Chapter 10 PPT

advertisement

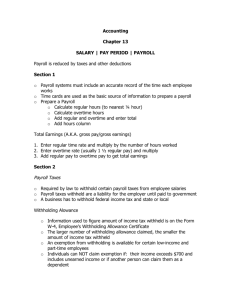

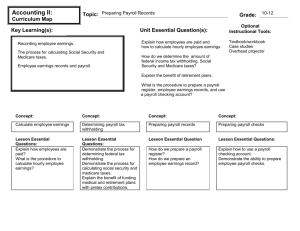

Chapter 10 Skyline College 10-1 Who Is an Employee? An employee is a person who is hired by and works under the direction of the employer. Works Uses under the control of the employer equipment provided by the employer Works hours that are set by the employer 10-2 An independent contractor is one who is paid by a company to carry out a specific task or job but is not under the direct supervision or control of the company. Does not work under the direct supervision or control of the company Furnishes his or her own tools or equipment Sets his or her own working hours No withholding for independent contractors No payroll tax for independent contractors 10-3 How do employees differ from independent contractors? Employee Independent Contractor Works under the control and direction of the employer Does not work under the direct supervision or control of the company Uses tools or equipment provided by the employer Furnishes his or her own tools or equipment Works certain hours that are set by the employer Sets his or her own working hours 10-4 The Fair Labor Standards Act of 1938 Also referred to as the Wage and Hour Law Applies only to firms engaged directly or indirectly in interstate commerce Sets a minimum hourly rate of pay and maximum hours of work per week to be performed at the regular rate of pay Employees who work beyond 40 hours a week are entitled to “time and a half.” 10-5 Time and a half Time and a half is the rate of pay for an employee’s work in excess of 40 hours a week. It is one and one-half times the regular hourly rate of pay. 10-6 Social Security Tax Social security tax is a tax imposed by the Federal Insurance Contributions Act (FICA) and collected on employee earnings to provide retirement and disability benefits. 10-7 Social Security Tax As of 2005 The amount of social security tax is determined by: rate earnings up to a calendar year earnings base 6.2% $90,000 The rate (6.2 percent) has remained constant in recent years. The earnings base has increased each year. 10-8 Medicare Tax Medicare tax is a tax on employees and employers to provide medical care for the employee and the employee’s spouse after each has reached age 65. 10-9 Medicare Tax As of 2005 The amount of Medicare tax is determined by: rate earnings 1.45% total earnings The rate (1.45%) has remained constant in recent years. The Medicare tax does not have an earnings base limit. 10-10 Gross Wages Employee Earnings social security tax (6.2% up to an earnings base limit) Medicare tax (1.45%) 10-11 Let’s assume an employee earns $100,000 in the calendar year. FICA Tax Employee (withheld) 6.2% X $90,000 = $5,580.00 Medicare Tax Employee (withheld) 1.45% X $100,000 = $1,450.00 Social Security Tax and Medicare Tax $5,580.00 $5,580.00 Social Security Tax Tax payable Medicare Tax $3,100.00 $50,000 X 6.2% = $3,100.00 $90,000 X 6.2% = $5,580.00 Earnings Employee 1 $50,000 Employee 2 $90,000 Employee 3 $100,000 $90,000 X 6.2% = $5,580.00 Tax payable Social Security Tax and Medicare Tax $5,580.00 $5,580.00 Social Security Tax Medicare Tax $3,100.00 $50,000 X 1.45% = $725.00 $1,450.00 $1,305.00 $725.00 $90,000 X 1.45% = $1,305.00 Earnings $100,000 X 1.45% = $1,450.00 Employee 1 $50,000 Employee 2 $90,000 Employee 3 $100,000 Federal Income Tax Employers are required to withhold an estimated amount of federal income tax from the employee’s earnings. 10-15 Gross Wages Employee Earnings federal income tax social security tax (6.2% up to an earnings base limit) Medicare tax (1.45%) 10-16 State and Local Taxes Most states, and many local governments, may require employers to withhold income taxes from employees’ earnings to prepay the employees’ state and local income taxes. The rules are generally almost identical to those governing federal income tax withholding. 