Which factors matter to investors? Evidence from mutual fund flows

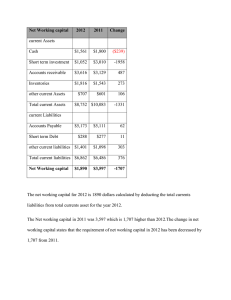

advertisement