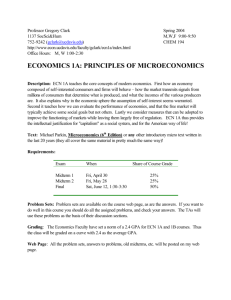

TOOLS OF NORMATIVE ANALYSIS

advertisement

INCOME REDISTRIBUTION Assoc. Prof. Y.Kuştepeli ECN 242 PUBLIC ECONOMICS 1 Virtually every important political issue involves the distribution of income. This part presents a framework for thinking about the normative and positive aspects of government income redistribution policy. (1) The theory of welfare economics indicates that efficiency by itself cannot be used to evaluate a given situation. Criteria other than efficiency must be considered when comparing alternative resource allocations. (2) Decision-makers care about the distributional implications of policy. The economist who systematically takes distribution into account can keep policymakers aware of both efficiency and distributional issues. Assoc. Prof. Y.Kuştepeli ECN 242 PUBLIC ECONOMICS 2 I. DISTRIBUTION OF INCOME Poverty line: a fixed level of real income considered enough to provide a minimally adequate standard of living. In contemplating policies that might alleviate poverty, it is sometimes helpful to know how far the poverty population lies below the poverty line. The poverty gap measures how much income would have to be transferred to the poverty population to lift every household’s income to the poverty line (assuming the transfers has no effect on the recipients’ work efforts). Assoc. Prof. Y.Kuştepeli ECN 242 PUBLIC ECONOMICS 3 A family’s income consists not only of the cash it receives but also in-kind receipts (payments to individuals in commodities or services). The TÜİK measure of income underestimates income by the amount of in-kind receipts. One major form of in-kind income is the value of time adults devote to their households. All of the income data are before-tax. The fact that the income tax system takes a larger share of income from high than from low income families is not reflected in the numbers. Assoc. Prof. Y.Kuştepeli ECN 242 PUBLIC ECONOMICS 4 Income should be measured over some time period. But it is not obvious what the time frame should be. It is better to measure the flow of income over a year. However, even annual measures may not reflect on individual’s true economic position due to unexpected fluctuations in income from year to year. Theoretically, lifetime income would be ideal but it is not possible. Should income distribution be measured over individuals or households ? Especially when distributional comparisons are being made across time, changes in household composition must be considered. One should be careful when making comparisons over time about the standard measures of income distribution and poverty levels. Assoc. Prof. Y.Kuştepeli ECN 242 PUBLIC ECONOMICS 5 II. RATIONALES FOR INCOME REDISTRIBUTION While there is no doubt that income is distributed unequally, people disagree about whether the government should undertake redistributional policies. 1) Simple Utilitarianism W = f (U1, U2, ..., UN) utilitarian social welfare function. Ui; W A change that makes someone better off without making anyone worse off, increases social welfare. Ex: W = U1 + U2 + ... + UN additive social welfare function Assoc. Prof. Y.Kuştepeli ECN 242 PUBLIC ECONOMICS 6 We assume: 1) Individuals have identical utility functions based on incomes. 2) There is diminishing marginal utility of income. 3) Total amount of income available is fixed. With these assumptions and additive social welfare function, government should redistribute income so as to obtain complete equality. As long as incomes are unequal, marginal utilities (MU) must be unequal and the sum of utilities can be increased by distributing income to the poorer individual. At I*, social welfare is maximized. Assoc. Prof. Y.Kuştepeli ECN 242 PUBLIC ECONOMICS 7 Problems: 1) It is impossible to determine whether individuals have identical utility functions, and whether they derive the same utility from equal amounts of income. 2) Although the MU of any given good may decrease with its consumption, this may not be true for income as a whole. If MU is constant, government redistributive policy cannot change social welfare. 3) Individual’s utility may depend on leisure, also. Government tries to maximize total utilities by distribution but to do so, takes taxes and reduces the fixed income possible. The optimal income distribution must take into account the cost of achieving more equality. Assoc. Prof. Y.Kuştepeli ECN 242 PUBLIC ECONOMICS 8 2) The Maximin Criterion W = min (U1, U2, ..., UN) Social welfare depends only on the utility of the person who has the lowest utility. The objective is to maximize utility of person with the minimum utility. The income distribution should be perfectly equal, except to the extent that departures from equality increase the welfare of the worst-off person. Rawl (1971)’s idea relies on the original position notion :an imaginary situation in which people have no knowledge of what their place in society is to be. In the original position, people adopt the maximin social welfare function because of the insurance it provides against disastrous outcomes. People are afraid that they may end up at the bottom of income