Managerial Accounting

Weygandt • Kieso • Kimmel

Financial Statement Analysis:

The Big Picture

Chapter 14

Prepared by

Alice Sineath

Forsyth Technical Community College

And

Ellen Sweat

Georgia Perimeter College

1

Chapter 14

Financial Statement Analysis: The Big

Picture

After studying Chapter 14, you should be able to:

• Describe and apply horizontal analysis.

• Describe and apply vertical analysis.

• Identify and compute ratios used in

analyzing a company’s liquidity, solvency,

and profitability.

• Understand the concept of quality of

earnings.

2

Comparative Analysis

• Any item reported in a financial statement has

significance if:

– Its inclusion indicates that the item exists at a given

time and in a certain quantity.

• For example, when Kellogg Company reports $136.4

million on its balance sheet as cash, we know that

Kellogg did have cash and that the quantity was

$136.4 million.

3

Comparative Analysis

• Whether the amount represents an increase

over prior years, or whether it is adequate in

relation to the company's needs, cannot be

determined from the amount alone.

• The amount must be compared with other

financial data to provide more information.

4

Comparative Analysis

There are three types of comparisons to

provide decision usefulness of financial

information:

• Intracompany basis

• Intercompany basis

• Industry averages

5

Intracompany Basis

• Comparisons within a company are often useful

to detect changes in financial relationships and

significant trends.

• A comparison of Kellogg's current year's cash

amount with the prior year's cash amount shows

either an increase or a decrease.

• A comparison of Kellogg's year-end cash

amount with the amount of total assets at yearend shows the proportion of total assets in the

form of cash.

6

Intercompany Basis

• Comparisons with other companies provide

insight into a company's competitive position.

• Kellogg's total sales for the year can be compared

with the total sales of its competitors such as

Quaker Oats and General Mills.

7

Industry Averages

• Comparisons with industry averages provide

information about a company's relative

position within the industry.

• Kellogg's financial data can be compared with

the averages for its industry compiled by

financial ratings organizations such as Dun &

Bradstreet, Moody's, and Standard & Poor's.

8

Financial Statement Analysis

Three basic tools are used in financial statement

analysis :

• Horizontal analysis

• Vertical analysis

• Ratio analysis

9

Horizontal Analysis

• Is a technique for evaluating a series of financial

statement data over a period of time.

• Purpose is to determine whether an increase or

decrease has taken place.

• The increase or decrease can be expressed as either

an amount or a percentage.

10

Horizontal Analysis

11

Percentage Change in Sales

The percentage change in sales for each of the 5 years,

assuming 1997 as the base period is:

Kellogg Company

Net Sales (in millions)

Base Period 1997

2001

2000

1999

$8,853.3

$6,954.7

$6,984.2

129.62%

101.82 %

102.26%

1998

1997

$6762.1

$6,830.1

99%

100.0%

12

Horizontal Analysis

of a Balance Sheet

KELLOGG COMPANY, INC.

Condensed Balance Sheets

December 31

(In millions)

Increase (Decrease)

during 2001

2001

Assets

Current Assets

Plant assets

Other assets

Total assets

2000

Amount

$ 1,902.0 $1,617.1 $ 284.9

2,952.8 2,526.9

425.9

5,513.8

742.0 4,771.8

$10,368.6 $4,886.0 $5,482.6

Percent

17.6

16.9

643.1

112.2

13

Horizontal Analysis

of a Balance SheetIncrease (Decrease)

2001

Liabilities and

Stockholders' Equity

Current liabilities

$ 2,207.6

Long-term liabilities

7,289.5

Total liabilities

9,497.1

Stockholders' equity

Common stock

195.3

Retained earnings

and other

1,013.3

Treasury stock

(337.1)

Total stockholders'

equity

871.5

Total liabilities and

stockholders' equity $10,368.6

2000

during 2001

Amount Percent

$2,482.3

1,506.2

3,988.5

$ (274.7)

5,783.3

5,508.6

(11.1)

384.0

138.1

205.8

(10.5)

(5.1)

1,065.7

(374.0)

(52.4)

36.9

(4.9)

9.9

897.5

(26.0)

(2.9)

$4,886.0

$5,482.6

112.2

14

KELLOGG COMPANY, INC.

Condensed Income Statement

For the Years Ended December 31

(In millions)

2001

Net sales

$ 8,853.3

Cost of goods sold

4,128.5

Gross profit

4,724.8

Selling & Admin.

3,523.6

Nonrecurring charges

33.3

Income from operations 1,167.9

Interest expense

351.5

Other income

(expense), net

(12.3)

Income before taxes

804.1

Income tax expense

322.1

Net income

$ 482.0

2000

$6,954.7

3,327.0

3,627.7

2,551.4

86.5

989.8

137.5

Increase (Decrease)

during 2001

Amount Percent

$1,898.6

27.3

801.5

24.1

1,097.1

30.2

972.2

38.1

(53.2) (61.5)

178.1

18.0

214.0

155.6

15.4

867.7

280.0

$ 587.7

(27.7) (179.9)

(63.6)

(7.3)

42.1

15.0

$ (105.7) (18.0)

15

Let’s Review

In horizontal analysis, each item is

expressed as a percentage of the:

a.

b.

c.

d.

net income amount.

stockholders’ equity amount.

total assets amount.

base-year amount.

