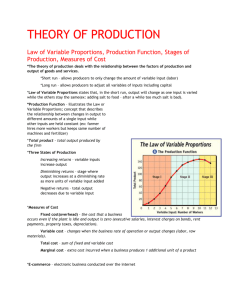

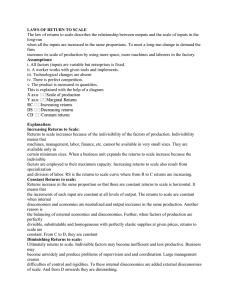

MODULE 56: Long-Run Costs and Economies of Scale AP Microeconomics Before you read the module: Summary This module examines how a firm’s costs behave in the short run and in the long run. Module Objectives Objective 1. Why a firm’s costs differ in the short run and the long run. Objective 2. How a firm’s technology of production can generate increasing returns to scale, also known as economies of scale. While you read the module: Key Terms Define these key terms as you read the module. The long-run average total cost curveIncreasing returns to scaleEconomies of scaleDecreasing returns to scaleDiseconomies of scaleConstant returns to scaleSunk cost- After you read the module: The lowest possible average total cost that can be achieved for each output level if the firm were to choose its fixed cost is used to determine a firm’s (1) ___________ average cost curve. This curve initially has a negative slope, indicating that the firm is experiencing (2) _______________ returns to scale (also known as economies of scale). In this situation, average cost (3) __________ as output increases. Eventually, this curve will have a positive slope, as the firm begins to experience (4) ____________ returns to scale (also known as diseconomies of scale). In this situation, average cost (5) ________________ as output increases. Specialization and initial set-up costs lead to (6) _______________ returns to scale, while problems of communication and coordination lead to (7) ______________ returns to scale. (8) ________________ costs should be ignored in decision-making. Module Review The Long Run Versus the Short Run When we talk about firms’ decisions making, we often refer to choices made in the long run or the short run. But how long is the long run and how short is the short run? Is a year considered the long run? The answer is that it depends. If you were a mother elephant waiting to give birth, a year would seem like no time at all—the gestation period for an elephant is the longest of any land animal at 22 months. However, if you were a fruit fly, a year would seem like an eternity—the average fruit fly lives less than two months. The idea of time is similar for a firm. The short run and the long run for a firm depend on the nature of the firm. A nuclear power plant can take decades to construct and begin operation. But a T-shirt concession can start up in a matter of hours. The long run and the short run are defined by the degree to which inputs are variable—not by a particular length of time. In the short run, there is at least one input that is fixed: the firm has no ability to change its use of that input. A firms returns to scale identify whether or not the firm can reduce its costs by increasing its level of production. Firms that have increasing returns to scale benefit from being relatively large, while firms with decreasing returns to scale find that getting larger is detrimental to them because as their output levels expand, their average costs rise. Consider a firm with increasing returns to scale: when this firm doubles its inputs, it doubles its costs. But when inputs are doubled, this firm can produce more than double its original level of output. This implies that its ATC, which is equal to TC/Q, will decrease because TC has doubled while Q has more than doubled. Consider a firm with decreasing returns to scale: when this firm doubles its inputs, it doubles its costs. But when inputs are doubled, this firm can only produce less than double its original level of output. This implies that its ATC, which is equal to TC/Q, will increase because TC has doubled while Q has less than doubled. Students often mix up the concepts of diminishing marginal returns to an input and returns to scale. Remember that diminishing returns to an input is based on changing the quantity of one input while holding constant the quantities of all other inputs. Diminishing returns is a short-run concept because at least one input is being held constant. Returns to scale, in contrast, is a long-run concept based on an equal opportunity proportionate increase in all inputs and the effect of this change on the firm’s level of output.