Consultation Paper - Offshore Petroleum Resource Management

advertisement

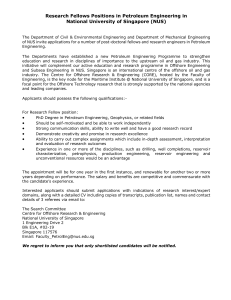

Table of Contents 1. Background and Process for Making Submissions.................................... 2 2. Policy and Framework Overview ............................................................... 4 Policy Context ....................................................................................................... 4 Resource Management Framework....................................................................... 6 Other Issues .......................................................................................................... 9 3. Exploration............................................................................................... 10 Policy Objectives ................................................................................................. 10 Key Elements of the Exploration Regime............................................................. 10 Precompetitive Geoscience and Data Management ........................................ 10 Acreage Release ............................................................................................. 11 Exploration Bidding and Permitting .................................................................. 12 Trends and Challenges ....................................................................................... 13 Emerging Issues.................................................................................................. 15 Precompetitive Data Acquisition and Acreage Release Strategies .................. 15 Building Data to Inform Decision-Making ......................................................... 16 Efficacy of the Exploration Permitting Regime ................................................. 17 4. Development ........................................................................................... 20 Policy Objectives ................................................................................................. 20 Key Elements of the Development Regime ......................................................... 20 Retention Leases............................................................................................. 20 Production Licences ........................................................................................ 21 Trends and Challenges ....................................................................................... 21 Large-scale Projects ........................................................................................ 22 Maturing Basins ............................................................................................... 23 Diminishing Resource ‘Pipeline’ ....................................................................... 23 Emerging Issues.................................................................................................. 25 Overall Effectiveness of the Retention Lease Framework in Promoting the Timely Commercialisation of Resources .......................................................... 26 Opportunities to Enhance Commercial Incentives for Efficient Infrastructure Development ................................................................................................... 27 Ability of the Development Frameworks to Manage More Complex Interactions and Project Operating Environments ............................................................... 28 Annex A: Terms of Reference ........................................................................ 31 Cover image: Courtesy of Woodside Energy Ltd. Northern Endeavour FPSO Northern Endeavour floating production, storage and offloading vessel, Laminaria-Corallina oil project, Northern Australia. CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 1 1. Background and Process for Making Submissions During 2014-15, the Department of Industry is undertaking a high-level strategic review of the framework governing oil and gas resource management in Commonwealth waters to ensure that the framework remains well placed into the future to support timely and efficient commercial investment, exploration and development. The Offshore Petroleum Resource Management Review (the Review) is being undertaken on the basis that the current regime has served Australia well. Its purpose is to test whether it can function better in the face of rapidly changing technological and commercial conditions. The Review will identify key issues affecting the operation of the offshore resource management regime across the exploration and production lifecycle. It will also identify strategic actions that could be implemented to help improve certainty and flexibility, reduce regulatory compliance costs, and attract efficient, timely investment and development. Further information about the Review is provided in the Terms of Reference (provided at Annex 1). The Review will be informed by an open consultation process to provide opportunity for effective stakeholder engagement. This Consultation Paper represents the beginning of this process. It seeks stakeholder views on the key issues and initial suggestions on strategic actions that could be considered to help enhance current arrangements. Comments received will be considered in developing an Interim Report which will outline possible policy responses. The Interim Report is scheduled for release for consultation in March 2015. The Final Report will be delivered to the Commonwealth Minister for Industry by 30 June 2015. Any future reforms contemplated by the Government will take into account the criticality of maintaining existing rights and obligations for market participants. Stakeholders are encouraged to contribute to this process by making written submissions, which are due by Friday 6 February 2015. Submissions can be made: Online: http://www.industry.gov.au/resource/UpstreamPetroleum/Pages/Offshor e-Petroleum-Resources-Management-Review.aspx By email: OPRMReview@industry.gov.au CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 2 By mail: Offshore Petroleum Resource Management Review Resources Division Department of Industry GPO Box 9839 CANBERRA ACT 2600 Publication of submissions: Submissions will ordinarily be available for public review at http://www.industry.gov.au/resource/UpstreamPetroleum/Pages/OffshorePetroleum-Resources-Management-Review.aspx, unless you request otherwise. Please indicate clearly on the front of your submission if you wish it to be treated as confidential, either in full or part. The Australian Government reserves the right to refuse to publish submissions, or parts of submissions, which contain offensive language, potentially defamatory material or copyright infringing material. A request may be made under the Freedom of Information Act 1982 (Cth) for a submission marked confidential to be made available. Such requests will be determined in accordance with provisions under that Act. Contact information, other than your name and organisation (if applicable) will not be published. Your name and organisation (if applicable) or jurisdiction will be included on the Review webpage to identify your submission. CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 3 2. Policy and Framework Overview Australia’s upstream petroleum sector has experienced substantial investment and growth in productive capacity in recent years, especially in gas with nearly $200 billion currently being invested in liquefied natural gas (LNG) projects nationally. This investment has in large part been underpinned by an effective and stable offshore petroleum framework. Policy Context Continued growth of Australia’s offshore petroleum industry can never be guaranteed particularly as global competition for investment intensifies. Australia’s pipeline of large uncommitted petroleum reserves is at relatively low levels. There are few undeveloped large offshore oil reserves and in offshore gas most of the remaining commercially viable reserves have been linked to major development proposals. More reserves will need to be found to support continued industry growth and gas supplies to our export and domestic markets. Timely and effective exploration supported by advanced precompetitive information will be needed to help address this challenge. Exploration in Australia is undergoing substantial change as greenfield activity expands into more challenging frontier and remote areas. It is also moving from the shallow to mid-depth water shelf into deep and ultra-deep water, which presents new challenges in terms of the cost, complexity and timeframes for exploration and subsequent development activities. The increased use of 3D seismic surveys, including multi-client seismic surveys, has increased the time taken to collect and process data, which is also contributing to delays and causing some operators to encounter difficulties in meeting annual work program commitments. This raises the question of whether the supporting administrative arrangements facilitating offshore exploration activities can be enhanced to reflect the changing operating environment. Translating discoveries into economic activity and growth requires timely and efficient commercialisation and production. Technological advances including new production technologies, like