Working Capital Finance

Working Capital Finance

By Jignesh Mehta,

B. COM, ACA & LCS.

Mobile No. 9699490918 .

Contents

Definition

Operating cycle of a manufacturing unit

AS – 2 – Valuation of Inventories

Classification of Current Assets and Current Liabilities

CMA data & Do’s and Don’ts

Assessment of working capital requirements

Methods for assessment of WC requirements

Forms of FB and NFB limits

Ratio Analysis and Holding levels of operating cycle items

Cash Flow and Fund Flow Statements

Security Creation and Perfection of security

Credmin documents

Early Warning Signals and Remedial Action.

Definition

The amount of current assets that is in excess of current liabili ties. Working capital is frequently used to measure a firm’s ability to meet current obligations. A high level of working capital indicates significant liquidity available with the firm.

Operating Cycle of a manufacturing unit

RM

Cash SFG

Receivables FG

AS – 2 :- Valuation of Inventories

Valuation of Inventories:

Inventories (include RM, WIP and Finished Goods) are valued at cost of net realisable value whichever is lower.

Cost of Inventories:-

The cost of inventories should comprise of: i. Costs of purchase, ii. Costs of conversion (direct costs like labour and production overhead) and iii. Other costs incurred in bringing the inventories to their present location and condition.

AS – 2 :- Valuation of Inventories (contd..)

Net Realisable Value:-

Inventories are valued on NRV if those inventories are damaged, if they have become wholly or partially obsolete, or if their selling prices have declined.

Methods of Valuation of Inventories:-

FIFO, WAM and Specific Identification of Project costs.

Classification of CA and CL

• An illustrative list of items of Current Assets and Current Liabilities is as under :-

Current Assets:-

I.

Cash and bank balances

II.

Short term Investments

III. Receivables other than outstanding for more than 6 months

IV. RM, WIP and FG

V.

Other consumable spares

VI. Pre-paid expenses and Advance payment of tax

VII. Advances for purchase of raw-materials, components and consumable stores

Classification of CA and CL (contd.)

Current Liabilities:-

I.

Short term borrowings (including bills purchased and discounted in time)

II. Sundry Creditors for RM & consumable stores and spares

III. Unsecured loans

IV. Public deposits maturing within one year

V. Interest and other charges accrued but not due for payment

VI. Advances/progress payments from customers

VII. Deposits from dealers, selling agents, etc.

VIII. Statutory Liabilities like PF dues, Provision for taxation etc.

IX. Proposed dividend, Outstanding expenses, etc.

•

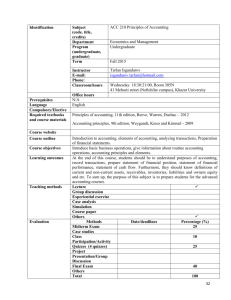

CMA data

Form Purpose and contents

I

II

III

(A&B)

IV

V

VI

Details of the borrower and the WC credit facilities existing and required

Operating Statement (Profit & Loss account restructured and reclassified)

Assets and Liabilities (Balance Sheet items in the sequence preferred by lending Bankers: Liabilities

(form III A) and Assets (form III B)

Holding period of Current Assets and also Trade

Creditors

Computation of MPBF (Maximum Permissible Bank

Finance)

Funds Flow Statement

CMA data - Do’s and Don’ts

• All Short Term / Temporary investments in money market instruments like

Commercial Paper, Certificate of Deposits can be considered as Current

Assets. However, other investments like ICDs (inter Corporate Deposits), investment in listed Shares & Debentures including investment in subsidiaries and associates are to be considered as Non-Current Assets.

• Cash margin for Non-Fund Based limits (like LCs / Guarantees) may be treated as part of current assets for the purpose of MPBF and Current

Ratio.

However, such margin held for Deferred Payment Guarantees should be considered as Non Current Assets.

• Cash required for normal operations of the company only should be considered as part of current assets. Cash / fixed deposits kept with public bodies (telephone, power connection, other security deposits, etc), funds earmarked for any long term purpose, should be classified as noncurrent assets.

• The borrowers are not expected to make the required contribution of 25 per cent from long-term sources in respect of export receivables.

Therefore, export receivables may be included in the total current assets for arriving at the maximum permissible bank finance but the minimum stipulated net working capital may be reckoned after excluding the quantum of export receivables from the total current assets.

