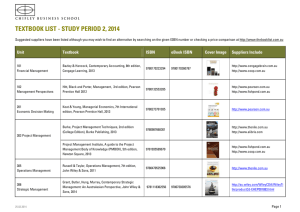

Managing Capacity

Chapter Objectives

Be able to:

Explain what capacity is, how firms measure

capacity, and the difference between theoretical

and rated capacity,

Describe the pros and cons associated with

three different capacity strategies: lead, lag, and

match.

Apply a wide variety of analytical tools to

capacity decisions, including expected value and

break-even analysis, decision trees, waiting line

theory, and learning curves.

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 2

Capacity Decisions

• Defining and measuring capacity

• Strategic versus tactical capacity

• Evaluating capacity alternatives

• Advanced perspectives

– Theory of Constraints

– Waiting lines

– Learning curves

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 3

Defining and Measuring Capacity

Measure of an organization’s ability to provide

goods or services

Jiffy Lube Oil changes per hour

Law firm Billable hours

College Student hours per semester

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 4

Consider:

Capacity for a PC Assembly Plant:

(800 units/shift/line)×(% Good)×(# of lines)×(# of Shifts)

Controllable Factors

1 or 2 shifts? 2 or 3 lines? Employee training?

Uncontrollable Factors

Supplier problems? 98% or 100% good? Late or on time?

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 5

Strategic versus Tactical

Capacity

• Strategic:

– One or more years out

– “Bricks & Mortar”

– Future technologies

• Tactical:

– One year or sooner

– Workforce level, schedules, inventory, etc.

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 6

Capacity

Capacity versus Time

Planning & Control

Tactical Planning

Strategic Capacity Planning

•Limited ability

to adjust

capacity

•Detailed planning

•Lowest risk

• Workforce, inventory,

subcontracting decisions

• Intermediate-level

planning

•Moderate risk

• “Bricks &

mortar” decisions

• High-level planning

• High risk

Days or weeks out

Months out

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Years out

Time

Chapter 8, Slide 7

Capacity Strategies: When,

How Much, and How?

Demand

Leader

Excess

Capacity

Lost Business

Laggard

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 8

How?

• Make or Buy (e.g., subcontracting)

• One extreme: “Virtual” Business

Walden Paddlers

(Marketing)

Hardigg Industries

(Manufacturing)

Independent Dealers

(Direct Sales)

General Composites

(Design)

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 9

Evaluating Capacity

Alternatives

•

•

•

•

Economies of scale (EOS)

Expected value analysis (EVA)

Decision Trees

Break-even points (BEP)

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 10

Economies of Scale

Total Cost for Fictional Line:

Fixed cost + (Variable unit cost)×(X)

= $200,000 + $4X

Cost per unit for X=1? X=10,000?

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 11

Shipping costs

Fixed & Unit Cost Scenarios

$40,000

$35,000

$30,000

$25,000

$20,000

$15,000

$10,000

$5,000

$0

5

15

25

35

45

55

65

75

Number of shipments

Common

Contract

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Private

Chapter 8, Slide 12

Indifference Point

Compares capacity alternatives — at what

volume level do they cost the same?

• Suppose one option has zero fixed cost and

$750 per unit cost; the other option has $5,000

fixed cost, but only $300 per unit cost.

$0 + $750X = $5,000 + $300X

What is the volume, X, at the indifference point?

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 13

Expected Value Analysis

Forecasted demand or volume is

uncertain, allows consideration of

the variability in the data

Data Requirements

Capacity cost structure

(alternatives?)

Expected demand

(multiple scenarios?)

EVA

Product and service

requirements

(e.g. time standards)

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 15

Expected Value Analysis

Pennington Cabinet Company

2000 jobs per year (20% likelihood)

5000 jobs per year (50%)

7000 jobs per year (30%)

Each job = $1,200 revenue

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 16

We Know:

• Average job requires:

2 hours of machine time

3-1/3 hours of assembly team time

• Machines and teams work 2000 hours per year

• Each machine and team has yearly fixed cost

= $200K

• 3 different capacity scenarios (see next slide!)