floating LNG facilities, which can change the economics of developing smaller fields and open access to resources previously beyond our reach. However, with production facilities and infrastructure now costing many billions of dollars, projects are typically more complex and harder to secure. In a world of growing investment competition it is important that long lived “foundation” assets can ensure a competitive return by securing long-term supply through a portfolio of fields. Yet this can create tensions with the goal CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 4 of timely resource development where alternative commercialisation options for individual fields might be feasible. Optimising long-term commercial resource recovery becomes even more important in these circumstances. As the understanding of reservoir dynamics improves, the optimisation of resource management in maturing fields and basins is gaining more focus, particularly how to minimise the inadvertent stranding or sterilisation of smaller resources. Minimising development risks and costs will be crucial for bringing forward efficient and timely offshore petroleum investment. Optimal and cost-effective development of offshore resources may require greater cooperation and coordination between industry participants in some cases, especially in relation to the development and use of related infrastructure, to reduce costs and improve competitiveness. These developments have the potential to test the effectiveness and resilience of the resource management framework into the future. As noted above, the framework has served Australia well to date and it is not the intention to revisit the fundamental principles that define the regime. Two principles which will remain critical to the regime are that resources are best exploited (and risks managed) through commercial development, and that key to this is the application of structured property rights which provide due recognition for the substantial investments and risks taken by businesses. This paper seeks to open a conversation on the challenges facing the industry at this time and potential opportunities to improve the regime’s efficacy in meeting both longer term public and commercial interests. Key Questions 1. What are the main factors affecting timely, innovative and efficient offshore petroleum exploration and development? economic operational commercial technological geological regulatory nature and volume of available reserves 2. What implications could they have for the operation and regulation of the offshore petroleum resource management framework? CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 5 Resource Management Framework The offshore petroleum resource management framework seeks to promote the timely discovery and development of petroleum resources for the economic benefit of the Australian community while also ensuring that activities are undertaken safely and in an environmentally responsible way and in accordance with good oil field practice principles. Figure 1 presents a high-level diagrammatic overview of the exploration and development framework. The framework includes a range of policy and regulatory sub-elements across the exploration-discovery-development lifecycle. It is principally (but not exclusively) defined through the Offshore Petroleum and Greenhouse Gas Storage Act 2006 (the Act) and in the Offshore Petroleum and Greenhouse Gas Storage (Resource Management and Administration) Regulations 2011 (the Resource Management Regulations). The Commonwealth jointly administers the regime with State and Northern Territory Governments through a Joint Authority (consisting of relevant responsible Ministers) for the offshore area of each State and the Northern Territory. It is responsible for the majority of decision making under the Act including the granting of petroleum titles, the imposition of title conditions and the cancelation of titles, as well as core decisions about resource management and resource security. Joint Authorities receive advice in relation to exercising their titles decisionmaking powers from the National Offshore Petroleum Titles Administrator (NOPTA), which is responsible for assessing applications in relation to offshore petroleum titles and providing related reports and recommendations. The policy goal of Australia’s resource management framework is not clearly defined in current legislation or regulations but is generally understood to be to optimise long-term resource discovery and recovery, recognising the practical constraints imposed by economic, technological, operational and geological factors. This is given effect in s.569 of the Act and in Regulation 1.04(1) of the Resource Management Regulations which states that “operations in an offshore area are [to be]: a) carried out in accordance with good oilfield practice; and b) compatible with the optimum long-term recovery of petroleum.” CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 6 Figure 1: An Overview of the Offshore Petroleum Exploration and Development Framework Area Selection Areas nominated for release by industry, state/NT governments and Geoscience Australia. Nominated areas are evaluated and selected for inclusion in a release Acreage Release Annual Acreage Release areas announced by the Federal Minister for Industry (areas clearly identified as available for either work program bidding or for cash bidding) Call for Work Program Bids The Joint Authority invites explorers to bid for areas in the work program bidding rounds Bids are assessed by the Joint Authority The Joint Authority agrees on the successful applicants. NOPTA, on behalf of the Joint Authority, offers permits to successful applicants who have 30 days to accept or reject the offer Call for Cash Bid Applications The Joint Authority invites explorers to (i) prequalify (based on technical and financial competence); then (ii) bid for areas in the cash bidding round Cash Bid Auction Applicants that satisfy the prequalification process are invited to place a cash bid for the area or areas. The applicant that places the highest cash bid for the area will be offered the permit. Successful applicants have 14 days to accept or reject the offer. Exploration Permit Granted NOPTA grants permit on behalf of the Joint Authority Authorities and Consents NOPTA may grant: Special Prospecting Authority over an area which is not covered by and exploration permit, retention lease or production licence. Max period 180 days. 6 Year Exploration Permit in force Work program permit: 1. 3 year guaranteed primary work program 2. 3 year secondary work program (guaranteed upon entry into each year) Cash bid permit: 3. 6 year permit (no work program requirements) Exploration Permit Renewed If permit is renewable - titleholder can apply to the Joint Authority for a renewal of the exploration permit Renewal for 5 years Halving rules may apply Potential limits on the number of renewals depending on grant date and/or permit size and type (cash-bid or work-bid) If applicable, maximum 1 renewal (cash bid) Access Authority to an existing petroleum titleholder for activities other than drilling a well outside their existing title. Discovery Made The exploration program is successful and a discovery is made. Titleholder can apply to the Joint Authority for the declaration of a location over the discovery Petroleum Scientific Investigation Consent to organisations undertaking scientific research, including exploration activities but does not cover exploration wells. Discontinued Permit does not continue due to: Location Declared Joint Authority declares location over field. Within requisite timeframe, titleholder can apply to Joint Authority for a retention lease or production licence Not yet Commercial Retention lease can be granted over the block(s) in the location if the discovery is not currently commercially viable, but is likely to become so within 15 years Retention Lease in Force 1. Permit surrendered (conditional to work commitments) 2. Permit cancelled (titleholder should consider good standing requirements) 3. Permit expires - not renewed Commercially viable Production licence can be granted over the block(s) covering a commercial discovery; a field development plan is also required Production Licence in Force Retention Lease gazetted by NOPTA and in force. Production Licence gazetted by NOPTA and in force 3. For 5 years with work program 4. Can reapply for further Retention Leases but have to prove not commercially viable, but likely to be within 15 years 1. For life of field while producing 2. May be terminated if petroleum recovery operations are not carried out for more than 5 years CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 7 The framework seeks to facilitate timely and efficient exploration and development through a coherent and integrated approach. It seeks to provide the industry with sufficient certainty and flexibility to minimise regulatory risk and compliance costs. Importantly the framework functions on the premise that industry operating in response to commercial incentives will generally deliver timely, efficient outcomes which are consistent with the public interest. This can on occasion create tensions between what might be the commercially optimal solution