distribution and therefore want the level at the bottom as high as possible. These decision-makers are so risk-averse that they are unwilling to take any chances. Assoc. Prof. Y.Kuştepeli ECN 242 PUBLIC ECONOMICS 9 III. PARETO EFFICIENT INCOME REDISTRIBUTION The previous discussions of additive and maximin social welfare functions assume that redistribution makes some people better off and others worse off. Redistribution was never a Pareto improvement – a change that allowed all individuals to be at least as well off as under status quo. This is a consequence of the assumption that each individual’s utility depends on his/her income only. If high-income individuals are altruistic, so their utilities depend on own and poor’s incomes, redistribution can actually be a Pareto improvement. Assoc. Prof. Y.Kuştepeli ECN 242 PUBLIC ECONOMICS 10 Thurow (1971) argues that the income distribution can be regarded as a public good, because everyone’s utility is affected by the degree of inequality. There is always some chance that through situations beyond your control, you will become poor. An income distribution policy is like insurance. When you are welloff, you pay premiums in the form of tax payments to those who are currently poor. If bad times hit, policy pays off and you receive relief. Some believe that income distribution programs help purchase social stability. If poor become too poor, they may engage in antisocial activities like crime, rioting etc. Assoc. Prof. Y.Kuştepeli ECN 242 PUBLIC ECONOMICS 11 IV. NONINDIVIDUALISTIC VIEWS Some thinkers have approached the problem by specifying what the income distribution should look like independent of individuals’ tastes. Tobin (1970) suggested that only special commodities should be distributed equally, which is called commodity egalitarianism. Most people believe that the right to vote should be distributed equally to all, as should the consumption of certain essential foodstuffs during times of war. Assoc. Prof. Y.Kuştepeli ECN 242 PUBLIC ECONOMICS 12 V. OTHER CONSIDERATIONS No attention is given to fairness of either processes by which the initial income distribution is determined or of the procedures used to redistribute it. If “equal opportunity” (somehow defined) were available to all, then the ensuing outcome would be fair, regardless of the particular income distribution it happened to entail. If the process generating income is fair, there is no scope for government-sponsored income redistribution. Assoc. Prof. Y.Kuştepeli ECN 242 PUBLIC ECONOMICS 13 VI. EXPENDITURE INCIDENCE The impact of expenditure policy on the distribution of real income is referred to as expenditure incidence. Any government program sets off a chain of price changes that affect incomes of people both in their roles as consumers and goods and as suppliers of inputs. A spending program that raises the relative price of a good you consume intensively makes you worse off, ceteris paribus. A program that raises the relative price of a factor you supply makes you better off. The problem is that it is very hard to trace all the price changes generated by a particular policy. Practically, assumptions that a given policy benefits the recipients only and the effects of other price changes on income distribution are minor are made. Assoc. Prof. Y.Kuştepeli ECN 242 PUBLIC ECONOMICS 14 1) Public goods: Substantial government expenditure is for public goods. But we have to know how much each family values a public good to determine its impact on the income distribution. 2) In-kind transfers: Not only lower-income individuals but also middle and upper income people benefit from in-kind transfers, ex. education. Unlike pure public goods, in-kind transfers are not consumed by everyone. Estimating their value to beneficiaries is difficult. A useful consumption is that 1 TL on in-kind transfer 1 TL in income. Assoc. Prof. Y.Kuştepeli ECN 242 PUBLIC ECONOMICS 15 Conclusions: (1) Under cash transfer program, individual may consume less X and more all other goods than under in-kind transfer program. (2) In-kind transfer of X2 does not make the individual as well off as equivalent income. These conclusions are not general. Because the individual is happy to consume more than X2, he is happy in both caser (in-kind transfer and cash transfer) It cannot be known for certain whether an in-kind transfer will be valued less than a direct income transfer. Assoc. Prof. Y.Kuştepeli ECN 242 PUBLIC ECONOMICS 16 In-kind transfer programs often entail substantial administrative costs. The costs may be so large that some communities choose not to participate. In-kind transfers may also help curb welfare fraud. People who do not qualify are sometimes able to obtain benefits. In-kind transfers may discourage ineligible persons from applying because some middle-class people may be quite willing to lie to receive cash but less willing to commit fraud to obtain a commodity they do not really want. In-kind transfers are attractive politically because they help not only the beneficiary but also the producers of the favored commodity. Assoc. Prof. Y.Kuştepeli ECN 242 PUBLIC ECONOMICS 17