Lecture 2

advertisement

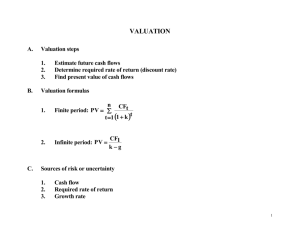

Advanced Corporate Finance FINA 7330 Ronald F. Singer Making Investment Decisions Lecture 2 Fall 2010 1 Capital Budgeting Decisions Check List 1. Net Present Value is the "Discounted value of incremental cash flow” 2. Cash flow is: CASH MONEY IN - CASH MONEY OUT 2 Capital Budgeting Decisions Check List 3. Consider only if it is an incremental cash flow, and consider all incremental cash flows: (a) not historical, or averages; (b) consider only cash flows that appear as a result of the project (c) consider the impact of the project on cash flows from other projects (d) exclude fixed or sunk costs (e) exclude allocated overhead unless it will change as a result of the project. 3 Capital Budgeting Decisions Check List 4. Treat inflation consistently: Discount real cash flow by real discount rates Discount nominal cash flows by nominal discount rates Note: Revenues and costs will not necessarily react uniformly to inflation. 5. All Cash Flow should be on an After-Tax basis. Use actual tax changes when paid! Don't forget to allow for the tax on capital gains Use future marginal tax rates applied to future taxable income 4 Capital Budgeting Decisions Check List 6. Include the opportunity cost of the project, even if there is no explicit cash flow realized Account for assets sold and not sold as a result of adoption of a project. 7. Account for changes in working capital and only changes in working capital. Recognize that working capital will in general be re-couped at the end of the project. 8. Ignore financing including the tax shield on interest 5 Capital Budgeting Decisions Check List 9. Include Asset's Entire Life 10. Include the depreciation tax shield, but not depreciation itself. 6 Capital Budgeting Decisions Check List No matter how complicated the decision: What is important? MAXIMIZE NPV PLAN TO TAKE ALL PROJECTS WITH A POSITIVE NET PRESENT VALUE AND REJECT ALL PROJECTS WITH A NEGATIVE NET PRESENT VALUE 7 Application of the NPV Rule and Capital Budgeting • For now we are going to assume that the appropriate discount rate is known. • The problem we want to tackle is to forecast the relevant cash flows. 8 Only Cash Flows Affect Wealth. What is and is not Cash Flow -Expenses are cash flow regardless of whether the accountant capitalizes and depreciates them or expenses them. -Capital expenditures are cash outflows regardless of the fact that accountants depreciate them over a period. 9 3. Only Incremental cash flows are relevant • Not historical cash flows, not averages, not sunk costs! • Example 1: Consider a firm having made an investment one year in the past. The project required an initial investment of $10,000; with the expectation of $14,000 to be generated within two years. At a discount rate of 10% should the firm have made the investment? 10 Only Incremental cash flows are relevant 14,000 -1---------------0-----------------1 10,000 11 Only Incremental cash flows are relevant 14,000 -1---------------0-----------------1 10,000 • Of course it should have. The NPV was: NPV = 1,564 12 Only Incremental cash flows are relevant • NOW THINGS CHANGE. A NEW DEVICE INTRODUCED BY A COMPETITOR MAKES THE PRODUCT OBSOLETE. THUS EXPECTED CASH FLOWS DECLINE TO $7,000. THAT IS THE INVESTMENT, DID NOT PAY OFF AS EXPECTED AND THE PROJECT IS NOW A LOSER. • SUPPOSE THAT FOR AN ADDITIONAL INVESTMENT OF $5,000, YOU CAN REGAIN YOUR COMPETITIVE POSITION, SO THAT EXPECTED CASH FLOW INCREASES TO THE ORIGINAL $14,000. SHOULD YOU MAKE THE NEW INVESTMENT? 13 Only Incremental cash flows are relevant 14,000 -1---------------0-----------------1 -10,000 -5,000 • Note that the project, looked at as a whole is still a loser: NPV(t = -1) = -10,000 - 5,000 + 14,000 (1.1) (1.1)2 = - 2,975 14 Only Incremental cash flows are relevant 14,000 -1---------------0-----------------1 -10,000 -5,000 • Note that the project, looked at as a whole is still a loser: NPV(t = -1) = -10,000 - 5,000 + 14,000 (1.1) (1.1)2 = - 2,975 BUT the additional investment should be made. • Determine the incremental cash flows. • Determine Net Present Value of the incremental cash flows Incremental Cash Flow: -5,000 + 7,000/(1.1) = 1,363.65 15 Only Incremental cash flows are relevant • Example 2: Assume that the original cash flow estimates were accurate. But that you can; by making an additional investment of 1,000, generate total second period cash flow of 15,050. Should the additional investment be made? (Still Assume r= 10%) 16 Only Incremental cash flows are relevant 14,000 -1---------------------0-----------------------1 -10,000 -5,000 1,050 -1---------------------0-----------------------1 -1,000 NPV (of Additional Investment) = -1000 + 1050 1.1 initial Incremental = - 45.45 • Even though, the original project is a winner, do not make the additional investment • You must Ignore Sunk Costs, and consider only incremental cash flows. 