for a particular operator and what might be achievable “in a perfect world”. Accordingly, the regime aims to maintain a realistic balance between the operator’s commercial incentives and ensuring the optimal stewardship of resources that belong to the Australian people. While these tensions exist it is unclear whether this creates ambiguity which in turn may discourage investment and industry participation. Alternatively, an overly prescriptive formulation of the policy goals and objectives could inadvertently reduce administrative flexibility and increase compliance costs. An appropriate balance needs to be maintained to provide flexibility while minimising regulatory uncertainty. Nonetheless, scope may exist to enhance the current resource management framework. Some possibilities which are canvassed in this paper might include: Introducing greater differentiation of titles with terms and conditions that more effectively reflect the uncertainties and longer timeframes associated with certain offshore activities like ‘frontier’ or remote exploration, or the commercialisation of long lead-time, large-scale LNG projects; Updating administrative practices and guidelines to reflect changing operational realities, to provide greater inherent flexibility and predictability to accommodate less certain and more risky activities; and Removing any undue impediments, if any, to the Joint Authority exercising appropriate flexibility to deliver more timely, balanced and effective decisions consistent with the resource management objectives of the Act. In considering possible reforms it is important to recognise that the sub-elements for the framework provide an integrated ‘cradle to grave’ set of incentives and obligations for industry participants. Thus, changes in one area may have important positive or negative effects on the incentives for activity or investment in other areas. CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 8 Other Issues There are a range of factors that have an indirect bearing on resource management outcomes including health, safety and environmental regulation, taxation, labour relations, social license to operate and carbon capture and storage. Although beyond the scope of this review, the Department would be interested in views on how these issues may affect the operation and performance of the resource management framework, especially where they can have a significant distortionary impact on timely and efficient investment in exploration and development. Key Questions 3. To what extent is the framework operating in an efficient and integrated manner? If not, what are the main areas of friction and how could they be addressed? clarification of policy objectives and key terminology nature and scope of legal and regulatory provisions application of the framework 4. To what extent does the framework provide sufficient stability and continuity of property rights to support efficient and timely investment from exploration through to commercialisation and production? 5. To what extent does the framework strike the right balance between flexibility and certainty for investment? 6. How could the administration of the framework be improved? nature, scope and flexibility of regulatory and administrative practices nature, scope and flexibility of Joint Authority decision-making 7. How effectively is the framework operating in response to matters that indirectly affect its performance? Are there other issues which might be examined to improve the regime affecting offshore petroleum activity and investment? CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 9 3. Exploration A vibrant and diverse exploration sector is essential for maintaining a strong and prosperous petroleum industry in Australia over the long term. Offshore petroleum exploration is a high-risk, high-cost activity and takes place within a highly competitive international market. At the same time, new technologies and practices are opening up new areas for exploration across the globe. For this reason it is critical that Australia’s exploration regime is robust, conducive to current and emergent practices, and well positioned to encourage and support future exploration efforts. Policy Objectives The exploration regime seeks to facilitate timely and efficient offshore exploration by: significantly advancing the assessment and understanding of the hydrocarbon potential of Australia’s offshore sedimentary basins; reducing commercial risk and encouraging investment through the provision of precompetitive geoscientific data; and providing a sound regulatory framework for exploration in Commonwealth waters. Key Elements of the Exploration Regime The Australian Government aims to establish a sound macroeconomic environment and regulatory framework for petroleum-related activities. In addition, it seeks to reduce commercial risk for offshore petroleum exploration through the collection and dissemination of precompetitive geoscientific data to the benefit of explorers and the Australian community. For the purposes of this paper, Australia’s ‘exploration regime’ includes precompetitive geoscience activities, acreage release, and exploration permitting as well as data management associated with these elements. Precompetitive Geoscience and Data Management The Australian Government plays an active role in improving the understanding of the nation’s offshore resources base. This work is primarily carried out by Geoscience Australia (GA) and it involves the collection, assessment and provision of geoscientific data and information about offshore sedimentary basins which aims to complement industry efforts (Figure 2 refers). CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 10 Figure 2: Relationship between exploration and precompetitive information Source: Geoscience Australia (2014), modified from BP (2006) In recent years, GA’s petroleum work program has been focused on frontier areas, in particular on those basins that are considered to be prospective but lack sufficient fundamental data to readily identify petroleum systems. Precompetitive data acquisition programs and geoscientific studies in these areas have been a priority for GA’s forward work program. In addition to acquiring new seismic or marine surveys, GA also stores and manages the data acquired and submitted by industry as part of the requirements under the Act. An important part of GA’s work is adding value to submitted data once it becomes open file. This data is used in basin analytical studies, which GA releases in dedicated data packages. This type of value-added data informs industry exploration efforts as well as the Government’s planning, acreage release and management of offshore areas. Acreage Release The Australian Government annually releases acreage for offshore petroleum exploration. Released areas are selected based on industry and, every so often, GA nominations. Shortlisting of areas is based on a range of criteria including: previous interest in, and exploration undertaken in the nominated area(s); CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 11 any potential adverse impact on current offshore exploration acreage release bidding rounds; relevant international maritime boundaries; new geoscientific or market developments, such as domestic demand changes or an opportunity for early commercialisation of fields, that might generate interest among potential bidders; ongoing precompetitive studies by Geoscience Australia; and implications for management of Commonwealth marine reserves. Interest in the acreage release areas has fluctuated in recent years. The varying degree of interest may be due to a range of factors including: broader economic conditions; access to capital for exploration (which is typically discretionary spend); market opportunities; risk-reward appetite; the relative cost of exploration in Australia; perceived prospectivity of release areas; and regulatory risk. Exploration Bidding and Permitting Explorers bid on acreage release areas for the exclusive right to apply to undertake exploration activities in that area. Exploration permits are awarded on a competitive basis through ‘work program’ and ‘cash bid’ processes. Successful work program bidders are awarded title for six years initially, with potential for two five-year renewals. They are required to undertake each component of the initial three-year guaranteed work program within the permit area in the prescribed year as presented in the original work program. Successful cash bidders are also awarded title for six years initially with the potential for one five-year extension. Cash bidders are not subject to work program conditions. In addition to these titles, ‘special prospecting authorities’ and ‘access authorities’ allow explorers (such as seismic acquisition companies) to acquire multi-client seismic surveys that can assist explorers in their search for petroleum. Currently, there are 188 offshore areas under petroleum exploration permits, with a further 30 areas offered for exploration in 2014. CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 12 Trends and Challenges Petroleum exploration is a dynamic business which responds quickly to market conditions. It is high-risk, high-cost and takes place within a very competitive international market. Figure 3 shows that recent offshore exploration expenditure remained at historically high levels of between $2.5 billion and $3.2 billion per annum between 2008 and 2013. At the same time, Figure 3 indicates that the number of new exploration wells drilled has experienced a steady and marked decline over the same period, with the number of new wells drilled in 2013 falling to less than a quarter of the levels recorded in 2009. This trend appears to be the result of the interplay between a number of factors, which include prospectivity, perceptions of prospectivity, well costs, rig availability and sub-optimal licencing conditions. Figure 3: Trends in Exploration Expenditure and Activity - 2008-2013 60 3000 50 $m 2500 40 2000 30 1500 20 1000 10 500 0 Number of wells drilled 3500 0 2008 2009 Number of wells drilled 2010 2011 2012 2013 Expenditure (Seasonally Adjusted) Source: Petroleum Exploration Society of Australia annual exploration review (APPEA Journal) and Australian Bureau of Statistics, Mineral and Petroleum Exploration, Australia, Table 6a. Petroleum Exploration - Expenditure, Cat.