The Statement of Revenue, Expenses, and Changes in Net Assets

advertisement

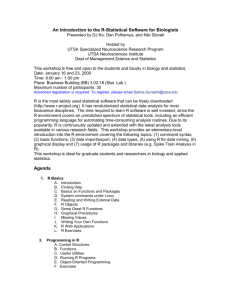

The University of Texas at San Antonio FY 08 Annual Financial Report Highlights January, 2009 Annual Financial Report Highlights The Annual Financial Report (AFR) is made up of three primary statements with many supporting schedules. 1. Balance Sheet – Explains what we own, our obligations and what is available. 2. Statement of Revenues, Expenses and Changes in Net Assets (SRECNA) – Shows the results of operations for the year. 3. Statement of Cash Flows – Shows what revenue came in, what was expended and what is left. Review pie charts and ratios that help explain our financial condition 2 UTSA FY 08 Balance Sheet The University of Texas at San Antonio – Balance Sheet ($ in millions) The Balance Sheet has three sections: Assets: What we own - Items that are available to meet operating costs of the Institution, plus buildings, land, equipment, etc. Investments increased by $37.8M due to additions and investment income. Capital Assets increased by $79.1M predominantly due to the construction of Engineering Building, Laurel Village, Thermal Energy Plant, and University Center III. Liabilities: Our obligations -Amounts due and payable within one year or beyond. Net Assets: What’s available - Capital Assets net of depreciation, endowment funds and other unrestricted funds. Amount invested in Capital Assets increased predominately by $79.1M due to construction. Unrestricted Net Assets grew by $18.2M due to increase in Tuition & Fees and a delay in implementing key strategic initiatives. % Variance Change 3.2 2% ASSETS: Current Assets 2008 161.8 2007 158.6 Noncurrent Assets 231.2 193.4 37.8 20% Other Noncurrent Assets Capital Assets, net 4.3 2.4 1.9 79% 629.4 550.3 79.1 14% 1,026.7 904.7 122.3 14% 153.7 2.3 141.1 2.3 12.6 0.0 9% 0% 156.0 143.4 12.6 9% 629.4 550.3 79.1 14% 89.6 77.5 12.1 16% 151.7 870.7 133.5 761.3 18.2 109.4 14% 14% Total Assets LIABILITIES: Current Liabilities Noncurrent Liabilities Total Liabilities NET ASSETS: Invested in Capital Assets, Net of Related Debt Restricted Unrestricted Net Assets The Statement of Revenue, Expenses, and UTSA Operating Revenues ($ in millions) Changes in Net Assets (SRECNA) . This Student Tuition and Fees - Net of Discounts statement is called the “Operating Statement” Sponsored Programs as it reports the results of operations for the Sales and Services of Educational Activities year. Auxiliary Enterprises Tuition and Fees increased by $4.6M (3%). Sponsored Programs increased by $6.9M (9%) due to Texas Grant Pass through funding. Operating Loss is calculated before State Appropriations. Operating expenses outpaced operating revenues causing an increase of $17.2M (23%). Other 2008 2007 148.1 143.5 779.7 72.8 7.7 6.7 15.1 17.9 Total Operating Expenses Operating Loss (75.0) (92.2) (75.0) 114.7 98.1 5.8 3.8 12.9 10.9 98.1 97. 13.8 3.5 10.8 6.1 (13.8) 12.4 12.4 4.1 State Appropriations Gift Contributions Income Before Other Revenues decreased by $22.7M (45%) due to a $13.8M Net Decrease in FV of Investments and an increase in Operating Loss. Gain/(Loss) onBefore State of Capital Assets (0.1) Income (Loss) Other Revenues, 27.4 Other Nonoperatin Revenues/Expenses 0.0 Expenses, Gains or Losses g Income (Loss) Before Other Revenues, Expenses, Gains Gifts and Sponsored Programs .5 or Losses 50.1 Additions to Permanent Endowments 4.4 Gifts and Sponsored Programs 0.0 Reclass From (To) Other Institutions 97.8 Additions to Permanent Endowments 4.0 Mandatory Transfers (28.3) Reclass From (To) Other Institutions (48.7) As on the previous exhibit, Change in Net Assets was $109.4M. This is predominately due to debt issued for construction projects for which bond proceeds are due from System. 293.8 315.6 Nonoperating Revenues (Expenses): Net Investment Income (Loss) Net Inc. (Dec.) in Fair Value of Investments 15. 14. 22.5 1 3.2 215.3 240.6 Total Operating Revenues State Appropriations increased by $16.6M (17%). Mandatory Transfers represent amounts transferred to System to pay debt service and Nonmandatory Transfers represent anticipated bond proceeds transferred to UTSA to fund construction projects. 72. 73. 26.7 8 6.0 2.5 3.1 240.6 256.5 348.7 315.6 2007 2006 143.5 118.7 Mandatory Transfers - Comp & Sys -Debt Svc 9.1 (19.7) Nonmandatory Transfers Admin Nonmandatory Transfers - Comp & Sys Admin 141.9 Transfers From (To) Other State entities (1.5) 50.1 0.0 0.0 32. 4.0 20.6 (48.7) 4.9 (19.7) 19.8 (1.4) (16.6) 141.9 28. (1.4) 6 Change in in Net Net Assets Assets Change Net Assets, Beginning of the Year Net Assets, Beginning of the Year 126.2 109.4 635.1 761.3 68. 