17 4. Treat inflation consistently • Make sure that inflation is accounted for in a consistent manner. Either: 1. State cash flows in terms of actual dollars, at the time the cash flows are received. These are nominal cash flows Or 2. State cash flows in terms of dollars, at the time the projections are made. These are real cash flows. • If cash flows are in nominal terms, use nominal discount rates to discount the cash flows. • If cash flows are in real terms use real discount rates to discount the cash flows. 18 Example • Suppose you are buying a machine that you believe will produce 10,000 widgets per year at a unit cost of $3.00. The machine will last for 10 years. • You can sell the widgets for $5.00 per unit. • The risk of widget production is about average, relative to the economy as a whole. (i.e. has a Beta of 1). • Your CFO thinks the return on the market will average 10% per year, over the next 10 years. • What is the NPV of this project if the machine costs $130,000? 19 Standard Result • Annuity is $20,000 per year for 10 years • Discount rate is 10% • NPV = 122,891 – 130,000 = -7109 • Reject 20 Treat inflation consistently • Example: There is 3% anticipated inflation per year. The real price of Honda Accords is expected to remain constant into the foreseeable future at $20,000. What will the nominal price be after 5 years? Nominal Price = (Real Price) (1.03)5 = $23,185.48 21 Treat inflation consistently • IN GENERAL TERMS: CONVERTING NOMINAL CASH FLOWS TO REAL CASH FLOWS, AND NOMINAL INTEREST RATES TO REAL INTEREST RATES. • If Y(t) is the nominal cash flow in period t, in is the annual anticipated inflation rate, then the real cash flow, y(t) is: y(t) = Y(t) (1+in)t and Y(t) = y(t)*(1+in)t 22 Treat inflation consistently • if R is the annual nominal interest rate, and r is the real interest rate, then: (1+R) = (1+r)(1+in) (1+r) = (1+R)/(1+in) • Don't assume that all cash flows will be affected equally by inflation. • BEWARE OF THE APPROXIMATION: R = r + in This works only if r times in is small. 23 Treat Inflation Consistently • The problem is what is convenient and conventional is typically inconsistent with this rule: • How do you project CF over time? • How do you determine the appropriate discount rate? 24 Example • Suppose you are buying a machine that you believe will produce 10,000 widgets per year at a unit cost of $3.00. The machine will last for 10 years. • You can sell the widgets for $5.00 per unit. • The widget industry has an asset Beta which is similar to the Beta of the S&P 500 • Your CFO thinks the return on the market will average 10% per year, over the next 10 years. • What is the NPV of this project if the machine costs $130,000? 25 Standard Result • Annuity is $20,000 per year for 10 years • Discount rate is 10% • NPV = 122,891 – 130,000 = -7109 • Reject 26 But: • Assume that inflation is anticipated to be 3% per year: • Now we have a growing annuity: • CF(1) = 20,600 • CF(2) = 21,218 • ………. 27 Problem • We had made the classic error of mixing real CF with nominal discount rates. • Use Real CF and Real interest rates: – Real rate = (1.10/1.03) -1 = 6.80% – Then NPV = $141,780 – 130,000 = 11,780 – Accept Project 28 6. Tying up assets uses a valuable resource and must be accounted for. • Example: A firm is considering installing a brick manufacturing kiln. The initial investment will require $300,000 in building and equipment. The kiln will be located on a vacant lot having an estimated market value of $1,000,000. The project is expected to generate net cash flow of $50,000 per year for 20 years. After 20 years, the kiln will be worthless. It is anticipated that the lot could be sold for $2,653,000 at the end of 20 years. At a 10% discount rate, is this a good investment? (Ignore taxes) 29 Tying up assets uses a valuable resource and must be accounted for. • ALTERNATIVE ONE Ignoring the opportunity cost of the (tied-up) land. NET PRESENT VALUE CALCULATION: NPV= -300,000 + PVA(20, 10%, 50,000) = -300,000 + 425,693.05 = 125,693.05 ACCEPT PROJECT • The problem with this is that you ignore the fact that you lose the use of $1,000,000 that you could have had if you had not adopted the project and sold the land (or used it in an alternative project). 