1111534861_341191

advertisement

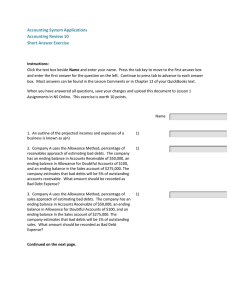

Apple Corporation Sample Accounts Receivable Subsidiary Ledger Acme Baxter Jones Martin Smith Gross Accounts Receivable Total Due $ 10,000 50,000 15,000 20,000 5,000 $100,000 LO1 Credit Sales Slows inflow of cash Risk of uncollectible accounts Trade Credit Retail Customer Receivables Sales Invoice Terms: 2/10, net 30 Accounting for Bad Debts: Direct Write-off Method Period of sale Future period charged with expense of bad debt write-off Journal entry to record write-off in period determined to be uncollectible: Bad Debts Expense XXX Accounts Receivable—Dexter XXX Accounting for Bad Debts: Allowance Method bad debt Period ofEstimated sale expense (and allowance account) recorded in the same period Accounting for Bad Debts: Allowance Method I estimate... Journal entry to record estimated bad debt expense in period of sale: Bad Debts Expense Allowance for Doubtful Accounts XXX XXX Balance Sheet Presentation – Allowance Method Partial Balance Sheet Accounts receivable Less: Allowance for doubtful accounts Net accounts receivable $xxx,xxx xxxx $XXX,XXX Accounting for Bad Debts: Allowance Method Bankrupt Journal entry to record bad debt write-off in period determined uncollectible: Allowance for Doubtful Accounts XXX Accounts Receivable—Dexter XXX Approaches to the Allowance Method % of Net Credit Sales Income Statement Approach % of Accounts Receivable Balance Aging Method Sheet Approach Percentage of Net Credit Sales Method Example: Assume prior years’ net credit sales and bad debt expense is as follows: Year 2007 2008 2009 2010 2011 Net Credit Sales $1,250,000 1,340,000 1,200,000 1,650,000 2,120,000 $7,560,000 Bad Debts $ 26,400 29,350 23,100 32,150 42,700 $153,700 Percentage of Net Credit Sales Method Example: 2012 Net credit sales $2,340,000 (given) Bad debt % ($153,700/$7,560,000) 2% Bad debts expense $ 46,800 Journal entry: Bad Debts Expense Allowance for Doubtful Accounts 46,800 46,800 Percentage of Accounts Receivable Method Example: Assume prior years’ ending Accounts Receivable and bad debts is as follows: December 31 Year Accounts Receivable Bad Debts 2007 $ 650,000 $ 5,250 2008 785,000 6,230 2009 854,000 6,950 2010 824,000 6,450 2011 925,000 7,450 $4,038,000 $32,330 Percentage of Accounts Receivable Method Example: $32,330 / $4,038,000 = 0.8% ratio of bad debts to the ending accounts receivable December 31, 2012 Accounts Receivable $865,000 × 0.8% Credit balance required in Allowance account after adjustment $6,920 Percentage of Accounts Receivable Method Assume the Allowance for Doubtful Accounts has a beginning credit balance of $2,100: Credit balance required in allowance account after adjustment Less: Credit balance in allowance account before adjustment Amount for bad debt expense entry $ 6,920 2,100 $ 4,820 Percentage of Accounts Receivable Method Assume the Allowance for Doubtful Accounts has a beginning credit balance of $2,100: Journal entry: Bad Debts Expense 4,820 Allowance for Doubtful Accounts To record estimated bad debts. 4,820 Percentage of Accounts Receivable Method The net realizable value of accounts receivable would be determined as follows: Accounts receivable $xxx,xxx Less: Allowance for doubtful account 6,920 Net realizable value $xxx,xxx Aging Method Estimated Percent Estimated Amount Amount Uncollectible Uncollectible $ 85,600 1% $ 856 Category Current Past due: 1–30 days 31,200 31–60 days 24,500 61–90 days 18,000 90+ days 9,200 Totals $168,500 4% 10% 30% 50% 1,248 2,450 5,400 4,600 $14,554 Aging Method Assume the Allowance for Doubtful Accounts has a beginning credit balance of $1,230: Credit balance required in allowance account after adjustment Less: Credit balance in allowance account before adjustment Amount for bad debt expense entry $14,554 (1,230) $13,324 Aging Method Assume the Allowance for Doubtful Accounts has a beginning credit balance of $1,230: Journal entry: Bad Debts Expense 13,324 Allowance for Doubtful Accounts 13,324 To record estimated bad debts. Aging Method The net realizable value of accounts receivable would be determined as follows: Accounts receivable $xxx,xxx Less: Allowance for doubtful account 14,554 Net realizable value $xxx,xxx Accounts Receivable Turnover Net Credit Sales Average Accounts Receivable Indicates how quickly a company is collecting (i.e., turning