Basics: Foundations of Financial Aid (OpInform

Back to Basics:

Foundations of

Financial Aid

OpInform 2015

OpInform 2015

Daniel M. Tramuta

Associate Vice President for Enrollment Services

State University of New York at Fredonia

New York State Financial Aid Administrators Association (NYSFAAA) – Past-President

Eastern Association of State Financial Aid Administrators (EASFAA) – State Rep tramuta@fredonia.edu

OpInform 2015

Overview Of Higher Education Landscape

• Demographics

• Decline in HS Graduates out to 2022

• Selectivity Matrix

• Program Demand

• Retention

• Merit-Based Arms Race

• Cost and Affordability

• Scholarship–increased discounting to finding price point

• Debt at Graduation

• Return on Investment

• New Academic Programs

OpInform 2015

Projected change in the number of high school graduates 2010 to 2019

OpInform 2015

Factors Most Noted in Choosing & Staying at a College

1. Majors & Career Programs Offered

2. Cost/Affordability

3. Location/Campus Characteristics/Faith Support

4. Campus Size/Safety

5. Characteristics of Enrolled Students

6. Selectivity

OpInform 2015

2014 Undergraduate Degree Demand – ACT Test Takers

OpInform 2015

Topics

The Basics

The Makings of a Financial Aid Package

How Financial Need is Determined

Best Practices

Discussing Financial Aid

Reviewing Award Letters

Change to FAFSA Process

SUNY SmartTrack

SUNY Financial Aid Days

OpInform 2015

What Makes up a Financial Aid Package?

OpInform 2015

What Makes up a Financial Aid Package?

Grant Programs

PELL Grant

Must have an EFC between $0-$5,199

Max. Award $5,775

NYS TAP Grant

Based on NYS net taxable income

Max. Award $5,165

OpInform 2015

What Makes up a Financial Aid Package?

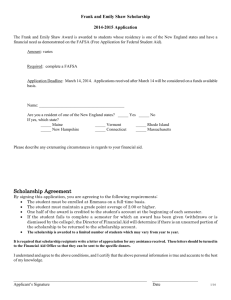

Scholarship Programs

Private scholarship search

At your college of interest

Free internet scholarship searches

www.fastweb.com

www.studentaid.gov

Local library resources

Local businesses and civic organizations (including professional associations) related to student's field of interest

Student’s employer

Parents’ employers/unions

OpInform 2015

What Makes up a Financial Aid Package?

Federal Work Study

Based on financial need

Traditionally on-campus employment

Usually 12 to 15 hours per week

OpInform 2015

What Makes up a Financial Aid Package?

Federal Perkins Loan Sunsetted by the U.S. Senate – discontinued as of 9/30/15 for all new borrowers

Based on financial need, 5% interest rate

Teacher Cancellation Benefits

OpInform 2015

What Makes up a Financial Aid Package?

William D. Ford Direct Loans

Subsidized

4.29%

Capped at 8.25%

Based on need

Federal government pays interest while student is in school

$3,500 for freshmen

Unsubsidized

4.29%

Capped at 8.25%

Not based on need

Maximum Direct Loans for freshmen: $5,500

OpInform 2015

What Makes up a Financial Aid Package?

Parent Loans for Undergraduate Students (PLUS)

For parents of dependent students

Borrow up to entire cost of college less financial aid

No adverse credit (parent must pass credit check)

Interest rate 6.84%

Capped at 10.5%

Time Payment Plans

May vary…typically, families spread the direct costs over the semester or year.

OpInform 2015

What Makes up a Financial Aid Package?

Additional Resources

OpInform 2015

What Makes up a Financial Aid Package?

SUNY State-Operated Campuses 2015-2016 TEACH Grant

Up to $3,728 per year

For students who intend to teach:

A high-need field

Students of low-income

Four-year service contract

More information: www.studentaid.ed.gov

OpInform 2015

What Makes up a Financial Aid Package?

STEM Incentive Program

Tuition scholarship at SUNY or CUNY

Eligibility

Need to graduate in top 10% of high school class

Need to study in STEM Field

Need to maintain a 2.5 average

Five-year service contract to work in NY state in a

STEM field

More information: www.hesc.ny.gov or Scholarship

Unit at 1-888-697-4372

OpInform 2015

What Makes up a Financial Aid Package?

NY-AIMS

Award of $500

Eligibility

NY State high school graduate

Achieved academic excellence

‒ Top 15%

‒ 3.3 GPA or above

‒ Honor Regents diploma or a score of 3 or higher on two advanced placement exams

Based on unmet need

Applications and more information available in May

More information: www.hesc.ny.gov or Scholarship Unit at 1-888-

697-4372

OpInform 2015

The New York State Masters-in-Education

Teacher Incentive Scholarship Program

Awarded to 500 top undergraduate students

Full graduate tuition to pursue Masters in Education at a

SUNY or CUNY

Available for the 2016-17 academic year

Eligibility

Student must be enrolled full-time in a master's degree in education program

Agree to teach in a NYS public elementary or secondary school for 5 years following degree completion

OpInform 2015

New York State ‘Get on Your Feet’ Loan

Forgiveness Program

Eligibility

Reside in NYS for 12 continuous months

Be a U.S. citizen or eligible non-citizen

Graduated or received a NYS HS equivalency diploma

Earned an undergraduate degree from a college or university located in NYS in or after 2014-15

Have a AGI of less than $50,000

Enrolled in the federal IBR plan or Pay as You Earn plan

If employed, primary work location in NYS

OpInform 2015

New York State ‘Get on Your Feet’ Loan

Forgiveness Program

Eligibility

Current on all federal or NYS student loans

Current on the repayment of any NYS award

Be in compliance with the terms of any service condition imposed by a NYS award

Earned no higher than a bachelor’s degree at the time of application

Apply within 2 years of receiving an undergraduate degree

OpInform 2015

What Makes up a Financial Aid Package?