10-17 Employer’s Payroll Taxes and Insurance Costs Employers withhold social security and Medicare taxes from employees’ earnings. In addition, employers pay social security and Medicare taxes on their employees’ earnings. Employers are also required to pay: Federal unemployment tax State unemployment tax Workers’ compensation insurance 10-18 The employer matches the social security tax withheld from the employee’s earnings. Employee Earnings federal income tax social security tax (6.2% up to an earnings base limit) Medicare tax (1.45%) 10-19 The employer matches the Medicare tax withheld from the employee’s earnings. Employee Earnings federal income tax social security tax (6.2% up to an earnings base limit) Medicare tax (1.45%) 10-20 Let’s assume an employee earns $100,000 in the calendar year. FICA Tax Employee (withheld) 6.2% X $90,000 = $5,580.00 Employer Total 6.2% X $90,000 = $5,580.00 12.4 % Federal Unemployment Tax FUTA Federal unemployment taxes (FUTA) are taxes levied by the federal government against employers to benefit unemployed workers. 10-22 State Unemployment Tax SUTA State unemployment taxes (SUTA) are taxes levied by the state government against employers to benefit unemployed workers. 10-23 Unemployment Rate Taxes The FUTA and SUTA tax rates are applied to FUTA wages: The federal tax rate is 6.2 percent. This can be reduced by the state tax rate (5.4 percent for many states). This text assumes that the taxable earnings base per employee is $7000 per year. 10-24 The SUTA-FUTA Connection SUTA tax rate FUTA tax rate (Less) SUTA tax rate 5.0% 6.2% 4.8% 6.2% (5.0) 5.4% 6.2% (4.8) (5.4) Net FUTA tax rate 1.2 1.4 0.8 Total taxes 6.2% 6.2% 6.2% 10-25 Gross Wages unemployment taxes (6.2% up to a taxable earnings base) Employee Earnings federal income tax social security tax (6.2% up to an earnings base limit) Medicare tax (1.45%) 10-26 Workers’ Compensation Insurance Workers’ compensation insurance is the insurance that protects employees against losses from job-related injuries or illnesses, or compensates their families if death occurs in the course of employment. 10-27 Employee Records Required by Law Federal laws require that certain payroll records be maintained. For each employee the employer must keep a record of: Employee’s name, address, social security number, and date of birth Hours worked each day and week, and wages paid at the regular and overtime rates (certain exceptions exist for employees who earn salaries) Cumulative wages paid during the year Amount of income tax, social security tax, and Medicare tax withheld for each pay period Proof that the employee is a United States citizen or has a valid work permit 10-28 Meet Kent Furniture and Novelty Co. Kent Furniture and Novelty Co. imports furniture and novelty items to sell over the Internet. The firm is a sole proprietorship owned and managed by Sarah Kent. Kent Furniture and Novelty Co. has five employees. Payday is each Monday. 10-29 Computing Total Earnings of Employees The first step in preparing payroll is to compute the gross wages or salary for each employee. There are several ways to compute earnings. Hourly rate basis Salary basis Commission basis Piece-rate basis 10-30 Hourly rate basis is a method of paying employees according to a stated rate per hour. Commission basis is a method of paying employees according to a percentage of net sales. 10-31 Piece-rate basis is a method of paying employees according to the number of units produced. Salary basis is a method of paying employees according to an agreedupon amount for each week, month or other period. 