the accounting process

advertisement

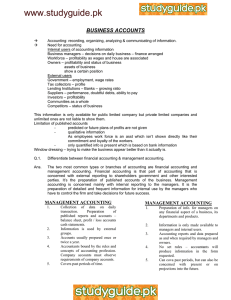

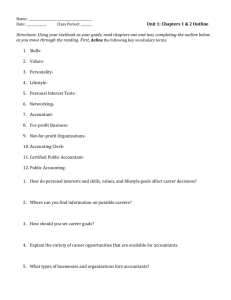

Accounting Process of measuring, interpreting, and communicating financial information to support internal and external business decision making. USERS OF ACCOUNTING INFORMATION • Owners, Stockholders, Potential Investors, Creditors • Management • Employees, Union Officials • Lenders, Suppliers • Government Agencies, Economic Planners, Consumer Groups • Open book management • Helps employees better understand how their work contributes to the company’s success. • Outsiders use financial data to evaluate investment opportunities. • Accountants serve public good. BUSINESS ACTIVITIES INVOLVING ACCOUNTING • Accounting plays a key role in each of a businesses three key areas: • Financing activities • Investing activities • Operating activities ACCOUNTING PROFESSIONALS Public Accountants • Accountant who works for an independent accounting firm. • Certified public accountants (CPAs) Management Accountants • Accountant employed by a business other than a public accounting firm. Government and Not-for-Profit Accountants • Perform professional services similar to those of management accountants. THE ACCOUNTING PROCESS Accounting process Set of activities involved in converting information about transactions into financial statements. This Set of Activities includes: 1. Recording 2. Classifying 3. summarizing individual transactions in order to produce financial statements The Process begins with: • Basic data from source documents • The data is then recorded in chronological order in a ledger and classified by account • The accounts in the ledger are then summarized and financial statements are prepared The Impact of Computers and the Internet on the Accounting Process • Simplifies the accounting process by automating data entry and calculations. • Software available to handle accounting information for international businesses. The Foundation of the Accounting System • Generally accepted accounting principles (GAAP). • Financial Accounting Standards Board (FASB). • Sarbanes-Oxley Act • Created the Public Accounting Oversight Board. • Added to the reporting requirements for publicly traded companies. The Accounting Equation • Assets Anything of value owned or leased by a business. • Liability Claim against a firm’s assets by a creditor. • Owner’s equity All claims of the proprietor, partners, or stockholders against the assets of a firm. • Basic accounting equation • Double-entry bookkeeping Process by which accounting transactions are entered. FINANCIAL STATEMENTS • Provide managers with information for evaluating organization’s ability to meet current obligations and needs, its profitability, and its overall financial health. The Balance Sheet • Statement of a firm’s financial position at a particular point in time. The Income Statement • Financial record of revenues, expenses, and profits over a period of time. The Statement of Cash Flows • Statement of a firm’s cash receipts and cash payments that presents information on its sources and uses of cash. • Inadequate cash flow is a reason for many business failures. FINANCIAL RATIO ANALYSIS • Ratio analysis Tool for measuring a firm’s liquidity, profitability, and reliance on debt financing, as well as the effectiveness of management’s resource utilization. Four Major Financial Ratio Categories: 1. Liquidity 2. Activity 3. Profitability 4. Leverage BUDGETS Budget Planning and control tool that reflects a firm’s expected sales revenues, operating expenses, and cash receipts and outlays. • Cash budget INTERNATIONAL ACCOUNTING Exchange Rates • Ratio at which a country’s currency can be exchanged for other currencies. • Financial statements must reflect gains and losses due to changes in exchange rates. International Accounting Standards • International Accounting Standards Committee (IASC).