INTRODUCTION The Role, History & Direction of Accounting

advertisement

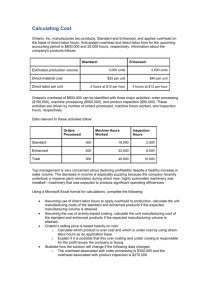

JOB-ORDER COSTING Chapter 4 Accounting Principles II AC 2102 - Fall Semester, 1999 Chapter 5 - 1 Two Basic Types Of Production • Job-Order Production & Costing – Production of unique, one-of-a-kind products – Note: the job can contain a batch of these special, distinct units • Process Production & Costing – Mass production of large quantities of similar or homogeneous products Chapter 5 - 2 Job-Order Cost Systems • Unique, one-of-a-kind, custom-made, tailor-made, built-to-order products • Often a job is associated with a particular customer’s order • Costs collected by job • Frequently prices are based on costs in a job-order environment • Examples: printing, construction, furniture making, auto repairs Chapter 5 - 3 Process Costing Systems • Mass production of large quantities of similar or homogeneous products • Accumulate production costs by process or department for a given period of time • The output for the process for that period is also measured • Unit costs are computed by dividing the total process costs for the period by the output • Example: gallons of paint, cans of corn, bottles of softdrinks, boxes of cereal Chapter 5 - 4 Job-Order vs. Process Costing Job-Order Costing Process Costing • Wide Variety of distinct products • Costs accumulated by job • Unit costs computed by dividing total job costs by units produced on that job • Homogeneous products • Costs accumulated by process or department • Unit costs computed by dividing process costs of the period by the units produced in the period Chapter 5 - 5 Assigning Costs To A Job • Production costs consist of direct materials, direct labor and manufacturing overhead • Overhead can be assigned using traditional approaches or an activity-based approach • Thus overhead can be assigned to a job using one of the three following methods: (1) unit-based plant-wide overhead rates, (2) unit-based departmental overhead rates, (3) activity-based costing Chapter 5 - 6 Applying Overhead Using Unit-Level Systems • Unit-level systems include applying overhead using plant-wide or departmental rates based on direct labor hours, machine hours, direct-labor dollars or units produced • Such systems can be effective or adequate if certain conditions exist Chapter 5 - 7 Conditions Under Which Unit-Level Systems Are Effective • Whenever one of the three following conditions exist, unit-level systems are adequate for costing and decision-making • The three conditions are: (1) The nonunit-level overhead is a small percentage of the total overhead (2) The products produced have the same overhead consumption ratios (3) the cost of using both unit-level & nonunitlevel drivers exceeds the benefits Chapter 5 - 8 Using Predetermined Overhead Rates In Job-Order Costing • The completion of a job rarely coincides with the completion of a fiscal year • Thus if overhead rates are not determined in advance - i.e.. by the use of predetermined rates, then there will be substantial delays in costing out jobs • Normal costing systems are therefore generally used in a job costing environment Chapter 5 - 9 Normal Costing Systems • Includes the following three costs in the cost of a job: – Actual material cost – Actual direct labor cost – Applied overhead based on predetermined rates • Those rates can be unit-based or activitybased rates Chapter 5 - 10 Calculating The Cost of A Job • The unit cost of a job is simply the total cost of the following items: – Materials used on the job – Labor worked on the job – Overhead assigned or charged to the job • And, to state it once again, the overhead can be assigned using single unit-level drivers or using the multiple-driver approach of activity-based costing Chapter 5 - 11 Why Companies Need Unit Costs • The generation of financial statements • The determination of profitability • The making of decisions – example: determining what price to charge Chapter 5 - 12 The Flow of Costs Through The Accounts (1) The “cost flow” refers to the way we account for costs from the point at which they are incurred to the point at which they are recognized as an expense on the income statement Chapter 5 - 13 The Flow of Costs Through The Accounts (2) • Five accounts are generally involved in the manufacturing cost flow process: – Raw Materials Inventory – Work-In-Process Inventory – Finished Goods Inventory – Manufacturing Overhead Control – Cost of Goods Sold Chapter 5 - 14 Accounting For Overhead In A Normal Costing System (1) • Actual overhead costs are collected in the manufacturing overhead account • The overhead rate used to assign overhead to jobs was predetermined based on estimated figures for the overhead dollars and the estimated level of the application bases • Thus, actual overhead is never assigned directly to jobs Chapter 5 - 15 Accounting For Overhead In A Normal Costing System (2) • Although actual overhead is not being directly assigned to jobs, it is still being accounted for • At the end of each fiscal year, the difference between the total overhead that has been charged to jobs and the total actual overhead incurred leads to an adjustment in the cost of goods sold account • for details read pages 168-175 in the text Chapter 5 - 16 Key Job-Order Source Documents Job-Order Cost Sheets • Each job has its own job-order cost sheet • On this sheet direct material and direct labor costs are collected and periodically overhead is assigned • The collection of all job-order cost sheets make up the work-in-process file Chapter 5 - 17 Key Job-Order Source Documents Material Requisitions • This document is completed whenever material is transferred into WIP inventory for a particular job • It specifies the identification number of the job and the quantities and cost per unit of the materials being used on the job • It is via this document that material can be physically traced to a job and therefore becomes a “direct” cost of a particular job Chapter 5 - 18 Key Job-Order Source Documents Job Time Tickets • This document is used to trace direct labor costs to particular jobs. • On this document workers provide their identity, the task they are performing, the amount of time consumed, and the job number • Then using the applicable wage rate, direct labor costs can be assigned to jobs • It is via this document that labor can be physically traced to a job and therefore becomes a “direct” cost of a particular job Chapter 5 - 19 Chapter 5 - 20 Chapter 5 - 21