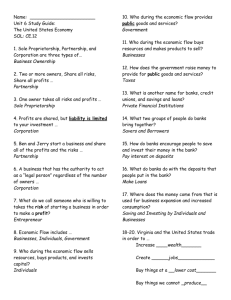

Chapter 8: Money, Banking, Saving, and Investing How should you

advertisement

Chapter 8: Money, Banking, Saving, and Investing How should you spend, save, and invest your money? Medium of exchange. Money is a medium, or means, of exchange. It enables us to carry out trade and commerce easily, much more easily than through barter. For example, rather than trying to find someone willing to take, say, a dozen pairs of flip-flops in trade for a new backpack, you can just hand a store clerk a quantity of dollars—the established medium of exchange in the United States. U.S. dollars are this country’s legal tender—they must be accepted as money for purchases and as payment for a debt. Standard of value. Money also serves as a standard of value. It allows us to measure and compare the value of all kinds of goods and services using one scale. If we had no standard of value, it would be much harder to compare prices. For example, imagine seeing advertisements from two stores. One advertises a backpack for sale for nine pairs of flip-flops. The other has the same backpack advertised for five T-shirts. Without a common standard of value, how would you know which backpack costs more? Store of value. Something is a store of value if it holds its value over time. A banana would be a poor store of value because it spoils quickly. A rotten banana has lost much or all of its original value. Money, however, holds its value over time. Put another way, money maintains its purchasing power over time. Purchasing power refers to the quantity of goods and services that can be bought with a particular sum of money. The $5 you have in your pocket today will buy $5 worth of goods or services now and for some time into the future. This stability allows you to hold on to your money, knowing you can spend it just as well tomorrow as today. Although money stores value very well, it is not a perfect store of value, because prices tend to rise over time. For example, your $5 will always get you $5 worth of pencils. But the number of pencils you can get for that price may decrease over time. Money Has Six Main Characteristics For money to perform its three primary functions well, whatever people use as money should exhibit the six characteristics listed below. As you read about these characteristics, think about how well they apply to a substance that was once widely used as money: salt. Acceptability. The most important characteristic of money is acceptability. In order for you to buy something, the seller must be willing to accept what you offer as payment. In the same way, when you sell your services—your labor—you must be willing to accept what your employer offers as payment, or wages, in exchange. In ancient times, traders throughout the Mediterranean region accepted salt as a medium of exchange. Roman soldiers received, as part of their wages, an allotment of salt known as a salarium. From that Latin term comes the English word salary. Scarcity. Whatever is used as money needs to be scarce enough to be valued by buyers and sellers. Throughout history, many cultures have used gold or silver as a medium of exchange. The relative scarcity of these metals adds to their value. If gold and silver were as common as sand, these metals would cease to be used as money. In ancient times, salt was scarce in many parts of the world. Yet the demand for salt was great. People seasoned and preserved foods with salt and used it in religious ceremonies. Scarcity, coupled with high demand, made salt a valued commodity. Portability. To be convenient as a medium of exchange, money must be portable. People must be able to carry it with them easily. Salt is portable—to some extent. But imagine lugging several large bags of salt with you to the mall. And think about the mess you might make paying for a pair of jeans with three cups of salt. By today’s standards, salt fails the portability test. Durability. If money is to serve as a store of value, it must be durable. Moreover, any medium of exchange must be able to withstand the physical wear and tear of being continually transferred from person to person. Salt can last a long time, but only if kept dry. Think how you would feel if a rainstorm dissolved and washed away your fortune. Salt fails the durability test. Divisibility. To be useful as a medium of exchange, money must be easy to divide into smaller amounts. To understand why, imagine an economy that uses glass bowls as its medium of exchange. Buyers in that economy would be unable to buy anything worth less than one bowl, because the seller would be unable to provide change. Shards of broken glass would be too hazardous to use as change for something worth just half of a bowl. A bag of salt, on the other hand, can be split into ever-smaller amounts. This ease of divisibility once made salt a useful medium of exchange. Uniformity. A dollar is a dollar is a dollar. We take for granted that each dollar bill is the same as the next. Why is such uniformity important? Consider an economy in which pumpkins are the chosen medium of exchange. Pumpkins