# 8412.0. as modified by NOPTA and the Department of Industry. More challenging business conditions reflecting increasing activity in deep and ultra-deep water and in remote locations with limited infrastructure are adding time, risk and cost to exploration activities, and particularly to the cost of drilling exploration wells. High mobilization and demobilization costs, especially in more remote areas, are combining with tight markets for offshore drilling rigs, often narrowing seasonal windows for undertaking exploration activity and relatively high labour costs to further increase the cost and time needed to conduct exploration activities. CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 13 They also reflect the innovative ways in which industry is responding to manage higher costs and risks. Explorers are increasingly deploying a range of sophisticated technologies and practices to more effectively identify and analyse prospective plays. This is reflected in the increasing deployment of 3D seismic surveys over the last decade, which has greatly improved the industry’s ability to cost-effectively identify and assess the commercial potential of offshore hydrocarbon pools. Figure 4 shows trends in offshore 3D seismic activity between 2000 and 2013. Figure 4: Growth in Offshore 3D Seismic Survey Activity - 2000-2013 60000 50000 Sq km 40000 30000 20000 10000 0 Source: Australian Petroleum Production & Exploration Association, Quarterly Seismic Statistics (various quarters, various years) Access to more detailed and accurate 3D seismic data is facilitating more sophisticated analysis and the development of more effective, ‘smarter’ exploration programs. This may be being translated into fewer, better targeted and more successful exploration wells and activities. This has also increased the time required to collect and analyse data, further extending the time taken to develop and execute exploration activities. This is resulting in delays to the implementation of exploration work programs in some cases and raises questions about the current administrative timeframes given the changing operating conditions, particularly in more remote or challenging areas. Whist the greater understanding provided by new 3D seismic data reduces exploration uncertainty, this reduction has not necessarily resulted in a substantially greater success rates for exploration wells. More importantly, the actual volumes of hydrocarbons that have been discovered have been modest, which is reflected in the relatively barren (“unallocated”) resource inventory within the exploration permits and retention leases. To some extent, this is the result of a focus on exploring for smaller, more subtle accumulations within existing provinces. CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 14 Risks, costs and time taken to undertake exploration programs can all be expected to increase as exploration moves into more remote regions and into more operationally, technologically and geologically challenging environments. Maintaining an internationally competitive exploration regime that can successfully adapt to these trends and challenges will be crucial for attracting the timely, efficient and innovative exploration investment needed to help maintain a healthy rate of commercial discoveries into the future. Emerging Issues In light of these challenges, it is worth considering where there might be opportunities to improve the regime. Issues to be considered include: the effectiveness of the precompetitive data acquisition and acreage release; availability and use of data to inform resource management and industry decision-making; and the permitting regime and whether it is conducive to current and future offshore exploration efforts in Australia. This is by no means and exhaustive list. Stakeholder feedback on other issues and how they relate to the regime would be welcomed. Precompetitive Data Acquisition and Acreage Release Strategies The value of precompetitive activities is widely recognised, given that much of Australia’s offshore areas are underexplored and frontier areas may offer significant potential for large-scale discoveries. However, resources for precompetitive data acquisition and interpretation are limited, and efforts need to be prioritised to promote timely and efficient exploration over the longer term. In this context, it is worth considering what kind of precompetitive information may most improve the chance of success in exploration, as well as the regions and types of areas (i.e. frontier) where precompetitive effort is best focused. Given the limits on public resources there may be merit in considering opportunities to leverage efforts between Government and industry in areas where there is limited or no information. This could, for example, be through partnerships to acquire dedicated precompetitive data sets that allow the assessment of hydrocarbon prospectivity. However, such an approach would require careful consideration of access and use of the data (possibly a short term look-ahead of data release) to ensure that public information needs are met while also providing a commercial incentive for private sector investment. In terms of the acreage release, blocks should include those considered most prospective and of immediate interest to explorers to sensibly maximise the commercial attractiveness of acreage offered for bidding. CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 15 However, this approach may not provide sufficient medium-term clarity when developing multi-year exploration strategies and schedules. Consideration could be given to whether the Australian Government’s acreage release (and to an extent precompetitive) activity should be “guided” by a clearer medium term exploration strategy that sets out broad goals and directions. It may also be timely to consider whether the acreage release as a whole is consistent with industry’s longer-term exploration strategies, including: appropriate size of release areas, and the benefits of larger or smaller areas; diversity of areas to offer opportunities for various explorers (larger and smaller companies, as well as seismic companies); and timing of the release, and whether one or two rounds per year best matches industry’s requirements. Key Questions 8. What opportunities are there to improve or leverage precompetitive geoscience activities to support more effective exploration in the longer term? 9. To what extent could there be benefit in providing opportunities for carefully defined precompetitive partnership programs? 10. How effectively is the precompetitive program targeted and linked with acreage release? How could these links be improved? 11. To what extent is the acreage release appropriately sized, diverse, and timed? What is working with the acreage release program and what could be improved? 12. Would there be benefit in developing an exploration strategy to help guide longer term activities? Building Data to Inform Decision-Making The current data management regime is well-regarded, delivering a world class geological information base. However, the data collection and management is being tested through changing practices and technologies. Significant amounts of data are generated and it is timely to ask whether this information is being used in the most effective way, including in reducing the overall costs of maintenance and access to data. CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 16 Advanced exploration technologies such as 3D seismic imaging are essential to greater drilling success, something critical given the decreasing numbers of wells being drilled. This is undoubtedly beneficial in terms of reducing uncertainty and informing decision-making. Given the greater use and benefit of these 3D seismic studies, it may be worth considering whether the regime – specifically, exploration work programs - appropriately recognises the value and timeframes associated with these seismic studies. There is also a question whether the confidentiality period for data will remain appropriate looking ahead. For example, non-exclusive seismic surveys have a 15 year confidentiality period, while exclusive surveys acquired as part of a work program have a confidentiality period of 3 years. While access to this data may be purchased from service providers, there is a question whether the 15 year confidentiality period remains appropriate, and whether this may present an unintended barrier for business and exploration. Key Questions 13. To what extent are the data management arrangements working effectively? 