2013-State-MC-Non-Math - Mid

advertisement

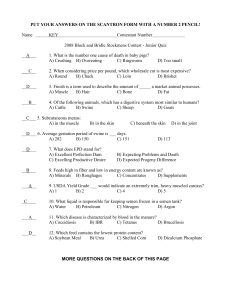

2013 State Farm Management Non-Math Multiple Choice 2. The objective of determining repayment capacity of a farm or ranch business should be A. to determine the net return to land, labor, and management for the business. B. to determine how much debt the business can safely handle. C. to determine the rate of return to farmer’s equity capital. D. to project the net worth of the business for the end of the year. E. None of the above • B 7. Livestock, stored grain, land, and personal property used to secure a loan are A. collateral. B. inventory. C. liability. D. net worth. E. None of the above • A 8. The main drawback of an adjustable rate mortgage is that A. the initial interest rate is usually higher than for other types of loans. B. the interest is not deductible for farm businesses. C. it is only available for loans under $100,000. D. the interest rate can increase. E. None of the above • D 12. Which of the following will always produce an increase in the gross margin for a corn producer? A. An increase in the price of corn and a decrease in corn yield. B. A decrease in the price of corn and an increase in corn yield. C. A decrease in the price of nitrogen fertilizer and an increase in corn yield. D. An increase in the price of nitrogen fertilizer and an increase in corn yield. E. None of the above • C 15. The price of a product changes from $100 to $75 and, as a result, the quantity demanded increased from 50 to 60 units. From this we can conclude that A. the demand is elastic. B. the demand is inelastic. C. the demand is of unit elasticity. D. the demand has decreased. E. None of the above • B 16. Corn and grain sorghum are substitutes for each other in many livestock feed rations. Assuming they are substitutes, a decrease in the supply of corn would cause the demand for grain sorghum to A. shift to the left. B. shift to the right. C. decrease. D. remain unchanged. E. none of the above • B 20. Purchase of a call option on corn means the buyer A. is required to sell a corn futures contract at a set price. B. may sell, but is not required to sell, a corn futures contract at a set price. C. may buy, but is not required to buy, a corn futures contract at a set price. D. is required to buy a corn futures contract at a set price. E. None of the above • C 21. A farmer with a long position in the futures market A. profits when prices go down, loses when prices go up. B. profits when prices neither go up nor down. C. profits when prices go up, loses when prices go down. D. loses when prices neither go up nor down. • C 23. A farmer placed too low a value on his feeder pigs in his closing inventory while all other records were accurate. The current ratio in his record summary is A. too high. B. too low. C. not affected. D. fixed • B 25. Ownership costs of a tractor include all but which of the following? A. Depreciation on the tractor B. Insurance for the tractor C. Taxes on the tractor D. Fuel for the tractor E. None of the above • D 26. In which of the following market structures would consumers be expected to pay the highest price? A. Pure competition B. Monopolistic competition C. Oligopoly D. Monopoly E. Monopsony • D 27. A cattle feeder, wishing to use futures markets to hedge the price of slaughter cattle, would at the time of his cattle purchase A. buy futures contracts expecting to sell the contracts when selling cattle. B. sell futures contracts expecting to sell more contracts when selling cattle. C. sell futures contracts expecting to buy contracts when selling cattle. D. buy futures contracts expecting to buy more contracts when selling cattle. E. None of the above • C 28. An increase in the value of the U.S. dollar relative to the currency of other countries should result in A. more costly imports. B. less costly imports. C. increased exports. D. no effect on imports or exports. E. None of the above • B 30. The demand curve shows the relationship between A. consumer tastes and the quantity demanded. B. price and the quantity demanded. C. price and production costs. D. money income and quantity demanded. E. None of the above • B 31. A projection of all income and expenses associated with growing an acre of a particular crop would be called A. a partial budget. B. an enterprise budget. C. a whole farm budget. D. an income statement. E. a balance sheet. • B 32. The asset turnover ratio equals A. net farm income divided by total assets. B. net farm income plus depreciation divided by total assets. C. value of farm production divided by total assets. D. value of farm production divided by net worth. E. None of the above • C 34. The Social Security wage base A. does not apply when calculating Medicare taxes. B. is the same for Medicare as for Social Security. C. is doubled when calculating self-employment income. D. is half as much for self-employed individuals. E. None of the above • A 35. In a livestock enterprise budget prepared on July 1, home-grown feed A. should not be included as a cost. B. should be included, valued at its net market price. C. should be included valued at its cost of production. D. should be valued at past year’s inventory value. E. None of the above • B 37. There is not a CME Group corn futures contract for which of these months? A. May B. July C. September D. December E. None of the above • E 38. In analysis of a farm, what would you do if a cash flow projection indicated that there would be more expense than income in a certain month? A. Terminate the enterprise causing the cash flow problem that month. B. Use savings, delay expenses, move up sales, or borrow money. C. Change from cash to accrual accounting method. D. Change depreciation methods. E. None of the above • B 39. A CME Group feeder cattle futures contract covers how many pounds of feeder cattle? A. 30,000 B. 40,000 C. 50,000 D. 60,000 E. None of the above • C 41. Which of the following would not appear on a cash flow statement? A. Interest paid on a loan for a tractor B. Principal paid on a loan for a tractor C. Depreciation expense on a tractor D. Rental payment received from the neighbor who used the tractor. E. None of the above • C 42. The USDA agency with primary responsibility for soil and water conservation is A. NASS. B. ERS. C. NRCS. E. FSA. E. None of the above • C 43. A price ceiling set below the equilibrium price creates A. shortages. B. black markets. C. surpluses. D. A and B. E. None of the above • D 44. The income that could have been received if the input had been used in its most profitable alternative use is A. alternative income. B. marginal revenue. C. not important in agriculture. D. opportunity cost. E. None of the above • D 45. The largest trading center for livestock futures is located in A. Chicago, Illinois. B. Sioux City, Iowa. C. Omaha, Nebraska. D. Oklahoma City, Oklahoma. E. Kansas City, Missouri. • A 46. If a farmer is to carry a hedge through to completion, the farmer A. will always make a profit. B. must always deliver the hedged commodity at the local elevator. C. must be prepared to meet all margin calls. D. the basis becomes a major consideration. E. None of the above • C 47. Salvage values do not need to be considered when comparing a cash outright purchase to A. a credit purchase. B. a financial lease. C. custom hire. D. All of these E. None of these • A 48. Operating costs do not need to be considered when comparing custom hire to A. a cash outright purchase. B. a financial lease. C. a credit purchase. D. All of these E. None of these • E 49. The value of operator labor needs to be considered when comparing a credit purchase to A. a cash outright purchase. B. a financial lease. C. custom hire. D. All of these E. None of these • C 50. Maintenance and repair costs need to be considered when comparing custom hire to A. an outright cash purchase. B. a financial lease. C. a credit purchase. D. All of these E. None of these • D