SHORT RUN PRODUCTION DECISIONS

advertisement

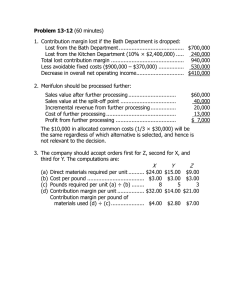

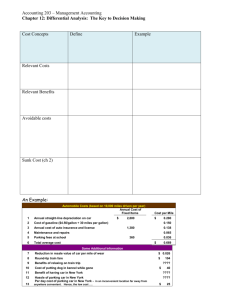

Decision Making ACC 2203 REVIEW WORKSHOP SINDHU BALA SHORT RUN PRODUCTION DECISIONS Managers have to make short-term production decisions on a continual basis. Some of those production decisions are: Adding or dropping a product line. E.g. should GM add a new line of SUV-Truck hybrids; should it drop its line of Pontiac-Aztek SUVs? Making or buying a component part. E.g. should Daimler-Chrysler make the seats for its cars or should it outsource the seats to a supplier? Accepting or rejecting a special order. E.g. should Ford accept/reject a special order from Hertz for a number of stripped down Ford Escorts? Deciding which product to make when facing an input/capacity constraint. E.g. when there is a shortage of skilled labor, which type of cars should GM primarily manufacture? Identifying Relevant Costs A relevant cost is a cost that differs between alternatives. An avoidable cost can be eliminated (in whole or in part) by choosing one alternative over another. Avoidable costs are relevant costs. Unavoidable costs are irrelevant costs. Two broad categories of costs are never relevant in any decision and include: Sunk costs. Future costs that do not differ between the alternatives. Relevant Cost Analysis: A Two-Step Process Step 1 Eliminate costs and benefits that do not differ between alternatives. Step 2 Use the remaining costs and benefits that do differ between alternatives in making the decision. The costs that remain are the differential, or avoidable, costs. Adding/Dropping Segments One of the most important decisions managers make is whether to add or drop a business segment, such as a product or a store. Let’s see how relevant costs should be used in this type of decision. Due to the declining popularity of digital watches, Lovell Company’s digital watch line has not reported a profit for several years. Lovell is considering dropping this product line. A Contribution Margin Approach DECISION RULE Lovell should drop the digital watch segment only if its profit would increase. This would only happen if the fixed cost savings exceed the lost contribution margin. Let’s look at this solution. Adding/Dropping Segments Segment Income Statement Digital Watches Sales Less: variable expenses Variable manufacturing costs Variable shipping costs Commissions Contribution margin Less: fixed expenses General factory overhead Salary of line manager Depreciation of equipment Advertising - direct Rent - factory space General admin. expenses Net operating loss $ 500,000 $ 200,000 300,000 $ 380,000 (80,000) $ 120,000 5,000 75,000 $ 60,000 90,000 50,000 80,000 70,000 30,000 Adding/Dropping Segments Investigation has revealed that total fixed general factory overhead and general administrative expenses would not be affected if the digital watch line is dropped. The fixed general factory overhead and general administrative expenses assigned to this product would be reallocated to other product lines. The equipment used to manufacture digital watches has no resale value or alternative use. Should Lovell retain or drop the digital watch segment? A Contribution Margin Approach Contribution Margin Solution Contribution margin lost if digital watches are dropped Less fixed costs that can be avoided Salary of the line manager Advertising - direct Rent - factory space Net (dis)advantage ? ? ? ? $ - Comparative Income Approach The Lovell solution can also be obtained by preparing comparative income statements showing results with and without the digital watch segment. Let’s look at this second approach. Comparative Income Approach Solution Keep Drop Digital Digital Watches Watches Sales $ 500,000 $ Less variable expenses: Manufacturing expenses 120,000 Shipping 5,000 Commissions 75,000 Total variable expenses 200,000 Contribution margin 300,000 Less fixed expenses: General factory overhead 60,000 Salary of line manager 90,000 Depreciation 50,000 Advertising - direct 80,000 Rent - factory space 70,000 General admin. expenses 30,000 Total fixed expenses 380,000 Net operating loss $ (80,000) Comparative Income Approach Difference - The Make or Buy Decision A decision to carry out one of the activities in the value chain internally, rather than to buy externally from a supplier is called a “make or buy” decision. The Make or Buy Decision: An Example Essex Company