Life Insurance in india=Final-Project

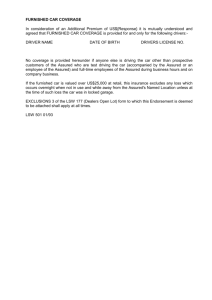

advertisement

TYBFM LIFE INSURANCE IN INDIA Executive Summary:- The service industry is one of the fastest growing sectors in India today. The upcoming sectors which are really showing the graph towards upwards are Telecom, Banking, and Insurance. These sectors really have a lot of responsibility towards the economy. Amongst the above-mentioned areas insurance is one sector, which took a lot of time in positioning itself. The insurance business of non-life companies was not much in problems but the major problem was with life insurance. Life Insurance Corporation of India had monopoly for more than 45 years, but the picture then was completely different. Previously people felt that “Insurance is only for classes not for masses” but now the picture is vice-versa. The story of insurance is probably as old as the story of mankind. The same instinct that prompts modern businessmen today to secure themselves against loss and disaster existed in primitive men also. They too sought to avert the evil consequences of fire and flood and loss of life and were willing to make some sort of sacrifice in order to achieve security. Though the concept of insurance is largely a development of the recent past, particularly after the industrial era – past few centuries – yet its beginnings date back almost 6000 years. Life Insurance in its modern form came to India from England in the year 1818. Oriental Life Insurance Company started by Europeans in Calcutta was the first life insurance company on Indian Soil. All the insurance companies established during that period were brought up with the purpose of looking after the needs of European community and these companies were not insuring Indian natives. 1 TYBFM LIFE INSURANCE IN INDIA However, later with the efforts of eminent people like Babu Muttylal Seal, the foreign life insurance companies started insuring Indian lives. But Indian lives were being treated as sub-standard lives and heavy extra premiums were being charged on them. Bombay Mutual Life Assurance Society heralded the birth of first Indian life insurance company in the year 1870, and covered Indian lives at normal rates. Starting as Indian enterprise with highly patriotic motives, insurance companies came into existence to carry the message of insurance and social security through insurance to various sectors of society. Bharat Insurance Company (1896) was also one of such companies inspired by nationalism. The Swadeshi movement of 1905-1907 gave rise to more insurance companies. The United India in Madras, National Indian and National Insurance in Calcutta and the Co-operative Assurance at Lahore were established in 1906. In 1907, Hindustan Co-operative Insurance Company took its birth in one of the rooms of the Jorasanko, house of the great poet Rabindranath Tagore, in Calcutta. The Indian Mercantile, General Assurance and Swadeshi Life (later Bombay Life) were some of the companies established during the same period. Prior to 1912 India had no legislation to regulate insurance business. In the year 1912, the Life Insurance Companies Act, and the Provident Fund Act were passed. The Life Insurance Companies Act 1912 made it necessary that the premium rate tables and periodical valuations of companies should be certified by an actuary. But the Act discriminated between foreign and Indian companies on many accounts, putting the Indian companies at a disadvantage. The formation of IRDA, entrance of private life insurance companies into India with one foreign partner, compulsory training of Insurance agents etc. developments started to take place. And this was the time when these companies 2 TYBFM LIFE INSURANCE IN INDIA started searching for proper channel partners who can help the organization in expanding its network and business in India. Channel partners are those who are going to be into direct selling of company’s products i.e. the insurance policies. They are the link between the customers and the management or company. These channel partners are people with different profiles. They are selected on some grounds like their network of people, their problem handling ability, convincing power and lot many things. The main idea behind company’s Questionnaire Survey is to find out and analyze the proper profile that can be recruited by company as a channel partner. Company has been focusing on some of the profile that can be very beneficial for the company. For example Chartered Accountants, Tax Consultants, Postal agents, Bank’s Daily Collection Agents etc. the main idea behind targeting the above profile is strong client network which is really very important for an insurance company. 3 TYBFM LIFE INSURANCE IN INDIA WHAT IS INSURANCE? Insurance is defined as a co-operative device to spread the loss caused by a particular risk over a number of persons who are exposed to it and who agree to ensure themselves against that risk. Risk is uncertainty of a financial loss. Insurance is a policy from large financial institutions that offers a person, company, or other entity reimbursement or financial protection against possible future losses or damages. MEANING OF INSURANCE:The meaning of insurance is important to understand for anybody that is considering buying an insurance policy simply understanding the basics of finance. Insurance is a hedging instrument used as a precautionary measure against future contingent losses. This instrument is used for managing the possible risks of the future. Insurance is bought in order to hedge the possible risks of the future which may or may not take place. This is a mode of financially insuring that if such a incident happens then the loss does not affect the present well-being of the person or the property insured. Thus, through insurance, a person buys security and protection. A simple example will make the meaning of insurance easy to understand. A biker is always subjected to the risk of head injury. But it is not certain that the accident causing him the head injury would definitely occur. Still, people riding bikes cover their heads with helmets. This helmet in such cases acts as insurance by protecting 4 TYBFM LIFE INSURANCE IN INDIA him/her from any possible danger. The price paid was the possible inconvenience or act of wearing the helmet; this is equivalent to the insurance premiums paid.Though loss of life or injuries incurred cannot be measured in financial terms, insurance attempts to quantify such losses financially. Insurance can be defined as the process of reimbursing or protecting a person from contingent risk of losses through financial means, in return for relatively small, regular payments to the insuring body or insurance company. TYPES OF INSURANCE:- 5 TYBFM LIFE INSURANCE IN INDIA INSURANCE NON-LIFE INSURANCE GENERAL INSURANCE LIFE INSURANCE MISCELLANEOUS INSURANCE 6 TYBFM LIFE INSURANCE IN INDIA WHAT IS LIFE INSURANCE? Life insurance may be defined as a contract in which the insurer in consideration of a certain premium either in lump sum or other periodical payments, agrees to pay to the assured or to the person for whose benefits the policy is taken, a stated sum of money on the happening of a particular event contingent on the duration of human life. Thus, under a whole-life assurance, the policy is payable at the of the assured and under an endowment policy, the money is payable on the assureds’ surviving a stated period of years. MEANING OF LIFE INSURANCE:According to sec (2) (11) of the Insurance Act, Life insurance business means “the business effecting contracts upon human life”. It includes:- a. Any contracts whereby the payment of money is assured upon death (except death by accident only) or the happening of any contingency dependent on human