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 17

Effective Capacity

Number of Machines

and Teams

Number of Hours

Available Each Year

Maximum Jobs per

Year

Machines

Teams

Machines

Machines

Current

3

5

6,000

10,000

3,000

3,000

Expanded

5

9

10,000

18,000

5,000

5,400

New Site

7

12

14,000

24,000

7,000

7,200

Teams

Teams

What is the effective capacity

of each capacity alternative?

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 18

Alternate Demand Scenarios

Current Level

Expanded

New Site

Demand

Revenue

Fixed

Expenses

Revenue

Fixed

Expenses

Revenue

Fixed

Expenses

2,000

$2,400,000

$1,600,000

$2,400,000

$2,800,000

$2,400,000

$3,800,000

5,000

$3,600,000

$1,600,000

$6,000,000

$2,800,000

$6,000,000

$3,800,000

7,000

$3,600,000

$1,600,000

$6,000,000

$2,800,000

$8,400,000

$3,800,000

What is the expected contribution if demand = 5000

AND we decide to move to a new site?

Why does revenue for current capacity max out at

$3.6 million?

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 19

Net Revenue Table

Demand

Current

Expanded

New Site

3,000

$800,000

($400,000)

($1,400,000)

5,000

$2,000,000

$3,200,000

$2,200,000

7,000

$2,000,000

$3,200,000

$4,600,000

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 20

Expected Value of Each

Capacity Alternative:

Current capacity level

(20%) × $800K

+(50%) × $2000K

+(30%) × $2000K

=

$1,760,000

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 21

Expected Value of Each

Capacity Alternative:

Expanded capacity level

(20%) × – $400K

+ (50%) × $3200K

+ (30%) × $3200K

=

$2,480,000

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 22

Expected Value of Each

Capacity Alternative:

New Site capacity level

+

+

(20%) × – $1400K

(50%) × $2200K

(30%) × $4600K

=

$2,200,000

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 23

Conclusions for Pennington

• Which alternative would you choose if you

wanted to minimize the worst possible

outcome (Maximin)? Maximize the best

possible outcome (Maximax)?

• Why is it important to know effective

capacity? How could this help future

capacity decisions?

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 24

Decision Trees

• Visual tool for evaluating choices

using expected value analysis

• Allows use of different outcomes

and different probabilities of

success for each

Decision Tree Requirements

• Decision points represented by

– Choose the best input — the highest EVA, lowest

cost, least risk, etc.

• Outcome points represented by

– Summation of all inputs (outcomes) weighted by their

respective probabilities. No choice can be made at

these points

• Trees drawn from final decision to the outcomes

affecting that decision, then on to lower level

decisions that might affect the those outcomes,

then the lower level outcomes affecting those

lower level decisions, and so on

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 26

Ellison Seafood Example

Here the probabilities

affecting the demand

level are the same for

the three options

considered.

But the decision tree

does allow them to be

different, can you

think of situations

where this might be

true?

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 27

Decision Tree Criteria

• Book example illustrates selecting highest

revenue option.

• Other option choices can be on basis of:

– Using total cost for outcomes (useful when selling

price is not known)

– Using estimated risk for outcomes

– Outcomes reflecting a desired result (choose highest

EVA) Can you think of an example?

– Outcomes reflecting undesirable results (choose

lowest EVA) Can you think of an example?

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 28

Break-Even Point (BEP)

Considers revenue and costs, at what

volume level are they equal?

• Suppose each unit sells for $100, the fixed cost

is $200,000 and the variable cost is $4

BEP $100X = $200,000 + $4X

What is the breakeven volume, X?

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 29

Self Test

• EBB Industries must decide whether to invest in

a new machine which has a yearly fixed cost of

$40,000 and a variable cost of $50 per unit.

• What is the break even point (BEP) if each unit

sells for $200?

