Do Internet HMO Auctions Work?

advertisement

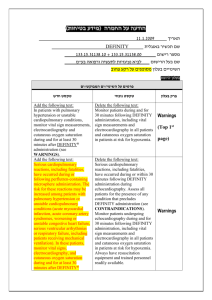

Consumer Driven Health Plans: Early Findings from the Field and Future Directions Stephen T. Parente, Roger Feldman, Jon B. Christianson University of Minnesota March, 2004 Funded by the Robert Wood Johnson Foundation Health Care Organization and Financing Initiative For more information: sparente@csom.umn.edu Presentation Objectives • Describe the CDHP business model. • Illustrate the mechanics of a CDHP using Definity Health as an example. • Provide an Overview of our RWJ evaluation of Definity. • Present current analysis results. • Opportunities and conundrums of CDHPs. Issues Driving CDHP Creation Patients Dissatisfaction with provider access Patient incentives are to consume Limited choices of benefits and providers Combative relationship with managed care companies Providers Loss of autonomy Erosion of physician/patient relationship Misalignment of physician reimbursement and incentives Employers Plan costs are increasing Employees are not happy Increase of employer administration burdens CDHP Business Enablers – ‘Ready to Lease’ Components of Health Insurance: • • • • • – Electronic claims processing National panel of physicians National pharmaceutical benefits management firms Consumer-friendly health data web portals Disease management vendors Internet • Transaction medium for claims processing • 2-way communication with members – ERISA-exemption • Lack of state oversight • Half the US commercial health insurance market is self-insured. Early CDHPs in Operation – Definity • Concept developed in 1998, Funded in April, 2000 • Minnesota based • Clear first mover & dot-bomb survivor – Lumenos • Started in 2000 • Based in Virgina • Havard B-School inspired (Regina Herzlinger) – Destinty • Operating as Medical Savings Account model • In operation for 10 years in South Africa Definity Health Component Details Health Tools and Resources $$ Health Coverage • Preventive care covered 100% • Annual deductible Definity • Expenses beyond the PCA Health Care • Nationwide provider access Advantage • No referrals required Health Tools and Resources • Care management program • Extensive easy-to-use information and services 1 2 Annual Deductible PCA Employer selects which expense apply toward the Health Coverage annual deductible. Paid out of employer’s general assets. Preventive Care 100% Health Coverage Annual Deductible Personal Care Account (PCA) • Employer allocates PCA1 • Member directs PCA • Section 213(d) “scope” • Roll over at year-end • Apply toward deductible2 Web- and PhoneBased Tools New RWJ-Funded Research Key Research Questions 1. 2. Is there an ‘adverse selection’ problem? Traditionally, adverse selection is defined as the situation when healthy individuals choose Definity leaving the sick in a traditional plan that will soon implode its premiums because of disproportionate share of sick individuals in the insurance pool. What is the impact on cost and utilization? Definity has been chosen as a response to rising premium prices in an attempt to make the consumer ‘drive the market’ be examining price variations and constraining their personal consumption, if possible. Research Design – 2 Year study (11/1/2002 - 10/31/2004) – Six employers examined: • • • • • • University of Minnesota, MN Medtronic, National Ridgeview Medical Center, MN Hannaford Bros, New England Welch-Allyn, Upstate NY (tentative) Raytheon (New England or South Atlantic firm) – Data collected • Claims data of all utilization for all health plan choices, pre (2001) and post (2002-2003) Definity. • Employer info on flexible spending accounts and employee income • Survey information on Definity choices in 2002 & 2003 from U of M. Early Results #1: Employee Choice of a Consumer Driven Health Plan in a Multi-Plan, Multi-Product Setting Conceptual Model to Address Selection Question We use a choice model based on utility maximization, where utility is considered to be a function of personal attributes such as health status, health plan attributes such as price, and the interaction of price and health status, formally stated as: Uij = f(Zj,Yi,Xij), where, • i is the decision-making employee choosing among, • j health plan alternative choices, • Yi = employee personal attributes, • Zj = health plan alternative attributes and • Xij = interactions between alternative-specific and personal attributes, Xij. Follows methods used by Harris, Schultz and Feldman (2002). Multivariate Analysis of Plan Choice – Focus on the University of Minnesota 2002 survey – Combine survey data with HR information including: • • • • • After tax income Contract type Age and Gender Location Medical premium choice set – Run Conditional Logistic Regression Model to predict the effects of premium price, employee characteristics and health plan feature preferences for early adopters of Definity compared to other health plans. Health Plan Choices 1. 2. 3. 