Return reversals and the compass rose: Insights from high

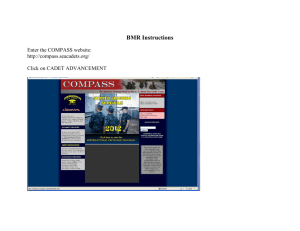

advertisement

Return reversals and the compass rose: Insights from high frequency options data Thanos Verousis (Swansea University) Owain ap Gwilym (Bangor University) The compass rose pattern architecture Conditions: – Sufficient price level volatility – Price discreteness – Small price changes Arithmetic derivation: Rt 1 ( P Pt ) / Pt ( P Pt ) nt 1h nt 1 t 1 t 1 Rt ( Pt Pt 1 ) / Pt 1 ( Pt Pt 1 ) nt h nt (Crack and Ledoit, 1996 JF) Rt 1 nt 1 h / Pt nt 1 nt h 1 Rt nt h /( Pt nt h) nt Pt (Szpiro, 1998 JBF) Are we able to increase returns’ predictability? Crack and Ledoit, 1996 JF: “an artefact of market microstructure” Lee et al. (2005, EJoF): “...may help in improving forecasts...” Batten and Hamada (2008, EFMA): “may suggest [...] an arbitrage opportunity for some investors” Return reversal architecture and predictability Gosnell (1995, JBFA) “a price change in the opposite direction to the previous price change” Linked with new information (Buckle et al., 1998 JBFA) In a compass rose plot, reversals (continuations) are found in the NW and SE (NE and SW) quadrants Where do we stand and the setup Study occurrence/visibility of the compass rose pattern in options Leverage effect Price level effect Lee et al (2005, EJoF): “the tick/volatility ratio is a determinant of the compass rose pattern” Show return reversals embedded in the compass rose plot Data Intraday LIFFE 28 firms (> 133m obs.) Returns on options: Sheikh and Ronn (1994, JF): at-the-money, nearest-to-mature Bollerslev and Melvin (1994, JIE): stale pricing problem – asks UHF, 15-min, 30-min, trades The compass rose in options contracts WRT Crack and Ledoit, 1996 JF: The assumption of continuity is not valid WRT Szpiro, 1998 JBF: formula is not universal ,Sk = Sk-1, Si = Si-1, Since , then Lee et al (2005, EJoF, p 103): “the pattern appears only if the tick/volatility ratio is above some threshold level” The above implies that: The pattern’s visibility increases with decreasing volatility (ceteris paribus) Contracts with same tick/volatility ratios produce a similar pattern Table 1: Ratio consistent when changes in frequency of observations… Quality is not an increasing function of the ratio Even at high tick/volatility, the ratio not a consistent measure Figure 3: Ratio may give inconclusive results on the strength of the pattern The compass rose and return reversals At UHF, certain assets exhibit a “pattern within the pattern” Explanations found in literature: Park (1995, JFQA): bid-ask bounce Christie and Schultz (1994, JF): speed of adjustment Figure 6: control for duration and the non-linearity? Continued... Buckle et al (1998, JBFA): news dissemination (local minima), scheduled macroeconomic announcements (global minima) and day trading strategies (global maxima) 42 41 40 39 38 37 36 35 34 33 32 Expected Sign Intercept Pr TS Liq OD Time 15 :3 0: 00 14 :3 0: 00 13 :3 0: 00 12 :3 0: 00 11 :3 0: 00 10 :3 0: 00 09 :3 0: 00 CD 08 :3 0: 00 08 :0 0: 00 Percentage Variable DMM TTM FV R-Square No. of Obs. + - Call Put 53.67*** 56.83*** 4.96*** 4.55*** -3.00*** -2.70*** 0.02*** 0.01** 5.46*** 6.05*** 1.10*** 1.07*** -3.79*** -3.44*** -0.02** -0.01 -2.10*** -2.42*** 0.10 0.09 54,235 54,410 Conclusions Compass rose in options: non-linearities Tick/volatility ratio consistent at high sampling frequencies Trading frequency key element Inconclusive results on the strength of the pattern Visual inspection only comparable measure Return reversals embedded in the compass rose Market opening and news announcements Price discovery