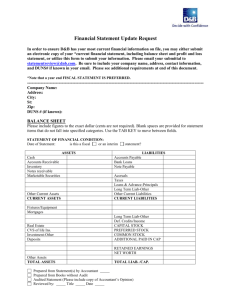

The Balance Sheet

McGraw-Hill/Irwin Copyright © 2012 by The McGraw-Hill Companies, Inc. All rights reserved.

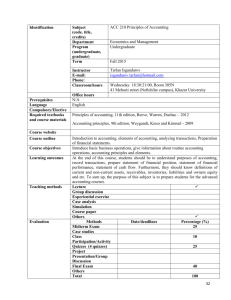

Accounting and Finance

Understanding financial accounting is essential to understanding corporate finance.

Key Components of the Financials:

The Balance Sheet

The Income Statement

The Statement of Cash Flows

3-2

The Balance Sheet

The Balance Sheet is a financial statement that shows the firm’s assets and liabilities at a particular time.

Why is it useful?

Shareholders’ Equity = Total Assets – Total Liabilities

3-3

Current Assets

•

Cash & Securities

•

Receivables

•

Inventories

+

Fixed Assets

•

Tangible Assets

•

Intangible Assets

___________________

Total Assets

The Balance Sheet

=

Current Liabilities

•

Payables

•

Short-term Debt

+

Long-term Liabilities

+

Shareholders’ Equity

____________________

Total Liabilities &

Shareholders’ Equity

3-4

Assets

Assets represent the uses of a firm’s funds i.e. Assets show what the firm “owns”

•

Liquid Assets can be converted easily into cash

•

Current vs. Fixed Assets

3-5

Current Assets: Examples

Which of the following assets is typically considered most liquid? Least liquid?

• Marketable securities

• Accounts receivable

• Inventories

Which of the following is a current asset?

• Property that a firm owns

• A firm’s production equipment

• Unsold inventories

3-6

Fixed Assets

Tangible Assets

Intangible Assets

Goodwill

3-7

Fixed Assets: Example

Which of the following represent tangible assets? Intangible assets?

• Property

• Production Facilities

• Patents

• Production Equipment

• Trademarks

• Copyrights

3-8

Liabilities

Liabilities represent the sources of a firm’s funding.

(i.e. Liabilities represent what a firm “owes.”)

Current vs. Long-Term Liabilities

Current Assets – Current Liabilities = Net Working Capital

3-9

Liabilities: Example

Which of the following is a current liability?

• Bond debt that matures in 3 years

• A bank loan that is due in 24 months

• An obligation to pay a supplier within 6 months

3-10

Net Working Capital: Example

In the balance sheet below, what was the value of net working capital in 2008? 2009?

3-11

Book Values vs. Market Values

GAAP

(Generally Accepted Accounting Principles)

Book Value

•

Value of assets or liabilities according to the balance sheet.

•

Values recorded at their historical cost adjusted for depreciation

Market Value

• The value of assets or liabilities were they to be resold in a market

3-12

Common-Size Balance Sheet

All balance sheet items are expressed as a percentage of total assets.

Why is this useful?

3-13

Common-Size Balance Sheet:

Example

Note the changes from 2008 to 2009.

3-14

The Income Statement

Income Statement: a financial statement that shows the revenues, expenses, and net income of a firm over a period of time.

Why is this useful?

3-15

Common-size Income Statement

All items on a common-size income statement are expressed as a percentage of revenues.

Why is this useful?

3-16

Income Statement: Example

In the income statement below, what was the value of Home

Depot’s EBIT in 2009?

Common

Size

Income

Statement

(right column)

3-17

Profits vs. Cash Flow

Differences between profits & cash flow:

Depreciation

Cash vs. accrual accounting

3-18

Cash Flows: Example

Consider a firm that spends $1,000 to produce goods in period 1. In period 2, it sells half of these goods for $750 and collects payment one period later.

The firm sells the other half in period 3 for another $750, and collects payment on these sales in period 4.

What are the cash flows in each of the 4 periods for the firm?

Period:

Sales ($)

-Accounts Receivable

- Cost of Goods Sold

- Changes in Inventories

= Net Cash Flow

1

0

0

0

1000

(1000)

2

750

750

500

(500)

0

3

750

0

500

(500)

750

4

0

(750)

0

0

750

3-19

The Statement of Cash Flows

The Statement of Cash Flows shows the firm’s cash receipts and cash payments over time.

Why is it useful?

Free Cash Flow is cash available for distribution to investors after the firm pays for new investments or additions to working capital.

3-20

The Statement of Cash Flows

Structure :

Cash flow from operations

+

Cash flow from investments

+

Cash flow from financing

____________________________

Change in cash balance

3-21

Cash Flow: Example

Net income for your firm was $10,000 last year.

The depreciation expense was $2,500; accounts receivable increased

$1,250; accounts payable increased $800; and inventories increased by $2,000.

What was the total cash flow from operations for the period?

Net income:

Depreciation:

Accounts Receivable:

Accounts Payable:

Inventories:

Cash flow from operations:

10,000

2,500

(1,250)

800

(2,000)

10,050

3-22

Accounting Practice

Most managers say that accounting earnings is the single most important number reported to investors.

What implications does this have for the investor?

3-23

Accounting Practice

Grey areas for financial managers:

Revenue recognition

Cookie-jar reserves

3-24

Accounting Practice

Additional grey areas for financial managers:

Off-balance sheet assets and liabilities

Mark-to-market accounting

3-25

Corporate Taxes

In the United States, corporations pay tax on their income.

US Corporate Tax Rates, 2011

3-26

Corporate Taxes: Example

What is the marginal tax rate for a corporation with $60,000 taxable income and an average tax rate of 16.67% if the next-lowest marginal tax rate of 15% covers taxable incomes up to $50,000?

($60,000) * (16.67%) = $10,000 total taxes paid

Income Rate Taxes Paid

$0 - $50,000

$50,001 - $60,000

Total:

15%

?

$7,500

$2,500

$10,000

($10,000) * (marginal tax rate) = $2,500

Marginal Tax Rate = 25%

3-27

Personal Tax

US Personal Tax Rates, 2011

3-28

Personal Tax: Example

What is the average tax rate for an individual with a net income of $50,000 and a total tax liability of $10,704.50?

Taxable Income = $50,000 + $10,704.50

Average Tax Rate =

Tax Liability

$10, 704.50

Taxable Income 60, 704.50

17.63%

3-29

The Problem of “Double Taxation”

When a corporation issues a dividend, each dividend dollar is effectively taxed twice:

1.

Each dollar of earnings taxed at corporate rate.

2.

Shareholders pay personal income taxes on all dividends received.

3-30