life. b. Any contract which is subject to the payment of premium for a term dependent on human life. 7 TYBFM LIFE INSURANCE IN INDIA c. Any contract which include the granting of disability and double or triple indemnity, accident benefits, the granting of annuities upon human life, and the granting of super-annuation allowances. HISTORY OF LIFE INSURANCE:The story of insurance is probably as old as the story of mankind. Life Insurance in its modern form came to India from England in the year 1818. Oriental Life Insurance Company started by Europeans in Calcutta was the first life insurance company on Indian Soil. All the insurance companies established during that period were brought up with the purpose of looking after the needs of European community and Indian natives were not being insured by these companies. However, later with the efforts of eminent people like Babu Muttylal Seal, the foreign life insurance companies started insuring Indian lives. But Indian lives were being treated as sub-standard lives and heavy extra premiums were being charged on them. Bombay Mutual Life Assurance Society heralded the birth of first Indian life insurance company in the year 1870, and covered Indian lives at normal rates. Starting as Indian enterprise with highly patriotic motives, insurance companies came into existence to carry the message of insurance and social security through insurance to various sectors of society. Bharat Insurance Company (1896) was also one of such companies inspired by nationalism. The Swadeshi movement of 1905-1907 gave rise to more insurance companies. The 8 TYBFM LIFE INSURANCE IN INDIA United India in Madras, National Indian and National Insurance in Calcutta and the Co-operative Assurance at Lahore were established in 1906. In 1907, Hindustan Co-operative Insurance Company took its birth in one of the rooms of the Jorasanko, house of the great poet Rabindranath Tagore, in Calcutta. The Indian Mercantile, General Assurance and Swadeshi Life (later Bombay Life) were some of the companies established during the same period. Prior to 1912 India had no legislation to regulate insurance business. In the year 1912, the Life Insurance Companies Act, and the Provident Fund Act were passed. The Life Insurance Companies Act, 1912 made it necessary that the premium rate tables and periodical valuations of companies should be certified by an actuary. But the Act discriminated between foreign and Indian companies on many accounts, putting the Indian companies at a disadvantage. The first two decades of the twentieth century saw lot of growth in insurance business. From 44 companies with total business-in-force as Rs.22.44 crore, it rose to 176 companies with total business-in-force as Rs.298 crore in 1938. During the mushrooming of insurance companies many financially unsound concerns were also floated which failed miserably. The Insurance Act 1938 was the first legislation governing not only life insurance but also non-life insurance to provide strict state control over insurance business. The demand for nationalization of life insurance industry was made repeatedly in the past but it gathered momentum in 1944 when a bill to amend the Life Insurance Act 1938 was introduced in the Legislative Assembly. However, it was much later on the 19th of January, 1956, that life insurance in India was nationalized. About 154 Indian insurance companies, 16 non-Indian companies and 75 provident were operating in India at the time of nationalization. Nationalization was accomplished in two stages; 9 TYBFM LIFE INSURANCE IN INDIA initially the management of the companies was taken over by means of an Ordinance, and later, the ownership too by means of a comprehensive bill. The Parliament of India passed the Life Insurance Corporation Act on the 19th of June 1956, and the Life Insurance Corporation of India was created on 1st September, 1956, with the objective of spreading life insurance much more widely and in particular to the rural areas with a view to reach all insurable persons in the country, providing them adequate financial cover at a reasonable cost. LIC had 5 zonal offices, 33 divisional offices and 212 branch offices, apart from its corporate office in the year 1956. Since life insurance contracts are long term contracts and during the currency of the policy it requires a variety of services need was felt in the later years to expand the operations and place a branch office at each district headquarter. Re-organization of LIC took place and large numbers of new branch offices were opened. As a result of re-organization servicing functions were transferred to the branches, and branches were made accounting units. It worked wonders with the performance of the corporation. It may be seen that from about 200.00 crores of New Business in 1957 the corporation crossed 1000.00 crores only in the year 1969-70, and it took another 10 years for LIC to cross 2000.00 crore mark of new business. But with re-organization happening in the early eighties, by 1985-86 LIC had already crossed 7000.00 crore Sum Assured on new policies. Today LIC functions with 2048 fully computerized branch offices, 109 divisional offices, 8 zonal offices, 992 satellite offices and the Corporate office.. It has crossed the milestone of issuing 1,01,32,955 new policies by 15th Oct, 2005, posting a healthy growth rate of 16.67% over the corresponding period of the previous year. From then to now, LIC has crossed many milestones and has set unprecedented performance records in various aspects of life insurance 10 TYBFM LIFE INSURANCE IN INDIA business. The same motives which inspired our forefathers to bring insurance into existence in this country inspire us at LIC to take this message of protection to light the lamps of security in as many homes as possible and to help the people in providing security to their families. SOME OF THE IMPORTANT MILESTONES OF LIFE INSURANCE:- 1818:- Oriental Life Insurance Company, the first life insurance company on Indian soil started functioning. 1850:- Non life insurance debuts with triton insurance company. 1870:- Bombay Mutual Life Assurance Society, the first Indian life insurance company started its business. 1912:- The Indian Life Assurance Companies Act enacted as the first statute to regulate the life insurance business. 1928:- The Indian Insurance Companies Act enacted to enable the government to collect statistical information about both life and non-life insurance businesses. 1938:- Earlier legislation consolidated and amended to by the Insurance Act with the objective of protecting the interests of the insuring public. 1956:- 245 Indian and foreign insurers and provident societies taken over by the central government and nationalized. LIC formed by an Act of Parliament, viz. LIC Act, 1956, with a capital contribution of Rs. 5 Crore from the Government of India. 11 TYBFM LIFE INSURANCE IN INDIA The General insurance business in India, on the other hand, can trace its roots to the Triton Insurance Company Ltd., the first general insurance company established in the year 1850 in Calcutta by the British. Some of the important milestones in the general insurance business in India are:- 1907:- The Indian Mercantile Insurance Ltd. set up, the first company to transact all classes of general insurance business. 1957:- General Insurance Council, a wing of the Insurance Association of India, frames a code of conduct for ensuring fair conduct and sound business practices. 1968:- The Insurance Act amended to regulate investments and set minimum solvency margins and the Tariff Advisory Committee set up. 1972:- The General Insurance Business (Nationalization) Act, 1972 nationalized the general insurance business in India with effect from 1st January 1973. 