Cost of Attendance

OpInform 2015

How is Financial Aid Determined?

Estimated Family Contribution (EFC) is determined by:

Parents’ income and assets - primary home value excluded

Student’s income and assets

Size of family

Age of parents

Number of children in college

COA minus EFC = Need

OpInform 2015

Best Practices

OpInform 2015

Best Practices

Discussing Financial Aid at Family Meetings

OpInform 2015

Best Practices

Reviewing Award Letters

OpInform 2015

Change to FAFSA

Process for 2017-18

OpInform 2015

Change to 2017-18 FAFSA Process

Using Prior-Prior Year (PPY) Tax Income Data on the FAFSA

The Free Application for Federal Student Aid (FAFSA) becomes available every January 1, and currently requires a family's federal income tax information from the year prior. Families are encouraged to file the FAFSA as soon as possible after January 1 st to maximize their odds of receiving financial aid. But with tax deadlines months later, most have to estimate their tax information on aid applications and make corrections later. In the worst case scenario, some families miss out on financial aid funds that are disbursed on a first-come basis.

Education Secretary Arne Duncan enacted a change this past Sunday (9/13/15) that would fix this widespread issue. By using income from two years ago, otherwise known as Prior-Prior year

(PPY) tax income data, families could file their FAFSA with tax information they already have, making the process quicker and easier. By taking advantage of the existing ability to import tax information directly from the IRS onto the FAFSA form, families will spend less time gathering paperwork and would make far fewer errors.

The use of prior-prior year income also presents an opportunity to align admissions and financial

aid decisions and give millions of families more time to plan for actual college costs, rather than sticker prices or projections. Low-income families experience very little income fluctuation from year to year and most would not see a significant change in their eligibility for a Pell Grant with a switch to prior-prior year income.

Prior-prior year income is the closest thing we have to a "silver bullet" for an industry in search of meaningful solutions. With earlier aid awards, financial aid administrators would have more time to help families evaluate their options and make informed financial decisions.

OpInform 2015

Change to 2017-18 FAFSA Process

Using Prior-Prior Year (PPY)Tax Income Data on the FAFSA

With the switch to PPY, students and families will be able to:

• File the FAFSA earlier. As we discussed, the FAFSA is made available January 1 of each calendar year, yet it is uncommon for a family or individual to be prepared to file an income tax return in the month of January. Under the new PPY system, the 2017-18

FAFSA will be available in October 2016 , rather than January 1, 2017, and as such families can use the PPY’s completed income tax return on their 1718 FAFSA.

• More easily submit a FAFSA. The IRS Data Retrieval Tool (DRT), which allows automatic population of a student’s FAFSA with tax return data and decreases the need for additional documentation, can be used by millions more students and families under

PPY, since tax data from two-years prior would be readily available upon application.

• Receive earlier notification of financial aid packages. If students apply for both admission and aid earlier, colleges can in turn provide financial aid notifications to students earlier, ensuring that students and families have more time to prepare for college costs. Notifying students earlier of their financial aid packages will also leave more time for one-on-one counseling with students and families.

* Next year’s (2016-17) aid applicants will be using the same prior year federal income (2015) for two consecutive years

OpInform 2015

Change to 2017-18 FAFSA Process

Students will no longer need to estimate income, since prior-prior year income will be used on the FAFSA

Admission Application timeline will be moved up

2017-18 FAFSA can be completed/submitted as early as October

1 st , 2017 using 2015 federal tax data

Financial aid packages will be developed & delivered earlier

Families will have more time to prepare for meeting college costs

OpInform 2015

SUNY Smart Track

OpInform 2015

SUNY Smart Track

SUNY standard award letter

System-wide financial literary

Student engagement/communication

Delinquency/default resolution

www.suny.edu/smarttrack

OpInform 2015

SUNY Smart Track

OpInform 2015

SUNY Smart Track Award Letters

OpInform 2015

Breaking Down a SUNY Smart Track

Award Letter

OpInform 2015

Breaking Down a SUNY Smart Track

Award Letter

OpInform 2015

Breaking Down a SUNY Smart Track

Award Letter

OpInform 2015

Breaking Down a SUNY Smart Track

Award Letter

College Overview

Section:

Graduation rate

Loan default rate

OpInform 2015

Breaking Down a SUNY Smart Track

Award Letter

College Overview Section:

Median borrowing

Repaying loan information

School contact information

OpInform 2015

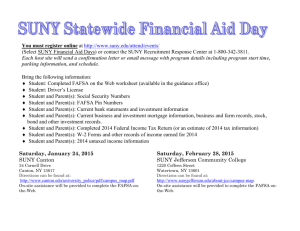

2016 SUNY Financial Aid Days

Saturday, January 16, 2016

Saturday, February 20, 2016

Ask questions about the financial aid application, types of aid and the award process

Some campuses will offer web access to complete the FAFSA online

Students may register at www.suny.edu/studentevents in early

December

OpInform 2015