manufactures part 4A that is used in one of its products. The unit product cost of this part is: Direct materials Direct labor Variable overhead Depreciation of special equip. Supervisor's salary General factory overhead Unit product cost $ 9 5 1 3 2 10 $ 30 The Make or Buy Decision The special equipment used to manufacture part 4A has no resale value. The total amount of general factory overhead, which is allocated on the basis of direct labor hours, would be unaffected by this decision. The $30 unit product cost is based on 20,000 parts produced each year. An outside supplier has offered to provide the 20,000 parts at a cost of $25 per part. Should we accept the supplier’s offer? The Make or Buy Decision Cost Per Unit Outside purchase price $ 25 Direct materials Direct labor Variable overhead Depreciation of equip. Supervisor's salary General factory overhead Total cost $ 9 5 1 3 2 10 $ 30 Cost of 20,000 Units Buy Make $ - $ Should we make or buy part 4A? - Opportunity Cost An opportunity cost is the benefit that is foregone as a result of pursuing some course of action. Opportunity costs are not actual dollar outlays and are not recorded in the formal accounts of an organization. How would this concept potentially relate to the Essex Company? Decision To Make/Buy An Input Problem – Berta Inc. is a manufacturer of quality mattresses with an annual production and sales of 10,000 units. Berta currently makes it own spring assemblies but has received an offer from a supplier to furnish the springs for $48. Berta’s costs of production are as follows: Direct materials Direct labor Variable overhead Fixed overhead TOTAL Cost per spring set $16.00 $3.50 $4.50 $28.00 $52.00 Total costs $160,000 $35,000 $45,000 $280,000 $520,000 30% of the fixed overhead is traceable to the spring assemblies and the rest is general overhead that is allocated to each unit. 1. Suppose the company has no alternative use for and cannot rent out the production space used for making the springs. Should it outsource the springs? 2. Suppose the company can use the production space for springs as a warehouse, replacing the warehouse it currently rents for $180,000. Should it outsource the springs? Decision To Make/Buy An Input Make part Buy part Revenues: we don’t know anything about the revenues, though we can assume they are the same in both cases. We will focus on the costs. Costs Costs of purchase DM DL VOH FOH Total costs Key Terms and Concepts A special order is a one-time order that is not considered part of the company’s normal ongoing business. When analyzing a special order, only the incremental costs and benefits are relevant. Accept or Reject Special Order Note: In the decision making problems that follow we will ignore: (1) all factors not explicitly given in the problem, (2) the time value of money Decision To Accept/Reject A Special Order Problem – Vince Pasta Inc. makes a fancy variety of fresh pasta which it sells for $3/lb. Vince currently uses 50% of its capacity, producing 150,000 pounds of pasta annually. Vince recently received an offer from a chain restaurant to supply 100,000 pounds of pasta at $2.20 per pound. Vince budgeted production costs at 150,000 and 250,000 pounds are as follows: Production quantity Direct materials ($0.8/lb.) Direct labor (0.6/lb.) Factory overhead* TOTAL COSTS 150,000 lb. 250,000 lb. $120,000 $90,000 $210,000 $420,000 $200,000 $150,000 $250,000 $600,000 Cost per pound $2.8/lb. $2.4/lb. * Variable factory OH is $0.4/lb. and fixed factory overhead is $150,000 The company does not expect to receive any additional orders in the near future. The sales manager wants Vince to accept the order but the production manager does not. The production manager argues that the order would cause a loss of $0.20 per pound. Should Vince accept the special order? Accept or Reject Special Order Incremental Approach: Status quo: making 150,000 lb. egg noodles New project/activity: special order to make 100,000 lb. of additional noodles. Incremental benefits: Incremental costs: Additional DM Additional DL Additional VOH Total: Accept or Reject Special Order If Vince had a maximum capacity of 200,000 lb., should it accept the special order? Assume this is an all or nothing order; Vince either provides all of the 100,000 pounds or none. Note that now we have opportunity costs. The opportunity costs are the benefits forgone from not selling 50,000 lb. to regular