• What is the expected value, given the following

demand probabilities:

250 units (25%), 300 units (50%), 350 units (25%)

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 30

Advanced Perspectives

• Theory of Constraints

• Waiting lines

•Learning curves

Theory of Constraints

Concept that the throughput of a supply chain is

limited (constrained) by the process step with the

lowest capacity.

Sounds logical, but what does this mean for managing the

other process steps?

Theory of Constraints

• Pipeline analogy

• Which piece of the pipe is restricting the

flow?

• Would making parts A or D bigger help?

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 33

Dealing with a Constraint

Identify the constraint

Exploit the constraint

Keep it busy!

Subordinate everything to the constraint

Make supporting it the overall priority

Elevate the constraint

Try to increase its capacity — more hours, screen out defective

parts from previous step, …

Find the new constraint and repeat

As one step is removed as a constraint, a new one will emerge.

Which piece of the pipe on the previous slide would be the new

constraint if Part C was increased in diameter?

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 34

Waiting Lines

• Waiting lines and services

– Waiting and customer satisfaction

– Factors affecting satisfaction

• Waiting Line Theory

– Terminology and assumptions

– Illustrative example

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 35

Waiting at Outback

Steakhouse...

Waiting

outside

or in bar

Waiting to get food...

Leaving

restaurant

Waiting to pay bill ...

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 36

Key Points

• Waiting time DECREASES value-added

experience

• On the other hand, adding serving

capacity INCREASES costs

• Businesses must have a way to analyze

the impact of capacity decisions in

environments where waiting occurs

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 37

COST

Waiting and Customer

Satisfaction

Cost of

service

Cost of

waiting

Lost

customers

Waiting time

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 38

Cost of Waiting = f(Satisfaction)

Factors Affecting Satisfaction

1. Firm-related factors

2. Customer-related factors

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 39

Firm-Related Factors

• “Unfair” versus “fair” waits

• Uncomfortable versus comfortable

waits

• Initial versus subsequent waits

• Capacity decisions

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 40

Waiting Line (Queuing) Theory

• Application of statistics to allow us to

perform a detailed analysis of system

– Utilization levels, line lengths, etc.

• Terminology and assumptions

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 41

Terminology and Assumptions I

Line

Phase

?

Service

System

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 42

Terminology and Assumptions

II

Single-Channel

Single-Phase

?

Service

?

Service

Multiple-Channel

Single-Phase

?

Service

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 43

Terminology and Assumptions

III

Complex service environment ...

?

Service

?

Service

?

Service

?

Service

?

Service

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

How

would

you

describe

this?

Chapter 8, Slide 44

Terminology and Assumptions

IV

• Population: Infinite or Finite

• Arrival rates:

Random or constant rate

– Random rates typically defined by Poisson

distribution for infinite population

• Service Rates: Random or constant

– Random service rates typically described by

exponential distribution

• Priority rules (aka “Queue Discipline”)

• Permissible queue length

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 45

Example

• A single drive-in window for Bank

• Arrival rate

– 15 per hour, on average

• Service rate

– 20 per hour, on average

• How many channels? Phases?

• What kinds of questions might we have?

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 46

Drive-In Bank

= arrival rate = 15 cars per hour

=

service rate = 20 cars per hour

Average utilization of the system:

= = 0.75

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 47

Drive-In Bank

Probability of n arrivals during period T is:

( T ) T

Pn

e

n!

n

e.g., probability of only 4 arrivals during a

45-minute period is:

(15 0.75) 150.75

P4

e

0.87%

4!

4

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 48

Drive-In Bank

Average number of cars in the system:

(waiting plus being served)

15

Cs

3.0 cars

( ) (20 15)

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 49

Drive-In Bank

Average number of cars waiting:

2

Cw

Cs

( )

( )

2

15

225

Cw

2.25 cars

20 (20 15) 100

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 50

Drive-In Bank

Average time spent in the system:

(waiting plus being served)

1

1

Ts

0.2 hours 12 minutes

( ) (20 15)

(How do we know the answer is in hours?)

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 51

Drive-In Bank

Average time spent in the line:

TW

Ts 0.75 0.2 hours 9 minutes

( )

(How do we know the answer is in hours?)

