M&A Due Diligence Checklist: Operations & Risk Management

advertisement

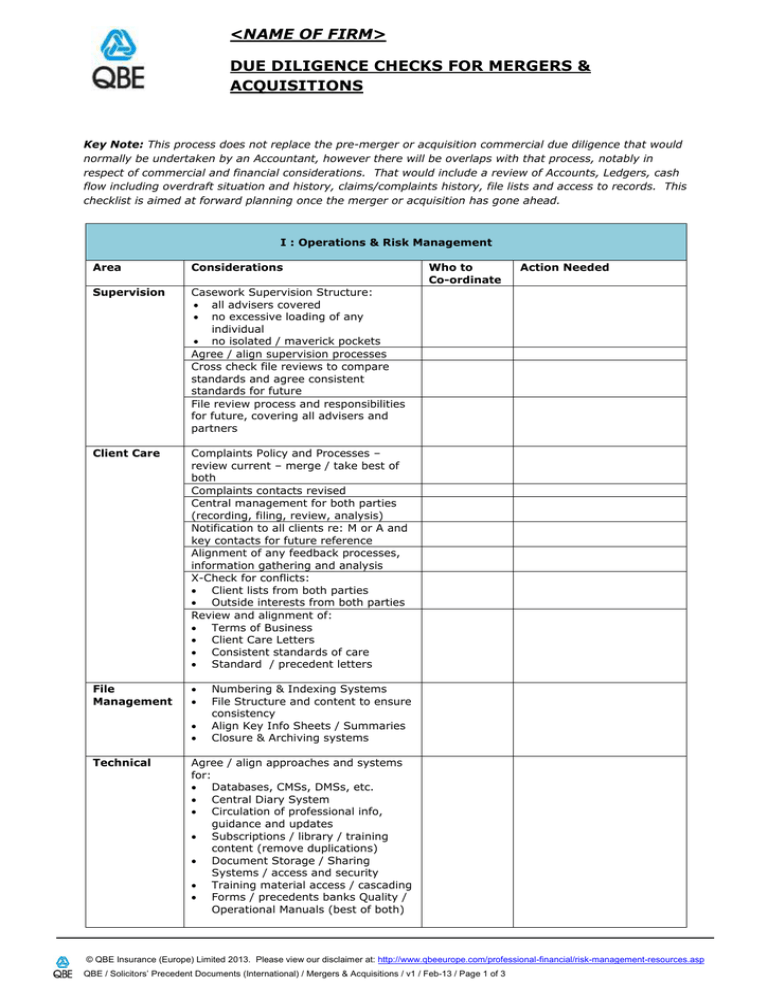

<NAME OF FIRM> DUE DILIGENCE CHECKS FOR MERGERS & ACQUISITIONS Key Note: This process does not replace the pre-merger or acquisition commercial due diligence that would normally be undertaken by an Accountant, however there will be overlaps with that process, notably in respect of commercial and financial considerations. That would include a review of Accounts, Ledgers, cash flow including overdraft situation and history, claims/complaints history, file lists and access to records. This checklist is aimed at forward planning once the merger or acquisition has gone ahead. I : Operations & Risk Management Area Considerations Supervision Casework Supervision Structure: all advisers covered no excessive loading of any individual no isolated / maverick pockets Agree / align supervision processes Cross check file reviews to compare standards and agree consistent standards for future File review process and responsibilities for future, covering all advisers and partners Client Care Complaints Policy and Processes – review current – merge / take best of both Complaints contacts revised Central management for both parties (recording, filing, review, analysis) Notification to all clients re: M or A and key contacts for future reference Alignment of any feedback processes, information gathering and analysis X-Check for conflicts: Client lists from both parties Outside interests from both parties Review and alignment of: Terms of Business Client Care Letters Consistent standards of care Standard / precedent letters File Management Technical Who to Co-ordinate Action Needed Numbering & Indexing Systems File Structure and content to ensure consistency Align Key Info Sheets / Summaries Closure & Archiving systems Agree / align approaches and systems for: Databases, CMSs, DMSs, etc. Central Diary System Circulation of professional info, guidance and updates Subscriptions / library / training content (remove duplications) Document Storage / Sharing Systems / access and security Training material access / cascading Forms / precedents banks Quality / Operational Manuals (best of both) © QBE Insurance (Europe) Limited 2013. Please view our disclaimer at: http://www.qbeeurope.com/professional-financial/risk-management-resources.asp QBE / Solicitors’ Precedent Documents (International) / Mergers & Acquisitions / v1 / Feb-13 / Page 1 of 3 I : Operations & Risk Management (Contd.) Area Considerations Who to Co-ordinate Case Management Alignment of Approaches, Systems and/or Documents for: Client Risk Assessment and Acceptance New matter risk assessment and acceptance Conflict Checks (separate or merged client databases) Precedent documents – system overlaps / duplications Undertakings – wordings, authority, monitoring Key Dates – which ones, what, where and reminders Central recording expectations and any standardised formats Time Recording Handover / holiday cover Monitoring and reporting on progress / inactivity Selection, Authorisation and Management of third parties Collation of risk information and agreement of risk monitoring, review and reporting processes Action Needed II : Structure and Organisation Area Considerations Organisation & Management Partnership: Written partners/Members Agreement / Articles of Association Consistency of all terms, rewards, entry and departure criteria Compliance / quality standards and expulsion criteria Management: Structure & decision-making process Allocation of managerial roles & consideration of competencies Partner - Peer Review arrangements Joint Ventures Review of any referral arrangements, appointed representatives and similar: conflicts contracts / referral agreements disclosure statements monitoring processes record keeping PI / Other Insurance Who to Co-ordinate Action Needed Succession issues / partpurchase / runoff cover (discuss with broker) Rationalise brokers and covers © QBE Insurance (Europe) Limited 2013. Please view our disclaimer at: http://www.qbeeurope.com/professional-financial/risk-management-resources.asp QBE / Solicitors’ Precedent Documents (International) / Mergers & Acquisitions / v1 / Feb-13 / Page 2 of 3 II : Structure and Organisation (Contd.) Area Considerations Personnel <The Lateral Hire Checklist should be referred to.> Consistency of expectations, remuneration / rewards: Terms of Employment Salary Brackets Align performance targets for Advisers; WIP; Write offs etc. Other objectives Alignment of approach to reviews/appraisals Equality & Diversity Policy / Process Who to Co-ordinate Action Needed Fit and Proper Checks (Certs, Quals, Disciplinary etc.) Collect info on Outside Interests for Conflict of Interest Checks Briefing sessions re: new structure, plans, objectives Business Planning & Budgeting Research & Planning Survey of aims and aspirations – Partners, fee-earners and staff Survey of both sets of clients – current views and future needs New Plan / Model(s) and Budgets Processes for monitoring above Expenditure Authorisation / Limits Update of all hard and soft marketing materials Alignment of CSR activities Changes to Business Continuity Plans Services Agree / Rationalise: Banks, Office Account/s and Client Account/s Accountants and Year End Brokers and Insurers Training Materials / Services Other advisers /consultants Any outsourced services (conflicts, contracts, monitoring, and controls, record keeping) Other For existing / additional premises: Check health safety records and plans Security and Access arrangements Equality / Accessibility of premises and service provision generally © QBE Insurance (Europe) Limited 2013. Please view our disclaimer at: http://www.qbeeurope.com/professional-financial/risk-management-resources.asp QBE / Solicitors’ Precedent Documents (International) / Mergers & Acquisitions / v1 / Feb-13 / Page 3 of 3