107 insurers amalgamated and grouped into four companies’ viz. the National Insurance Company Ltd., the New India Assurance Company Ltd., the Oriental Insurance Company Ltd. and the United India Insurance Company Ltd. GIC incorporated as a company. 12 TYBFM LIFE INSURANCE IN INDIA Objectives of life insurance:The objectives of life insurance are as follows: Spread Life Insurance widely and particular to the rural areas and to the socially and backward classes with a view to reaching all insurable persons in the county and providing them adequate financial cover against death at a reasonable cost. Maximize mobilization of people’s savings by making insurance-linked savings adequately attractive. Bear in mind, in the investment of funds, the primary obligation to its poliyholders, whose money it holds in trust, without losing sight of the interest of the community as a whole, the funds to be developed to the best advantage of the investors as well as a whole, keeping in view national priorities and obligations of attractive return. Conduct business with utmost economy and with the full realization that money belong to the policyholders. Act as trustees of the insured public in their individual and collective capacities. Meet the various life insurance needs of the community that would arise in the changing social and economic environment. Involve all people working in the corporation to the best of their capability in furthering their interests of the insured public by providing efficient service with courtesy. 13 TYBFM LIFE INSURANCE IN INDIA Promote amongst all agents and employees of the corporation a sense of participation, pride and job satisfaction through discharge of their duties with dedication towards to achievement of corporate objective. Proper understanding and analysis of life insurance industry. To know about brand awareness of Kotak Life Insurance and customer’s preference about Kotak Life Insurance. Conduct market survey on a sample selected from the entire population and derived opinion on that research. According the market survey come know about how much potential of insurance market in our city. And base on analysis of the result thus obtained make a report on that research. Training aims at recruiting maximum number of Life Advisors and to Sell the maximum policies for the company and bring the business for the company which ever is going at the particular point of time. Along with it I will be gaining the thorough knowledge of insurance sector. This will give me in more confidence in marketing products given to me. 14 TYBFM LIFE INSURANCE IN INDIA Limitation of insurance:Some of the difficulties and limitations faced by me during my training are as follows: Lack of awareness among the people – This is the biggest limitation found in this sector. Most of the people are not aware about the importance and the necessity of the insurance in their life. They are not aware how useful life insurance can be for their family members if something happens to them. Perception of the people towards Insurance sector – People still consider insurance just as a Tax saving device. So today also there is always a rush to buy an Insurance Policy only at the end of the financial year like January, February and March making the other 9 months dry for this business. Insurance does not give good returns – Still today people think that Insurance does not give good returns. They are not aware of the modern Unit Linked Insurance Plans which are offered by most of the Private sector players. They are still under the perception that if they take Insurance they will get only 5-6% returns which is not true nowadays. Nowadays most of the modern Unit Linked Insurance Plans gives returns which are many times more than that of bank Fixed deposits, National saving certificate, Post office deposits and Public provident fund. Lack of awareness about the earning opportunity in the Insurance sector – People still today are not aware about the earning opportunity that the Insurance sector gives. After the privatization of the insurance sector many private giants have entered the insurance sector. These private companies in order to beat the competition and to increase their Insurance Advisors to increase their reach to the customers are giving very high commission rates but people are not aware of that. Increased competition – Today the competition in the Insurance sector has became very stiff. Currently there are 14 Life Insurance companies working in India including the LIC (life insurance Corporation of India). Today each and every company is trying to 15 TYBFM LIFE INSURANCE IN INDIA increase their Insurance Advisors so that they can increase their reach in the market. This situation has created a scenario in which to recruit Life insurance Advisors and to sell life Insurance Policy has became very very difficult. RESEARCH METODOLOGY:- Research always starts with a question or a problem. Its purpose is to question through the application of the scientific method. It is a systematic and intensive study directed towards a more complete knowledge of the subject studied. Marketing research is the function which links the consumer, customer and public to the marketer through information- information used to identify and define marketing opportunities and problems generate, refine, and evaluate marketing actions, monitor marketing actions, monitor marketing performance and improve understanding of market as a process. Marketing research specifies the information required to address these issues, designs, and the method for collecting information, manage and implemented the data collection process, analyses the results and communicate the findings and their implication. 16 TYBFM LIFE INSURANCE IN INDIA 17 TYBFM LIFE INSURANCE IN INDIA DATA COLLECTION:- After the research methodology, research problem in marketing has been identified and selected; the next step is together the requisite data. There are two types of data collection method – primary data and secondary data. In our live project, we decided primary data collection method because our study nature does not permit to apply observational method. In survey approach we had selected a questionnaire method for taking a customer view because it is feasible from the point of view of our subject & survey purpose. Insurance sector reforms:- 18 TYBFM LIFE INSURANCE IN INDIA In 1993, Malhotra Committee, headed by former Finance Secretary and RBI Governor R. N. Malhotra, was formed to evaluate the Indian insurance industry and recommend its future direction. The Malhotra committee was set up with the objective of complementing the reforms initiated in the financial sector. The reforms were aimed at “creating a more efficient and competitive financial system suitable for the requirements of the economy keeping in mind the structural changes currently underway and recognizing that insurance is an important part of the overall financial system where it was necessary to address the need for similar reforms…”. 1997:- Insurance regulator IRDA set up. 2000:- IRDA starts giving licenses to private insurers: Kotak Life Insurance ICICI prudential and HDFC Standard Life insurance first private insurers to sell a policy. 2001:- Royal Sundaram Alliance first non life insurer to sell a policy 2002 Banks allowed selling insurance plans. In 1994, the committee submitted the report and some of the key recommendations included:1. STRUCTURE:- Government stake in the insurance companies to be brought down to 50%. 19 TYBFM LIFE INSURANCE IN INDIA Government should take over the holdings of GIC and its subsidiaries so that these subsidiaries so that these subsidiaries can act as independent corporations. All the insurance companies should be given greater freedom to operate. 