CMA data - Do’s and Don’ts (contd)

• If analyst doubts on the recoverability (within 1 year) of any current assets, than also it should be treated as non current assets. Slow moving inventory / obsolete (dead inventory) should be classified as non current assets.

• Debtors exceeding 6 months though part of working capital cycle is conservatively treated as non current assets.

• Advances/progress payments from customer should be classified as current liabilities.

• It may be added that installments of various term liabilities due within next one year are treated as current liabilities for calculating current ratio, but are treated as long term source and part of NWC (long term sources – long term uses) for

MPBF assessment, since the same are not a part of working capital cycle.

CMA data - Do’s and Don’ts (contd)

• Inter Corporate Deposits (ICDs) taken are to be treated as Current

Liabilities.

• Unsecured loans from promoters not to be included in both TNW as well as debt provided it is interest free and subordinated to Bank’s exposure.

• In case of other statutory dues, dividends, etc., estimated amount payable within one year should be shown as current liabilities.

• Bill purchased / Bills discounted which is shown as contingent liability in B/S to be added in Bank borrowing. Similar amount to be added in (domestic and / or exports) receivables as applicable. This will give the true picture of leverage and receivable holding levels.

• Intangible assets like goodwill, deferred tax assets, etc should be invariably shown as intangible assets.

Assessment of working capital requirements

RBI setup a committee under the chairmanship of Shri P.L. Tandon in

July 1974.

RBI in April 1997 has decided to withdraw the prescription in regard to assessment of working capital needs based on the concept of MPBF enunciated by Tandon Study Group.

Now, the banks can follow MPBF Method, Turnover Method,

Assessed Bank Finance Method, Cash Budget Method or any other method approved by the boards for assessment of working capital requirements.

Methods for assessment of WC requirements

The various methods for assessment of WC req are as under:-

Turnover Method ( P R Nayak Committee recommendation) :This method has been introduced in 1993 by RBI with a view to improve overall credit flow to the SSI sector.

Applicability:-

Particulars

MSEs

Non MSEs

Working capital limit upto

Upto 5 crs

Upto 2 crs

Applicable to

Manufacturing sector & services sector

Traders, Merchants, exporters etc. who do not have fixed operating cycle.

Normally 25% of the estimated gross sales turnover value shall be computed as working capital requirements, of which 20% shall be provided by the bank and the balance 5% by way of promoter contribution towards margin money.

Under this method current ratio would be min. 1.25 times.

Methods for assessment of WC requirements (contd)

Cash Budget Method :In the case of specific industries / seasonal activities such as software export, construction activity, tea and sugar, normally, the system of assessment based on the cash budget may be adopted. For Format - Refer pg no. 20 of working Capital Manual .

MPBF Method:-

• Working Capital Gap

This represents excess of current assets over current liabilities excluding bank borrowings. A part of the Current Assets are financed by Current

Liabilities (other than bank borrowings).

• Net Working Capital

NWC indicates the margin or long term sources provided by the borrower for financing a part of the current assets. Rest part of current assets gets funded by current liabilities (including Bank Borrowings).

Methods for assessment of WC requirements (contd)

Tandon committee recommendations for MPBF calculation:-

Three methods for determining MPBF

• Method 1: MPBF=0.75(CA-CL)

• Method 2: MPBF=0.75(CA)-CL (mostly used)

• Method 3: MPBF=0.75(CA-CCA)-CL, where CA- current asset, CL- current liabilities, CCA- core current assets (permanent component of working capital).

Explanation:-

• Method 1:- Banks can finance upto 75% of WCG and balance should come from long term sources

• Method 2:- Borrower should provide 25% of total current assets out of long term funds. Banks will provide balance amount after deducting credit available for purchases and other current liabilities (other than bank borrowings)

Methods for assessment of WC requirements (contd..)

Tandon committee recommendations for MPBF calculation:-

Current Assets Rs.(in millions)

Raw material

Work in process

Finished goods

Receivables(including bills Discounted)

Other current assets

18

5

10

15

2

—

50

—

Current Liabilities

Trade Creditors -

Other current liabilities -

Bank borrowings (including Bills discounted)-

12

3

25

—

40

—

MPBF for Mercury Company Limited as per above methods are:

Method 1: 075(CA-CL) = 0.75(50-15) = Rs.26.25 million

Method 2: 0.75(CA)-CL = 0.75(50)-15 = Rs.22.5 million

Method 3: 0.75(CA-CCA)-CL = 0.75(50-20)-15 = Rs.7.5 million

Forms of FB and NFB limits

Working Capital Finance is extended in different forms based on the requirement as follows:

I.

