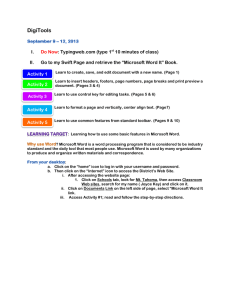

Microsoft Financing - Microsoft Center

advertisement

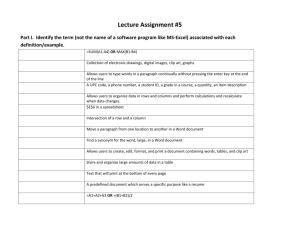

Trevor Hudson Agenda Overview What & How Benefits for LARS Benefits for Microsoft Customers LAR 101 Promotion Further information Overview - Rationale for Microsoft Financing Launched – U.S. – 2003 (US $420m) – Aust – April 2006 – N.Z. – August 2006 Microsoft Financing is a financing program offered and administered by De Lage Landen (DLL) – DLL is a subsidiary of Rabobank – DLL provide back office support in 11 countries, including US, UK, Canada, Australia & NZ Microsoft policy direction – Pricing – Credit assessment Value Proposition Microsoft Brand – Support the sale of Microsoft products • Break even Philosophy – Industry knowledge Simple, Easy & Affordable – Simple - financing agreement – Easy - fast approval process – Affordable – low rates & no fees Microsoft Financing – What we’ll finance Total Solution Financing • – Software • Microsoft software • ISV software • Third party software License Financing (software only) – Enterprise Agreements – Select L or L&SA – Open License Agreements – Software Assurance – Microsoft Dynamics Products – Partner Services • Implementation or migration • Ongoing services – Hardware • Must have a Microsoft component • Any combination • No minimum % hardware Microsoft Financing – How we finance Simple Principal & Interest Loan Finance – Minimum deal size - $15,000 $3,000 – Repayment terms from 2 to 5 years – Flexible repayment structures • Monthly in arrears • Deferred payments • Structured payments – Cater to annuity licenses or milestone implementation • Line of credit facilities/Progress Payments – Competitive rates • Competitive against asset finance rates • No application fees or management fees Microsoft Financing – Documents & KPI’s Easy Application Process • Fast credit decisions* – 24 hours for <$100k – 48 hours for <$500k • Aggressive approval policy – >95% approval rates (ANZ) – >90% globally – “One shot” application • up to $500,000 – 2 page application • over $500,000 or line of credit Fast Supplier payments* – 48 hours on receipt of original documentation * Conditional on correctly executed documentation Benefits To Our Partners Increased dollar value of customer contracts – Financed sales are, on average, 15% to 40% larger than traditional deals. – Create Up selling & cross selling opportunities – Less discounting – focus on payments, not upfront price Shorter sales cycle – Less client decision time Define future sales opportunities – Clearly defined payment cycles – Provide additional opportunities to discuss upgrade strategy Benefits To Our Partners (cont) Stronger Client Relationships – Become a Total Solution Provider – Develop multi-level relationships within customer management – Protect your customers Microsoft Financing is very competitive – Aim is to support sales of Microsoft products Revenue recognition remains the same – Direct sales (eg, EA – no change) – Indirect sales – receive payment from DLL Microsoft Financing – Customer Benefits You wouldn’t dream of paying cash upfront for your office space. Why would you for your IT solutions? Competitive cost of funds Simple & easy application process. We understand solution financing No residuals or balloon payments Match payments with usage. Improve ROI – Free up cash & other credit facilities for core business. Customers can budget confidently over time – predictable cash flow. Purchase decisions made based on requirements, not upfront cost. Microsoft Financing – Customer Benefits Microsoft Office Professional ($55,000) Microsoft Windows® XP ($22,000) Microsoft Windows ServerTM ($4,000) Microsoft Exchange Server ($8,000) Services or other Microsoft Products ($11,000) LAR/ESA 101 Promotion for ANZ • Microsoft ANZ LAR and ESAs only. • Valid 13 December 2006 till COB 30 June 2007. • Payment of a 1% referral fee for Microsoft Financing transactions. • Maximum of AUD/NZD $10,000 per transaction. • Financing that is structured with annual billing (EA’s for example) will receive the 1% referral fee on the first year’s loan amount. • Transaction containing Microsoft Licensing including FPP, Academic, Open, Open Value, Select, and EA level A1, A2, and B transactions DO qualify for the 101 promotion. • Transactions containing EA level C and D transactions DO NOT qualify for the 101 promotion. LAR/ESA 101 Promotion for ANZ • Completion of base MSF training for staff at LARs/ESAs IS REQUIRED to be eligible to participate in the 101 promotion. • Payment for the 101 Promotion will be made by De Lage Landen at time of loan funding. APOC have NO involvement and payment is NOT related to the ESA fee payment. • Engagement for this promotion is with MSF BDMs. – Steve Kerr – Trevor Hudson Microsoft Financing – Resources Web – customer site – www.microsoft.co.nz/financing Brochures – Hard copy (available on request) – Soft copy (pdf available) Phone support – Pre sales • 0800 876 432 – Post Sales (applications & documentation) • 0800 000 229 • 0800 000 304 (fax) In person support – Steve Kerr (partner support & mid market) • P: +61 2 9870 2919 • M: +61 448 864 168 • E: v-steke@microsoft.com – Trevor Hudson (Enterprise customers) • P: +61 2 9870 2898 • M: +61 409 910 328 • E: v-thuds@microsoft.com – Katrinia Braund (SMS&P Sales & Program Manager) • P: +61 2 9870 2415 • M: +61 404 827 913 • E: katbrau@microsoft.com