14. To what extent are the arrangements (i.e. work program timing) relevant given current technology? 15. To what extent are the current data confidentiality structures appropriate? 16. What implications does increasing use of multi-client surveys have for exploration and the operation of the exploration regime? Efficacy of the Exploration Permitting Regime Delivering on committed work programs has been challenged by ongoing difficulty of operating in a tight rig market with growing pressure on availability and scheduling. These factors - in addition to seasonal, environmental and climatic factors that are outside the control of operators - and can have a significant impact on exploration in terms of cost and time, and with implications for permit management. Frontier areas are becoming increasingly accessible with the benefit of new technologies and practices. However, given the lack of geological data they involve different risks, costs and time for development. In addition, frontier exploration often occurs in deeper water, across large and remote areas, with little or no existing infrastructure. CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 17 These factors raise the question of whether the administration of work program activities is sufficiently flexible to allow explorers to manage operational pressures. There have been a relatively high number of work program variations, suspensions, and extensions granted in recent years. While there are legitimate reasons for these variations, the scale of variations suggests that explorers are finding it difficult to meet their “annual” work program commitments. This may be due in part to explorers ‘over-bidding’ with unrealistic work programs to secure exploration permits. It also suggests that greater flexibility may be required so that the expectations around mandatory work programs can more efficiently adjust to changing commercial realities. In this regard, it may be worth considering what would be most appropriate for different exploration activities in terms of the permit conditions, including: permit term – (whether a six year term is appropriate); guaranteed work periods and upfront commitment to activities; the valuation attached to seismic activities; and the number, value and timing of wells. The expectations around competitive work program bids for large, remote, deep-water frontier areas could be very different to those for areas in shallow water, close to known accumulations and infrastructure. In practice, these considerations are taken into account in bid assessment; however there may be merit in developing a clearer understanding of the activities that can be reasonably expected in these different areas. There may be some frontier areas where explorers wish to screen for its hydrocarbon potential by carrying out studies before committing to acquiring seismic data or drilling wells. Such an activity could take two or more years (rather than a full six year program), but currently the instruments are of limited duration to allow this to occur. The Department of Industry is currently consulting stakeholders on options to bring additional flexibility in petroleum exploration permits through a review of the suite of exploration guidelines. This work is being undertaken in parallel to this review, and is expected to be finalised in May 2015. Further information can be obtained by contacting petroleum.exploration@industry.gov.au. A further option for work program exploration permits relates to adjoining exploration permits held by the one title-holder, whereby the actual exploration activities cover a play concept and are managed as one project, but separated by the borders of the title. There may be some merit and efficiencies in converting the individual permits into one larger permit to cover the play concept , which could result in a more efficient exploration outcome, and reduce cost and administrative burden. CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 18 However this raises some issues given that the permit was awarded within a competitive process based on an individual work program, and that the work program commitments should be honoured. It also raises challenges where a play concept spans permits held by different joint ventures. Key Questions 17. To what extent do exploration bidding and work programs – and how they are administered - reflect the reality of offshore exploration, and offer explorers sufficient flexibility to manage operational pressures? 18. What opportunities are there to encourage more effective frontier exploration, including shorter periods for screening activity? 19. What elements of the regime could be tweaked to encourage frontier exploration? permit length renewability work program commitments CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 19 4. Development Offshore petroleum resource management regulations provide a framework for managing the orderly progression of petroleum discoveries through commercialisation to production. Policy Objectives The framework’s principal objective in relation to development is to provide a coherent, transparent and predictable regime that delivers sufficient certainty for investment and reinforces commercial incentives for timely and efficient development. Key Elements of the Development Regime The policy objective at the development stage is largely secured through the application of two complementary regulatory elements of the production framework; retention leases and production licenses. A declaration of a location over a petroleum accumulation is required before a retention lease or production licence is granted. Locations While not a title under the Act, locations underpin the offshore petroleum development regime by providing the mechanism to transition areas within an exploration permit to a production licence or a retention lease following the discovery of petroleum. Areas declared as locations remain part of the exploration permit until a production licence or retention lease is granted. Locations are another component of the regime that seeks to support the earliest commercialisation of petroleum resources while also providing security of tenure to holders of exploration permits. Locations remain valid for two years however this may be extended for a further two years at the discretion of the Titles Administrator. Retention Leases Retention leases are addressed under Part 2.3 of the Act. Their purpose is to provide security of title for petroleum resources that are not currently commercially viable but which have genuine development potential. A retention lease may only be granted where the applicant demonstrates that the recovery of petroleum: is not commercially viable1 at the time of application; and is likely to become commercially viable within 15 years of submitting a retention lease application. 1 Commercially viable as defined in the operating guidelines for retention leases means the petroleum can be developed given existing knowledge of the field, having regard to prevailing market conditions and using proven, readily available technology. CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 20 Retention leases have a term of 5 years and can be renewed subject to meeting the commerciality test and any related lease conditions. Lease renewals may be refused where the Joint Authority considers the resource to be commercially viable or is unlikely to become commercially viable within 15 years. Where the resource is considered commercially viable, the applicant has 12 months to apply for a production licence. In addition, third parties are able to make submissions to NOPTA on retention lease renewals. There are currently 58 active retention leases. 