Appendix - University of Central Florida

advertisement

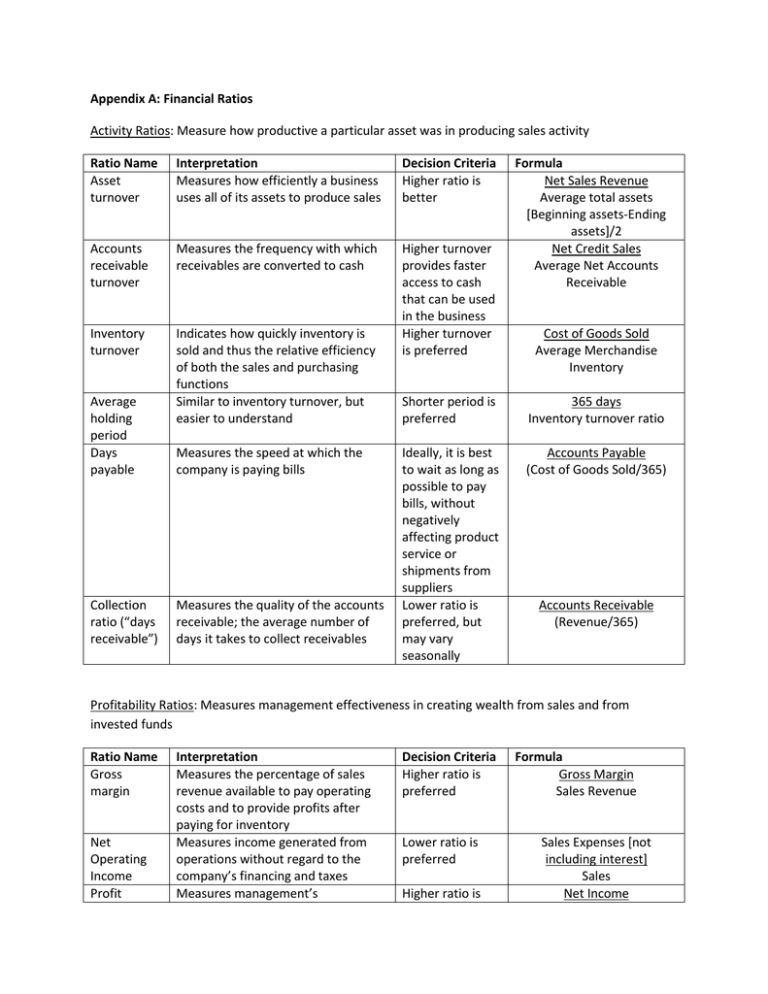

Appendix A: Financial Ratios Activity Ratios: Measure how productive a particular asset was in producing sales activity Ratio Name Asset turnover Interpretation Measures how efficiently a business uses all of its assets to produce sales Decision Criteria Higher ratio is better Accounts receivable turnover Measures the frequency with which receivables are converted to cash Inventory turnover Indicates how quickly inventory is sold and thus the relative efficiency of both the sales and purchasing functions Similar to inventory turnover, but easier to understand Higher turnover provides faster access to cash that can be used in the business Higher turnover is preferred Average holding period Days payable Collection ratio (“days receivable”) Measures the speed at which the company is paying bills Measures the quality of the accounts receivable; the average number of days it takes to collect receivables Formula Net Sales Revenue Average total assets [Beginning assets-Ending assets]/2 Net Credit Sales Average Net Accounts Receivable Cost of Goods Sold Average Merchandise Inventory Shorter period is preferred 365 days Inventory turnover ratio Ideally, it is best to wait as long as possible to pay bills, without negatively affecting product service or shipments from suppliers Lower ratio is preferred, but may vary seasonally Accounts Payable (Cost of Goods Sold/365) Accounts Receivable (Revenue/365) Profitability Ratios: Measures management effectiveness in creating wealth from sales and from invested funds Ratio Name Gross margin Net Operating Income Profit Interpretation Measures the percentage of sales revenue available to pay operating costs and to provide profits after paying for inventory Measures income generated from operations without regard to the company’s financing and taxes Measures management’s Decision Criteria Higher ratio is preferred Lower ratio is preferred Higher ratio is Formula Gross Margin Sales Revenue Sales Expenses [not including interest] Sales Net Income margin, also called return on sales (ROS) Return on equity effectiveness in managing all costs relative to sales preferred Measures management’s effectiveness in using investor funds to provide profits Higher ratio is preferred Return on assets Measures management’s effectiveness in using the assets of the business to provide profits Measures management’s effectiveness in using the invested capital of the business to provide profits Measures profitability per share investment Higher ratio is preferred Net Income – Preferred Stock Dividends Declared Average Common Stockholders’ Equity Net Income Average Total Assets Higher ratio is preferred Net Income Average Investment Return on investments (ROI) Earnings per share Examined over time; increasing trend is preferred Sales Revenue Net Income – Preferred Stock Dividends Declared Weighted Average Common Stock Outstanding Valuation Ratio: Measures returns to investors Ratio Name Interpretation Price/earnings Measures the price (P/E) ratio that investors are willing to pay for a company’s stock for each dollar of the company’s earnings Decision Criteria Higher ratio means investors expect higher earnings growth in the future compared to other companies with lower P/E. Useful to compare ratios between companies in the same industry, to the market in general, or to the company’s historical P/E. Formula Price of Stock Earnings per share Cash Flow Ratios: Measures a company’s cash position Ratio Name Cash flow cycle Cash flow debt coverage ratio Interpretation Measures the number of days it takes to convert inventory and receivables into cash Measures whether a company can meet its debt service requirements Decision Criteria Formula (Receivables + Inventory) Cost of Goods Sold A 1.25-to-1 ratio minimum should be targeted EBITDA [Earnings before interest, taxes, depreciation, and amortization] (Interest + principle due on debt) Liquidity Ratios: Measures the business’s ability to pay debts and expenses that are due in the current accounting period Ratio Name Current ratio Acid test or Quick ratio Interpretation Measures how much money can be made available to pay obligations within the fiscal year Measures how much money can be made available very quickly to pay obligations within the fiscal year Decision Criteria Higher