2. COMPETITION:- Private companies with a minimum paid up capital of Rs.1 billion should be allowed to enter the industry. No company should deal in both life and general insurance through a single entity. Foreign companies may be allowed to enter the industry in collaboration with domestic companies. Postal life insurance should be allowed to operate in the rural market. Only one state level life insurance company should be allowed to operate in each state. 3. REGULATORY BODY: The insurance act should be changed. An insurance regulatory body should be set up. Controller of insurance should be made independent. 4. INVESTMENTS:- Mandatory investments of LIC life fund in government securities to be reduced from 75% to 50%. GIC and its subsidiaries are not to hold more than 5% in any company. 20 TYBFM LIFE INSURANCE IN INDIA 5. CUSTOMER SERVICE:- LIC should pay interest on delays in payments beyond 30 days Insurance companies must be encouraged to set up unit linked pension plans. Computerization of operations and updating of technology to be carried out in the insurance industry. The committee emphasized that in order to improve the customer services and increase the coverage of the insurance, industry should be opened up to competition. But at the same time, the committee felt the need to exercise caution as any failure on the part of new players could ruin the public confidence in the industry. Hence, it was decided to allow competition in a limited way by stipulating the minimum capital requirement of Rs. 100 crores. The committee felt the need to provide greater autonomy to insurance companies in order to improve their performance and enable them to act as independent companies with economic motives. For this purpose, it had proposed setting up independent regulatory body. The Insurance Regulatory and Development Authority (IRDA):- The Insurance Act, 1938 had provided for setting up of the Controller of Insurance to act as a strong and powerful supervisory and regulatory authority for insurance. Post nationalization, the role of Controller of Insurance diminished considerably in significance since the Government owned the insurance companies. 21 TYBFM LIFE INSURANCE IN INDIA But the scenario changed with the private and foreign companies foraying in to the insurance sector. This necessitated the need for a strong, independent and autonomous Insurance Regulatory Authority was felt. As the enacting of legislation would have taken time, the then Government constituted through a Government resolution an Interim Insurance Regulatory Authority pending the enactment of a comprehensive legislation. The Insurance Regulatory and Development Authority Act, 1999 is an act to provide for the establishment of an Authority to protect the interests of holders of insurance policies, to regulate, promote and ensure orderly growth of the insurance industry and for matters connected therewith or incidental thereto and further to amend the Insurance Act, 1938, the Life Insurance Corporation Act, 1956 and the General insurance Business (Nationalization) Act, 1972 to end the monopoly of the Life Insurance Corporation of India (for life insurance business) and General Insurance Corporation and its subsidiaries (for general insurance business). The act extends to the whole of India and will come into force on such date as the Central Government may, by notification in the Official Gazette specify. Different dates may be appointed for different provisions of this Act. The Act has defined certain terms; some of the most important ones are as follows appointed day means the date on which the Authority is established under the act. Authority means the established under this Act. Interim Insurance Regulatory Authority means the Insurance Regulatory Authority set up by the Central Government through Resolution No. 17(2)/ 94-lns-V dated the 23rd January, 1996. Words and expressions used and not defined in this Act but defined in the Insurance Act, 1938 or 22 TYBFM LIFE INSURANCE IN INDIA the Life Insurance Corporation Act, 1956 or the General Insurance Business (Nationalization) Act, 1972 shall have the meanings respectively assigned to them in those Acts. A new definition of "Indian Insurance Company" has been inserted. "Indian insurance company" means any insurer being a company (a) Which is formed and registered under the Companies Act, 1956 (b) In which the aggregate holdings of equity shares by a foreign company, either by itself or through its subsidiary companies or its nominees, do not exceed twenty-six per cent. Paid up capital in such Indian insurance company (c) Whose sole purpose is to carry on life insurance business, general insurance business or re-insurance business? PRINCIPLES of life insurance:- 1. ELEMENTS OF A VALID CONTRACT:- Contract of life insurance has the essential elements of a general contract, since the life insurance contract is a contract as defined in the Indian Contract Act. A valid contract of life insurance comes into existence where the essential elements of agreement [offer and acceptance, competency of the parties, free consent of the parties, legal consideration and legal objectives] are present. 2. INSURABLE INTREST:23 TYBFM LIFE INSURANCE IN INDIA A person cannot insure the life of another unless he has an insurable interest in it. The risk against this policy is the death of the insured. A person has unlimited insurable interest in his own life. A husband is presumed to have insurable interest in his wife’s life and vice-versa. In life insurance the insurable interest must exist at the time of the contract of insurance. 3. UTMOST GOOD FAITH:- Insurance contracts however are contract i.e. One base on utmost good faith or the contract of utmost good faith. The insured is bound to disclose all material facts and figures known to him but unknown to the insurer. Every fact which is likely to influence the mind of the insurer in deciding whether to accept the proposal or in fixing the rate of premium in materials for this purpose. Similarly, the insurer is bound to exercise the same good faith in disclosing the scope of insurance which is prepared to grant. In life insurance, age, income, education, occupation, halt, family size, etc are some examples of material facts that should be disclosed at the time of entering into the contract. 4. WARRANTIES:- Warranties are an important feature of life insurance contract. Warranties are the basis of the contract between the proposer and the insurer. If any statement whether material or nonmaterial facts and figures are untrue the contract shall be null and void and the premium paid by him may be forfeited by the insurer. The policy issued will contain that the proposal and personal statement shall form part of the policy and be the basis of the contract. 24 TYBFM LIFE INSURANCE IN INDIA 5. ASSIGNMENT AND NOMINATION:- Both assignment and nomination are essential features of life insurance policy. Assignment of a life policy means transferring the rights of the assured in respect of the policy, to the assigner. In the case of the nomination, a person is merely named to collect the amount to be paid by the insurer on the death of the assured. 6. CAUSE IS CERTAIN:- In life assurance policy, the insurer has to pay the insured amount one day or other because the death of the assured or his reaching a particular age is certain to happen. 7. PREMIUM:- The premium is the price for the risk of loss undertaken by the insurer. In the case of insurance, premium is usually required to be paid in cash and advance payment of the premium is a condition of a binding contract of insurance. The amount of premium for payment of insured is paid monthly or annual installments for a certain period. In life insurance, the premium is calculated on the average rate of mortality and the fixed periodical premium may continue either until death or a specified number of years. Premium is payable till the maturity of the policy. 