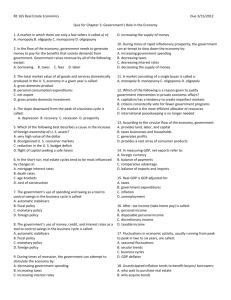

Demand-side and Supply-side Policies

advertisement

Demand-side and Supply-side Policies Macroeconomics Section 3.4 1 Automatic stabilizers when economy overheats 2 Social benefits and taxes can act as automatic stabilizers Unemployment Falls Social payments decline Government spending declines AD falls Higher income: higher taxes Less disposable income Reduction in Consumption AD falls Automatic stabilizers in recession 3 Social benefits and taxes can act as automatic stabilizers Unemployment increase Social benefits increase Government spending increases AD rises Lower incomes: lower taxes More disposable income Increase in Consumption AD rises Fiscal and Monetary Policies Demand-side & Supply-side Policies 4 Discretionary Stabilization Policies 5 Discretionary Policies aim to Stabilize the Economy Fiscal Demand-side Policies Monetary Supply-side Policies Demand-side Policies 6 Fiscal Policy Focus on taxes and/or government spending Monetary Policy Focus on interest rates Expansionary Fiscal Policies (in recession) 7 Fiscal Policy Increase government spending Decrease personal and/or business taxes Combination of both policies 8 The Government Budget and the National Debt (Public Debt) Government Budget = annual government spending Budget Surplus = Tax Receipts > Spending Budget Deficit = Tax Receipts < Spending National Debt = Money borrowed domestically and/or internationally (foreign debt) to balance the budget National Debt often expressed as % of GDP 9 10 Contractionary Policies (in inflation) 11 Fiscal Policy Decrease government spending Increase personal and/or business taxes Combination of both policies Strengths of Fiscal Policy 12 Combats rapid and escalating inflation Government spending directed at redistribution of income Government spending on the provision of public goods and services Combats a deep recession Weaknesses of Fiscal Policy 13 Time lags in recognizing the problem, determining and implementing policies Inadequate information Political constraints Crowding-out i.e. Government borrowing raises interest rates Tax cuts may be ineffective Unable to fine tune economy 14 The Neoclassical/Monetarist Challenge Argument that discretionary fiscal polices that try to stabilize the economy are so flawed that they actually cause instability Monetarist argue that governments should: 1. Take a long-term view about spending and taxation to achieve social priorities 2. Ensure steady supply of money 3. Ensure price and wage flexibility 4. Focus on supply-side policies to achieve economic growth Supply-side Policies Market-orientated/ Interventionistorientated 15 Growth Policies 16 Discretionary Fiscal Policies that aim to increase potential output Market-orientated Policies Interventionistorientated Policies Supply-side Policies Market-orientated 17 Market-orientated Policies 18 Economic Growth through supply-side policies Price Stability Full Employment 19 Market-orientated Supply-side Policies: Objectives Reduce Government Sector Improve incentives for private initiative Ensure the Labor market responds to supply and demand Free Trade (Discussed in Section 4) 20 Reduce Government Sector Deregulation to encourage competition and efficiency Restrict Monopolies Privatization to increase incentives and reduce costs Reduce Government Sector Private Financing of Public Services Outsourcing to Private Sector 21 Reduce Government Sector: Pros and Cons More competition Greater efficiency Lower costs Improved services Public monopoly becomes private monopoles Private financing expensive Loss of flexibility Job losses Dangers of deregulation 22 Improve incentives by lowering taxes Lowering taxes on interest income to stimulate saving and investment Lowering business taxes to increase investment, R&D and innovation Reduce personal taxes to encourage more work Improve incentives for private initiative 23 Improving incentives : Pros and Cons Increase quantity of labor and capital Reduce unemployment Increase saving and investment Increase R&D Reducing taxes impacts AD People work less & spend more Inflation Worsen income distribution Increase government budget deficit 24 Make labor more responsive to supply and demand Weaken unions to provide greater flexibility, increase profits and spur economic growth Abolish minimum wage to provide greater flexibility increase profits and spur economic growth Reduce unemployment benefits to lower unemployment rates Make labor more responsive to supply and demand Reduce job security so firms can fire at will 25 Make labor more responsive to supply and demand : Pros and Cons Labor markets more competitive Wages respond to supply and demand Lower costs and higher profits Increased employment Increase income inequality Unemployment benefits help to maintain consumption Supply-side Policies Interventionist-orientated 26 27 Government policies to improve industry Fund and provide incentives for R&D Provide education and health to improve quality of labor Support SMEs (small to medium sized firms) Support industry Support infant industries through grants, subsidies tax exemptions & tariffs Invest in infrastructure 28 Government policies to improve industry: Pros and Cons Provide an underpinning for economic growth Inefficiencies and resources misallocation Opportunity costs Increased taxes 29 Shifting the SRAS and the LRAS in the AS-AD Model SR LR • Focus on the price of labor, inputs and taxation and legislation • Focus on new technology, new production methods, quality and/or quantity of FOPs The Multiplier, accelerator and crowding effect HL Topics 30 31 The Multiplier Effect • Any change in Consumption, Investment, Government Spending and Net Exports Change components of AD Change in real GDP • Induced expenditures, a change reaction of further expenditures Marginal Propensity MPS • Marginal Propensity to Consume MPC •Marginal Propensity to Save MPI •Marginal Propensity to Tax MPT •Marginal Propensity to Import 1 32 33 Example of the Multiplier in Effect Initial Spending by government $100m 2nd Round of Spending $60m 3rd Round of Spending $36m 4th Round of Spending $21.6m 5th Round of Spending $12.96m And So On Last Round Total Spending, including initial spending by government $0.01m $249.99m Assumption 60% of additional income spent on Consumption (MPC = 0.6) The Multiplier = 1/1-MPC The Multiplier Effect 35 The Accelerator Theory & the Combined multiplier/accelerator effect Argues that small changes in GDP produces larger changes in investment spending. These fluctuations interact with the Multiplier effect to increase the momentum of business cycle. 36 Crowding-out Effect Governments borrow to finance fiscal polity Interest rates rise Private investment falls Crowding-out Effect Crowding-out Effect