Inventory Limits (Pre-Sales) (projected level of the borrower’s operations)

• Cash Credit (CC) including WCDL wherever permitted Export Packing Credit (EPC)

• Overdraft

• Vendor financing

II.

Finance against Receivables (Post-Sales)

• Overdraft against Book Debts

• Bills Purchased / Discounted/Negotiated

• Receivable Buyout

III. Non-Fund based limit (based on genuine needs and capacity of the borrowers)

• Letter of Credit (LC)

• Trade Credit Bank Guarantee (TCBG)

• Bank Guarantee (BG)

• Loan Equivalent Risk (LER)

Ratio Analysis and Holding levels of operating cycle items

Ratio Analysis:- Important ratios are as under:-

To Examine Financial Ratio used

Current Ratio Liquidity aspects

Total Liability vis-à-vis stake of shareholders

Servicing capacity of

Interest

Servicing capacity of repayment obligations

Gearing Ratio

Interest Coverage

Ratio or Interest

Cover

Debt Service

Coverage Ratio

(applicable to loans)

Formula

CA/CL

TOL/TNW,

Where TOL = Long term liabilities + Short term liabilities, &

TNW= Shareholders’ funds viz., Share Capital + Reserves and Surplus

PBDILT/Interest, where PBDILT = Profit before interest, depreciation, lease rentals and taxes

Annual Cash Accruals or PBILD/Annual Instalment of TL +

Annual lease rental, where

PBILD = PAT + Depreciation and other non-cash expenses +

Interest on term loan + Annual lease rental)

Ratio Analysis and Holding levels of operating cycle items (contd..)

Holding Levels of Inventory:- Helps in fixing working capital requirements:-

Holding Period (in days)

RM holding

WIP holding

FG holding

Receivables holding

Creditors holding

Formula

Stock of RM/ Annual RM consumed * 365

WIP/ Cost of Production * 365

Finished Goods/Cost of goods sold * 365

Receivables/Annual Gross sales * 365

Creditors/Annual Purchases * 365 where,

RM consumed = Op stock of RM + RM purchased – Cl stock of RM

Cost of Production = RM + Labour + Other direct expenses + Op WIP – Cl WIP

Cost of Goods sold = Sales – Gross Profit

Cash Flow and Fund Flow Statements

Cash Flow statement (AS – 3 of ICAI):- Helps to take business decision say, investment in fixed assets, financing through bank borrowings etc. where the unit needs information on the amount of cash actually held at a particular point of time.

Cash Flow Statement

Particulars

Net Cash used in operating activities

Net Cash used in financing activities

Net Cash used in investing activities

Cash generated from all activities

Add:- Opening cash and cash equivalents

Closing cash and cash equivalents

Amount xx xx xx xx xx xx

Cash Flow and Fund Flow Statements

(contd..)

Fund Flow Statement - Historical Perspective:- The importance of funds flow analysis as a tool for decision-making was recognised by Dehejia

Committee in the late sixties. Subsequently in 1974, Tandon committee put further emphasis on the concept. The format for Funds Flow was later incorporated by RBI in CMA format.

Meaning:- A balance sheet item is known as Fund. The change in position of an item in the balance sheet is known as flow. Thus, the statement of changes in financial position is known as “Statement of funds flow” or simply

“Funds flow statement”.

Rule:- Increase in a liability denotes a Source and Increase in an asset denotes a Use. On the other hand, decrease in liability is a Use and decrease in asset is a Source. The box diagram for the same is as under:-

Liabilities

Assets

Increase

Source

Use

Decrease

Use

Source

Cash Flow and Fund Flow Statements

(contd..)

Items of Sources:-

A. Long term Sources:- PAT, Depreciation (added back to profit since it a notional exp debited to P/L A/c, Increase in share capital/Reserves &

Surplus/Term Liabilities/Debentures, Public Deposits etc, Sale of fixed asset.

B.

Short term sources:Disposal/Reduction of current assets (e.g.

inventory, receivables), Increase in Current Liabilities like Creditors, bank borrowings, etc.

Items of Uses:-

A. Long term Uses:- Drawings, Increase in share capital/Reserves &

Surplus/Term Liabilities/Debentures, Public Deposits etc.

