CH05

advertisement

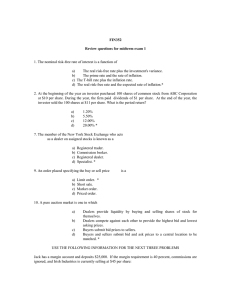

Chapter 5 How Securities Are Traded Learning Objectives • Explain the role of brokerage firms and stockbrokers. • Describe how brokerage firms operate. • Outline how orders to buy and sell securities are executed. • Discuss the regulation of the Canadian securities industry. • Explain the importance of margin trading and short selling to investors. Brokerage Operations • Brokerage firms earn commissions on executed trades, sales charges on mutual funds, profits from securities sold from inventory, underwriting fees and administrative account fees • Full-service brokers offer a full range of services including order execution, information on markets and firms, and investment advice • Full-service brokers in Canada are primarily owned by large banks (e.g., RBC Dominion Securities, BMO Nesbitt-Burns, and Scotia Capital Markets Brokerage Operations • Discount brokers concentrate on executing orders and thus are able to charge lower fees • Do not offer research reports and recommendations and/or advice • Most of the full service brokerage firms have discount brokerage operations (e.g. Royal Bank Action Direct Discount Brokerage, TD Waterhouse, and Bank of Montreal Investor Line Brokerage Account Types • Cash account: Investor pays 100% of purchase price for securities to the broker (the most common type of brokerage account) • Margin account: Investor borrows part of the purchase price from the broker • Wrap account: A new type of brokerage account where all costs are wrapped in one fee (for investors with minimum investments of $100,000) Fees and Costs • Brokerage commissions differ by security, broker, and investor • The US eliminated fixed commissions requirements in 1975 and Canada in 1983, now fees are supposed to be negotiated Institutional investors have greatest negotiating power (Why?) On-line trading offers significantly lower commission rates to individual investors • • In 1992 E*TRADE became the first brokerage service to offer on-line trading E*TRADE now offers banking services as well Electronic Trading and the Internet • Individual investors now have three choices when executing trades: 1- Full-service brokers: e.g., BMO Nesbitt-Burns 2- Large discount brokers: e.g., TD Waterhouse 3- Internet discount brokers: e.g., E*TRADE Canada Investing without a broker • Dividend reinvestment plans (DRIPs) permit the shareholders to reinvest dividends to purchase additional shares of stock at no additional cost • Some plans (approximately one third of Canada’s 70) offer 3 to 5% discount for share purchases • Therefore, it is possible to invest in the market without a stockbroker • A number of companies now sell shares directly to investors (e.g., Exxon allows investors to open a direct purchase account to buy its stock) • Companies selling stock by this method view it as a way to raise capital without underwriting fees Orders on Organized Exchanges • The TSX introduced the world’s first computerassisted trading system (CATS) in 1977 • On April 23, 1997 the TSX closed all floor trading, and al TSX and TSX Venture Exchange stocks are now traded electronically • The NYSE continues to make use of the specialist system Specialists maintain the limit order book Specialists keep a fair and orderly market by providing liquidity Orders in OTC Markets • Dealers are ready to either buy or sell Bid price is the highest offer price to buy Ask price is the lowest price willing to sell • Ask price - Bid price >0 (dealer spread) Dealer “makes a market” in the security More than one dealer for each security in overthe-counter markets Types of Orders • Investors can buy or sell stocks in “board lots” or “odd lots,” or a combination of both • Canadian exchanges define “board lots” as orders in multiples of 100 shares. • A trade of less than 100 shares is considered to be an “odd lot.” • For example, an order of 356 shares would be for three board lots and one odd lot. Types of Orders • Market order: The most common type of order, authorizes immediate transaction at best available price • Limit order: An order that is executed only if the buyer (seller) obtains the stated sell (ask) price. - Limit orders are executed in order of price (e.g., a limit buy order with a bid of $35 is filled before one with a bid of $34.5, while a limit sell order with an ask price of $36 is filled before one with an ask price of $36.5) - Investors can enter limit orders as day orders or gooduntil-cancelled (GTC) orders which remain in effect until cancelled or renewed. Types of Orders • All or none orders (AON) orders are only executed if the total number of shares specified in the order can be bought or sold (“fill or kill” orders). The advantage of this type of order is that prevents accumulation of odd lots, which can be more expensive to trade • Stop order: Specifies a particular market price at which a market order takes effect (e.g., a stop order to sell at $50 becomes a market order to sell as soon as the market price reaches (or declines to) $50. • A sell stop order can be used to protect a profit in the case of a price decline Difference between limit and stop orders • A stop order specifies a certain price at which the market order takes effect. The exact price specified in the stop order is not guaranteed and may not be realized. • Limit orders are placed on opposite sides of the current market price of a stock from stop orders. • For example, while a buy limit order would be placed below a stock’s current market price, a buy stop order would be placed above its current market price. Clearing Procedures • The settlement date is the same day for government T-bills; two business days for other Government of Canada liabilities • Settlement dates for stocks are three