Notes and Practice with Answers

advertisement

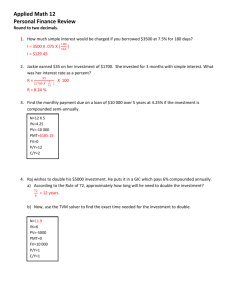

Notes on Chapter 19 This worksheet uses the TVM Solver key on the TI-84 or TI-83 Plus or TI-83 to solve compound interest problems. The answers found by using the calculator will be different from the answers found by using the tables. The reason for this is the table values have been rounded to four decimal places. The calculator values are not rounded until the final answer is found. To locate this key do the following: For the TI-84 or TI-83 Plus: Press the APPS key, #1 Finance, #1 TVM Solver. OR For the TI-83: Press 2nd Finance, #1 TVM Solver. The screen should now look like: N= I%= PV= PMT = FV= P/Y = C/Y= N is the total number of periods in the loan. For example: For compounded monthly for 1 year, N = 12. For compounded monthly for 5 year, N = 60. For compounded quarterly for 1 year, N = 4. For compounded quarterly for 6 year, N = 24. I% is the interest rate. DO NOT CHANGE THE PERCENT TO A DECIMAL. PV is the Present Value of the loan. This amount will be the beginning value of the loan. It should be entered as a negative value if there is no payment amount. PMT is the payment amount. We will not use this in Chapter 19, but will use it in later chapters. FV is the Future Value of the loan. This is the ending value of the loan. P/Y is the number of periods in a year. C/Y is the number of compounding in a year. (In general, these will be the same). PMT: END BEGIN leave END highlighted Set decimal to 2 places. Go to the TVM Solver screen. Enter the values for each. When the value is unknown, enter 0 for the value. 1 Example 1: Maria Juarez invested $1,200, at 8% interest compounded quarterly, for 5 years. What is the future value of her money? What is the amount of the compound interest? N= 5*4 I%= 8 PV=-1200 PMT =0 FV= 0 ALPHA SOLVE 1783.14 P/Y = 4 C/Y=4 The future value is ___$1783.14_____. The compound interest is $1783.14 - $1200 = $583.14. Example 2: Sheryl Nelson wants $5,000 in 8 years. Find how much Sheryl must invest now at 6% interest compounded semiannually in order to have $5,000, 8 years from now. N= 8 *2 I%= 6 PV=0 ALPHA SOLVE -3115.83 PMT =0 FV= 5000 P/Y = 2 C/Y=2 The investment amount is _$3115.83___. The compound interest is $5000 - $3115.83 = $1884.17. Example 3: Thomas invested $3000 at 4.5% compounded monthly for 7 years. What is the future value of his money? What is the amount of the compound interest? N= 7*12 I%= 4.5 PV=-3000 PMT =0 FV= 0 ALPHA SOLVE 4108.36 P/Y = 12 C/Y=12 The future value is __$4108.36_. The compound interest is $4108.36 - $3000 = $1108.36 2 Example 4: Joe Marshall wants $3250.00 in 2 years. Find how much Joe must invest at 4.3% interest compounded daily in order to have $3250.00 in 2 years? N= 2*365 I%= 4.3 PV=0 ALPHA SOLVE -2982.20 PMT =0 FV= 3250 P/Y = 365 C/Y=365 The investment amount is _$2982.20____. The compound interest is $3250 - $2982.20 = $267.80 Practice Problems. 1. a.)What is the simple interest earned on $18,400.00 at 9% for 4 years? Show work. Answer: _______ b.) What is the amount of compound interest earned on $18,400.00 at 9% compounded annually for 4 years? Answer: _______ N= I%= PV= PMT = FV= P/Y = C/Y= c.) What is the difference in the simple interest earned and the compound interest earned? Answer: _______ 2. Find the future value and the compound interest. Round to the nearest cent. Principal $10,000.00 Investment terms 6 years at 8% compounded annually Future Value Compound Interest N= I%= PV= PMT = FV= P/Y = C/Y= 3 3. Find the future value and the compound interest. Round to the nearest cent. Principal $2,500.00 Investment terms 15 years at 10% compounded daily Future Value Compound Interest N= I%= PV= PMT = FV= P/Y = C/Y= 4. Find the future value and the compound