customers. Incremental Approach: Status quo: making 150,000 lb. egg noodles New project/activity: special order to make 100,000 lb. of additional noodles. Incremental benefits: increase in revenue: Incremental costs: Additional DM Additional DL Additional VOH Opportunity costs of 50,000 lb. Total: Utilization of a Constrained Resource Key Terms and Concepts • When a limited resource of some type restricts the company’s ability to satisfy demand, the company is said to have a constraint. • The machine or process that is limiting overall output is called the bottleneck – it is the constraint. When a constraint exists, a company should select a product mix that maximizes the total contribution margin earned since fixed costs usually remain unchanged. A company should not necessarily promote those products that have the highest unit contribution margin. Rather, it should promote those products that earn the highest contribution margin in relation to the constraining resource. Utilization of a Constrained Resource An Example Ensign Company produces two products and selected data are shown below: Product 2 1 Selling price per unit Less variable expenses per unit Contribution margin per unit Current demand per week (units) Contribution margin ratio Processing time required on machine A1 per unit $ 60 36 $ 24 2,000 40% 1.00 min. $ 50 35 $ 15 2,200 30% 0.50 min. Utilization of a Constrained Resource An Example Machine A1 is the constrained resource and is being used at 100% of its capacity. There is excess capacity on all other machines. Machine A1 has a capacity of 2,400 minutes per week. Should Ensign focus its efforts on Product 1 or 2? Utilization of a Constrained Resource An Example The key is the contribution margin per unit of the constrained resource. Utilization of a Constrained Resource An Example The key is the contribution margin per unit of the constrained resource. Product 2 1 Contribution margin per unit Time required to produce one unit Contribution margin per minute $ ÷ 24 $ min. ÷ 15 min. Utilization of a Constrained Resource An Example Alloting Our Constrained Resource (Machine A1) Weekly demand for Product 2 Time required per unit Total time required to make Product 2 Total time available Time used to make Product 2 Time available for Product 1 × 2,200 units 0.50 min. min. - min. min. min. Joint Products – Sell or Process further The decision is whether to sell the joint products at the splitoff point or to process them further and then sell Joint costs – costs of simultaneously producing two or more products, called joint products, that must, by the nature of the process, be produced together. Examples of joint products: Oil and gas, hamburger and steaks Split-off point – the point in the production process at which the joint products become distinct or separate items Note: In joint products problems where a company has to decide whether to process joint products further beyond the split-off point, the costs incurred up to the split-off point are sunk and hence are irrelevant. Any attempt to allocate such costs to joint products and to consequently factor them into the decision process would lead to imprudent production decisions. Joint Products – Sell or Process further Example: Buy a new car for $20,000 Incur $2,000 in costs and sell for $11,000 Current market value is $8,000 Get it painted and install new stereo You can sell as is This is the split-off point Get $8,000 Joint Products – Sell or Process further Example: Buy a new car for $20,000 Incur $2,000 in costs and sell for $11,000 Get it painted and To answer Current the market question of sellinstall as isnew or stereo process value further, is $8,000 you need to examine the incremental costs and incremental benefits You can sell as is This is the split-off point Get $8,000 Joint Products – Sell or Process further Problem – Bass Chemicals Inc. produces three chemicals: Acetox, Denox, and Pectix through one joint process costing $80,000. These chemicals can all be sold at the split-off point or processed further and sold at a higher price. Sales value at Additional costs of Sales value split-off point processing further if processed further Acetox $50,000 $23,000 $65,000 Denox $25,000 $44,000 $82,000 Pectix $85,000 $93,000 $184,000 Which of the products should be processed further and which ones should be sold at the split of point? If the joint processing costs were $120,000, would you change your answer?