business days after the trade date Legal ownership transferred and financial arrangements settled with brokerage firm • Transfer of securities and funds between exchange members facilitated by a clearinghouse: The Canadian Depository for Securities (CDS) Canadian Regulatory Environment • Self-Regulatory Organizations (SROs) regulate their own activities • Canadian Investor Protection Fund (CIPF) was established to protect investors • Investment Dealers Association of Canada (IDA) is the national trade association for the investment industry • Canadian Securities Institute (CSI) is the national education body of the Canadian securities industry Margin Accounts • Exchanges set minimum required deposits of cash or securities • Investor pays part of investment cost, borrows remainder from broker Margin is the percent of total value that cannot be borrowed from broker • Margin call occurs when the actual margin declines below the margin requirement • Actual margin= (Market value of securities – Amount borrowed) Market value of securities Margin Accounts • Cash has 100% loan value, which means that $100,000 in cash deposits constitutes a $100,000 margin • Stocks have 50% (or lower) loan value because of potential fluctuations in their market value (i.e., an investor may have to deposit $200,000 worth of stocks to satisfy a $100,000 margin requirement • Margin requirements for stocks traded in Canada range from 30% to 100%, depending on the stock’s price (Table 5.1 pg 141) • The margin requirements increase as the stock price decreases, reflecting the additional risk associated with lower-priced stocks. Margin Accounts What are the advantages and disadvantages of margin accounts? • Margin accounts allow for the magnification of gains (but also losses). • With a margin requirement of 50%, percentage gains are doubled (ignoring transaction costs and interest costs), because the investor only has 50% of the value of the transaction at stake • The risks are obvious, if the transaction goes against the investor, the percentage losses are doubled Margin Accounts • Example 1 If the margin requirement is 30% on a $10,000 transaction (100 shares at $100 per share). How much money must the investor come up with? How much will the investor borrow from the broker? Margin Accounts • Example 2 Assume that the margin requirement is 30% and that the price of 100 shares of stock declines from $100 to $95. Calculate the new actual margin. How much will the investor have to contribute in order to restore the margin requirement of 30% Margin Accounts • Example 3 An investor purchases common shares of two companies on margin. The first share (A) has a margin requirement of 70% and is presently trading for $10, while the second share (B) has a margin of 50% and is trading at $2. a- What is the total margin requirement if the investor purchases 1,000 shares of A and 1,000 shares of B? b- If the price of A immediately increases to $11 and the price of B falls to $1.5, how much is the required deposit on the margin account? Short Sales • The sale of a stock not owned by the investor but borrowed from a third party in order to take advantage of an expected decline in the price of the stock • Borrowed security sold in open market, to be repurchased later at an expected price lower than sale price • The investor profits from the difference between the price at which the borrowed stock was sold and the price at which it was purchased Short Sales • The securities could be borrowed from another broker • Individuals sometimes agree to lend securities to short sellers in exchange for interest-free loans equal to the value of the securities sold short Investor (short seller) liable for declared dividends Short sale proceeds held by broker, no funds are immediately received by the short seller There is no limit on short sales. Short sellers can remain short indefinitely until the lender wants the securities back Short sales are permitted only on rising prices or an uptick Short sellers must have a margin account to sell short Risks associated with short selling • The threat of being required to purchase shares at undesirable prices if the margin is not maintained and/or if originally borrowed stock is called by its owners and cannot be replaced • The possibility of volatile prices if a rush to cover short positions occurs • Unlimited potential loss Short Sales • Example 1 Molson requires a margin of 130%. If Helen short sells 100 shares for $36 each, How much will she have to deposit to bring the margin account up to 130%? If the price of Molson rises to $42, how much will Helen have to deposit in order to restore the margin? If the Price of Molson fell to $30, how much will Helen be able to withdraw from the margin? Short Sales • Example 2 What amount must an investor put into a margin account, if the margin requirement is 130% and the investors short sells 1,000 shares at $10? What will happen if the price of the shares increase to $12? Appendix 5-A: Trading on the NYSE • Centralized continuous auction market • Exchange participants: single specialist commission brokers independent floor brokers registered traders • SuperDot • Major roles of NYSE specialist Dealer Agent Catalyst Auctioneer • Commissions deregulated in 1975 Appendix 5-B: U.S. Securities Regulation • The Securities and Exchange Commission (SEC) was created by the US Congress in 1934 An independent and quasi-judicial agency of the US government • SEC is required to investigate complaints of violations in securities transactions • Investment advisor and companies must register with the SEC and disclose certain information • The National Association of Securities Dealers (NASD) is a trade association established to enhance the self-regulation of the securities industry