interest. Round to the nearest cent. Principal $20,000 Investment terms 2 years at 6% compounded monthly Future Value Compound Interest N= I%= PV= PMT = FV= P/Y = C/Y= 5. John Mackey deposited $5,000 in his savings account at Salem Savings Bank. If the bank pays 6% interest compounded quarterly, what will be the balance of his account at the end of 3 years? N= I%= PV= PMT = FV= P/Y = C/Y= Answer: _____________ 4 6. Pine Valley Savings Bank offers a certificate of deposit at 12% interest, compounded quarterly. What is the effective rate (APY) of interest? Hint: use $100.00 as the deposit amount. Show work. N= I%= PV= PMT = FV= P/Y = C/Y= Answer: _____________ 7. Jack Billings loaned $6,000 to his brother-in-law Dan, who was opening a new business. Dan promised to repay the loan at the end of 5 years, with interest of 8% compounded semiannually. How much will Dan pay Jack at the end of 5 years? N= I%= PV= PMT = FV= P/Y = C/Y= Answer: _____________ 8. Find the present value and the compound interest. Round to the nearest cent. Future Value $2,500 Investment terms 6 years at 8 % compounded annually Present Value Compound Interest N= I%= PV= PMT = FV= P/Y = C/Y= 5 9. Find the present value and the compound interest. Round to the nearest cent. Future Value $53,050 Investment terms 1 year at 12% compounded monthly Present Value Compound Interest N= I%= PV= PMT = FV= P/Y = C/Y= 10. Mary Wilson wants to buy a new set of golf clubs in 2 years. They will cost $775. How much money should she invest today at 9% compounded annually so that she will have enough money to buy the new clubs? N= I%= PV= PMT = FV= P/Y = C/Y= Answer: __________________ 11. Jack Beggs plans to invest $30,000 at 10% compounded semiannually for 5 years. What is the future value of the investment? N= I%= PV= PMT = FV= P/Y = C/Y= Answer: __________________ 6 12. Ron Thrift has a 1991 Honda that he expects will last 3 more years. Ron does not like to finance his purchases. He went to First National Bank to find out how much money he should put in the bank to purchase a $20,300 car in three years. The banks 3-year CD is compounded quarterly with a 4% rate. How much should Ron invest in the CD? N= I%= PV= PMT = FV= P/Y = C/Y= Answer: __________________ Practice Problems ANSWERS 1) a) b) Answer: c) I = p*r*t I = 18400 (.09) 4 I = $6624.00 N= 4*1 I%= 9 PV=-18400 PMT =0 FV= 0 ALPHA SOLVE 25973.10 P/Y =1 C/Y=1 FV= $25973.10 Comp Interest $25973.10 - $18400 = $7573.10 difference $7573.10 - $6624.00 = $949.10 2) N= 6*1 I%= 8 PV=-10000 PMT =0 FV= 0 ALPHA SOLVE 15868.74 P/Y = 1 C/Y=1 Answer: FV= $15868.74 CI = $15868.74 – 10000 = $5868.74 7 3) N= 15*365 I%= 10 PV=-2500 PMT =0 FV= 0 ALPHA SOLVE 11201.92 P/Y = 365 C/Y=365 Answer: FV = $11201.92 CI = $11201.92 - $2500 = $8701.92 4) N= 2*12 I%= 6 PV=-20000 PMT =0 FV= 0 ALPHA SOLVE 22543.20 P/Y = 12 C/Y=12 Answer: FV = $22543.20 CI = $22543.20 - $20000 = $2543.20 5) N= 3*4 I%= 6 PV=-5000 PMT =0 FV= 0 ALPHA SOLVE 5978.09 P/Y = 4 C/Y=4 Answer: $5978.09 6) N= 1*4 NOTE: APY is for 1 year I%= 12 PV=-100 PMT =0 FV= 0 ALPHA SOLVE 112.55 P/Y = 4 C/Y=4 Answer: CI = $112.55 - $100 = $12.55 𝐶𝐼 APY= 𝑃𝑉 = 12.55 10 = .1255 = 12.55% 8 7) N= 5*2 I%= 8 PV=6000 PMT =0 FV= 0 ALPHA SOLVE 8881.47 P/Y = 2 C/Y=2 Answer: $8881.47 8) N= 6*1 I%= 8 PV=0 ALPHA SOLVE -1575.42 PMT =0 FV=2500 P/Y = 1 C/Y=1 Answer: PV= $1575.42 CI = $2500 – $1575.42 = $924.58 9) N= 1*12 I%= 12 PV=0 ALPHA SOLVE -47079.18 PMT =0 FV=53050 P/Y = 12 C/Y=12 Answer: PV= $47079.18 CI = $53050 – $47079.18 = $5970.82 10) N= 2*1 I%= 9 PV=0 ALPHA SOLVE -652.30 PMT =0 FV= 775 P/Y = 1 C/Y=1 Answer: $652.30 9 11) N=5*2 I%= 10 PV=-30000 PMT =0 FV= 0 ALPHA SOLVE 48866.84 P/Y = 2 C/Y=2 Answer: $48866.84 12) N= 3*4 I%= 4 PV=0 ALPHA SOLVE -18015.22 PMT =0 FV= 20300 P/Y = 4 C/Y=4 Answer: $18015.22 10