16

Let’s Review

In horizontal analysis, each item is

expressed as a percentage of the:

a.

b.

c.

d.

net income amount.

stockholders’ equity amount.

total assets amount.

base-year amount.

17

Vertical Analysis

• Is a technique for evaluating financial

statement data that expresses each item

in a financial statement as a percent of

a base amount.

• Total assets is always the base amount

in vertical analysis of a balance sheet.

• Net sales is always the base amount in

vertical analysis of an income

statement.

18

KELLOGG COMPANY, INC.

Condensed Balance Sheets

December 31

(In millions)

2001

Assets

Amount Percent

Current Assets $ 1,902.0

18.3

Property Assets

2,952.8

28.5

Other assets

5,513.8

53.2

Total assets

$10,368.6 100.0%

2000

z

Amount

Percent

$1,617.1

33.1

2,526.9

51.7

742.0

15.2

$4,886.0

100.0%

19

KELLOGG COMPANY, INC.

Condensed Balance Sheets

December 31

(In millions)

2001

Liabilities and

Amount

2000

Percent* Amount Percent*

Stockholders' Equity

Current liabilities

Long-term liabilities

Total liabilities

Stockholders' equity

Common stock

Retained earnings

and other

Treasury stock

Total stockholders'

equity

Total liabilities and

stockholders' equity

$ 2,207.6

7,289.5

9,497.1

91.6

21.3

$2,482.3

70.3

1,506.2

3,988.5

81.6

50.8

30.8

195.3

1.9

205.8

4.2

1,013.3

(337.1)

9.8

(3.3)

1,065.7

(374.0)

21.8

(7.6)

871.5

8.4

$10,368.6

100.0

897.5

$4,886.0

18.4

100.0

*Percentages may be rounded up or down

20

KELLOGG COMPANY, INC.

Condensed Income Statement

For the Years Ended December 31

(In millions)

2001

Amount Percent*

$8,853.3

100.0

Net sales

Cost of goods sold 4,128.5

Gross profit

4,724.8

Selling & admin.

3,523.6

Nonrecurring chgs.

33.3

Income operations 1,167.9

Interest expense

351.5

Other income

(expense),net

(12.3)

Income before

income taxes

804.1

Income tax ex.

322.1

Net income

$ 482.0

*Percentages may be rounded up

46.6

53.4

39.8

0.4

13.2

4.0

(0.1)

9.1

3.6

5.5

or down

2000

Amount Percent*

$6,954.7

100.0

3,327.0

3,627.7

2,551.4

86.5

989.8

137.5

47.8

52.2

36.7

1.3

14.2

2.0

15.4

0.2

867.7

280.0

$ 587.7

12.4

4.0

8.4

21

Condensed Income Statements

For the Year Ended December 31, 2001

(in millions)

Kellogg Company, Inc.

Amount Percent*

Net sales

Cost of goods sold

Gross profit

Selling and administrative

expenses

Nonrecurring charges

Income from operations

Other expenses and

revenues (including

income taxes)

Net income

General Mills,Inc

Amount Percent*

$8,853.3 100.0

4,128.5 46.6

4,724.8 53.4

$7,949.0 100.0

4,767.0 60.0

3,182.0 40.0

3,523.6 39.8

33.3 0.4

1,167.9 13.2

1,909.0 24.0

190.0 2.4

1,083.0 13.6

685.9

$ 482.0

7.7

5.5

622.0

$ 461.0

7.8

5.8

*Percentages may be rounded up or down

22

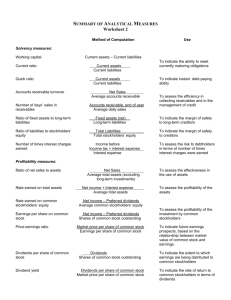

Ratio Analysis

23

Ratios

• Three types:

Liquidity ratios

Solvency ratios

Profitability ratios

• Can provide clues to underlying conditions that

may not be apparent from an inspection of the

individual components.

• Single ratio by itself is not very meaningful.

24

Liquidity Ratios

Measure the short-term ability of the

enterprise to pay its maturing

obligations and to meet unexpected

needs for cash.

WHO CARES?