48 of these leases (83%) are in their first term (24 leases) or have been renewed once (24 leases), while ten have been renewed on two or more occasions (17%). Thirteen retention lease renewal applications are currently under assessment. Production Licences Under Part 2.4 for the Act, a production licence authorises the licensee to carry out petroleum recovery operations in a licence area. Production licences provide the legal basis for projects entering construction and production and have specific resource management objectives and requirements, which are largely achieved through approved rates of production and field development plans (FDP’s). FDP’s are technical documents that detail a proponent’s strategy for developing and exploiting a discovery over its economic life. In addition to the general condition that the licensee continue to explore for petroleum and recover petroleum where commercially viable to do so, a production licence can include separate conditions relating to resource management. Effective resource management is also supported by unit development provisions. Section 191 of the Act provides for unitisation through a ‘unit development agreement’ between adjacent production licence holders where a petroleum pool straddles separate titles. The purpose of the unitisation obligation is to ensure that both title holders are able to exercise their rights without detriment to the other or damage to petroleum resource recovery. However, unitisation has been very minimal to date and its impact on timely and integrated field development needs to be further considered. Currently there are 116 production licences. The majority are located in the Gippsland or Carnarvon Basins. Trends and Challenges Technological advances, changing business practices, the changing nature of the resources available for development and the evolving nature of international and domestic energy markets are reshaping the offshore petroleum industry, particularly the gas sector. These developments raise a number of commercialisation and production related challenges which may test the longer term robustness of the development framework. CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 21 Large-scale Projects Offshore petroleum projects, especially LNG projects, are by nature large, expensive and technically and financially complex. Table 1 provides a snapshot of recent large-scale LNG developments in the Carnarvon Basin. It shows that these projects are typically characterised by long lead times, high risk, high capital costs and long production lives, all of which can have substantial implications for the timing of resource development. Within the Carnarvon Basin there will soon be four LNG projects operating, which will have between one and five LNG ‘trains’ producing between 4.3 and 16.3 million tonnes of LNG per annum. The larger of these projects typically have 40 to 50 year plus lifespans. These projects require access to substantial quantities of gas. For instance, the NWS Project, at a 16.3 million tonne per annum rate of production, would consume up to 35 trillion cubic feet (TCF) of gas over 45 years. Moreover, there are plans for substantial expansion beyond the current capacity; Pluto to two trains, Wheatstone to a maximum of five trains and Gorgon to perhaps four trains. Table 1: Snapshot of Major LNG Projects in the Carnarvon Basin Project Capital Expenditure North West Shelf ~$27 Billion Gorgon ~$55 Billion Pluto ~$14.9 Billion Wheatstone ~$29 Billion Ichthys ~$34 Billion Prelude ~$12 Billion Production Capacity1 5 trains ~16.3 mtpa 3 trains ~15.6 mtpa 1 train ~4.3 mtpa 2-5 trains ~8.9 mtpa 2 trains ~8.4 mtpa 1 train (floating) ~3.5 mtpa Notes: 1 = Currently or proposed. 2 = Period from discovery to first gas. Source: NOPTA 2014 Period to Commercialise2 Production Period ~18 years ~45 years from 1989 ~36 years ~50+ years from 2015-16 ~7 years ~25+ years ~12 years ~25-40 years from 2016 ~16 years ~40+ years from 2017 ~10 years 25 years from 2017 These projects need secure long term access to resources to ensure a return on the large capital investments in plant and infrastructure. Initial foundation fields typically underpin 20 to 30 years of production, with the remaining resources required to underwrite these projects provided by smaller satellite fields which will be brought on-stream to maintain full capacity as the foundation fields are depleted. Given a 40 to 50 year project life, it is possible given the current interpretation and application of the retention lease provisions that satellite fields associated with large scale LNG projects could remain within a retention lease for an extended period. This currently creates tensions with other interests which may see alternative development options for individual fields. At present these parties could provide a submission to CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 22 NOPTA identifying alternative commercialization options or they can make a commercial bid for the resource. At the same time, the business environment is increasingly challenging with growing international competition for investment from projects in North America, the Middle East, Russia, and East Africa. Any additional uncertainty that serves to increase project risk and cost could result in investment moving to competing international projects. Ensuring security of access to resources over the long life of these projects is crucial for attracting the substantial investment needed for their commercialisation and eventual development. However, this raises the issue of how to balance security and certainty against the objective of bringing forward efficient and timely development of resources. Maturing Basins Significant exploration and development in the Carnarvon and Gippsland basins has resulted in a more complex development landscape with multiple fields and ownerships structures. This is raising new challenges for achieving optimal long-term commercial resource recovery. For example, the evolution of the Carnarvon Basin shows that up until 1990 the basin would have appeared to be dominated by a series of large, isolated hydrocarbon pools. The potential for regional interactions between fields, which could have affected optimal, long-term commercial recovery from those pools, is unlikely to have been considered. However, the acceleration of discoveries from the mid-90’s onwards has revealed that the basin is actually made up of a dense mosaic of pools, many of which overlie, overlap or are continuous with each other. As a result, there may be a greater potential for developments to have unintended effects, which may have implications for optimal long-term commercial resource recovery in the future. For instance, the current approach to the management of resources on a project-by-project basis may not always effectively account for the potential impacts on, and from, other projects in surrounding licences, which may result in sub-optimal long-term commercial resource recovery from petroleum systems spanning multiple projects. There are also risks that differing commercial priorities could result in the stranding of some less attractive (but still commercial) resources. Diminishing Resource ‘Pipeline’ Fewer and smaller pools of standalone commercially viable resources will influence the way the industry develops them. This may have implications for the nature and timing of resource commercialisation and production into the future. CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 23 The significant number of substantial new LNG projects in the Carnarvon Basin has been made possible by discoveries that were made decades ago in some cases. Although there have been a large number of small discoveries over the last eight years, no giant fields have been discovered over the period. Other sedimentary basins in Commonwealth waters have recorded similar results with the exception of the Browse Basin. This trend is reflected in a diminishing ‘pipeline’ of commercially viable gas resources for further greenfield projects beyond the projects currently being developed. For example, Figure 5 shows that in the Carnarvon Basin there is only one gas accumulation in either the retention lease or exploration permit system which could act as a foundation pool for a greenfield LNG project (>~5 TCF). Indeed, most may be too small to support a floating LNG development (>~3 TCF). Several factors affect the time taken to commercialise a resource including: market demand; resource size; state of the existing infrastructure; water depth; geographic remoteness; and available ‘ullage’. As a result, pools can remain within retention leases through several renewal cycles, until the combination of economic and market conditions, knowledge and technology allow their commercial development. Figure 5: Estimated Available Recoverable Gas Resources in Exploration Permits and Retention Leases in the Carnarvon Basin 45 40 D i s c o v e r i e s 35 30 25 20 15 10 5 0 >5 TCF 1-5 TCF 0.5-1 TCF Estimated TCF (P50) <0.5 TCF Note: Gas resources yet to be commercially linked with a proposed development project. Source: NOPTA 2014 CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 24 Innovative application of more mobile, flexible and cost-effective production technologies, such as floating LNG, offer the potential to bring forward commercialisation and production of some smaller and more remote fields. Similarly, developers are deploying lower cost, mobile drilling and production technologies based on Floating Production Storage and Offloading (FPSO) vessels to produce portfolios of adjacent small fields which otherwise would not have been cost-effective to develop. Commercialisation and production of smaller pools might also be brought forward by optimising the use of, or access to, existing infrastructure to help reduce development costs. However, there may be some practical limitations to multiple use of existing infrastructure, especially where the chemical composition of petroleum differs significantly across fields. How the market will respond to these opportunities and challenges remains to be seen. Pressure for faster commercialisation of petroleum resources is also increasing from third parties and some State Governments, particularly some larger domestic gas consumers. Concerns have been raised about the application of the retention lease provisions, which some large domestic gas users have argued can provide