126.2 7 566.4 635.1 Net Assets, End of the Year 870.7 761.3 761.3 635.1 Transfers From (To) Other State entities 4 The University of Texas at San Antonio FY 08 – Statement of Cash Flows Cash from operations includes tuition and fees and expenditures for operations includes salaries, scholarship/fellowship and supplies. ($ in millions) Cash Flows 2008 2007 Cash received from operations 277.7 262.0 Cash expended for operations (337.1) (301.1) Net cash used in operating activities (59.4) (39.1) Net cash used by noncapital financing activities 111.3 105.8 Investing Activities include the purchase/sale of investments, interest income and endowment income distribution. Net cash used by capital and related financing activities (26.3) (38.4) Net cash used by investing activities (38.8) (30.2) Cash & Cash Equivalents decreased by $13.2M due to increased spending for operations. Net decrease in cash and cash equivalents (13.2) (1.9) Cash and cash equivalents, beginning of the year 77.8 79.7 Cash and cash equivalents, end of year 64.6 77.8 Noncapital financing activities include State appropriations and Gifts. Capital and related financing activities include purchase of equipment and construction of buildings. 5 UTSA FY 2008 Sources of Revenue by Category Operating Sources by Category ($ in Millions) Federal Government $64.5 17% Institutional Resources $51.4 13% State of Texas $126.2 32% Student & Parent $148.1 38% 6 UTSA FY 08 Sources of Revenue Operating Sources Sales & Services $7.7 2% Private Gifts & Grants $8.8 2% ($ in Millions) Net Auxiliary Enterprises $17.9 5% Local Government Grants $0.7 0% Endowment & Interest Income $12.9 3% Federal Grants & Contracts $64.5 17% Other Income $3.4 1% State Appropriations $111.7 28% State Grants & Contracts $11.5 3% Research Development Funds $3.0 1% Tuition & Fees $148.1 38% 7 UTSA FY 08 Uses of Funds Operating Uses Academic Support $28.7 9% ($ in Millions) Student Services $28.9 9% Public Service $16.6 5% Research $26.8 8% Instruction $106.8 31% Institutional Support $31.5 10% Operations & Maintenance of Plant $37.8 11% Scholarships & Fellowships $24.9 8% Capital Outlay $8.9 3% Auxiliary Enterprises $20.5 6% 8 UTSA FY 08 Analysis of Financial Condition Composite Financial Index Composite Financial Index measures the overall financial health by combining four core ratios into a single score: primary reserve ratio, expendable resources to debt ratio, return on net assets ratio and the annual operating margin ratio. The CFI decreased by .9 primarily due to decrease in the fair value of investments of $13.8M, as well as $69.2M increase in the amount of debt outstanding. 6.0 4.0 3.1 4.4 3.7 3.6 2005 2006 3.5 2.0 0.0 2004 2007 2008 System’s benchmark is 3.0 or greater. 9 UTSA FY 08 Analysis of Financial Condition Operating Expense Coverage Ratio Measures an institution’s ability to cover future operating expenses with available year-end balances. Ratio is expressed in number of months coverage. 6.0 5.0 5.0 Increase slightly from 5.0 months to 5.1 months is due to increase in unrestricted net assets as a result of increases in Tuition & Fees attributable to rate increases. In addition, a delay in implementing several key initiatives. 4.2 3.6 4.0 3.0 3.0 2.0 1.0 0.0 2004 5.1 2005 2006 2007 2008 System satisfactory rating is at two months or above and should be stable or improve. 10 UTSA FY 08 Analysis of Financial Condition Debt Service Coverage Ratio This ratio measures the actual margin of protection provided to investors by annual operations. Calculation is used by Moody’s Investment Services, system-wide to determine bond rating. This is watched very closely so UT System can maintain AAA bond rating. 4.0 2.9 3.0 3.1 3.0 2.4 2.2 Trend helps to determine if an institution has assumed more debt than it can afford to service. 2.0 1.0 The debt service coverage declined but still exceeds UT System’s benchmark of greater than 1.8. This means that our net resources are 2.4 times what we are currently expending for debt payments. The ratio decreased as a result of a reduction in operating performance and an increase in debt service. 0.0 2004 2005 2006 2007 2008 11 UTSA FY 08 Analysis of Financial Condition Expendable Resources to Debt Ratio This ratio measures an institution’s ability to fund outstanding debt with existing net asset balances should an emergency occur. 0.8 0.7 0.7 0.7 0.7 0.6 UTSA’s debt ratio changed slightly due to a increase in debt associated with Engineering Building, Laurel Village and University Center III. 0.6 0.4 Restated Restated 0.2 0.0 This ratio shows that more and more of our resources are going towards paying off debt. System’s Satisfactory benchmark is 0.8x or greater. 2004 2005 2006 2007* 2008 12 UTSA FY08 Analysis of Financial Condition Debt Burden Ratio This ratio examines the institution’s dependence on borrowed funds and cost of borrowing relative to overall expenses. 10.0% 8.5% 8.0% UTSA’s debt burden ratio increased dramatically as a result of a major capital improvements program resulting in increased debt service payments. The institution is heavily reliant on debt to fund cost. System’s Satisfactory benchmark is less than 5.0%. 6.2% 6.0% 5.7% 5.9% 2005 2006 6.6% 4.0% 2.0% 0.0% 2004 2007 2008 13 UTSA FY 08 AFR Summary UTSA continues to receive a “Satisfactory” rating from UT System as a result of a healthy financial condition. UTSA’s operating margin ratio of 7.3% is high but we expect it to trend downward. Future expenditures are expected to exceed revenue growth as strategic initiatives are implemented, new positions are hired, equipment is replaced and planned capital renovations are completed. The university must establish an appropriate level of reserves and closely monitor its debt capacity. 14