Debt Proceeds to Pay a Dividend or Repurchase Shares

advertisement

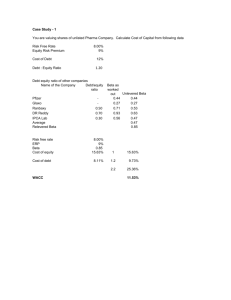

THE WM. WRIGLEY JR. COMPANY Team 14 Constantine Brocoum Courtney Delia Stephanie Doherty David Dubois Radu Oprea November 19th, 2009 William Wrigley Junior Page i Contents Objectives ..................................................................................................................................................... 1 Management Summary ................................................................................................................................ 2 Active Investor Strategy ................................................................................................................................ 2 Effects of $3 Billion in New Debt for Dividend or Stock Repurchase ............................................................ 2 a. Outstanding Shares ..................................................................................................................... 2 b. Book Value of Equity ................................................................................................................... 2 c. Price per Share............................................................................................................................. 3 d. Earnings per Share ....................................................................................................................... 3 e. Debt Interest Coverage Rations and Financial Flexibility ............................................................ 3 f. Outstanding Shares .......................................................................................................................... 3 Wrigley’s Current Weighted Average Cost of Capital (WACC)...................................................................... 3 Debt Proceeds to Pay a Dividend or Repurchase Shares .............................................................................. 4 Wrigley’s Recapitalization ............................................................................................................................ 4 Should Wrigley’s directors undertake the recapitalization? ........................................................................ 4 Appendices.................................................................................................................................................... 5 William Wrigley Junior Page ii Objectives This report seeks to answer the following five questions about William Wrigley Jr.: 1. In the abstract, what is Blanka Dobrynin hoping to accomplish through her active-investor strategy? 2. What will be the effects of issuing $3 billion of new debt and using the proceeds either to pay a dividend or to repurchase shares on: a. Wrigley’s outstanding shares? b. Wrigley’s book value of equity? c. The price per share of Wrigley stock? d. Earnings per share? e. Debt interest coverage ratios and financial flexibility? f. Voting control by the Wrigley family? 3. What is Wrigley’s current (pre-re-capitalization) weighted-average cost of capital (WACC)? 4. What would you expect to happen to Wrigley’s WACC if it issued $3 billion in debt and used the proceeds to pay a dividend or to repurchase shares? 5. Should Blanka Dobrynin try to convince Wrigley’s directors to undertake the recapitalization? William Wrigley Junior Page 1 Management Summary The analysis identifies both risks and benefits associated with undertaking the recapitalization for Wrigley. Given the reduction WACC, Wrigley should undertake the recapitalization. The conclusions reached in the following will illustrate the effects that the recapitalization will have on both equity in terms of outstanding shares, voting powers, and earnings per share. It will also illustrate the effect of WACC in a B/BB environment. Active Investor Strategy Blanka Dobrynin is a managing partner of the Aurora Borealis Company. The company utilizes a strategy called “Active Investor” in which the firm indentifies companies that could benefit from restructuring and then invests heavily in the company’s stock. Aurora Borealis must convince management and directors that restructuring will benefit the company and its stock holders. Wrigley has virtually no debt. If Wrigley were to change the capital structure of the company by increasing its debt/equity ratio, significant financial value would be created from the debt tax shelter. This strategy created $156 million to be invested for shareholder gain. The value of this extra cash flow is shown as the present value of a perpetuity at $1.2 billion. This is a significant amount of value that is created due to the leveraging of the firm. The market value of a levered firm versus an unlevered firm is as follows: EBIT Interest EBT Tax@40% Levered $ 527.00 $ 390.00 $ 137.00 $ 54.80 Difference Borrow Rate PVP Unlevered In Millions $ 527.00 $ $ 527.00 $ 210.80 $ 156.00 13% $ 1,200.00 Effects of $3 Billion in New Debt for Dividend or Stock Repurchase a. Outstanding Shares Issuing 3 billion dollars of new debt to buy back shares will reduce the number of outstanding shares, placing those shares in the company treasury as treasury stock. Paying a dividend with this borrowed money will not affect the number of shares outstanding. b. Book Value of Equity The net asset value or book value of a company is calculated by total assets minus intangible assets (patents, goodwill) and liabilities. So as the company issues more debt the book value is William Wrigley Junior Page 2 not changed since both sides of the balance sheet are increased by $3 Billion. The book value of the company should not be affected by a dividend payout. c. Price per Share The price of a share will decrease by the amount of the dividend paid per share. Repurchasing shares of the company stock will not have an effect on the share price directly. Some investors see share repurchase as a “bullish sign” for the company so the shares may appreciate on that basis. d. Earnings per Share Earnings per share (EPS) = Earnings After Taxes(EAT)/Outstanding Shares. If the number of outstanding shares is reduced by a buyback of shares then the EPS will increase if the EAT remains unchanged. However the EAT is reduced since there is interest expense. If the dividend payout remains the same then the dividend paid per share will increase as well. The debt interest would be 13% of $3 billion which is $390 million. EBIT in 2001 was $527,366,000. So the EBIT is $137,366,000. Then this is taxed at 40% so the EAT is $82,420,000. So by taking on more debt the EAT diminishes so the earnings per share will drop dramatically. Dividends affect next years earnings as they are taken out of the EAT. e. Debt Interest Coverage Rations and Financial Flexibility The debt interest coverage ratio is EBIT/Debt Interest. The interest on the debt is $390 million as calculated above. The EBIT in 2001 is $527,366,000. So debt coverage ratio is 527,366/390,000=1.35 If Wrigley’s gets a non-investment grade rating then their financial flexibility is severely limited. f. Outstanding Shares Issuing 3 billion dollars of new debt to pay dividends should not have any effect on the voting control of the Wrigley family. Using that money to buy back shares will have an effect on the voting right of the family. When shares are repurchased they are put in the company treasury and are no longer outstanding. Then the Wrigley family’s percent of outstanding shares would rise giving them more voting control. They also have 58% if the outstanding shares of the Class B shares which have a 10 to 1 voting advantage over the common share class. These shares are not affected by the buyback. Wrigley’s Current Weighted Average Cost of Capital (WACC) The practice at Aurora Borealis is to use an equity market risk premium of 7.0 percent, therefore this number was used in the WACC calculation. Wrigley’s Market value of Equity is 13.103 (from exhibit 5). William Wrigley Junior Page 3 WACC rD * (1-Tc) * D/V + rE * E/V Unlevered Equity Beta Risk free rate Equity Market Risk Premium Corporate tax rate (tc) re rd (net cost of debt) debt/equity Wdebt Wequity 0.750 4.86% 7.00% 40.0% 10.11% 0.000% 0 0.000 1.000 WACC 10.110% Debt Proceeds to Pay a Dividend or Repurchase Shares The $3 billion in debt would be used to either pay a dividend or repurchase shares, both having as effect a reduction in market equity for Wrigley. When paying a dividend of 3B, the share price would decrease correspondingly with 3B /outstanding shares, thus reducing the equity with 3B. When repurchasing shares for 3B, the purchased stock would be either retired or kept in the treasury with no voting rights or dividend rights. The number of shares outstanding is reduced with 3B/share price, thus reducing the equity with 3B. The effect of paying a divident or repurchasing shares lowers the cost of equity, thus lowering the investment risk in Wrigley. The WACC is consistently under the opportunity cost of capital, after and before paying the dividend or repurchasing shares. We can conclude that borrowing 3B would benefit Wrigley, by lowering the cost of capital and keeping shareholders happy (by paying a dividend or increasing the EPS), while maintaining the same level of investment risk. Wrigley’s Recapitalization Dobrynin estimates the Cost of Debt to be around 13%, placing it in line with the B/BB bonds. The leveled WACC was mostly calculated considering the unleveled WACC as the opportunity cost of capital (r) and estimating the cost of equity re, Modigliani and Miller prop2, as re = r + (r – rd) D/E On one instance the WACC was calculated by leveraging Beta and afterwards using CAPM. βl = βu + βu(1- Tc) D/E Wrigley’s market equity after taking debt and before payign dividends was calculated using Modigliani and Miller prop 1, as Equity = Equityunlevered + Tc * D William Wrigley Junior Page 4 WACC Calculation Unlevered CAPM Equity Beta Risk free rate (tr) Expected return on market Corporate tax rate (tc ) Cost of equity (re) Cost of debt (rd) Debt/Equity Wdebt Wequi ty Wrigley's Equity (market) Wrigley's Debt Cost of debt Net cost of debt 0.75 4.86% 11.86% 40.0% 10.11% 5.850% 0 0.000 1.000 13.103 0.000 WACC 10.110% Levered (BB) MM2 Levered (Dobr) Levered(Dobr) Levered (B) MM2 CAPM+lv beta MM2 0.869 4.86% 4.86% 4.86% 4.86% 11.86% 11.86% 11.86% 11.86% 40.0% 40.0% 40.0% 40.0% 10.762% 10.723% 10.95% 10.458% 7.652% 7.800% 7.800% 8.798% 0.265 0.265 0.265 0.265 0.210 0.210 0.210 0.210 0.790 0.790 0.790 0.790 11.303 11.303 11.303 11.303 3.000 3.000 3.000 3.000 12.753% 13.000% 13.000% 14.663% 7.652% 7.800% 7.800% 8.798% 9.468% 9.456% 11% 10% 9% 8% 7% 9.632% 9.372% WACC/Cost of Debt 12.753% 13.000% 13.000% 14.663% Conclusion Should Wrigley’s directors undertake the recapitalization? After carefully considering the risks and benefits of the recapitalization for Wringley, we recommend that the Board of Directors should undertake the recapitalization. As Wrigley currently does not hold any debt, financial value would be added as a debt tax shelter would be created by which the Company would be increasing its debt to equity ratio. As previously stated $156 million would be invested for shareholder gain and the extra cash flow would have a present value of $1.2billion. Looking at the question about if a dividend or a stock repurchase occurred the positives of this scenario was that there would be no affect on outstanding shares as this transaction would take them from outstanding and put them back into treasury. Besides them being a treasury stock the only other effect would be dividends paid. In addition, if this occurs, since they would now be treasury stock Wrigley would have more voting control as the portion of Wrigley stock would William Wrigley Junior Page 5 be greater. The book value of equity would remain unchanged as the balance sheet equity of assets is equal to liabilities and equity would be balances because the $3 billion transaction would affect both sides of the equation. The price per share would also remain unchanged because this number only changes when a dividend is paid. The only negative of this transaction would be that next year’s earnings after taxes would drop due to the dividends. Finally, the cost of equity was 13% which is B/BB, our WACC is declining of unlevered 10.110, levered BB of 9.409%, levered (DoBr) of 9.396, and levered (B) of 9.304% support our conclusion that the board should undertake the recapitalization. Appendices Levered Beta Calculation Beta Calculations - Using Exhibit 6 Equity Beta estimate Equity Beta = Asset Beta * (1 + MV D/E) Unlevered Levered 0.75 Equity Beta = 0.75 + 0.75 * (1 - 0.4) * 0.265 0.869 Equity Beta = 0.75 * (1 + 0) = CAPM Unlevered Levered William Wrigley Junior CAPM = .0486 +.750 (.07) = CAPM = .0486 + 0.869 (.07) = 10.110% 10.943% Page 6