companies with a potential mechanism to schedule production for future export at the expense of domestic users - a practice commonly referred to as warehousing. However, recent reviews of the retention lease arrangements have concluded that the rationale for retention leases – to create a continuing property right that provides certainty and incentive for efficient exploration and development - remains valid. Emerging Issues From a framework perspective many of the main challenges relate to the tensions inherent in a system that is structured on field by field assessment and the private versus public considerations in optimising long-term resource recovery. This is not to suggest that the key principle of commercial development is under consideration – this approach has been the foundation of Australia’s success in attracting investment and will remain so into the future. Keeping an appropriate balance between timely development and providing certainty for long-term investment will be crucial for ongoing success. Key aspects of the regime identified for deeper consideration include: the overall effectiveness of the retention lease framework in promoting the timely commercialisation of resources; opportunities to enhance the incentives for efficient infrastructure development; and the ability of development frameworks to manage more complex interactions and integrated project structures. CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 25 Overall Effectiveness of the Retention Lease Framework in Promoting the Timely Commercialisation of Resources The retention lease framework is applied in the same way across all titles despite the fact that nearly all petroleum discoveries and resources are unique in their combination of geology, location and commercial prospects. It is clear that there are fields, such as those located in remote or deep water areas, which are unlikely to advance significantly towards commercialisation within the five year duration of an initial retention lease. This may be especially so for capital intensive large-scale projects in remote locations which are dependent on securing multiple fields in advance to underpin project economics and long-term supply contracts. The Joint Authority currently takes these matters into consideration when evaluating retention lease applications and renewals. However, rolling renewals may create the perception of development being unduly delayed which may lead to claims of warehousing. It could also be argued that extending the duration of retention leases may weaken the incentive to develop commercially viable fields in a timely and efficient manner. In these circumstances, the question arises as to whether a ‘one-size-fits-all’ five year renewal timeframe serves a practical purpose or whether it adds unnecessarily to compliance burdens and project risks. Should consideration be given to extending the period of a retention lease, or to setting commerciality periods that more closely reflect project development timeframes? What impact might this have on commercial incentives for timely development? It is also evident in some circumstances that the commercialisation of clustered smaller fields is likely to be tied to access to foundation infrastructure and processing facilities. This could suggest that treating such resources as part of an overall project - which could comprise fields in several separate leases - rather than assessing them on a lease by lease basis may be more realistic and practical. Flexible and pragmatic interpretation and application of the framework has helped maintain an appropriate balance to date. However, it is worth questioning whether reliance on administrative flexibility alone is appropriate and whether it will continue to provide sufficient resource certainty for investors undertaking long lead-time, large-scale petroleum projects. Scope may exist to augment the current administrative flexibility with differentiated titles that provide greater legal certainty of tenure for long-term, multi-field development projects. Options may include differentiated titles such as a special form of retention lease, or possibly by linking retention leases directly to production licenses in cases where fields form an integral part of an ongoing production project. A key goal in this and any other reform is ensuring that the perception of “sovereign risk” is maintained at the lowest practical levels. CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 26 Alternatively, there may be opportunities to clarify and improve flexibility through improved guidelines and practices. For example, establishment of a process that provides greater transparency around retention lease decision-making may help to address concerns raised by third-parties about potential warehousing. Scope may exist to improve transparency, for example, through more clearly defined and articulated avenues for stakeholder input to title decisions and through the publication of the reasons for decisions. Comment is sought on whether a more differentiated approach could provide greater and more practical flexibility. If such flexibility was to be considered how could it also ensure that there were sufficient competitive pressures for timely development? Could this include greater transparency in decision making associated with a retention lease? Key Questions 20. To what extent is the retention lease framework providing the right balance between certainty and flexibility for investment and timely, efficient commercialisation? 21. To what extent is the current use of administrative discretion providing sufficient flexibility and security of tenure to attract investment and support timely, efficient commercialisation? 22. How could the retention lease framework be improved to facilitate greater certainty for investment and more timely, efficient and cost-effective commercialisation? a. differentiated retention leases or production licenses to improve security of tenure for long-term, multi-field developments b. more flexible durations for retention leases c. removal of the rolling 15 year development window d. increased administrative flexibility through guidelines and practices e. improved administrative transparency through clearer mechanisms for stakeholder input and publication of reasons for decisions Opportunities to Enhance Commercial Incentives for Efficient Infrastructure Development Poorly coordinated infrastructure development and limited access could affect optimal resource recovery in maturing basins or across adjoining project areas. It could also make small field development more challenging with a consequent risk of delayed or deferred development, and possibly result in resource stranding or sterilisation in extreme cases. In addition, it could result in inefficient use of existing infrastructure as basins mature and foundation fields are depleted. CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 27 History has shown that attempts by Government to dictate development outcomes in a commercial space are rarely, if ever, successful. However, it remains to be seen whether efficient and timely commercial solutions will emerge to bring forward integrated projects involving third-parties. Comment is sought on whether there are opportunities within the current development frameworks to improve commercially-driven incentives for coordinated and efficient investment in, and access to, offshore infrastructure. Key Questions 23. How could incentives for efficient infrastructure investment and operation be improved within the existing development framework? a. coordinated regional development of infrastructure b. more efficient use of existing infrastructure c. multi-use access to infrastructure Ability of the Development Frameworks to Manage More Complex Interactions and Project Operating Environments Increasingly crowded operating environments in mature provinces are raising new challenges for resource management. While not commonplace there have been instances in recent times where exploration and development activity has resulted in multiple discoveries within a title (e.g. an oil and gas deposit) or in a better understanding of complex geological interactions between fields. These may potentially create circumstances where the commercial interest of an operator may focus only on one resource leaving another with commercial potential stranded or sterilised, or result in individual production strategies across a field that spans more than one project title area. Unit development provisions seek to address some of these circumstances but are currently limited to directing more effective resource recovery in cases of adjoining production titles that share a common resource. Scope may exist to increase the coverage of unit development agreements between holders of retention leases and exploration licenses, as a way to encourage more efficient and timely coordinated development in cases where a field spans multiple titles. CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 28 Another possibility may be to issue production titles with boundaries that are more closely correlated with the geological dimensions of discoveries, to help strengthen commercial incentives for optimal long-term resource recovery while reducing the need for