come in all sizes and weights. Could a large pumpkin be exchanged for more goods than a small pumpkin? How would producers and consumers agree on the value of any one pumpkin? Like dollar bills, all salt is pretty much the same. Thus salt passes the uniformity test, as it does the tests of acceptability, scarcity, divisibility, and—for ancient traders—portability. Historically, salt had most of the characteristics of a useful medium of exchange. A Brief History of Money Gold, silver, and salt have all served as money at some time in history. So have shells, cattle, beads, furs, and tobacco. Economists categorize all of these items of exchange as commodity money. A commodity—a good that has value in trade—becomes commodity money when it is used as a medium of exchange. The value of commodity money is about the same as the value of the commodity it consists of. Commodity money was used for thousands of years, all over the world. Of all the many commodities used as money, precious metals such as gold and silver were historically preferred over other forms of commodity money. These metals had all the useful characteristics of money. They were scarce, portable, durable, divisible, and, best of all, acceptable. In the form of bars and coins, these metals could even be made uniform. As trade flourished in Europe during the Renaissance, wealthy merchants and nobles needed safe places to store their gold and silver bars and coins. In the larger cities, private banks arose to meet this need. A bank is a business that receives deposits and makes loans. A loan is a transaction in which a lender gives money to a borrower, who agrees to repay the money at some point in the future. These early banks accepted depositors’ precious metals and in return gave the depositors elaborate paper receipts known as banknotes. The banks promised to exchange these banknotes for gold or silver “on demand”—that is, whenever the holder asked for such an exchange. Economists call banknotes given in exchange for gold and silver commodity-backed money. The notes had minimal value in and of themselves. One could not eat them, wear them, or otherwise consume them. As commodity-backed money, they had value only as a medium of exchange. These banknotes were the forerunners of modern printed money issued by governments. But there is a big difference between the two. Paper money today is no longer backed by gold, silver, or any other commodity. It has value only because it is generally accepted as a means of payment. That acceptance comes in part because governments declare that the paper notes they issue are money. You can read this declaration, for example, on any bill issued by the U.S. government: This note is legal tender for all debts, public and private. In the past, such government decrees were known as fiats. Thus paper money issued without the backing of gold or silver came to be known as fiat money. U.S. dollars may not be backed by gold or silver, but they are backed by the full faith and credit of the U.S. government. As long as consumers believe they can purchase goods and services with dollars, people will continue to use dollars as a medium of exchange. What Counts as Money Today When people nowadays think of money, they most often think of cash, in the form of paper bills or metal coins. Together, bills and coins circulating throughout the economy are known as currency. Currency, however, is only part of a nation’s money supply, or the total amount of money in the economy. What else counts as money? The answer depends on the kinds of assets economists choose to count as money in addition to currency. The most common measure of money used by economists today is known as M1. Besides coins and bills, M1 includes liquid assets that can be used as cash or can easily be converted into cash. Currency makes up about half of the M1 money supply. Most of the rest consists of what economists call checkable deposits, or deposits in bank checking accounts. Depositors can write checks on these accounts to pay bills or make purchases. A check is a signed form instructing a bank to pay a specified sum of money to the person named on it. Checks themselves are not considered money, but the deposits they access are. Traveler’s checks are also included in the M1 money supply. Travelers buy these checks, usually from a bank, and then use the checks like cash to pay for goods and services. The M1 money supply, then, is made up of currency, checkable deposits, and traveler’s checks. What about money deposited in savings accounts? Savings account deposits are considered near-money. Although savings account funds can usually be transferred to a checking account fairly easily, they are not used directly to buy things. For example, you cannot go into a store with your savings account statement and buy a pair of shoes. Because people’s savings are not as liquid as cash, economists put them into a second category known as the M2 money supply. M2 consists of M1 plus money saved in various kinds of accounts or funds. You can buy a pair of shoes with a credit card. But even though people sometimes