30 Tying up assets uses a valuable resource and must be accounted for. • ALTERNATIVE TWO Explicitly consider the land as part of the inputs: You estimate that the land will be worth $2,653,000 in 20 years. PRESENT VALUE CALCULATION: NPV = -1,000,000 -300,000 + PVA(20, 10%50,000) + PV(20, 10%, $2,653,000) = - 1,300,000 + 425,678 + 394,352 = - 479,970 REJECT PROJECT • NOTICE HOW THE TIED UP LAND IS TREATED! 31 Tying up assets uses a valuable resource and must be accounted for. • ALTERNATIVE THREE Consider this as two projects: 1. Consider land as priced correctly in the market (In fact the return to the land is (and assume should be 5%) 2. So NPV of investment in land is 0 • What is the right way to do this? 32 7. Account for changes in working capital and only changes in w.c. • Other Incremental Costs Are Increases in overhead costs as a result of project. Increases in working capital as a result of project. • Notice the reduction in working capital would be a cash inflow at that time. • Do not use allocated overhead, or allocated working capital. 33 Account for changes in working capital and only changes in wc. • Example: Suppose, due to the adoption of the project, the firm is required to increase working capital from $100,000 to $110,000 per annum for the life of the project. How do you account for the working capital? 34 Account for changes in working capital and only changes in wc. • Example: • Suppose, due to the adoption of the project, the firm is required to increase working capital from $100,000 to $110,000 per annum for the life of the project. How do you account for the working capital? +10,000 -10,000 35 Account for changes in working capital and only changes in wc. • Example: Suppose, due to the adoption of the project, the firm is required to increase working capital from $100,000 to $110,000 per annum for the life of the project. How do you account for the working capital? So you see that this is simply a timing problem 36 Remember taxes 1. Calculate all cash flows after taxes 2. Include non-cash expenses (depreciation) for its effect on taxes, but not as a cash flow itself. • HOW TO HANDLE THE DEPRECIATION TAX SHIELD We want the project's AFTER TAX CASH FLOW Equals: Before Tax Cash Flow Less Corporate Taxes Taxes = tc [Cash revenue - Cash Expenses - Depreciation] Therefore, for each year: After Tax Cash Flow =(Cash Revue - Cash Expenses)(1 - tc)+ tc Depr Where: tc x Depr is the Depreciation Tax Shield) 37 5. Remember taxes on Capital Gains 3. Tax on gains/(losses) from sale of assets is an additional negative/positive cash flow Tax on Gains/Losses On sale = tc x (Market Value - Book Value) • If Market Value > Book Value, then tax on gain is cash outflow. • If Market Value < Book Value, then we have a loss on sale, tax is negative, and there is a cash inflow. 38 Remember taxes on Capital Gains • Example: • XYZ Corp. has a project which is going to last 5 years. P & E for this project of $1,000,000, we can assume a scrap value of 300,000 at the end of 5 years. On a straight line basis, that means the firm depreciates the assets @ $140,000 per year, leaving 300,000 when the project ends. 39 Remember taxes and the effect of selling assets • However, you expect that you can sell the asset for $500,000 at the end of 5 years. Thus there is a taxable capital gain of: (MV-BV) = $200,000. • At a 35% Corporate Capital Gain Tax rate, that means that after tax cash flow from the disposal of P&E is 0.35 * $200,000 = $70,000 Thus the Cash flow from selling the asset is: $500,000 -70,000 = $430,000 (Remember to add back Book Value) 40 8. Ignore the means of financing both as a direct cash flow and as its effect on taxes. • Interest payments are not cash flows when doing project analysis. Discounting already takes the time value of money into account. To deduct interest would be double counting. • Example: Suppose that you borrow $500, and put in $500 of your money into the following project. (Bank charges 8% on loan) 0 1 Cash Flow -1000 1125 Interest -40 Net -1000 1085 • To say that we reject the project since NPV (of net cash flow) is negative at 10% (NPV = -13) is double counting. We penalize the project twice, one by deducting interest, second by discounting. • The NPV of this project is:- 1,000 + (1,125)/1.10 = 23 41 STEPS IN PROJECT ANALYSIS 1. MAKE INITIAL PROJECTIONS Made by operations manager Generally in form of income statement Clarify assumptions 2. ADJUST FOR INFLATION IF APPROPRIATELY 3. REARRANGE IN CASH FLOW FORM 4. PERFORM NET PRESENT VALUE CALCULATIONS 5. PERFORM "WHAT IF" CALCULATIONS 42