10-32 Determining Pay for Hourly Employees Two pieces of data are needed to compute gross pay for hourly rate basis employees: number of hours worked during the payroll period rate of pay 10-33 Hours Worked Many businesses use time clocks for hourly employees. Each employee has a time card and inserts it in the time clock to record the times of arrival and departure. The payroll clerk collects the cards at the end of the week. 10-34 Computing Gross Pay The gross pay for hourly employees for the week ended January 6 is determined as follows: Total hours Rate of pay Gross pay Alicia Martinez 40 hours X $ 10.00 = $400.00 Jorge Rodriguez 40 hours X $ 9.50 = $380.00 George Dunlap 40 hours X $ 9.00 = $360.00 10-35 Overtime George Dunlap earns $9.00 per hour. He worked 45 hours. He is paid 40 hours regular rate of pay and 5 hours at time and a half. Therefore, Dunlap’s gross pay adds up to: Regular earnings: 40 hours X $ 9.00 = $360.00 Overtime earnings: 5 hours X $13.50 = $ 67.50 Gross Pay $427.50 10-36 Withholdings for Hourly Employees Required by Law Recall that federal law requires employers to make three deductions from employees’ gross pay: FICA (social security) tax Medicare tax Federal income tax withholding 10-37 Tax-exempt Wages Earnings in excess of the base amount ($90,000 as of 2005) are not subject to FICA withholding. If an employee works for more than one employer during the year, the FICA tax is deducted and matched by each employer. When the employee files a federal income tax return, any excess FICA tax withheld from the employee’s earnings is refunded by the government or is applied to payment of the employee’s federal income taxes. 10-38 Social Security Tax To determine the amount of social security tax to withhold, multiply the taxable wages by the social security tax rate and round off to the nearest cent. Employee Cindy Taylor Jorge Rodriguez George Dunlap Cecilia Wu Gross pay $400.00 380.00 427.50 560.00 Total social security tax Tax rate X X X X 6.2% 6.2% 6.2% 6.2% Tax = = = = $24.80 23.56 26.51 34.72 $109.59 10-39 Medicare Tax To compute the Medicare tax to withhold from the employee’s paycheck, multiply the wages by the Medicare tax rate, 1.45 percent. Employee Alicia Martinez Jorge Rodriguez George Dunlap Cecilia Wu Gross pay $400.00 380.00 427.50 560.00 Total Medicare tax Tax rate X X X X 1.45% 1.45% 1.45% 1.45% Tax = = = = $ $ $ $ 5.80 5.51 6.19 8.12 $25.62 10-40 The amount of federal income tax to withhold from an employee’s earnings depends on: Earnings during the pay period Length of the pay period Employee’s instructions: Marital status Number of withholding allowances 10-41 Withholding Allowances In the simplest circumstances, a taxpayer claims a withholding allowance for: The taxpayer A spouse who does not also claim an allowance Each dependent for whom the taxpayer provides more than half the support during the year As the number of withholding allowances increases, the amount of federal income tax withheld decreases. 10-42 The Employee’s Withholding Allowance Certificate, Form W-4 is a form used to claim exemption (withholding) allowances. The wage-bracket table method is a simple method to determine the amount of federal income tax to be withheld using tables provided by the government. 10-43 Computing Federal Income Tax Withholding The wage-bracket table method is the most common way to compute the federal income tax withholding. The wage-bracket tables are in Publication 15, Circular E or online on www.IRS.gov 10-44 Wage-Bracket Table Method Use the following steps to determine the amount to withhold: 1. Choose the table for the pay period and the employee’s marital status. 