8. TERM OF POLICY:- 25 TYBFM LIFE INSURANCE IN INDIA An insurance policy specifies the terms and conditions or period of time; it covers often the nature of risk against which insurance is sought, determines the period or life of the policy. A life insurance policy may cover a specified number of years, or the balance of the insured life or the balance. 9. RETURN OF PREMIUM:- Premium is the consideration for the risk run by the insurers, and if the risk insured against is not run, then the consideration fails, the policy does not attach, and as a consequence the premium paid can be recovered from the insurer. The general principle applicable to the claim for the return of the premium is that if the insurers have never been on the risk, they cannot be said to have earned the premium. 26 TYBFM LIFE INSURANCE IN INDIA Types of life insurance policies:- 1. ON THE BASIS OF PREMIUM PAYMENT:The following important policies are issued by the corporation on the basis of premium payment:- a) SINGLE PREMUIM POLICY:- Single premium policy is useful to those who desire to provide the whole premium in one installment at the time of taking the policy. Single premium policy becomes matured on the assureds’ death or on his attainment of selected term whichever occurs earlier. For ex. Bima nivesh, Bima Bachat. b) LEVEL PREMIUM POLICY:Unlike single premium policy, under this policy premiums are payable on a regular basis for a selected term or till prior death. It is useful to those persons having regular earnings. Premium is lesser as compared to single premium policy. The assured becomes payable if the assured reaches a particular age or on the assureds death whichever is earlier. For ex. Endowment or money back policies 27 TYBFM LIFE INSURANCE IN INDIA 2. ON THE BASIS OF PARTICIPATION IN PROFIT:Policies issued on the basis of participation in profits are discussed below:- a) PARTICIPATING POLICIES OR WITH PROFIT POLICIES:With profit policies are also termed as participating policies. Unlike non-participation policies, participating policy holders are entitled to get the share of profits or bonus or benefits or paid up facilities as per the terms and conditions of the Corporation. The sum assured with profit shall become payable to the insured at the end of the maturity on the event of death if earlier. b) NON PARTICIPATING POLICIES OR WITHOUT PARTICIPATING POLICIES:Under this policy only sum assured will become payable without any paid up facilities to the incurred at the end of the selected term or on the death of life assured if earlier. These policies do not get any share in the profit of the insurer. 3) ON THE BASIS OF NUMBER OF PERSONS ASSURED:Important policies on the basis of number of persons assured are discussed below:- a) SINGLE LIFE POLICIES:This policy is designed on the basis of number of persons assured. Single life policy covers the risks on one individual; it may be issued on attaining a selected term or on the death of the life assured whichever is earlier. 28 TYBFM LIFE INSURANCE IN INDIA b) MULTIPLE LIFE POLICIES:Multiple life policies is a policy issued on the basis of the number of persons assured. The Multiple life policies may be joint life policies, last survivorship policies. c) JOINT LIFE POLICIES:Unlike single life policies joint life policy covers the risks of more than two individuals. The sum ensured is payable at the time of maturity or on the extent of the death of the first assured whichever is earlier. This policy is useful to partners of a firm or on the lives of husband and wife of a family. For E.G.: JEEVAN SATHI. 4) ON THE BASIS OF DURATION OF POLICIES:- a) WHOLE LIFE POLICY:- 1) NORMAL WHOLE LIFE POLICY:Under this policy the premium is payable for 35 years or till age go whichever is more. The policies where the premium is payable throughout the life of the assured is called the normal whole life term policy. This is the cheapest policy because the premium rate is lower. It is useful to the dependant of the assured against his/her death and to provide the payment of estate duty. 2) LIMITED PAYMENT WHOLE LIFE POLICY:The policies where the premium is payable is limited is called limited payment whole life policy. Under this plan the premium rate is higher. Premium are payable for a selected 29 TYBFM LIFE INSURANCE IN INDIA period of years or on the death of the assured whichever occurs earlier. This is a suitable form of life assurance for family provisions. 3) CONVERTIBLE WHOLE LIFE POLICY:This policy is issued by the corporation on the basis of duration. The basic object of this policy is to convert or Term Assurance Policy into whole life or endowment. Assurance policy without having further medical examination of the assured. The rate of premium and terms and conditions are the same as applicable to the new policy. If the policy is converted into an endowment assurance with profits, policy participates in profits from the dates of conversion and the bonuses will be at the rate applicable to endowment assurance. If the policy is converted into an endowment assurance without profits, the policy is not entitled to any bonus. b) TERM INSURANCE POLICIES:This policy provides the protection of death risk cover. Term insurance policies issued usually for a shorter period are treated as temporary contracts. There are two types of terms insurance policies as they are: - EG: ANMOL JEEVAN. 1) TEMPORARY ASSURANCE POLICY:This policy is issued by the Corporation on the basis of term insurance policy. This policy is designed to cover the risks against life assured for a period of less than two years. The sum assured will be payable only in the event of the life ASSURED’S death occurring within the selected period from the commencement of the policy. 2) RENEWABLE TEAM POLICIES:- 30 TYBFM LIFE INSURANCE IN INDIA Renewable team policies are issued on the basis of term of assurance. The plan of assurance is renewable at the end of the selected term for an additional term period without having to undergo fresh medical examination. Premiums are usually quoted according to the age attained at the time of renewal. c) ENDOWMENT POLICIES:This is a popular policy issued by LIC OF INDIA. The basic objectives is that the policy for the sum assured becomes matured on the policy holders death or on his attaining a particular age whichever is earlier. The period for which the policy is taken is called as Endowment Period. The premium under this policy is a little higher as compared with term assurance. This policy is a useful to the family in case of a sudden death of the policy holder. 1) ORDINARY ENDOWMENT POLICY:This policy provides a fund for family provision and investment. The sum assured is payable to the policy holder for a specific term of years either on the assured death or on his survival on the stipulated term of years until the maturity date premiums are payable throughout the life time of the assured or for a selected period of years or until prior death of the life assured. 2) JOINT ENDOWMENT POLICY:This policy is designed to cover the risks on the two or more lives under a single policy. The sum assured shall becomes payable on the maturity of the policy or on the death of 31 TYBFM LIFE INSURANCE IN INDIA either of the two lives assured whichever is earlier. This policy is useful to partners of a firm and for husband and wife in a family. EG: JEEVAN SATHI. 3) DOUBLE ENDOWMENT POLICY:Under this policy, premium is payable throughout the life time of the assured or for a selected period of years or until prior death of the life assured. This is the best form of life assurance; the insurer agrees to pay the assured double the amount of insured sum on the expiry of the term or on the death of the life assured whichever is earlier. EG: JEEVAN MITRA Double Cover. 