subsequent unit agreements. However, closer alignment of title boundaries based on incomplete knowledge at the time of issuing a production license may risk creating title boundaries that impinge on unlicensed acreage, increase the risk and frequency of stymied unitisation, and result in acreage relinquishment patterns that make recycling areas problematic. There may also be scope to consider the wider regional implications of development through the field development planning process. Alternatively, there may be opportunity to improve access to wider regional information, possibly through the publication of such information as part of a non-binding basin development strategy, which could be published by the Joint Authority. Comment is sought on how the Joint Authority might best look to promote optimal long term resource recovery within a framework of commercially driven development in such circumstances. Could refined titling that more closely aligns title boundaries with the geology of discoveries result in more efficient long-term commercial production outcomes? How could this work in practice when titles are held by different joint venture or joint venture structures? Similarly, could more effective use be made of unitisation provisions to facilitate efficiently coordinated development in some cases? Is there scope to take a more regional system-wide approach to field development planning, or to improve access to system-wide information to inform more effective commercial decision-making affecting regional production in these circumstances? Key Questions 24. How effectively is the framework operating in response to more complex geological and operating environments? a. promoting timely development of small fields b. minimising sub-optimal commercial resource recovery in the long term from fields and formations spanning multiple producers c. minimising the incidence of stranding and sterilisation 25. How could the framework be improved to more effectively encourage optimal long-term commercial resource recovery in these circumstances, including minimising the risks of stranding or sterilisation? d. extend the scope and coverage of unitisation provisions to support more effective coordinated field development where required. e. adopt production title boundaries that more closely reflect the CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 29 underlying geology. f. consider the regional system-wide implications of production proposals during field development plan assessment. g. publish regional system-wide information to inform collective commercial production decisions. h. scope to support more efficiently coordinated basin development. CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 30 Annex A: Terms of Reference OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW TERMS OF REFERENCE 1. Context Australia’s offshore resource management legal and operational framework aims to encourage timely and efficient and sustainable exploration and development of oil and gas resources in Commonwealth waters. The current regime has served Australia well to date, attracting substantial investment and supporting the development of an efficient, dynamic and internationally competitive offshore oil and gas industry. However, challenges from growing international competition and a changing offshore operating environment with risks and costs rising as fields mature and new frontier areas are explored and developed make it prudent to look at whether ongoing and timely development of Australia’s oil and gas resources are being appropriately supported into the future. New technologies and industry practices have and will continue to improve the offshore petroleum industry’s ability to access and exploit resources previously considered too difficult or uneconomic. These changes across the sector are testing the robustness of the policy, legal and regulatory framework governing Australia’s offshore resource management going forward. A framework that is flexible enough to keep pace with this evolving operating environment could help attract investment in the exploration and development of Australia’s offshore oil and gas resources. During 2014-15, the Australian Government will undertake a high-level strategic review of the framework governing oil and gas resource management in Commonwealth waters. The Offshore Petroleum Resource Management Review will ensure that the framework is fine tuned to support timely and efficient commercial investment, exploration and development. CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 31 2. Objectives & Scope Consistent with the Government’s regulatory reform agenda, the Review will identify key strategic actions that could be implemented to improve the policy and regulatory framework governing offshore resource management in Commonwealth waters. Any proposed actions will seek to enhance the framework’s clarity and flexibility and reduce regulatory risks and costs, with the aim of supporting optimal commercial investment in the development of Australia’s offshore oil and gas resources. They will not be applied retrospectively to change existing property rights or contractual arrangements. The Review will examine in an integrated manner the key sub-elements of the offshore resource management framework as they apply over the entire exploration and production lifecycle. This could range from how precompetitive data and information supports exploration activities in rank frontiers or underexplored regions to the assessment whether the current regime governing exploration, retention and production activities are providing the most effective commercial incentives and flexibility needed to retain and attract new investment in Australia’s offshore petroleum sector. The Review will also take into consideration changing technologies and industry practices in Australia and world-wide. The Review will identify key emerging economic, commercial, geological and technical issues that are currently or have the future potential to affect offshore resource management across the exploration and production lifecycle. It will also review the policy and regulatory framework governing resource management to identify strategic opportunities to: clarify and reinforce the policy objectives and principles underpinning the Government’s approach to resource management in Commonwealth waters; identify legal and regulatory gaps; and clarify, simplify and rationalise the legal and regulatory framework to help improve regulatory certainty and reduce related costs; and improve the flexibility of the resource management framework so it can more effectively accommodate complex geological conditions, technological advances, evolving commercial practice and emerging operating challenges. The Review will reflect strategic directions established in the Energy White Paper and related ongoing policy development being undertaken by the Australian Government. It will also provide an opportunity for external stakeholders to identify actions to remove undue impediments to business activity and to improve the attractiveness of the framework. CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 32 The Review will deliberately maintain a high level and strategic focus and as such it will not undertake a detailed assessment of all existing legal, regulatory and administrative arrangements governing resource management in Commonwealth waters. However, detailed examination of some arrangements may be required in the context of developing proposed key strategic actions. There are a range of issues that indirectly affect resource management outcomes which are outside the scope of the Review. These include: health, safety and environmental regulation; taxation; labour relations and skills formation; developments in capital and commodity markets; and social licence to operate. Similarly, the resource management dimensions of rules pertaining to offshore carbon sequestration are considered outside the scope of this Review. 3. Deliverables The Review will propose a clear set of strategic actions that could be readily implemented to improve the policy and regulatory framework governing offshore petroleum resource management in Commonwealth waters. A consultation paper will be released in November 2014 to seek stakeholder views on key issues and strategic actions to enhance current arrangements. An interim report will be released for consultation in March 2015. The final report will be delivered to the Commonwealth Minister for Industry by 30 June 2015. 4. Project Management The Review will be undertaken by the Commonwealth Department of Industry in close consultation with key stakeholders. Representatives from industry, jurisdictions and various Commonwealth bodies will be invited to work alongside Departmental staff undertaking the Review. The Review will be supported by a Commonwealth-led working group including key industry, jurisdictional and institutional partners. The Review will be facilitated though an open consultative process which will provide opportunity for effective stakeholder engagement and for all stakeholders to make substantive written submissions in response to the consultation paper and interim report. CONSULTATION PAPER: OFFSHORE PETROLEUM RESOURCE MANAGEMENT REVIEW 33