over) its receivables LO2 Accounts Receivable Turnover Too fast may mean: credit policies too stringent; may be losing sales Too slow may mean: credit department not operating effectively; dissatisfied customers Interest-Bearing Promissory Note Principal Baker Corporation promises to pay HighTec, Inc. $15,000 plus 12% annual interest on March 13, 2013. Interest Date: December 13, 2012 Signed:_________ Baker Corporation Maturity Date LO3 Interest-Bearing Promissory Note Maker Gives a Note to Payee Receipt of Interest-Bearing Promissory Note Journal entry to record the receipt of the note on December 13, 2012: Notes Receivable Sales Revenue 15,000 15,000 Interest-Bearing Promissory Note Adjusting entry to record interest on Dec. 31, 2012: Interest Receivable 90 Interest Revenue 90* *Interest = $15,000 × 12% × 18/360 Interest-Bearing Promissory Note Journal entry to record the collection of the note on March 13, 2013: Cash 15,450 Notes Receivable 15,000 Interest Revenue 360* Interest Receivable 90 *15,000 × 12% × 72/360 Accelerating the Cash Inflow from Sales Credit card sales Discounting notes receivable LO4 Credit Card Sales Competitive necessity Credit card company: • Charges fee • Assumes risk of nonpayment Discounting Notes Receivable Sell note prior to maturity date for cash Receive less than face value (i.e., discounted amount) Can be sold with or without recourse Reasons Companies Invest in Other Companies Short-term cash excesses Long-term investing for future cash needs Exert influence over investee Obtain control of investee LO5 Investment in a CD Example: On October 2, 2012, Creston invests $100,000 of excess cash in a 120-day CD. Principal plus interest @ 6% due upon investment maturity. Purchase of investment: Short-Term Investments—CD Cash 100,000 100,000 Investment in a CD Year-end adjusting entry: Interest Receivable 1,500 Interest Revenue 1,500 Interest (I) = Principal (P) × Rate (R) × Time (T) $1,500 = $100,000 × 6% × 90*/360 *October = 29 days November = 30 days December = 31 days 90 days Investment in a CD Upon investment maturity: Cash 102,000 Short-Term Investments—CD 100,000 Interest Receivable 1,500 Interest Revenue* 500 *Interest earned in January: $100,000 × 6% × 30/360 = $500 Accounting for Common-Stock Investments Fair Value Method Equity Method Consolidated Financial Statements 100% 0% No significant influence Our focus in Appendix Significant influence Control Investment in Bonds Bonds of other companies Intent and ability to hold until maturity $100,000, 10% bond due ten years Investment in Bonds Example: On 1/1/12, Atlantic buys: $100,000, 10% bonds @ face value Bonds mature in ten years Interest payable semiannually Record the purchase of the bonds and receipt of the first interest payment Recording Bond Purchase Investment in Bonds 100,000 Cash To record purchase of ABC bonds. $100,000, 10% bond due 2022 100,000 Recording Receipt of Interest Payment 6/30/12 Cash ($100,000 × 10% × 1/2) Interest Income 5,000 To record interest income on ABC bonds. 5,000 Recording Bond Sale 7/1/12 Cash Loss on Sale of Bonds Investment in Bonds To record sale of ABC bonds. 99,000 1,000 100,000 Investment in Stocks Stocks of other companies Recorded at cost, including any brokerage fees, commissions or other fees paid to acquire the shares Investment in Stocks Example: On February 1, 2012, Dexter Corp. pays $50,000 for shares of Stuart common stock plus $1,000 commissions : Investment in Stuart Common Stock 51,000 Cash 51,000 Record the purchase of common stock Recording Receipt of Dividends Dexter receives $500 cash dividends from Stuart common stock on March 31, 2012: Cash Dividend Income 500 To record the receipt of dividends 500 Sale of Investment in Stocks Sale of Investment in Stuart common stock on May 20, 2012 for $53,000: Cash Investment in Stuart Common Stock Gain on Sale of Stock 53,000 51,000 2,000 To record the sale of Stuart common stock. Liquid Assets and the Statement of Cash Flows – Indirect Method Operating Activities Net income Increase in accounts receivable Decrease in accounts receivable Increase in notes receivable Decrease in notes receivable Investing Activities Purchases of held-to-maturity and available-for-sale securities Sales/maturities of held-to-maturity and available-for-sale securities Financing Activities xxx – + – + – + LO6 End of Chapter 7