ratio is preferred Formula Current Assets Current Liabilities Higher ratio is preferred Current Assets – (Inventories + Prepaid Assets) Current Liabilities Leverage Ratios: Measures that indicate the relative risk that a business setback could cause bankruptcy Ratio Name Debt to assets ratio Interpretation Measures the extent to which the business can meet its obligations for the long haul Debt to equity ratio Measures the extent to which the business can meet its obligations for the long haul Times earned interest Measures the risk of being forced into bankruptcy for not meeting required interest payments Decision Criteria Lower ratio indicates greater solvency, greater ratio indicates increased business risk Lower ratio indicates greater solvency, greater ratio indicates increased business risk Higher is preferred Formula Total Liabilities Total Assets Total Liabilities Total Owners’ Equity Operating Income before Interest and Income Tax Interest Expense Sources (all): Entrepreneurial Finance McGraw-Hill/University of Central Florida Appendix B: Legal Forms of Business Definition Pros and Cons Tax Implications Sole Proprietorship An unincorporated business with one owner. Not a separate entity. Pros: Cons: Simple to form, operate, and Limited Capital dissolve Difficult to obtain credit Limited skills of management Owner keeps all profits and employees Freedom of control Unlimited personal liability for the company’s debts Secrecy Business has a limited life, because the business and the Tax Advantages owner are one in the same. Because the business and the owner are the same entity, all profits of the business flow through into the owner’s personal income. For tax purposes, the income of the business becomes the income of the owner. This can provide an advantage, as the tax structure for other types of business is not as favorable as the structure for personal income tax. Definition Pros and Cons Tax Implications Definition Pros and Cons Tax Implications General Partnership Two or more persons carrying on a business for profit. Not a separate entity, but rather the aggregate of all the partners. Pros: Cons: Simple to form Limited life Ability to divide labor and Unlimited personal liability for the company’s debts management responsibility (personal assets are liable to the partnership’s Collaboration of ideas and obligations) plans from all members Each partner is jointly and severally liable for the actions Access to the skills of all the of the other partner(s), and a partner cannot obtain members bonding protection against the acts of the other Greater chance at obtaining partner(s) capital over a sole Risk of an impasse forming when partners do not agree proprietorship Death of any one partner terminates the partnership More sources of personal capital As in a sole proprietorship, the business income flows through to the owners and becomes personal income of the owners for tax purposes. This retains the same tax advantage of a sole proprietorship. Unless the partnership agreement states otherwise, partners have a right to share equally in all distributions of profits; i.e., 4 partners, each get 25%. Corporation (C-Corporation) A legal business entity that is separate and distinct from its owner(s). A corporation has many of the rights and responsibilities that an individual would have (i.e., can enter into contracts, loan and borrow money, sue and be sued, own assets, pay taxes, etc.) The corporation is created (incorporated) by its shareholders—owners who are represented by their shares of stock in the company. The shareholders elect a board of directors, who then appoint and oversee management of the company. Pros: Cons: Can have representative management Perceived as impersonal Ease of raising large amounts of capital Owners have limited interest/control over Separate and distinct from its owners as the company’s activities individuals High incorporation fees in some states Can be permanent in existence, as the loss Double income taxation (see below) of a shareholder does not affect the life of Government requirements for procedures the corporation and extensive financial reports and Owners’ personal liability for the company’s statements debt is limited to the amount of their The charter limits the corporation’s investment powers, limiting the ability to do business in other states A C-Corporation is subject to what is