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 52

Question?

What happens as the arrival rate

approaches the service rate?

Suppose is now 19 cars per

hour

One Answer:

Average number of cars waiting:

19

Cw

18.05 cars

( ) 20 (20 19)

2

2

Implications? What are we assuming here?

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 54

Other Types of Systems

(Discussed in the supplement to Chapter 8)

• Single-channel, single-phase with

constant service time

– Example: Automatic car wash

• Multiple-channel, multiple-phase

(hospital)

– Usually best handled using

simulation analysis

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 55

Self Test I

• Look back at the drive-in window example.

How can we have an average line length > 1

while the average number of cars being served

is < 1?

• Similarly, what happens as the arrival rate

approaches the service rate?

• Suppose the teller at the drive-in window is

given training and can now handle 25 cars an

hour (a 25% increase in service rate). What

happens to the average length of the line?

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 56

Self Test II

• Look back at the Outback Steakhouse

example. What kind of queuing system

is it?

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 57

Question?

How can capacity change, even

when we do not hire new people

or put in new equipment?

Learning Curves

• Recognize that people (and often

equipment) become more productive

over time due to learning.

• First observed in aircraft production

during World War II

• Getting more emphasis as companies

outsource more activities

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 59

A Formal Definition

For every doubling of cumulative output, there will be

a set percentage improvement in time per unit or some

other measure of input

Time

per

unit

10 hrs.

8 hrs.

80% learning curve Where does the name come from?

6.4 hrs.

5.12 hrs.

1 2

4

8

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

4.096 hrs.

16

Output

Chapter 8, Slide 60

A Formal Definition (cont’d)

Tn T1n

b

Where:

Tn = time for the nth unit

T1 = time for the first unit

b = ln(learning percent) / ln2

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 61

Example

•

•

•

•

•

Reservation clerk at Delta Airlines

First call (while training) takes 8 minutes

Second call takes 6 minutes

What is the learning rate?

How long would you expect the 4th call to

take? The 16th? The 32nd?

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 62

Key Points

• Quick improvements early on, followed by

more and more gradual improvements

• The lower the percentage, the steeper the

learning curve

• Practically speaking, there is a floor

• Estimates of effective capacity must consider

learning effects!

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 63

Another Question . . .

How could learning curves be

used in long-term purchasing

contracts?

Johnston Controls I

• Johnston Controls won a contract to produce 2

prototype units for a new type of computer.

• First unit took 5,000 hrs. to produce and $250K

of materials

• Second unit took 3,500 hrs. to produce and

$200K of materials

• Labor costs are $30/hour

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 65

Johnston Controls II

• The customer has asked Johnston

Controls to prepare a bid for an

additional 10 units.

• What are Johnston’s expected costs?

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 66

Johnston Controls III

• Labor learning rate:

3500 hours / 5000 hours = 70%

• Materials learning rate:

$200K / $250K = 80%

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 67

Johnston Controls IV

• “Additional 10 units” means the third through

twelfth units.

• Total labor for units 3 through 12:

= 5,000 hours × (5.501 – 1.7)

= 19,005 hrs

5.501 is sum of nb for 12 units

1.7 is the sum of nb for the first two units

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 68

Johnston Controls V

• Total material for units 3 through 12:

= $250,000 × (7.227 – 1.8)

= $1,356,750

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 69

Johnston Controls VI

• Total cost for “additional 10 units”:

= $30 × (19,005 hours) + $1,356,750

= $1,926,900

What if there is a significant delay before

the second contract?

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 70

Self-Test

• Assume that there WILL BE a

significant delay before Johnston

Controls makes the next 10 units.

Assuming that Johnston has to “start

over” with regard to learning, estimate

total cost for these additional 10 units.

© 2008 Pearson Prentice Hall --- Introduction to Operations and Supply

Chain Management, 2/e --- Bozarth and Handfield, ISBN: 0131791036

Chapter 8, Slide 71

Case Study in Managing

Capacity

Forster’s Market