call their credit cards “plastic money,” economists do not regard credit cards as a form of money. To see why, consider what the term credit means. Credit is an arrangement that allows a person to buy something now with borrowed money and pay for it later or over time. Each purchase with a credit card creates a loan that the user must pay back to the bank, store, or other business that issued the card. The credit card is a convenient means for taking out such a loan—so convenient that since 2003, credit card purchases have outnumbered those made with checks or cash. But the card itself is not money. You can also buy shoes with a debit card. A debit card allows you to access the money in your bank account. Used at a store, a debit card electronically transfers funds from your account to the store’s account. Although it is a handy tool for accessing money, a debit card, like a check, is not itself considered part of the money supply. Which of these is money? Using the M1 definition, only currency, deposits in checking accounts, and traveler’s checks are liquid enough to qualify as money. Credit cards, checks, and debit cards can be used to access cash, but are not themselves money. Currency, however, is only part of a nation’s money supply, or the total amount of money in the economy. What else counts as money? The answer depends on the kinds of assets economists choose to count as money in addition to currency. The most common measure of money used by economists today is known as M1. Besides coins and bills, M1 includes liquid assets that can be used as cash or can easily be converted into cash. Currency makes up about half of the M1 money supply. Most of the rest consists of what economists call checkable deposits, or deposits in bank checking accounts. Depositors can write checks on these accounts to pay bills or make purchases. A check is a signed form instructing a bank to pay a specified sum of money to the person named on it. Checks themselves are not considered money, but the deposits they access are. Traveler’s checks are also included in the M1 money supply. Travelers buy these checks, usually from a bank, and then use the checks like cash to pay for goods and services. The M1 money supply, then, is made up of currency, checkable deposits, and traveler’s checks. What about money deposited in savings accounts? Savings account deposits are considered near-money. Although savings account funds can usually be transferred to a checking account fairly easily, they are not used directly to buy things. For example, you cannot go into a store with your savings account statement and buy a pair of shoes. Because people’s savings are not as liquid as cash, economists put them into a second category known as the M2 money supply. M2 consists of M1 plus money saved in various kinds of accounts or funds. You can buy a pair of shoes with a credit card. But even though people sometimes call their credit cards “plastic money,” economists do not regard credit cards as a form of money. To see why, consider what the term credit means. Credit is an arrangement that allows a person to buy something now with borrowed money and pay for it later or over time. Each purchase with a credit card creates a loan that the user must pay back to the bank, store, or other business that issued the card. The credit card is a convenient means for taking out such a loan—so convenient that since 2003, credit card purchases have outnumbered those made with checks or cash. But the card itself is not money. You can also buy shoes with a debit card. A debit card allows you to access the money in your bank account. Used at a store, a debit card electronically transfers funds from your account to the store’s account. Although it is a handy tool for accessing money, a debit card, like a check, is not itself considered part of the money supply. What do you notice when you enter a bank? Perhaps you pass an automated teller machine in the lobby. ATMs can dispense cash, accept deposits, and make transfers from one account to another. You may see desks and offices on the main floor. There are probably bank tellers behind a counter ready to assist you. Beyond the counter, there may be a large vault for storing money and other valuables. The process seems fairly straightforward. Money comes in. Money goes out. The bank keeps track of every penny. But what goes on behind the scenes? How does your bank fit into the whole banking system? The Elements of the Banking System Banks are financial institutions—firms that deal mainly with money, as opposed to goods and services. Like all financial institutions, a bank must have a charter, or agreement, from the state or federal government that spells out how it will operate and how it will be regulated. There are several kinds of banks, including commercial banks, savings and loans, mutual savings banks, and credit unions. Historically commercial banks served business and industry. The others focused on consumers, encouraging them to embrace the idea of saving—putting money aside for later use. Today the differences between the various types