2010 State Non-Math M/C - Mid

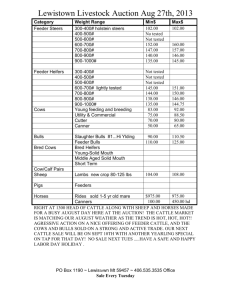

advertisement

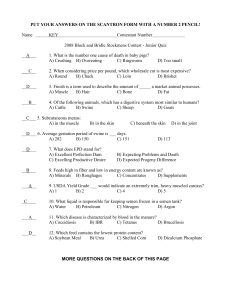

2010 State Non-Math M/C Farm Management CDE 1. For tax year 2009, the social security wage base was A. $94,200 B. $97,500 C. $102,000 D. $106,800 D. E. None of the above 5. The two primary methods of describing the size and location of farmland are rectangular survey and A. angle and distance. B. differential elevation. C. border calibration. D. metes and bounds. E. None of the above D. . 6. How many acres are in a quarter section of land? A. 40 acres B. 160 acres E. None of the above C. 640 acres B D. 1,000 acres . 8. Which of the following farm items is not eligible to be depreciated? A. A machine shed constructed by the farmer B. A used tractor purchased from a neighbor C. A new pickup D. Raised heifers added to the breeding herd E. None of the above D . 9. Advantages of incorporating the farm business include all of the following except A. limiting personal liability. B. better income tax treatment for fringe benefits. C. simpler record keeping. D. facilitates multiple owners. E. None of the above .C 10. A decrease in the value of the U.S. dollar relative to the currency of other countries should result in A. more costly imports. B. less costly imports. C. decreased exports. D. no effect on imports or exports. E. None of the above A. . 11. Carrie Cattlefeeder buys feeder cattle and corn and sells fed cattle.If she wants to be totally hedged in the futures market for her price risk in the coming year, she would be A. "short" fed cattle, "long" feeder cattle, and "long" corn. B. "short" fed cattle, "short" feeder cattle, and "short" corn. C. "short" fed cattle, "short" feeder cattle, and "long" corn. D. "long" fed cattle, "short" feeder cattle, and "short" corn. E. None of the above A. 12. The best indication that a farmer is making financial progress year-to-year is A. an increase in the value of total assets on the balance sheet. B. a decrease in the value of total liabilities on the balance sheet. C. an increase in net worth on the balance sheet. D. an increase in total cash flow on the cash flow statement. E. None of the above C. . 14. For an amortized loan, the amount of interest in the first payment will be A. more than the amount of the principal. B. less than the amount of the principal. C. equal to the amount of the principal. D. dependent on the length of the loan. E. None of the above E. . 16. The maximum amount that can be claimed as a Section 179 expense deduction on your 2009 tax return is A. $5,000. B. $25,000. C. $100,000. D. $250,000. E. None of the above D. . 22. A farmer's net returns per acre for establishing alfalfa the first year are negative, but he makes money for each of the next four years before the alfalfa has to be reestablished. In preparing an enterprise budget to compare alfalfa with other crops A. he should use only the returns after the alfalfa has been established. B. he should decrease the annual returns after the alfalfa has been established by the cost of establishing the crop. C. he should decrease the annual returns after the alfalfa has been established by 20% of the establishment year losses to cover the cost of establishment. D. he should amortize the establishment year losses over the remaining four years. E. None of the above D . 23. Which is heavier, a bushel of shelled corn or a bushel of soybeans? A. Shelled corn B. Soybeans C. They weigh the same. D. Depends on whether measured in pounds or kilograms. E. None of the above B 24. If the interest rate is 10%, what is the present value of a dollar to be received by a producer two years from now? A. $0.826 B. $0.900 C. $1.100 D. $1.210 E. None of the above A. 25. When an increase in production of one enterprise causes a reduction in the production of another enterprise, the two enterprises are said to be A. independent. B. complementary. C. supplementry. D. competitive. E. None of the above D. . 27. A grain farmer who normally stores his soybeans at a local elevator has decided to use the options market to create a synthetic storage. To do so he will sell his beans at harvest and A. buy a put option. B. sell a put option. C. buy a call option. D. sell a call option. C. . 29. The primary goal of income tax management for a farm operator is to A. minimize income taxes paid. B. maximize the taxable income. C. minimize the taxable income. D. maximize the farm's after tax income. E. None of the above D. 30. The demand curve shows the relationship between A. consumer tastes and the quantity demanded. B. price and the quantity demanded. C. price and production costs. D. money income and quantity demanded. E. None of the above B. . 35. The best measure of a firm's ability to make a short-term loan payment is A. debt/asset ratio. B. solvency ratio. C. current ratio. D. leverage ratio. E. net capital ratio. C. 36. If the U.S. wheat industry has an inelastic demand curve, a decrease in the amount of wheat supplied to the market would A. have no effect on total revenues for wheat producers. B. increase the total revenues for wheat producers. C. decrease the total revenues for wheat producers. D. cause a sharp increase in the demand for wheat. E. None of the above B 37. A trader with a long position in the futures market A. profits when prices go down, loses when prices go up. B. profits when prices neither go up nor down. C. profits when prices go up, loses when prices go down. D. loses when prices neither go up nor down. E. cannot lose money. C 38. Livestock, stored grain, land, and personal property used to secure a loan are A. B. C. D. E. collateral. inventory. liabilities. net worth. Illiquid. A 39. Which of the following is not a supply shifter for farm products? A. B. C. D. E. weather new technology government programs consumer income None of the above D 41. Cooperatives pay patronage refunds according to A. B. C. D. E. one man, one vote. size of farm. amount of business done by patron. total assets. All of the above C 42. For a trader who is short in the market, a standing order to buy should the futures price move above a certain level is called a A. B. C. D. E. stop order. limit order. permanent block. hedge. None of the above A . 44. Interest rates go up, causing Jack's annual interest expense to increase from $12,000 to $14,000. This will cause his rate of return A. B. C. D. E. increase. decrease. not change. Any of the above None of the above B on equity to . 45. Crop prices decline, causing Marcia's sales income to decline while leaving her cash operating expenses unchanged. This will cause her capital turnover to A. B. C. D. E. increase. decrease. not change. Any of the above None of the above B 46. The ability of larger firms to be more profitable than smaller firms in the same industry is an example of A. B. C. D. E. diminishing returns. imperfect competition. inelastic supply. economies of size. None of the above D