Catholic School Job Description – School Accountant Position Title

advertisement

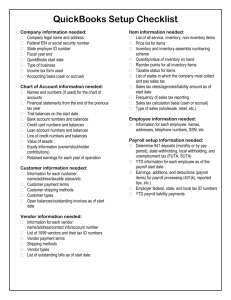

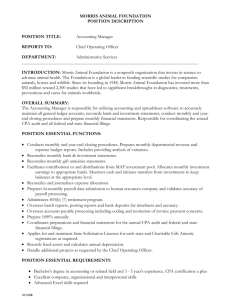

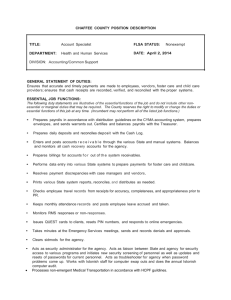

______________________ Catholic School Job Description – School Accountant Position Title: School Accountant/Business Manager Reports to: Principal Terms of Employment: Full Time- 7:30am - 4:00pm Monday - Friday. General Summary of the Position: The school accountant provides support to the Principal and Pastor. This position performs duties related to the processing of receivables, payables, payroll, and related financial reporting, as well as, the proper maintenance of accounting records. This position provides the diocese with required reports and attends diocesan business manager and school accountants meetings. Essential Duties and Responsibilities of the Position: Cash Receipts and Receivables: Tracks all cash and/or checks received in QuickBooks. Tracks outstanding receivables (particularly tuition), provides monthly report to principal containing list of families with outstanding balances. Endorses checks and prepares deposit for Principal’s review and approval. Makes file copy of all deposit items and posts same to QuickBooks. Maintains deposit records and files. Manages FACTS Tuition and incidental billing accounts, collections, and related QuickBooks interface; reconciles accounts receivable balances in FACTS to accounts receivable balances in QuickBooks. Makes monthly phone calls to families with past due balances; maintains a collection call log including date and response. Runs credit card settlement each day and reconciles to credit card receipt book. Cash Disbursements: Matches packing slips and supporting documents to invoices/check requests and organizes same for Principal’s approval/account coding. Reconciles, researches, and resolves any accuracy/legitimacy issues with vendors as per Principal’s instructions. Enters approved/coded invoices into QuickBooks for weekly bill payment processing. Processes bill payment checks and submits same to Principal for final approval and signature; receives signed checks from Principal and prepares checks for mailing and/or distribution. Files paid bills and maintains vendor files. Obtains completed W-9 forms from vendors where applicable; updates vendor record in QuickBooks for 1099 purposes. Reconciles and prepares annual 1099 forms for review, approval, and filing with the IRS. Payroll/Benefits Management: Tracks employee attendance and personnel changes, provides to principal for approval, and submits approved changes to payroll processor. Compiles and verifies payroll information and data entry for substitute teachers and hourly staff. Makes necessary payroll adjustments regarding pay, benefits, deductions, etc. Processes payroll twice a month using system required by Diocese, currently, PayChoice. Reconciles employee retirement contributions each payroll. Manages employee family benefits. Files school copies of payroll reports. Other Duties: Performs month-end and year-end general ledger review, account reconciliations, and period close. Performs budget to actual variance analysis on a monthly basis and provides feedback of same to Principal and/or Pastor. Prepares and provides interim financial reports as needed on a monthly, quarterly, or other basis as required by the Principal, Pastor, School Advisory Council, and Diocese. Coordinates with external auditors in preparation for and completion of the annual audit/agreed upon procedures review; follows up on auditor recommendations. Assists in budget process including preparation of supporting documents; enters final budgets into QuickBooks. Maintains accounting records and files. Attends school finance committee meetings, budget preparation meetings, and other meetings as required by Principal and/or Pastor. Covers administrative assistant duties when necessary. Performs any other duties that may arise as required by Principal and/or Pastor. Position Requirements – General: Must possess strong communication skills. Must possess a positive attitude, ability to relate well to others, and work as a team member. Must possess a basic understanding and the skills necessary for all areas of accounting. Must possess good math and calculation skills. Must possess an ability to organize and coordinate workflows. Must possess an ability to analyze a problem and find the appropriate solution. Must possess ability to effectively present information and respond to questions. Must be proficient with Microsoft Office applications, especially Excel, Word, and Outlook. Must possess a general knowledge of generally accepted accounting principles. Must possess ability to multi-task and switch focus at a moment’s notice. Must possess an ability to maintain confidentiality in all areas of work. Position Requirements – Education and Experience: Bachelor’s degree in accounting preferred OR comparable experience in full-charge bookkeeping.