Notes Payable

advertisement

Current

Liabilities

and

Contingencies

.

JOIN KHALID AZIZ

• ACCOUNTING(FINANCIAL & COST) OF

ICMAP STAGE 1,2,3,4 (CRASH CLASSES)

CA..MODULE A,B,C,D

PIPFA (FOUNDATION,INTERMEDIATE,FINAL)

ACCA-F1,F2,F3

BBA,MBA

B.COM(FRESH),M.COM

MA-ECONOMICS..O/A LEVELS

KHALID AZIZ…..0322-3385752

http://finance.groups.yahoo.com/group/cost-accountants

.

CHARACTERISTICS OF

LIABILITIES

Most liabilities obligate the debtor to pay cash at

specified times and result from legally enforceable

agreements.

Some liabilities are not contractual obligations and may

not be payable in cash.

A liability has three essential characteristics. Liabilities:

1. are probable, future sacrifices of economic benefits

2. that arise from present obligations (to transfer goods or

provide services) to other entities

3. that result from past transactions or events

.

What is a Current Liability?

LIABILITIES

Current Liabilities

Long-term Liabilities

Generally, payable within one year.

Formally, expected to be satisfied

with current assets (or by the

creation of other current liabilities).

Conceptually, should be recorded at present

value, but ordinarily are reported at maturity

amounts.

.

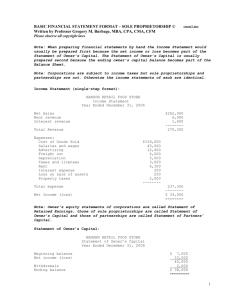

GENERAL MILLS, INC.

BALANCE SHEET

MAY 30, 2007 AND MAY 28, 2006

(Rs in millions)

ASSETS

[BY CLASSIFICATION]

LIABILITIES

Current Liabilities:

Accounts payable

Current portion of long-term debt

Notes payable

Other current liabilities

Total current liabilities

2007

Rs 778

1,734

1,254

2,079

Rs5,845

Long-term Liabilities:

[LISTED INDIVIDUALLY]

Shareholders’ equity

[BY SOURCE]

.

2006

Rs 673

2,131

1,503

1,831

Rs6,138

8: Notes Payable

The components of notes payable and their respective weighted

average interest rates at the end of the period are as follows:

2007

2006

Dollars in millions:

U.S. commercial paper

5.1%

Euro commercial paper

Financial institutions

Total notes payable

Weighted

Weighted

Average

Average

Note

Interest

Note Interest

Payable Rate

Payable Rate

Rs477

639

138

Rs1,254

.

5.4% Rs 713

5.4

9.8

462 5.1

328 5.2

Rs1,503

8: Notes Payable (cont.)

To ensure availability of funds, we maintain bank

credit lines sufficient to cover our outstanding shortterm borrowings. Our commercial paper borrowings

are supported by Rs2.95 billion of fee-paid

committed credit lines and Rs351 million in

uncommitted lines. As of May 27, 2007, there were

no amounts outstanding on the fee-paid committed

credit lines and Rs133 million was drawn on the

uncommitted lines, all by our international

operations. Our committed lines consist of a Rs1.1

billion credit facility expiring in October 2007, a

Rs750 million credit facility expiring in January 2009,

and a Rs1.1 billion credit facility expiring in October

2010.

.

Interest

Interest on notes is calculated as :

Face

Amount

Amount

borrowed

×

Annual

Rate

Interest rate is

always stated

as an annual

rate.

.

×

Time To

Maturity

Interest owed is

adjusted for the

portion of the year

that the debt is

outstanding.

Note Issued for Cash

On May 1, Affiliated Technologies, Inc., a consumer

electronics firm, borrowed Rs700,000 cash from First

BancCorp under a noncommitted short-term line of credit

arrangement and issued a 6-month, 12% promissory note.

Interest was payable at maturity.

Cash

Notes payable

May 1

November 1

700,000

700,000

Interest expense (Rs700,000 x 12% x 6/12) 42,000

Notes payable

700,000

Cash (Rs700,000 + 42,000)

742,000

.

Example

On September 1, Tru Fashions borrows Rs80,000 from

Second Bank. The note is due in 6 months and has a

stated interest rate of 9%.

Cash

Notes payable

80,000

80,000

How much interest does Tru owe at year-end, on Dec. 31?

a.

Rs 2,400

b.

Rs 3,600

c.

Rs 7,200

d.

Rs87,200

.

Example

On September 1, Tru Fashions borrows Rs80,000 from

Second Bank. The note is due in 6 months and has a

stated interest rate of 9%.

How much interest does Tru owe at year-end, on Dec. 31?

a.

Rs 2,400

Interest is calculated as:

b.

Rs 3,600

Face

Annual

Time to

× Rate

× maturity =

c.

Rs 7,200

Amount

d.

Rs87,200

Rs80,000

9%

4/12 =

×

×

Rs2,400 interest.

.

Noninterest-Bearing Note

The proceeds of the note are reduced by the interest in a “noninterestbearing” note.

Situation: Rs700,000 noninterest-bearing note, with a 12% “discount

rate.” The Rs42,000 interest is “discounted” at the outset, rather than

explicitly stated:

May 1

Cash (difference)

Discount on notes (Rs700,000 x 12% x 6/12)

Notes payable (face amount)

658,000

42,000

700,000

November 1

Interest expense

Discount on notes

Notes payable

Cash

42,000

700,000

(face amount)

.

42,000

700,000

Noninterest-Bearing Note

The amount borrowed is only Rs658,000, but the

interest is calculated as the discount rate times the

Rs700,000 face amount. This causes the effective

interest rate to be higher than the 12% stated

rate:

Rs 42,000 interest for 6 months

÷ Rs658,000 amount borrowed

=

6.38% rate for 6 months

12/6

x

to annualize the rate

__________

= 12.76%

effective interest rate

.