called “double taxation”. When the company earns profits, they are taxed at the corporation level (at high corporate tax rates). The profits left over may be disbursed to the shareholders in the form of dividends. Then, these dividends are again taxed at the individual level as the personal income of each shareholder. Definition Pros and Cons (as compared to a C-Corporation) Tax Implications Subchapter S Corporation (S-Corporation) A type corporation that has acquired a special status to be taxed under Subchapter S of the IRS Code. With certain limitations, this type of corporation is able to benefit from the same limited liability as a C-Corporation, but is taxed more favorably like a partnership. Pros: Cons: Can maintain corporate structure Numerous restrictions limit the Owners’ personal liability for the company’s number of businesses that can debt is limited to the amount of their qualify investment Must be a domestic company Taxed like a partnership—profits flow through Can only have one class of stock to the owners as personal income without (common stock) being taxed first on the corporation level A maximum of 100 shareholders is required, and these shareholders must be domestic Shareholders must be individuals, estates, or in some cases, trusts Shareholders cannot be other corporations or partnerships Unlike a C-Corporation, profits of the business are not taxed at the corporate level first. Profits “flow through” to the shareholders and appear as personal income of the individual shareholders. Income is taxed only once at the shareholder level, thus avoiding the “double taxation” problem of C-Corporations. Pros and Cons Limited Liability Partnership (LLP) A business (not a separate entity) with two or more partners, in which at least one of the partners does not have unlimited personal liability—they are limited partners and are liable only to the extent of their investment. Limited partners do not receive dividends, but enjoy direct access to the flow of income and expenses. The limited partnership interests are treated as “securities” like corporate stock when it comes to federal regulation purposes. Pros: Cons: Owners that are limited partners do not have Limited partners do not have the right unlimited personal liability for the business’s to participate in management debts General partners are personally liable Limited partners can assign, buy, or sell their for the business’s debts and losses interest in the company without dissolving the partnership Loss of a limited partner will not dissolve the company Tax Implications As in a general partnership, the business income flows through to the owners and becomes personal income of the owners for tax purposes. This allows for single taxation Definition at the individual partners’ tax rates. A limited partnership does, however, have to file an informational return with the IRS. Additionally, unless the partnership agreement states otherwise, both general and limited partners share in the profits of the business based on the proportion of their capital contribution, unlike a general partnership. Definition Pros and Cons Dissolution Tax Implications Limited Liability Company (LLC) A business entity that is a “hybrid” of a C-Corporation and a partnership—similar to an SCorporation. Pros: Cons: Provides all of the benefits of an S-Corporation (limited Members cannot sell their liability for owners—called “members”—and only single interest without the taxation) but without all of the restrictions placed on Sconsent of all other Corporations members All members may participate in management (“member managed”), or can choose to centralize management (“manager managed”) The rules for dissolution can be perceived as both pros and cons. An LLC will dissolve if: a. All members consent, b. Expiration of any stated period of duration, c. The death, incapacitation, retirement, resignation, or bankruptcy of any member, UNLESS the remaining members vote to continue, d. Or, in some states, when only one member remains. Taxed like an S-Corporation or a Limited Liability Partnership, the business’s profits flow through to the individual members and become their personal income, avoiding double taxation. Like the limited liability partnership, unless the agreement states otherwise, profits and losses of the business are allocated based on the proportion of the members’ capital contributions.