B. Short term Uses:- Increase in Current Assets like (e.g. inventory, receivables), Decrease in current liabilities like payment to creditors, repayment of short term loan, etc.

Security Creation and Perfection of security

The security to be created is as under:-

Type of security Nature of documentation

Primary Security

Collateral Security

Hypothecation of Stock and Bookdebts

• Equitable mortgage/Regd. Mortgage of properties

• Pledge of shares/Assignment of rights

• Personal Guarantees of directors/Corporate Guarantee of flagship co.

Security Creation and Perfection of security (contd..)

Perfection of Security:-

Forms of security Sr.

No.

1.

2.

3.

4.

Perfection Requirement

Indenture of Mortgage

Equitable

Mortgage/Deposit

Title Deeds

Hypothecation

Pledge of shares of

• Filing of Form 8 with ROC

• Registration with relevant Sub-register of Assurances

• Filing of Form 8 with ROC

• Registration with relevant Sub-register of Assurances only in the states of Gujarat and MP

• Notarisation of Directors’ Declaration

• Filing of Form 8 with ROC

Physical

• Deposit of share certificate with the pledgee

• POA for voting rights need to be notarised

Dematerialized shares

• Filing under Depository Act/Regulations including filing of form W (for NSDL) and Pledge Request Form (For CDSL) for recording pledge of shares

• POA for voting rights need to be notarised

Credmin Documents

Stock Statements:- Computation of Drawing Power.

1.

Inventories

Total inventory (excluding non usable non moving, slow moving stocks)

(period to be specified)

LESS; Unpaid stocks, stock under LC

Value of paid stock (A – B)

LESS: Stipulated margin on stocks as per sanction

DP / DL on stocks (C-D)

2.

Book-debts

Total amount of inland credit sales (not exceeding the period permitted by the sanctioning authority

LESS; Value of bills (discounted by the Bank/Factors) & advance received against suppliers

Net bills receivables / debtors unfinanced by the Bank / Factors (F-G)

LESS: Stipulated margin on book debts as per sanction

DP / DL on Book Debts (H-I) or stipulated sub limit under Book Debt whichever lower

A

B

C

D

E

F

G

H

I

J

Credmin Documents (contd..)

Stock Audit:- Stock Audit mainly involves the counting of physical stock presenting the specified premises and verifying the same with computed stock maintained by the company. The main advantages are:-

• Direct impact on costs and bottom line

• Prevent pilferage and fraud

• Identifies slow moving stock, obsolete stock, dead stock and scrap

• Third party independent opinion, especially for agent warehouses

• Identifies gap in current inventory management process

• Enable accurate valuation of inventory

Other Credmin documents:-

• QIS (Tandon Committee)/FFR /QMR statements & Quarterly results

• Visit/Inspection Report

• Consortium Meeting Minutes

Early Warning Signals & Remedial

Action

Some of the Early Warning Signals which can make an account bad are as under:-

Financials:-

1.

Below benchmark Current Ratio, ICR and DSCR.

2.

High gearing ratio or debt burdened company.

3.

Company incurring losses for last financial years.

4.

Receivables stuck up.

5.

Continuous excess borrowings in past audited years as per CMA data

6.

Variation between Actual results v Estimated/Projections by more than

10/20%.

Early Warning Signals & Remedial

Action (contd..)

Operations:-

1.

Large slow and non-moving items.

2.

RM not available.

3.

Finished goods not sold.

4.

Production disrupted due to natural calamities, strikes, lock-outs, etc.

5.

Payment not made to suppliers in time.

6.

Any other adverse comment(s) made in Stock Audit Report.

Security Creation/Documentation:-

1.

Adequate securities not created or perfected as per Sanction terms.

2.

Legal Vetting not done.

3.

Land not acquired for creation of mortgage.

4.

Environment clearances not obtained.

5.

Any other pre-disbursement condition not complied with.

Early Warning Signals & Remedial

Action (contd..)

Conduct of the account:-

1.

A/c reported as SMA 1 or 2 or Critical overdues not cleared.

2.

Low credit summation.

3.

Short term funds utilised for long term purposes.

4.

Frequent cheque returns.

5.

Adhoc TODs granted frequently.

6.

Fall in DP.

Remedial Action:-

1.

Necessary promoter’s margin is available.

2.

Gearing Ratio is less than 3 times.

3.

All securities are created and perfected and legal vetting is done.

4.

Necessary Credmin documents are in place.

5.

Satisfactory conduct of the account.