2. Find the row in the table that matches the wages earned. Find the column that matches the number of withholding allowances claimed on Form W-4. The income tax to withhold is the intersection of the row and the column. 10-45 Cecilia Wu is married, claims two withholding allowances, and earned $560 for the week. MARRIED Persons—WEEKLY Payroll Period If the wages are--At least 520 530 540 550 560 And the number of withholding allowances claimed is-0 1 2 3 4 5 6 7 8 9 10 But less The amount of income tax to be withheld shall be-than The tax to withhold is $30; this is 530 42 33 22 19 10 4 0 0 0 0 0 where the row and column intersect. 540 43 34 23 20 11 5 0 0 0 0 0 550 45 36 24 21 12 6 0 0 0 0 0 560 46 37 29 22 16 10 4 0 0 0 0 570 48 39 30 23 17 11 5 0 0 0 0 1. Go to the table for married persons paid weekly. 2. Find the line covering wages between $560 and $570. Find the column for two withholding allowances. 10-46 Other Deductions Required by Law Most states and some local governments require employers to withhold state and local income taxes from earnings. In some states employers are also required to withhold unemployment tax or disability tax. The procedures are similar to those for federal income tax withholding. Apply the tax rate to the earnings, or use withholding tables. 10-47 There are many payroll deductions not required by law but made by agreement between the employee and the employer. Some examples are: Group life insurance Group medical insurance Company retirement plans Bank or credit union savings plans or loan repayments United States savings bonds purchase plans Stocks and other investment purchase plans Employer loan repayments Union dues 10-48 Determining Pay for Salaried Employees A salaried employee earns a specific sum of money for each payroll period. Exempt employees are salaried employees who hold supervisory or managerial positions who are not subject to the maximum hour and overtime pay provisions of the Wage and Hour Law. 10-49 Withholdings for Salaried Employees Required by Law The procedures for withholding taxes for salaried employees is the same as withholding for hourly employees. Apply the tax rate to the earnings or use withholding tables. 10-50 Recording Payroll Information for Employees A payroll register is a record of payroll information for each employee for the pay period. 10-51 Completing the Payroll Register PAYROLL REGISTER NAME Martinez, Alicia Rodriguez, Jorge Dunlap, George Wu, Cecil Booker, Cynthia (A) WEEK BEGINNING NO. OF ALLOW. MARITAL STATUS 1 1 3 2 1 January 1, 20-- CUMULATIVE EARNINGS M S S M S NO. OF HRS. 40 40 45 40 40 (B) (C) (D) RATE 10.00 9.50 9.00 14.00 480.00 (E) Enter the employee’s name (Column A), number of withholding allowances and marital status (Column B), and rate of pay (Column E). 10-52 Completing the Payroll Register PAYROLL REGISTER NAME Martinez, Alicia Rodriguez, Jorge Dunlap, George Wu, Cecil Booker, Cynthia (A) WEEK BEGINNING NO. OF ALLOW. MARITAL STATUS 1 1 3 2 1 January 1, 20-- CUMULATIVE EARNINGS M S S M S NO. OF HRS. 40 40 45 40 40 (B) (C) (D) RATE 10.00 9.50 9.00 14.00 480.00 (E) The Cumulative Earnings column (Column C) shows the total earnings for the calendar year before the current pay period. Since this is the first payroll period for the year, there are no cumulative earnings prior to the current pay period. 10-53 Completing the Payroll Register PAYROLL REGISTER NAME Martinez, Alicia Rodriguez, Jorge Dunlap, George Wu, Cecil Booker, Cynthia (A) WEEK BEGINNING NO. OF ALLOW. MARITAL STATUS 1 1 3 2 1 January 1, 20-- CUMULATIVE EARNINGS M S S M S NO. OF HRS. 40 40 45 40 40 (B) (C) (D) RATE 10.00 9.50 9.00 14.00 480.00 (E) In Column D enter the total number of hours worked in the current period. This data comes from the weekly time sheets. Note that all employees were paid for eight hours on January 1, a holiday. 