Chapter 9

advertisement

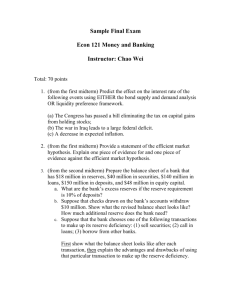

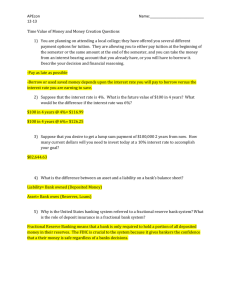

Chapter 5 Policy Makers and the Money Supply © 2000 John Wiley & Sons, Inc. Chapter Outcomes Discuss the objectives of national economic policy and the conflicting nature of these objectives Identify the major policy makers and briefly describe their primary responsibilities Identify the policy instruments of the U.S. Treasury and briefly explain how the Treasury manages its activities 2 Chapter Outcomes (Continued) Describe U.S. Treasury tax policy and debt management responsibilities Discuss how the expansion of the money supply takes place in the U.S. banking system Briefly summarize the factors that affect bank reserves 3 Chapter Outcomes (Concluded) Explain the meaning of the monetary base and money multiplier Explain what is meant by the velocity of money and give reasons why it is important to control the money supply 4 National Economic Policy Objectives Economic Growth High and Stable Levels of Employment Price Stability International Financial Equilibrium 5 National Economic Policy: Important Points GROSS DOMESTIC PRODUCT: GDP is the output of goods and services in an economy INFLATION: Increase in price of goods/services not offset by increase in quality REAL GDP: When GDP exceeds rate of inflation, the result is higher living standards 6 Major U.S. Policy Makers FEDERAL RESERVE SYSTEM -Sets Monetary Policy THE PRESIDENT -Helps set Fiscal Policy CONGRESS -Helps set Fiscal Policy U.S. TREASURY -Conducts Debt Management Policy 7 Fiscal Policy: Definition and Fundraising Activities FISCAL POLICY: Government influence on economic activity through taxation and expenditure plans FUNDRAISING ACTIVITIES: A government raises funds to pay for its activities by: levying taxes, borrowing, or printing money for its own use 8 Fiscal Policy: Stabilizing Factors AUTOMATIC STABILIZERS: Continuing federal programs that stabilize economic activity EXAMPLES: -Unemployment insurance -Welfare payments -Pay-as-you-go progressive income tax 9 Changing the Money Supply FRACTIONAL RESERVE SYSTEM: Allows Fed to alter the money supply PRIMARY DEPOSIT: Deposit that adds new reserves to a bank DERIVATIVE DEPOSIT: Occurs when reserves created from a primary deposit are made available to borrowers through bank loans 10 Checkable Deposit Expansion [Assume: reserve requirement is 20%] Bank A receives a $10,000 primary deposit and makes a loan of $8,000. The “books” would show: BANK A Assets: Liabilities: Reserves $10,000 Deposits $10,000 Loans $8,000 11 Checkable Deposit Expansion [Continued] [Assume: a check is drawn against Bank A and is deposited in Bank B (representing all other banks)] BANK A Assets: Liabilities: Reserves $2,000 Deposits $10,000 Loans $8,000 BANK B Assets: Liabilities: Reserves $8,000 Deposits $8,000 12 Checkable Deposit Expansion [Concluded] [Assume: Bank B loans 80% of its reserves] BANK B Assets: Liabilities: Reserves $8,000 Deposits $14,400 Loans $6,400 Now, if a $6,400 check is written on Bank B: BANK B Assets: Liabilities: Reserves $1,600 Deposits $8,000 Loans $6,400 13 Multiple Expansion of Checkable Deposits BASIC EQUATION APPROACH: Change in Checkable Deposits = (Increase in Excess Reserves)/(Reserve Ratio) Assume Excess Reserves increase by $1,000 and the Reserve Ratio is 20%, then the Change in Checkable Deposits would be: $1,000/.20 = $5,000 14 Important Definitions of Reserves in the Banking System BANK RESERVES: Reserve balances held at Federal Reserve Banks and vault cash held in the banking system REQUIRED RESERVES: The minimum amount of total reserves that a depository institution must hold 15 Important Definitions of Reserves in the Banking System (Continued) EXCESS RESERVES: The amount that total reserves are greater than required reserves DEFICIT RESERVES: The amount that required reserves are greater than total reserves 16 Transactions Affecting Bank Reserves NONBANK PUBLIC: Change in the demand for currency held outside the banking system FEDERAL RESERVE SYSTEM: Changes in open market operations, reserve ratio, and other transactions UNITED STATES TREASURY: Change in Treasury cash holdings and spending 17 Federal Reserve System Transactions Affecting Bank Reserves Change in Reserve Ratio Open Market Operations Change in Bank Borrowings Change in Float Change in Foreign Deposits Held in Reserve Banks Change in Other Federal Reserve Accounts 18 Monetary Base and Money Multiplier EQUATION: MB x m = M1 MONETARY BASE (MB): Banking system reserves plus currency held by the public MONEY MULTIPLIER (m): In a simple monetary system, the ratio of 1 divided by the reserve ratio MONEY SUPPLY (M1): Basic definition of the money supply 19 Complex Money Multiplier (m) EQUATION: m = (1 + k)/[r(1 + t + g) + k] DEFINITIONS: r = ratio of reserves to total reserves k = ratio of currency held by nonbank public to checkable deposits t = ratio of noncheckable deposits to checkable deposits g = ratio of government deposits to checkable deposits 20 Complex Money Multiplier (m) Example Basic Information: r = 20%; k = 20%; t = 10%; & g = 5%. What is the money multiplier (m)? m = (1 + k)/[r(1 + t + g) + k] m = (1 + .20)/[.20(1 + .10 + .05) + .20] = (1.20)/[.20(1.15) + .20] = 1.20/.43 = 2.8 21 Link Between Money Supply and Gross Domestic Product Velocity of money (M1V) is the rate of circulation of money supply Money supply (M1) is linked to gross domestic product (GDP) via velocity Nominal GDP is real GDP (RGDP) + Inflation (I) In terms of growth rates (g) we have: M1g + M1Vg = RGDPg + Ig 22