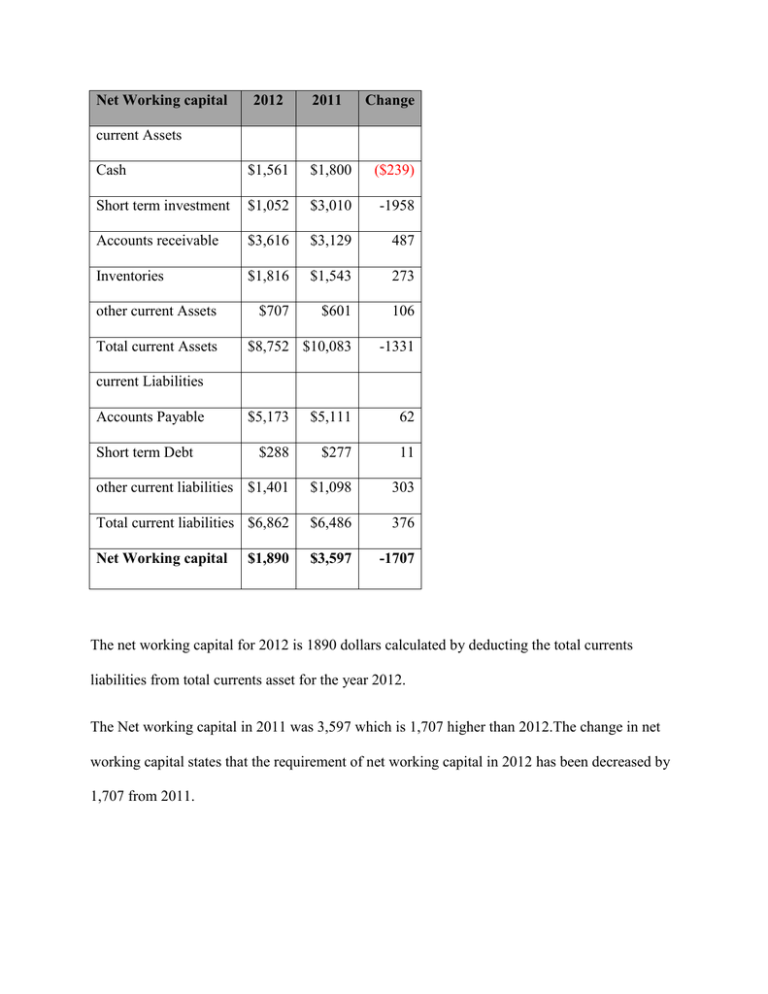

Net Working capital 2012 2011 Change current Assets Cash $1,561

advertisement

Net Working capital 2012 2011 Change Cash $1,561 $1,800 ($239) Short term investment $1,052 $3,010 -1958 Accounts receivable $3,616 $3,129 487 Inventories $1,816 $1,543 273 $707 $601 106 $8,752 $10,083 -1331 current Assets other current Assets Total current Assets current Liabilities Accounts Payable $5,173 $5,111 62 $288 $277 11 other current liabilities $1,401 $1,098 303 Total current liabilities $6,862 $6,486 376 Net Working capital $3,597 -1707 Short term Debt $1,890 The net working capital for 2012 is 1890 dollars calculated by deducting the total currents liabilities from total currents asset for the year 2012. The Net working capital in 2011 was 3,597 which is 1,707 higher than 2012.The change in net working capital states that the requirement of net working capital in 2012 has been decreased by 1,707 from 2011. Cash flow from Assets Operating cash flows 7,155 Net capital spending (2,372) Addition to Net working capital 1,707 Cash flow from Assets 6,490 The cash flow from assets is being calculated by deducting the total net capital spending and additions to working capital from operating cash flows. In our case study the additions to working capital is negative showing a decrease of 1707 in working capital that’s why it is added in operating cash flows to calculated cash flow from assets. http://www.investopedia.com/terms/w/workingcapital.asp http://www.zenwealth.com/BusinessFinanceOnline/FCF/CashFlowFromAssets.html Answer B The amount will calculated by finding future value of annuity for 17 years at 9.5% by using the FVIF = (1.095^17-1)/.095 = 38.7135, the amount after 17 years will be 38.7135*3000 = $116140. Now use the future value formula to calculate the amount accumulated at the end of 15 years will be 116140*1.095^15 = $453101. If the deposit would have been made at the start of the year, it is annuity due, which can be calculated by multiplying the future value by 1.095 * 116140 = $127173. The amount after 15 years for annuity due will be 127173*1.095^15 = $496144. http://www.financeformulas.net/Future_Value_of_Annuity.html Answer C The possible range for the correlation coefficient would be from -1 to + 1, where correlation coefficient of +1 states a perfect upward sloping of (+)linear relationship between two variables however the -1 states a perfect downward sloping of (-) linear relationship between two variables. Investors Diversify their portfolio in order to minimize the risk .The correlation coefficient for diversified portfolios would be the one where investors will invest in securities which have an inverse relations for example if security A will rise by 500 then security B will decline by 500 so in order to minimize the loss of one investment with the return of the other investment. The statement can be justified by the fact that investors are risk averse which means that investors do not wanted to take risk .Risk averse investors are those investors which agree on lower return in exchange for lower risk rather than going for higher return in exchange of higher reward.This can also be proved from the above example that investors diversify their portfolio in such a manner that if one of their investment will occur losses then other investments will incur profits and hence the overall loss for the portfolio will be minimized . http://www.investing-in-mutual-funds.com/correlation.html http://highered.mcgraw-hill.com/sites/dl/free/0070997594/918724/Peirson11e_Ch07.pdf