10-54 Completing the Payroll Register PAYROLL REGISTER NAME Martinez, Alicia Rodriguez, Jorge Dunlap, George Wu, Cecil Booker, Cynthia (A) REGULAR 400.00 380.00 360.00 560.00 480.00 2,180.00 (F) WEEK BEGINNING EARNINGS OVERTIME 67.50 67.50 (G) January 1, 20-GROSS AMOUNT 400.00 380.00 427.50 560.00 480.00 2,247.50 CUMULATIVE EARNINGS 400.00 380.00 427.50 560.00 480.00 2,247.50 (H) (I) Using the hours worked and the pay rate, calculate regular pay (Column F), the overtime pay (Column G), and gross pay (Column H). 10-55 Completing the Payroll Register PAYROLL REGISTER NAME Martinez, Alicia Rodriguez, Jorge Dunlap, George Wu, Cecil Booker, Cynthia (A) REGULAR 400.00 380.00 360.00 560.00 480.00 2,180.00 (F) WEEK BEGINNING EARNINGS OVERTIME 67.50 67.50 (G) January 1, 20-GROSS AMOUNT 400.00 380.00 427.50 560.00 480.00 2,247.50 CUMULATIVE EARNINGS 400.00 380.00 427.50 560.00 480.00 2,247.50 (H) (I) Calculate the cumulative earnings after this pay period (Column I). 10-56 Completing the Payroll Register AND ENDING NAME Martinez, Alicia Rodriguez, Jorge Dunlap, George Wu, Cecil Booker, Cynthia (A) January 6, 20-- PAID TAXABLE WAGES SOCIAL MEDICARE SECURITY 400.00 400.00 380.00 380.00 427.50 427.50 560.00 560.00 480.00 480.00 2,247.50 2,247.50 (J) (K) FUTA 400.00 380.00 427.50 560.00 480.00 2,247.50 (L) January 8, 20-DEDUCTIONS SOCIAL MEDICARE SECURITY 24.80 5.80 23.56 5.51 26.51 6.19 34.72 8.12 29.76 6.96 139.35 32.58 (M) (N) The Taxable Wages columns shows the earnings subject to taxes for social security (Column J), Medicare (Column K), and FUTA (Column L). Only the earnings at or under the earnings limit are included in these columns. 10-57 Completing the Payroll Register AND ENDING NAME Martinez, Alicia Rodriguez, Jorge Dunlap, George Wu, Cecil Booker, Cynthia (A) January 6, 20-SOCIAL SECURITY 24.80 23.56 26.51 34.72 29.76 139.35 (M) PAID DEDUCTIONS MEDICARE 5.80 5.50 6.19 8.12 6.96 32.58 (N) INCOME TAX 19.00 34.00 23.00 30.00 49.00 155.00 (O) January 8, 20-HEALTH INSURANCE 40.00 40.00 80.00 (P) The Deductions columns show the withholding for social security tax (Column M), Medicare tax (Column N), federal income tax (Column O), and medical insurance (Column P). 10-58 Completing the Payroll Register AND ENDING NAME Martinez, Alicia Rodriguez, Jorge Dunlap, George Wu, Cecil Booker, Cynthia (A) January 6, 20-- PAID January 8, 20-- DEDUCTIONS DISTRIBUTION INCOME HEALTH NET CHECK OFFICE SHIPPING TAX INSURANCE AMOUNT NO. SALARIES WAGES 19.00 350.40 1601 400.00 34.00 316.93 1602 380.00 23.00 40.00 331.80 1603 427.50 30.00 40.00 447.16 1604 560.00 49.00 394.28 1605 480.00 155.00 80.00 1,840.57 480.00 1,767.50 (O) (P) (Q) (R) (S) (T) Subtract the deductions (Columns M, N, O, and P) from the gross earnings (Column H). Enter the results in the Net Amount column (Column Q). This is the amount paid to each employee. 10-59 Completing the Payroll Register AND ENDING NAME Martinez, Alicia Rodriguez, Jorge Dunlap, George Wu, Cecil Booker, Cynthia (A) January 6, 20-- PAID January 8, 20-- DEDUCTIONS DISTRIBUTION INCOME HEALTH NET CHECK OFFICE SHIPPING TAX INSURANCE AMOUNT NO. SALARIES WAGES 19.00 350.40 1601 400.00 34.00 316.93 1602 380.00 23.00 40.00 331.80 1603 427.50 30.00 40.00 447.16 1604 560.00 49.00 394.28 1605 480.00 155.00 80.00 1,840.57 480.00 1,767.50 (O) (P) (Q) Enter the check number in Column R. 10-60 (R) (S) (T) Completing the Payroll Register AND ENDING NAME Martinez, Alicia Rodriguez, Jorge Dunlap, George Wu, Cecil Booker, Cynthia (A) January 6, 20-- PAID January 8, 20-- DEDUCTIONS DISTRIBUTION INCOME HEALTH NET CHECK OFFICE SHIPPING TAX INSURANCE AMOUNT NO. SALARIES WAGES 19.00 350.40 1601 400.00 34.00 316.93 1602 380.00 23.00 40.00 331.80 1603 427.50 30.00 40.00 447.16 1604 560.00 49.00 394.28 1605 480.00 155.00 80.00 1,840.57 480.00 1,767.50 (O) (P) (Q) (R) (S) (T) The payroll register’s last two columns classify employee earnings as office salaries (Column S) or shipping wages (Column T). 