of banks have almost vanished. All banks work with businesses and consumers, and all offer the same basic kinds of services. Banks Offer a Range of Services Banks serve consumers in a variety of ways. They cash checks, issue credit cards, change foreign currency into dollars and vice versa, and provide safe-deposit boxes for storing valuables. Banks also offer the convenience of electronic banking through ATMs, debit cards, direct deposit of paychecks, and automatic payment of bills. Customers can use the Internet to monitor their accounts, pay bills, and transfer money from one account to another. A bank’s main function, however, is to serve as a financial intermediary—an institution that brings together sellers and buyers in financial markets. The sellers and buyers that banks bring together are savers and borrowers. Banks help transfer assets from one to the other. Specifically, banks receive deposits from savers and make loans to borrowers. These are the two main services that banks deliver. Banks Receive Customers’ Deposits A time-tested way to save money is to deposit it in a bank. Banks offer three kinds of deposits: checkable deposits, savings deposits, and time deposits. Each bank has its own rules about when savers can withdraw deposited money. As a result, accounts vary in their liquidity, or the ease with which they can be converted into cash. They also vary in their return, or the amount of earnings they generate. Checkable deposits. A checkable deposit is an amount of money placed in a checking account. Checkable deposits are highly liquid. That is, they can easily and quickly be converted into cash. You can withdraw money deposited in a checking account on demand, any time you wish. This withdrawal once called for writing a check, but today most checking accounts can be accessed electronically using the Internet, a debit card, or an ATM. Money in a checking account, however, earns little or no interest. Interest is money paid periodically in return for the use of borrowed funds. Checkable deposits, then, provide safety and liquidity, but not much in the way of earnings. Savings deposits. Money deposited in a savings account earns more interest than checkable deposits, although the return is still low. Funds can be held for any length of time, and the entire deposited amount can be withdrawn on demand. Savings deposits are only slightly less liquid than checkable deposits. Savers usually make withdrawals from savings accounts by using ATMs or by presenting withdrawal slips to bank tellers. Time deposits. Savers who want higher returns can put their money into certificates of deposit. The trade-off for these higher returns is lower liquidity. CDs, also known as time deposits, tie up cash for a set period of time—typically several months or longer. If you take your money out of a CD before the end date, you will pay a penalty that amounts to a percentage of the interest you would have earned. Why are people willing to trust their money to banks? The main reason is safety. The risk, or chance of losing money, is very low with any bank deposit, thanks to the Federal Deposit Insurance Corporation. Congress established this federal agency in 1933 to help stabilize the banking system during the Great Depression. Today, nearly all bank deposits are insured by the FDIC for up to $100,000 per depositor. Should a bank fail, the FDIC guarantees that depositors will get their money back up to that amount. Banks Make Loans to Borrowers Banks use the money deposited by savers to make loans to other customers. Bank loans come in three forms: commercial loans, consumer loans, and mortgage loans. Commercial loans. Businesses often take out commercial loans to buy machinery, equipment, and materials or to pay labor costs. Before making such a loan, banks consider the firm’s financial condition and borrowing history as well as the general state of the economy. Consumer loans. Individual borrowers take out consumer loans to make major purchases such as a new car or boat. These loans are often called installment loans, because most are paid back in equal monthly installments, or payments. Before making a consumer loan, the bank looks at the individual’s credit history. This is a history of the person’s past borrowing along with his or her record of repaying loans on time and in full. Individuals can take out loans to buy smaller items by making their purchases with a credit card. Using a credit card is easy—so easy that many people charge more than they can afford. Those who cannot pay off their credit card bills each month are charged interest on their unpaid balances by the bank that issued the card. Interest rates for credit card debt are generally much higher than for other kinds of loans. For many cardholders, the result of overcharging is an everincreasing pile of debt. Mortgage loans. Banks also offer longer-term loans to consumers and businesses in the form of mortgages. A mortgage is a loan used to buy a house, an office building, land, or other real estate. The term of a mortgage typically ranges from 15 to 30 years. As with any loan, a