two reasons. (5 points) 13. What type of insurance would you consider the most important and why? (4 points) Directions: Please indicate if the following statements are true or false by placing a T or F on each line. If the statement is false, rewrite the statement to make it true. (Each question is worth 1 point.) 14. ______ Medical payment insurance covers injuries sustained by the driver or passengers of the insured vehicle if it is only someone else’s fault. 15. ______ A beneficiary is the individual who takes out the life insurance policy. 16. ______ A dependent is a person who relies on someone else financially. Directions: Write the word which is described by the following statements in the spaces provided. The number of blanks corresponds to the number of letters each word contains. 1. Amount paid out of pocket by policyholder for the initial portion of a loss before the insurance company pays. __________ 2. Protection for a dwelling against perils like fire and lightning. __________ 3. Accident, theft, damage, destroyed, unexpected. 4. Fee paid to the insurer to be covered under the specified terms. ____ _______ 5. Many high school participants are covered under their parents for this type of insurance. _ _ _ _ _ _ 6. Consumer who purchased the policy. ____________ 7. People must have this type of insurance to drive their vehicle. __________ 8. Contract between the individual and an insurer specifying the terms of the insurance. ______ 9. Title of people receiving money from a life insurance policy after the insured person dies. ___________ 10. Arrangement between an individual and an insurer for protection against risk. 11. Insurance which helps to provide income during an illness or injury. _________ __________ 12. Unnecessary insurance for high school participants with no financial dependents. ____