4) FIXED TERM (MARRIAGE) ENDOWMENT POLICY:This plan is designed to meet the needs of the provision relating to marriage of any one of the family members of the policy holders. Under this plan, the sum assured together with profits shall be payable on the maturity of the policy or on the death of either of the two lives assured whichever is earlier. Premiums are payable for the selected terms of the policy or till death of the life assured if it occurs during the selected term. 5) EDUCATIONAL ANNUITY POLICY:This plan provides for a sum assured to be kept aside to meet the educational expenses of children. Under this plan, the sum assured together with profit is payable to the insured at the end of the selected term either in a lump sum or in ten half yearly installments at the option of the life assured. Premiums are payable for the selected term of the policy or kill the death of the life assured if it occurs during the selected term. The policy will be issued to persons agreed not less than 18 years and not more than 60 years at entry. The policies will be issued for minimum term of 5 years and maximum term for 25 years subject to maturity age of 70 years. 32 TYBFM LIFE INSURANCE IN INDIA The minimum sum assured under this plan will be Rs 10,000. E.G: Child Career Plan, child future plan, KOMAL JEEVAN. 6) TRIPLE BENEFIT POLICY:This plan is most suitable for housing loan purpose. Under this plan the benefits availing the policy holders on the death of the life assured during the term of the policy is thrice the basic sum, payable or on survival to the date of maturity, only the basic sum assured is payable. Premiums are payable for the selected term of the policy or till prior death of the life assured. EG: JEEVAN MITRA Triple Cover. 7) ANTICIPATED ENDOWMENT POLICY:Under this policy sum assured will be payable on the basis of half of the sum assured paid before the death of the policy holders and the balance of the sum assured is payable at the end of the assured before the attainment of the term period, full lump sum assured amount is payable to the policy holder. Premiums are payable for the selected term of the policy or till death if earlier. 8) MULTI PURPOSE POLICY:This form of life insurance not only makes provisions for the family of life assured in the event of his death but also to meet the needs of a person in old age. It is also useful to meet the expenses relating to family and provisions for education and marriage of his children. 9) CHILDREN DEFERRED ENDOWMENT ASSURANCE:This policy is to meet the needs of the provision relating to CHILDREN’S education and marriage. Policies Under this plan are issued on lives of both male and female children who have 33 TYBFM LIFE INSURANCE IN INDIA not completed 18 years. This is the cheapest form of life insurance because of low rate of premium. The main object of this policy is to cover the risk against the life of children on behalf of their parents and guardians. 5) ON THE BASIS OF METHOD OF PAYMENT OF POLICY AMOUNT:a) LUMPSUM POLICY:Lump sum policies are designed by the corporation on the basis of methods of payment of policy amount. Under this policy the sum assured shall be payable in a lump sum to the policy holder at the end of the maturity or on the death of the life assured whichever is earlier. b) INSTALMENTS OR ANNUITY POLICIES:This is a plan of assurance designed to provide a large amount of risk cover or payment of a premium which is comparatively a small amount. Under this policy, the full amount is not payable in lump sum but the insured amount is payable to the assured by periodical installments for a selected period of terms or till the death of the assured. 34 TYBFM LIFE INSURANCE IN INDIA STRUCTURE OF INSURANCE INDUSTRY: Snap Shot Historical Perspective:i) ii) Prior to 1956 242 companies operating 1956 - 2001 Nationalization – LIC monopoly Player – Government control (iii) 2001 -- Opened up sector Industry:(a) LIC – Fully owned by Government (b) Postal Life Insurance. (ii) Private players 1. Bajaj Allianz Life Insurance Co. Ltd. 2. Birla Sun Life Insurance Co. Ltd. (BSLI) 35 TYBFM LIFE INSURANCE IN INDIA 3. HDFC Standard Life Insurance Co. Ltd. (HDFC STD LIFE) 4. ICICI Prudential Life Insurance Co. Ltd. (ICICI PRU) 5. ING Vysya Life Insurance Co. Ltd. (ING VYSYA) 6. Max New York Life Insurance Co. Ltd. (MNYL) 7. MetLife India Insurance Co. Pvt. Ltd. (METLIFE) 8. Kotak Mahindra Old Mutual Life Insurance Co. Ltd. 9. SBI Life Insurance Co. Ltd. (SBI LIFE) 10. TATA AIG Life Insurance Co. Ltd. (TATA AIG) 11. Reliance Life Insurance 12. Aviva Life Insurance Co. Pvt. Ltd. (AVIVA) 13. Sahara India Life Insurance Co. Ltd. (SAHARA LIFE) 14. Shriram Sunlam (iii) Other likely players – PNB Life Insurance, Axa Bharti Enterprises 36 TYBFM LIFE INSURANCE IN INDIA Potential of the Insurance sector:- Total population 1.1 billion Total population of 253 millions Insurable class Total population 88.5 millions insured 37 TYBFM LIFE INSURANCE IN INDIA Market Share:- Company Indian Foreign Market Promoter/ Insurance share based on Partner premium Aviva life Dabur Aviva, UK 1.12 Bajaj Bajaj Auto Allianz, 6.12 Allianz Germany Birla sun Aditya Birla Sun Life, life group Canada HDFC HDFC Standard Standard 1.84 2.96 Life, UK 38 TYBFM LIFE INSURANCE IN INDIA ICICI ICICI Bank Prudential, Prudential UK ING Vysya Vysya Bank ING 7.11 0.63 Insurance, Netherlands Kotak Kotak Old Mutual Mahindra, Mahindra South Africa Old Mutual Bank Max New Max India York New York 0.71 1.32 Life, US MetLife Jammu & MetLife, US 0.40 Kashmir CONTRIBUTION TO INDIAN ECONOMY:- Bank (i) Life Insurance is the Sahara Life Sahara Insurance India SBI Life SBI None 0.80 only sector which garners long term savings. Cardiff, 1.52 (ii) Spread of financial services in rural France areas and amongst socially Tata AIG Tata Group AIG, US 1.78 less privileged. (iii) Long term funds for infrastructure. (iv) Strong positive correlation between development of capital markets and insurance/pension sector. (v) Employment generation 39 TYBFM LIFE INSURANCE IN INDIA Spread of financial services in rural areas and amongst socially underprivileged:- • IRDA Regulations provide certain minimum business to be done (i) In rural areas (ii) In the socially weaker sections • Life Insurance offices are spread over nearly 1400 centers. • Presence of representative in every tensile – deeper penetration in rural areas. • Insurance agents numbering over 6.24 lakhs in rural areas. • Policies sold in rural areas (2004-05) - No. of policies - 55 lakhs Sum assured 46,000 crore. • Social security - No. of lives covered 2003-04 40 TYBFM LIFE INSURANCE IN INDIA 17.4 lakhs 2004-05 42.1 lakhs Long term funds for infrastructure:- • For GDP to grow at 8 to 10%, qualitative improvement in infrastructure is essential. • Estimates of funds required for development of infrastructure vary widely. • An investment of 6, 19,600 crore is anticipated in the next 5 years (Source: SSKI India) • Tenure of funding required for infrastructure normally ranges from 10 to 20 years. • Major portion of these funds are routed through debt/private equity participation 41 TYBFM LIFE INSURANCE IN INDIA Development of Capital Markets/Economic Growth:•Industry also contributes in economic development through investments in capital market. Present level of investments is over Rs. 40,000 crore. (Mark to Market basis around 80,000 Crores). •Annual Investment of around 9000 Crores in capital markets. •Contribution to Five Year Plans9th Plan 2, 30,900 Crores Last Two Years 1, 70,900 Crores EMPLOYMENT GENERATION:• Life insurance industry provides increased employment opportunities. • Employees in insurance sector as on 31st March, 2005 is around 2lakhs. • Many agents depend on insurance for their livelihood–No. of agents on 31st March 2004 – 15.59 lakhs •Brokers, corporate agents, training establishment provide extra employment opportunities. 