ACCRUED LIABILITIES

Liabilities accrue for expenses that are

incurred, but not yet paid.

Recorded by adjusting entries at the

end of the reporting period, prior to

preparing financial statements.

Common examples are: salaries and

wages payable, income taxes payable,

and interest payable.

.

ACCRUED INTEREST

PAYABLE

Assume the fiscal period for Affiliated Technologies ends on

June 30, two months after the 6-month note is issued. The

issuance of the note, intervening adjusting entry, and note

payment would be recorded as shown below:

Issuance of note May 1

Cash

700,000

Note payable

700,000

Accrual of interest on June 30

Interest expense (Rs700,000 x 12% x 2/12)

Interest payable

14,000

14,000

Note payment November 1

Interest expense (Rs700,000 x 12% x 4/12)

28,000

Interest payable (from adjusting entry)

14,000

Note payable

700,000

Cash (Rs700,000 + 42,000)

742,000

.

Liabilities from Advance

Collections

• Refundable Deposits

• Advances from

•

Customers

Collections for Third

Parties

.

Customer Advance

Tomorrow Publications collects magazine subscriptions from

customers at the time subscriptions are sold. Subscription

revenue is recognized over the term of the subscription.

Tomorrow collected Rs20 million in subscription sales during

its first year of operations. At December 31, the average

subscription was one-fourth expired. (Rs in millions)

When Advance is Collected

Cash

Unearned subscriptions revenue

When Product is Delivered

Unearned subscriptions revenue

Subscriptions revenue

20

5

.

20

5

Short-Term Obligations Expected

to Be Refinanced

Short-term obligations can be reported as noncurrent

liabilities only if the company:

(a) intends to refinance on a long-term basis and

(b) demonstrates the ability to do so:

by either an existing

refinancing agreement

by actual financing (prior to the

issuance of the financial

statements)

or

The specific form of the long-term refinancing (bonds,

bank loans, equity securities) is irrelevant.

The concept of substance over form.

.

Contingencies

A loss contingency is an

existing uncertain

situation involving

potential loss

depending on whether

some future event

occurs.

.

Contingencies

Two factors affect whether a loss

contingency must be accrued and

reported as a liability:

1. the likelihood that the confirming

event will occur.

2. whether the loss amount can be

reasonably estimated.

.

Contingencies – Likelihood of

Occurrence

• Probable

– A confirming event is likely to occur.

• Reasonably Possible

– The chance the confirming event will occur is

> remote, but < likely.

• Remote

– The chance the confirming event will occur is

slight.

.

Loss Contingencies

Accounting Treatments

Likelihood

Probable

Reasonably

Possible

Remote

Dollar Amount of Potential Loss

Reasonably

Not Reasonably

Known

Estimable

Estimable

Liability

Liability

Disclosure

Accrued &

Accrued &

Note

Disclosure Note Disclosure Note

Only

Disclosure

Disclosure

Disclosure

Note

Note

Note

Only

Only

Only

No

No

No

Disclosure

Disclosure

Disclosure

Note

Note

Note

.

Product Warranties and

Guarantees

The contingent liability for product warranties almost always is accrued.

Caldor Health introduced a new therapeutic chair carrying a 2-year

warranty against defects. Estimates indicate warranty costs of 3% of

sales during the first 12 months following the sale and 4% the next 12

months. During December of 2009, its first month of availability,

Caldor sold Rs2 million of the chairs.

During December

Cash (and accounts receivable)

Sales revenue

2,000,000

December 31, 2006 (adjusting entry)

Warranty expense ([3% + 4%] x Rs2,000,000)

Estimated warranty liability

.

140,000

2,000,000

140,000

Subsequent Events

If information becomes available that sheds light on a

contingency that existed when the fiscal year ended, that

information should be used in determining the probability

of a loss contingency materializing and in estimating the

amount of the loss.

Cause of Loss Contingency

Clarification

Fiscal Year Ends

Financial Statements

.

UNASSERTED CLAIMS AND

ASSESSMENTS

It must be probable that an unasserted claim or assessment

or an unfiled lawsuit will occur before considering whether

and how to report the possible loss.

Example: The EPA is in the process of investigating the

possibility of environmental violations at a company’s site, but

has not proposed a penalty assessment. Since the claim or

assessment is unasserted as yet, a two-step process is

involved in deciding how it should be reported:

1. Is a claim or assessment probable? {If not, no disclosure

is needed.}

2. Only if a claim or assessment is probable should we

evaluate (a) the likelihood of an unfavorable outcome and

(b) whether the dollar amount can be estimated.

If the conclusion of step 1 is that the claim or assessment is

not probable, no further action is required.

.

Gain Contingencies

Desirable to anticipate losses,

but recognizing gains should

await their realization.

As a general rule, we

never record GAIN

contingencies.

Should be disclosed in notes

to the financial statements.

Care should be taken that

the disclosure note not give

"misleading implications as to

the likelihood of realization."

.

ATTENTION COMMERCE

STUDENTS

ACCOUNTING(FINANCIAL & COST) OF

ICMAP STAGE 1,2,3,4 (CRASH CLASSES)

CA..MODULE A,B,C,D

PIPFA (FOUNDATION,INTERMEDIATE,FINAL)

ACCA-F1,F2,F3

BBA,MBA

B.COM(FRESH),M.COM

MA-ECONOMICS..O/A LEVELS

KHALID AZIZ…..0322-3385752

http://finance.groups.yahoo.com/group/cost-accountants

.