mortgage is part principal—the amount of money actually borrowed—and part interest on the principal. You might be surprised at the total cost of paying off a home mortgage. A house purchased for $220,000 with a traditional 30-year mortgage at a fixed interest rate of 5 percent per year, and paid in monthly installments, could end up costing the buyer more than $400,000 by the time the loan is paid off. How Banks Make a Profit RF/Masterfile This family bought a new home with the help of a long-term bank loan called a mortgage. Homebuyers who take out mortgages must pay back the principal, or amount borrowed, as well as interest on the principal. Over the course of several years, interest can add considerably to the overall cost of a home purchase. In their role as financial intermediaries, banks channel funds from savers to borrowers by taking money deposited into various accounts and using it to make loans. In the process, banks profit by charging more interest on loans than they pay on deposits. For borrowers, interest represents the cost of using someone else’s money. For savers, interest represents payment for letting someone else use their money. How, you might wonder, can a bank lend out depositors’ money and still promise to return that money to its depositors on demand? The answer is that banks don’t lend out all the money they take in. They are required by law to keep a certain fraction of it in reserve to cover depositors’ withdrawals from their accounts. For example, suppose you deposit $1,000 into a checking account. Your bank may be required to keep one-tenth, or $100, in reserve. That would leave $900 for the bank to lend out and charge interest on. This system—whereby banks keep a fraction of deposits in reserve and make loans with the rest—is known as fractional reserve banking. The system keeps enough money available for withdrawals while allowing banks to profit from the rest. The fraction that banks are required to keep on hand is set by the Federal Reserve System, which was established in 1913 to oversee the banking system. The Federal Reserve: Our Nation’s Central Bank The Federal Reserve System, commonly known as the Fed, is the central bank of the United States. A central bank does not serve individual consumers and businesses, and making a profit is not one of its goals. The Fed’s customers are the nation’s thousands of banks, and its goals involve keeping the entire banking system stable and healthy. The Fed provides several important financial services. Holding reserves. The Fed requires each bank to keep a fraction of its deposits in reserve. Some of that reserve takes the form of currency in the bank’s vault, and some goes into an account set up for the bank at the Fed. In this way, the Fed serves as a bank for banks. Providing cash and loans. When a bank needs cash to meet withdrawal demands, the Fed supplies it from the bank’s account. The Fed also lends money to banks when they run short of funds. Clearing checks. If you write a check to a store and the store deposits the check into its account with a different bank, the Fed takes care of transferring funds from your bank to the store’s bank. This process is known as check clearing. The Fed clears billions of checks each year. Linking banks electronically. The Federal Reserve and nearly all of the nation’s banks are linked electronically. Using this electronic network, banks can quickly transfer funds from one financial institution to another. The Fed Manages the Banking System The Federal Reserve does more than provide services. It also manages the banking system to ensure that banks operate according to sound financial principles. Another important job of the Fed is to control the nation’s money supply. It does this in part by setting reserve requirements, the minimum fraction of deposits that banks must keep in their own vaults or at the Federal Reserve. The Fed also issues Federal Reserve notes, the paper currency we know as dollars. Through all of its activities the Fed aims to provide liquidity—to make sure consumers and businesses have ready access to money. The Fed’s structure aids in the task of managing the banking system. A seven-member Board of Governors oversees the Federal Reserve System from its headquarters in Washington, D.C. From there, it formulates Fed policies related to the money supply and sets reserve requirements. Twelve regional Federal Reserve Banks carry out many of the system’s day-to-day activities. Each Reserve Bank provides financial services to its region’s banks and supervises their operations. Reserve Banks also feed economic information about their regions to the Board of Governors. About 30 percent of the banks in the United States are members of the Federal Reserve System. Members include all national banks—commercial banks chartered by the federal government— and many state-chartered banks. All commercial banks, whether Fed members or not, enjoy the same privileges when it comes to borrowing from the Fed and must follow the Fed’s regulations. And when the Fed takes steps to adjust the money supply, all banks feel the effects.