42 TYBFM LIFE INSURANCE IN INDIA • Many of these openings are in rural sectors. Life Insurers:Sr.No Registratio Date of . n Name of the Company Reg. Number 1 101 23.10.2000 HDFC Standard Life Insurance Company Ltd. 2 104 15.11.2000 Max New York Life Insurance Co. Ltd. 3 105 24.11.2000 ICICI Prudential Life Insurance Company Ltd. 4 107 10.01.2001 Kotak Mahindra Old Mutual Life Insurance Limited 5 109 31.01.2001 Birla Sun Life Insurance Company Ltd. 6 110 12.02.2001 Tata AIG Life Insurance Company Ltd. 7 111 30.03.2001 SBI Life Insurance Company Limited. 8 114 02.08.2001 ING Vysya Life Insurance Company Private Limited 43 TYBFM LIFE INSURANCE IN INDIA 9 116 03.08.2001 Bajaj Allianz Life Insurance Company Limited 10 117 06.08.2001 Metlife India Insurance Company Ltd. HDFC STANDARD LIFE INSURANCE COMPANY LTD:- HDFC Standard Life, one of India’s leading private life insurance companies, offers a range of individual and group insurance solutions. It is a joint venture between Housing Development Finance Corporation Limited (HDFC), India’s leading housing finance institution and Standard Life plc, the leading provider of financial services in the United Kingdom. HDFC Ltd. holds 72.43% and Standard Life (Mauritius Holding) Ltd. holds 26.00% of equity in the joint venture, while the rest is held by others. HDFC Standard Life’s product portfolio comprises solutions, which meet various customer needs such as Protection, Pension, Savings, Investment and Health. Customers have the added advantage of customizing the plans, by adding optional benefits called riders, at a nominal price. The company currently has 32 retail and 4 group products in its portfolio, along with five optional rider benefits catering to the savings, investment, protection and retirement needs of customers. 44 TYBFM LIFE INSURANCE IN INDIA HDFC Standard Life continues to have one of the widest reaches among new insurance companies with 568 branches servicing customer needs in over 700 cities and towns. The company has a strong presence in its existing markets with a base of 2, 00,000 Financial Consultants. MAX NEW YORK LIFE INSURANCE CO. LTD:- Max New York Life Insurance Company Ltd. is a joint venture between Max India Limited, one of India's leading multi-business corporations and New York Life International, the international arm of New York Life, a Fortune 100 company. The company has positioned itself on the quality platform. In line with its vision to be the most admired life insurance company in India, it has developed a strong corporate governance model based on the core values of excellence, honesty, knowledge, caring, integrity and teamwork. Incorporated in 2000, Max New York Life started commercial operation in April 2001. In line with its values of financial responsibility, Max New York Life has adopted prudent financial practices to ensure safety of policyholder's funds. The Company's paid up capital as on 31 st 45 TYBFM LIFE INSURANCE IN INDIA August, 2010 is Rs 1,973 crore. Max New York Life has multi-channel distribution spread across the country. Agency distribution is the primary channel complemented by partnership distribution, bancassurance and dedicated distribution for emerging markets. The Company places a lot of emphasis on its selection process for agent advisors, which comprises four stages - screening, psychometric test, career seminar and final interview. The agent advisors are trained in-house to ensure optimal control on quality of training. Max New York Life has put in place a unique hub and spoke model of distribution to deepen our rural penetration. This is the first time such a model has been put in place for rural marketing of insurance. Max New York Life offers a suite of flexible products. It now has 25 products covering both life and health insurance and 8 riders that can be customized to over 800 combinations enabling customers to choose the policy that best fits their need. Besides this, the company offers 6 products and 7 riders in group insurance business. ICICI PRUDENTIAL LIFE INSURANCE COMPANY LTD:- 46 TYBFM LIFE INSURANCE IN INDIA ICICI Prudential Life Insurance Company is a joint venture between ICICI Bank - one of India's foremost financial services companies-and prudential plc - a leading international financial services group headquartered in the United Kingdom. Total capital infusion stands at Rs. 47.80 billion, with ICICI Bank holding a stake of 74% and Prudential plc holding 26%. We began our operations in December 2000 after receiving approval from Insurance Regulatory Development Authority (IRDA). Today, our nation-wide reach includes over 1,900 branches (inclusive of 1,074 micro-offices), over 210,000 advisors; and 7 bancassurance partners. For three years in a row, ICICI Prudential has been voted as India's Most Trusted Private Life Insurer, by The Economic Times - AC Nielsen ORG Marg survey of 'Most Trusted Brands'. As we grow our distribution, product range and customer base, we continue to tirelessly uphold our commitment to deliver world-class financial solutions to customers all over India. 47 TYBFM LIFE INSURANCE IN INDIA KOTAK MAHINDRA OLD MUTUAL LIFE INSURANCE LIMITED:- Kotak Mahindra Old Mutual Life Insurance Ltd is a joint venture between Kotak Mahindra Bank Ltd., its affiliates and Old Mutual. A company that combines its international strengths and local advantages to offer its customers a wide range of innovative life insurance products, helping them in taking important financial decisions at every stage in life and stay financially independent. The company is one of the fastest growing insurance companies in India and has shown remarkable growth since its inception in 2001. Kotak Life Insurance employs around 5,565 people in its various businesses and has 197 branches across 141 cities. The Kotak Mahindra group is one of India’s leading banking and financial services organizations, with offerings across personal financial services; commercial banking; corporate and investment banking and markets; stock broking; asset management and life insurance. The Kotak Group has over 1,300 offices, and services around 5.9 million customer accounts across India. Kotak also has offices in London, New York, San Francisco, Singapore, Dubai and Mauritius 48 TYBFM LIFE INSURANCE IN INDIA BIRLA SUN LIFE INSURANCE COMPANY LTD:- Established in 2000, Birla Sun Life Insurance Company Limited (BSLI) is a joint venture between the Aditya Birla Group, a well known and trusted name globally amongst Indian conglomerates and Sun Life Financial Inc, leading international financial services organization from Canada. The local knowledge of the Aditya Birla Group combined with the domain expertise of Sun Life Financial Inc., offers a formidable protection for its customers’ future. With an experience of over 9 years, BSLI has contributed significantly to the growth and development of the life insurance industry in India and currently ranks amongst the top 5 private life insurance companies in the country. Known for its innovation and creating industry benchmarks, BSLI has several firsts to its credit. It was the first Indian Insurance Company to introduce “Free Look Period” and the same was made mandatory by IRDA for all other life insurance companies. Additionally, BSLI pioneered 49 TYBFM LIFE INSURANCE IN INDIA the launch of Unit Linked Life Insurance plans amongst the private players in India. To establish credibility and further transparency, BSLI also enjoys the prestige to be the originator of practice to disclose portfolio on monthly basis. These category development initiatives have