chapter 7 production and cost even number answers, solutions, and

advertisement

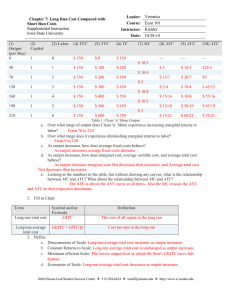

CHAPTER 7 PRODUCTION AND COST EVEN NUMBER ANSWERS, SOLUTIONS, AND EXERCISES ANSWERS TO ONLINE REVIEW QUESTIONS 2. a. Fixed. Ordering and installing more ovens probably takes longer than a month. b. Variable. The furniture manufacturer will increase this input in step with the quantity of its output. c. Variable. Same reasoning as (b). d. Variable. When not covered under some long-term contract, labor is almost always a variable input. e. Probably variable in a month. Hertz can add cars to its fleet quickly; however, if governed by longer-term contracts with automakers, its fleet may be a fixed input over a month. 4. Fixed costs are the costs involved in purchasing a firm’s fixed inputs; variable costs are costs of obtaining a firm’s variable inputs. Using this classification: a. Variable. Steel is a variable input for GM that changes when output changes. b. Fixed. Rent does not vary with output. c. Variable. Varies with the number of papers printed, i.e., output. 6. While there is no logical necessity for the U shape of the typical LRATC curve, it seems to typify the cost structure of firms in a variety of industries. The downward sloping portion of the curve results from economies of scale. These are realized when long-run total cost rises proportionately less than output, due to gains from specialization or more efficient use of lumpy inputs. At some point, these economies are exhausted; however, as output continues to increase, diseconomies of scale are encountered. In this situation, long-run total cost rises more than in proportion to output. PROBLEM SET 2. a. TC1 gives long-run total cost because it registers the cost of 0 units of output as 0. In the long run, all inputs can be varied, and the cheapest way to produce zero output is to use zero inputs. Short-run total costs are detailed in column TC2. In the short run, not all inputs can be varied, and there will be some fixed costs incurred, even at 0 output. b. c. At 3 units and 5 units, long-run total cost = short-run total cost; hence, in the short run, the firm must be producing these output levels with the same input mix. d. Their managerial skills are wanting. They overlook the economies of scale evident from the fact that when output doubles from 2 units to 4 units, long-run total cost less than doubles, implying that it is not necessary to double all inputs. Another way of saying this is that the firm is on the declining portion of the LRATC curve. e. The most straightforward way to answer this problem is to compute LRATC at each output level using the total cost figures in the column labeled TC1: Q LRATC 0 — 1 $300 2 $200 3 $155 4 $124 5 $112 6 $100 7 $100 There are economies of scale (declining LRATC) from 1 to 6 units of output, and constant returns to scale (constant LRATC) from 6 to 7 units. 4. The increase in demand for petroleum products must have led to an increase in their price. Since fuel is a major variable input for any airline, Continental’s MC, AVC, and ATC curves must have all shifted upward. Its AFC, however, would be unaffected, since fixed costs are the cost of fixed inputs such as hangars and aircraft. 6. Down On Our Luck Studios should still release the film because their TR > TVC. If they release the movie, their total revenue will be $6 + $2 = $8 million, because they can earn $12/2 million from Box office sales and $2 million from DVD sales. Their total fixed cost is $100 million (they already spent this) and their total variable cost is $5 million, which they can choose to spend or not, by choosing whether to release. Since $8 million > $5 million they should release. This way they will sustain a loss of (TFC+TVC)-TR = ($100 + $5) – $8 = $97 million. Alternatively, if they do not release, they will sustain a loss of $100 million, their total fixed cost. 8. a. If the new project costs a total of $5 billion, it would be wiser to implement it, starting from scratch. In that case the total cost would be $5 billion for the new project plus $3 billion already spent on the old project, a total of $8 billion. However, if the administration sticks with the old project, it will have spent $3 billion plus additional $8 billion, a total of $11 billion. Thus, it is better to switch even though $3 billion would be wasted. b. If the new proposal costs a total of $10 billion, then it would not be wise to implement it. In this case, if they choose the new proposal the government would spend $10 billion plus $3 billion already invested, a total of $13 billion. This is more than $11 billion, which would be the total cost if the government sticks with the old project. 10. a. b. Increasing marginal returns to labor are evident for the range between 0 and 2 accountants. Diminishing marginal returns then set in for each remaining accountant. c. The crucial assumption here is that the quantity of other, nonlabor inputs (equipment) remain fixed. Hence, additional accountants might not have ready access to computer equipment, printers, or even desk space. This would decrease the amount of services that each additional accountant could produce. MORE CHALLENGING 12. a. b. From 0 to A, the marginal product is positive but decreasing—diminishing marginal returns to labor. Beyond point A, marginal product is negative— negative marginal returns. There are never increasing returns. 14. Whenever the MC curve is below ATC, ATC must fall, and whenever the MC curve is above ATC, then ATC must rise. Keeping this in mind, the MC curve would be graphed as: