MoneySKILL

advertisement

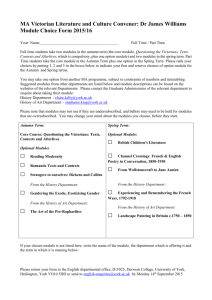

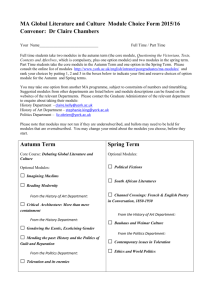

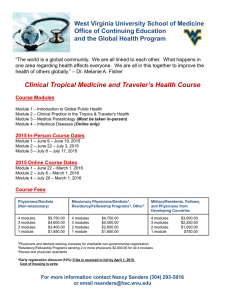

TEENS SPENDING POWER $216.3 BILLION DOLLARS 25.3 MILLION TEENS ( AGES 13-18) PRODUCTS AND SERVICES U.S. Census Bureau 61% OF TEENS OBTAIN MONEY FROM THEIR PARENTS AS A SOURCE OF INCOME IT’S FREE! On-line, interactive course High School College Junior High/Middle School Personal finance concepts Income Expenses Saving and Investing Credit Insurance AGE • Start working • Married • Purchase home • Retirement BUDGET • Housing/Utilities • Food • Transportation • Insurance • Entertainment HOW LONG DOES IT TAKE TO COMPLETE? 20-40 minutes a module 12-24 hours all modules HOW IS IT INTERESTING TO STUDENTS? Follows storyline of 3 high school students – Andrew, Maria, and Jamie • Designed to be used in business, economics, math, social studies or personal finance • Self study • Homework, project outside class or during class as a group Entirely web-based • Pre- and Post-tests • Modules • Life Simulation • Grade book • Class/student setup • Module retake Select/order modules Duplicate course Import class roster Date for release and completion Print modules/scores Student module retake Add modules Completion Certificate Easier to read List of modules to complete, score and overall average Adjust font & audio Calculator Monthly survey question Email teacher • How would you evaluate the curriculum? Very Good to Excellent • How would you evaluate the technology? Very Good to Excellent • How would you evaluate the student reaction to curriculum and technology? Good to Very Good • • • • Identity Theft Modules Used in colleges Offered as part of GED Changes to Web site and technology in 2011 – – – – – – – Hand held devices/tablets Browsers Jump around in modules Email student score to parents Student email teacher question Manage font size/audio options Simulation 10. Adaptable for the teacher’s use, curriculum and technology changes. 9. 24/7 toll-free number for teachers and online technology support. 8. Teacher suggestions are given top priority as to future changes in technology, admin site and curriculum. 7. Provides understanding of the importance of taking control of one's financial life . 6. Life simulation incorporates student’s life plan into the curriculum. 5. Teachers do not require training or expertise to use the course with students. 4. Students can complete the course outside class room. 3. Tests students’ understanding of each concept as it is presented. 2. Comprehensive personal finance curriculum. 1. ITS FREE!