helped BSLI be closer to its policy holders’ expectations, which gets further accentuated by the complete bouquet of insurance products (viz. pure term plan, life stage products, health plan and retirement plan) that the company offers. Add to this, the extensive reach through its network of 600 branches and 1,75,000 empanelled advisors. This impressive combination of domain expertise, product range, reach and ears on ground, helped BSLI cover more than 2 million lives since it commenced operations and establish a customer base spread across more than 1500 towns and cities in India. To ensure that our customers have an impeccable experience, BSLI has ensured that it has lowest outstanding claims ratio of 0.00% for FY 2008-09. Additionally, BSLI has the best Turn Around Time according to LOMA on all claims Parameters. Such services are well supported by sound financials that the Company has. The AUM of BSLI stood at Rs. 8165 crs as on February 28, 2009, while as on March 31, 2009, the company has a robust capital base of Rs. 2000 crs. 50 TYBFM LIFE INSURANCE IN INDIA TATA AIG LIFE INSURANCE COMPANY LTD:- Tata AIG Life Insurance Company Limited (Tata AIG Life) is a joint venture company, formed by the Tata Group and American International Group, Inc. (AIG). Tata AIG Life combines the Tata Group’s pre-eminent leadership position in India and AIG’s global presence as one of the world’s leading international insurance and financial services organization. The Tata Group holds 74 per cent stake in the insurance venture with AIG holding the balance 26 per cent. Tata AIG Life provides insurance solutions to individuals and corporate. Tata AIG Life Insurance Company was licensed to operate in India on February 12, 2001 and started operations on April 1, 2001. Tata is a rapidly growing business group based in India with significant international operations. Revenues in 2007-08 are USD 62.5 billion (around Rs. 251,543 crores), of which 61% was from business outside India. The Group’s Net Profit for 2007-08 is USD 5.4 billion (around Rs. 21,578 crores). The Group employs around 350,000 people worldwide. The Tata name has been respected in India for 140 years for its adherence to strong values and business ethics. The business operations of the Tata Group currently encompass seven business sectors Communications and Information Technology, Engineering, Materials, Services, Energy, Consumer Products and Chemicals. The Group's 28 publicly listed enterprises have a combined market capitalization of around $60 billion, among the highest among Indian business houses, and a shareholder base of 2.9 million. The major companies in the Group include Tata Steel, 51 TYBFM LIFE INSURANCE IN INDIA Tata Motors, Tata Consultancy Services (TCS), Tata Power, Tata Chemicals, Tata Tea, Indian Hotels, Tata Teleservices and Tata Communications. American International Group, Inc. (AIG), a world leader in insurance and financial services, is the leading international insurance organization with operations in more than 130 countries and jurisdictions. AIG companies serve commercial, institutional and individual customers through the most extensive worldwide property-casualty and life insurance networks of any insurer. In addition, AIG companies are leading providers of retirement services, financial services and asset management around the world. AIG's common stock is listed on the New York Stock Exchange, as well as the stock exchanges in Ireland and Tokyo. SBI LIFE INSURANCE COMPANY LIMITED:- SBI Life Insurance is a joint venture between State Bank of India and BNP Paribas 52 TYBFM LIFE INSURANCE IN INDIA Assurance. SBI owns 74% of the total capital and BNP Paribas Assurance the remaining 26%. SBI Life Insurance has an authorized capital of Rs. 2,000 crores and a paid up capital of Rs 1,000 crores. Mission: "To emerge as the leading company offering a comprehensive range of life insurance and pension products at competitive prices, ensuring high standards of customer satisfaction and world class operating efficiency, and become a model life insurance company in India in the post liberalization period". Values : • Trustworthiness • Ambition • Innovation • Dynamism • Excellence 53 TYBFM LIFE INSURANCE IN INDIA ING VYSYA LIFE INSURANCE COMPANY PRIVATE LIMITED:- ING Vysya Life Insurance (ING Life), a part of the ING Group the world’s largest financial services corporation* entered the private life insurance industry in India in September 2001. Headquartered at Bangalore, ING Life India is staffed by over 6,500 employees and services more than 1.2 million customers. ING Life India is a joint venture between ING Group (ING Insurance International B.V.) & Exide Industries. ING Life has a pan India network, and distributes its products through two channels, the Tied Agency Force and the Alternate Channel. The Tied Agency force comprises of over 50,000 ING Life Advisors spread across the country. The channel has branches in 232 cities, and 365 sales teams across the country. The Alternate Channels business within ING Life is one of the fastest growing distribution channels. The company currently has tie ups with over 200 cooperative bank across the country. The Alternate Channels division has Bancassurance (ING Vysya Bank), Referral Banks, Corporate Agents, Brokers and SMINCE. 54 TYBFM LIFE INSURANCE IN INDIA BAJAJ ALLIANZ LIFE INSURANCE COMPANY LIMITED:- Bajaj Allianz Life Insurance is a union between Allianz SE, one of the largest Insurance Company and Bajaj Finserv. Allianz SE is a leading insurance conglomerate globally and one of the largest asset managers in the world, managing assets worth over a Trillion (Over INR. 55, 00,000 Crores). Allianz SE has over 119 years of financial experience and is present in over 70 countries around the world. At Bajaj Allianz Life Insurance, customer delight is our guiding principle. Our business philosophy is to ensure excellent insurance and investment solutions by offering customized products, supported by the best technology. 55 TYBFM LIFE INSURANCE IN INDIA METLIFE INDIA INSURANCE COMPANY LTD:- MetLife India Insurance Company Limited (MetLife) is an affiliate of MetLife, Inc. and was incorporated as a joint venture between MetLife International Holdings, Inc., The Jammu and Kashmir Bank, M. Pallonji and Co. Private Limited and other private investors. MetLife is one of the fastest growing life insurance companies in the country. It serves its customers by offering a range of innovative products to individuals and group customers at more than 600 locations through its bank partners and company-owned offices. MetLife has more than 50,000 Financial Advisors, who help customers achieve peace of mind across the length and breadth of the country. MetLife, Inc., through its affiliates, reaches more than 70 million customers in the Americas, Asia Pacific and Europe. Affiliated companies, outside of India, include the number one life insurer in the United States (based on life insurance in force), with over 140 years of experience and relationships with more than 90 of the top one hundred FORTUNE 500® companies. The MetLife companies offer life insurance, annuities, automobile and home insurance, retail banking and other financial services to individuals, as well as group insurance, reinsurance and retirement and savings products and services to corporations and other institutions. 56 TYBFM LIFE INSURANCE IN INDIA 57 TYBFM LIFE INSURANCE IN INDIA Conclusion All the insurance company must advertise more in the market because not all people know more about life Insurance policy. Most number of people wants Guaranteed Returns so company must focus on this for the customer investment. Make insurance policy which can buy any one so we can insured them through this type of life insurance policy. 58