10-61 The Payroll Register When the payroll data for all employees has been entered in the payroll register, total the columns. 10-62 Recording Payroll Recording payroll information involves two separate entries: Record the payroll expense 2. Pay the employees 1. 10-63 AND ENDING January 6, 20-- PAID January 8, 20-- DEDUCTIONS DISTRIBUTION NAME INCOME HEALTH NET CHECK OFFICE SHIPPING TAX INSURANCE AMOUNT NO. SALARIES WAGES Martinez, Alicia 19.00 350.40 1725 400.00 Rodriguez, Jorge 34.00 316.93 1726 380.00 Dunlap, George 23.00 40.00 331.80 1727 427.50 Wu, Cecil 30.00 40.00 447.16 1728 560.00 Booker, Cynthia 49.00 394.28 1729 480.00 The information 155.00 in 80.00 1,840.57 480.00 1,767.50 the (A) register is (O) (P) (Q) (R) used for recording GENERAL JOURNAL the payroll expense. DATE DESCRIPTION POST. (S) (T) PAGE DEBIT 1 CREDIT REF. 20-Jan. 8 Office Salaries Expense Shipping Wages Expense Social Security Tax Payable Medicare Tax Payable Employee Income Tax Payable Health Insurance Premiums Payable Salaries and Wages Payable Payroll for week ending Jan. 6 480.00 1,767.50 139.35 32.58 155.00 80.00 1,840.57 AND ENDING January 6, 20-- PAID January 8, 20-- DEDUCTIONS MEDICARE NAME SOCIAL INCOME HEALTH SECURITY TAX INSURANCE Martinez, Alicia 24.80 5.80 19.00 Rodriguez, JorgeEach23.56 5.50 is credited 34.00 type of deduction to Dunlap, George 26.51 6.19 23.00 40.00 a separate liability account. Wu, Cecil 34.72 8.12 30.00 40.00 Booker, Cynthia 29.76 6.96 49.00 139.35 32.58 155.00 80.00 (A) (M) (N) (O) GENERAL JOURNAL A separate liability account is set up DATE DESCRIPTION POST. for each REF. 20-- deduction. Jan. 8 Office Salaries Expense Shipping Wages Expense Social Security Tax Payable Medicare Tax Payable Employee Income Tax Payable Health Insurance Premiums Payable Salaries and Wages Payable Payroll for week ending Jan. 6 (P) PAGE DEBIT 1 CREDIT 480.00 1,767.50 139.35 32.58 155.00 80.00 1,840.57 AND ENDING January 6, 20-- PAID January 8, 20-- DEDUCTIONS DISTRIBUTION NAME INCOME HEALTH NET CHECK OFFICE SHIPPING TAX INSURANCE AMOUNT NO. SALARIES WAGES Martinez, Alicia 19.00 350.40 1601 400.00 Rodriguez, Jorge 34.00 316.93 1602 380.00 Net pay is credited to the Dunlap, George 23.00 40.00 331.80 1603 427.50 liability account, Salaries and 40.00 Wu, Cecil 30.00 447.16 1604 560.00 Cynthia 49.00 394.28 1605 480.00 WagesBooker, Payable. 155.00 80.00 1,840.57 480.00 1,767.50 (A) (O) (P) (Q) (R) (S) GENERAL JOURNAL DATE 20-Jan. DESCRIPTION 8 Office Salaries Expense Shipping Wages Expense Social Security Tax Payable Medicare Tax Payable Employee Income Tax Payable Health Insurance Premiums Payable Salaries and Wages Payable Payroll for week ending Jan. 6 POST. REF. (T) PAGE DEBIT 1 CREDIT 480.00 1,767.50 139.35 32.58 155.00 80.00 1,840.57 Paying Employees Most businesses pay their employees by check or by direct deposit. By using these methods, the business avoids the inconvenience and risk involved in dealing with currency. 10-67 Wages Paid On January 8 Kent Furniture and Novelty Co. wrote five checks for payroll, Check numbers 1601-1605. GENERAL JOURNAL DATE Jan. DESCRIPTION 8 POST. REF. Salaries and Wages Payable DEBIT PAGE 1 CREDIT 1,840.57 Cash 1,840.57 To record payment of salaries and wages for week ended Jan. 6 General Journal Format 10-68

![[Product Name]](http://s2.studylib.net/store/data/005238235_1-ad193c18a3c3c1520cb3a408c054adb7-300x300.png)