Short-term creditors such as bankers

and suppliers

25

Liquidity Ratios

•

•

•

•

•

•

•

Working capital

Current ratio

Current cash debt coverage ratio

Inventory turnover ratio

Days in inventory

Receivables turnover ratio

Average collection period

26

Working Capital

Indicates immediate short-term debtpaying ability

Current Assets - Current Liabilities

27

Current Ratio

Indicates short-term debt-paying ability

Current Assets

Current Liabilities

28

Current Cash Debt

Coverage Ratio

Indicates short-term debt-paying ability

(cash basis)

Cash provided by operations

Average current liabilities

29

Inventory Turnover Ratio

Indicates liquidity of inventory

Cost of Goods Sold

Average Inventory

30

Days in Inventory

Indicates liquidity of inventory and

inventory management

365 days

Inventory Turnover Ratio

31

Receivables Turnover Ratio

Indicates liquidity of receivables

Net Credit Sales

Average Gross Receivables

32

Average Collection Period

Indicates liquidity of receivables and

collection success.

365 days

Receivables Turnover Ratio

33

Solvency Ratios

Measure the ability of the enterprise to

survive over a long period of time

WHO CARES?

Long-term creditors and stockholders

34

Solvency Ratios

•

•

•

•

Debt to total assets ratio

Cash debt coverage ratio

Times interest earned ratio

Free cash flow

35

Debt to Total Assets Ratio

Indicates % of total assets provided by

creditors

Total Liabilities

Total Assets

36

Cash Debt Coverage Ratio

Indicates long-term debt-paying ability

(cash basis)

Cash provided by operations

Average total liabilities

37

Times Interest Earned Ratio

Indicates company’s ability to meet interest

payments as they come due

Net Income Before Interest

Expense & Income Tax

Interest Expense

38

Free Cash Flow

Indicates cash available for paying dividends or expanding

operations

Cash Provided By Operations

-

Capital Expenditures

-

Dividends Paid

Free Cash Flow

39

Profitability Ratios

Measure the income or operating success of an enterprise

for a given period of time

WHO CARES? Everybody

WHY? A company’s income affects:

• its ability to obtain debt and equity financing

• its liquidity position

• its ability to grow

40

Profitability Ratios

•

•

•

•

•

•

•

•

Earnings per share (EPS)

Price-earnings ratio

Gross profit rate

Profit margin ratio

Return on assets ratio

Assets turnover ratio

Payout ratio

Return on common stockholders’ equity ratio

41

Earnings Per Share (EPS)

Indicates net income earned on each

share of common stock sales

Net Income - Preferred Stock

Average common shares outstanding

42

Price Earnings Ratio

Indicates relationship between market

price per share and earnings per share

Stock Price Per Share

Earnings Per Share

43

Gross Profit Rate

Indicates margin between selling

price and cost of good sold

Gross profit

Net sales

44

Profit Margin Ratio

Indicates net income generated by each

dollar of sales

Net income

Net sales

Higher value suggests favorable

return on each dollar of sales.

45

Return On Assets Ratio

Reveals the amount of net income

generated by each dollar invested

Net income

Average total assets

Higher value suggests favorable

efficiency.

46

Asset Turnover Ratio

Indicates how efficiently assets are

used to generate sales

Net sales

Average total assets

47

Payout Ratio

Indicates % of earnings distributed in the

form of cash dividends

Cash dividends decl. on common stock

Net income

48

Return on Common Stockholders’

Equity Ratio

Indicates profitability of common

stockholders’ investment

Net income - preferred stock dividends

Average common stockholders’ equity

49

Limitations Of

Financial Analysis

• Horizontal, vertical, and ratio analysis are

frequently used in making significant

business decisions.

• One should be aware

of the limitations of

these tools and the

financial statements.

50

Alternative Accounting Methods

• One company may use the FIFO method,

while another company in the same

industry may use LIFO.

• If the inventory is significant for both

companies, it is unlikely that their current

ratios are comparable.

• In addition to differences in inventory

costing methods, differences also exist in

reporting such items as depreciation,

depletion, and amortization.

51

Quality of Earnings

Indicates the level of full and transparent

information that is provided to users of the

financial statements.

52

Pro Forma Income

A measure of the net income generated

that usually excludes items that the

company thinks are unusual or

nonrecurring.

53

Relationships among Profitability

Measures

54

Let’s Review

In vertical analysis, the base amount for

depreciation expense is generally:

a. net sales.

b. depreciation expense in a previous year.

c. gross profit.

d. fixed assets.

55

Let’s Review

In vertical analysis, the base amount for

depreciation expense is generally:

a. net sales.

b. depreciation expense in a previous year.

c. gross profit.

d. fixed assets.

56

Copyright © 2005 John Wiley & Sons, Inc. All rights

reserved. Reproduction or translation of this work

beyond that named in Section 117 of the United States

Copyright Act without the express written consent of the

copyright owner is unlawful. Request for further

information should be addressed to the Permissions

Department, John Wiley & Sons, Inc. The purchaser

may make back-up copies for his/her own use only and

not for distribution or resale. The Publisher assumes no

responsibility for errors, omissions, or damages, caused

by the use of these programs or from the use of the

information contained herein.

57