4. Health Partners: Staff model HMO with direct capitation contracting at a limited number of group practices. Patient Choice: A ‘Tiered-direct contracting’ descendent of Minnesota’s Buyers Health Care Action Group health benefit design experiment. Definity Health: Consumer-driven Health Plan Preferred One: Preferred Provider Organization UPlan Options/Enrollment (2002) HealthPartners Classic Patient Choice Cost Group I Patient Choice Cost Group II Patient Choice Cost Group III PreferredOne National Definity Health Option 1 Definity Health Option 2 Total HealthPartners Classic Patient Choice Cost Group I Patient Choice Cost Group II Patient Choice Cost Group III PreferredOne National Definity Health Option 1 Definity Health Option 2 Total Single & Family Total Total Cost $137.84 $137.84 $147.15 $157.90 $189.61 $150.52 $150.48 Total Cost $344.59 $344.59 $363.15 $389.65 $467.83 $375.55 $375.47 Employee-only coverage Less UM Employee contribution contribution Enrollment $137.84 $0.00 5,027 $137.84 $0.00 $137.84 $9.31 2,091 $137.84 $20.06 $137.84 $51.77 731 $137.84 $12.68 349 $137.84 $12.64 8,198 Family coverage Less UM Employee contribution contribution $323.92 $20.67 $323.92 $20.67 $323.92 $39.23 $323.92 $65.73 $323.92 $143.91 $323.92 $51.63 $323.92 $51.55 Enrollment 3,967 2,808 997 346 8,118 16,316 Early UM Definity Experience Year 2002 46% 49% 54% 51% Option 1 Option 2 Female Male 49% 49% 51% 51% Family Single Employee Dependents Definity Age/Gender Distribution 2002 University of Minnesota 70 60 50 40 Definity Male Definity Total Other Plans 30 20 10 0 <25 25-34 35-54 55-64 >65 All Respondents Satisfaction with Plan Overall By Whether Respondent or Dependent Has Chronic Condition Yes No How would you rate your overall experience with your health plan in 2002? (1=worst possible, 10=best possible) Definity Other Plans For Definity respondents, would you recommend Definity to a friend, family member or colleague? (%) Yes No Don't know/refused 7.47 7.55 7.41 7.64 7.50 7.49 85.0 12.4 2.6 87.4 9.3 3.3 83.6 14.1 2.2 Health Plan Features Most Preferred 0 20 Percent agreement 40 60 My doctors in health plan 76.44 50 No referral authorizations Has preventive care 46.4 National provider panel 36.7 29.8 PCA balance rolls over Small out-of-pocket $$ Small paycheck deduction No copayments Online tools 80 16 15 12 6.93 Other Health Plans Definity 100 Results: Premium Sensitivity • Employees are sensitive to out-of-pocket premiums, and surprisingly, employees with chronic conditions are more premium-sensitive • If Definity raised its premium by 1% it would lose 4.6 % of healthy single enrollees and 5.4% of healthy families • 1% premium boost would cause 6.9% of singles and 10.7% of families with chronic condition to leave Definity • The results depend on 100% of the premium hike being passed along to the employee (i.e, defined contribution), as is the case for the UM Results: Health Status and Other Employee Characteristics • Employees and families with chronic conditions prefer the PPO, but otherwise, there is no evidence of adverse selection • Having a chronic condition is associated with a 3.2% increase in the probability of choosing PreferredOne vs. HealthPartners • Note that PreferredOne had the highest premiums ($189.51 for single coverage and $448.40 for family coverage per pay period), suggesting that the plan is experiencing adverse selection • Higher income employees chose Definity or Choice Plus, suggesting these plans may evolve as favorites of the ‘well-to-do’ • Older employees chose PreferredOne or Choice Plus Early Results #2: Consumer-Driven Health Plans: Early Evidence about Utilization, Spending and Cost Study Setting • Health plan choices by employees: – HMO, 2000-2002 – PPO, 2000-2002 – CDHP, 2001-2002 • Variation in cost sharing by contract • Take-up of CDHP approximately 15%. • General caveat: Each of the six employers’ experience can be quite different due to: – – – – Alternatives offered Plan design Communications with employees Sponsor’s objectives for the plan Presentation of Results • Results are limited to two groups of employees who worked for their firm continuously for three years (2000-2002) where: 1. • • Employee chose the CDHP in 2001 and 2002. 2. Employee chose another health plan in 2001 and 2002. This limitation removed 40% to 50% of all employees from the analysis. Why make this limitation? We want to see both adoption and maturing impact of CDHP while controlling for prior spending. – – – 2000: Pre-CDHP experience controls for prior spending 2001: CDHP adoption year 2002: CDHP ‘maturation’ year Statistical Approach • Used difference-in-difference approach • Generate unadjusted and regression-adjusted comparisons. • Regression adjustment based on two-part model • Regressors included: age, gender, baseline illness burden (ADGs), contemporaneous health shock, number of dependents, FSA election and income. • Subsequent tests for regression to the mean found the problem to be present, but not to a degree that would influence our results by the last year of our findings. Baseline Demographics Demographic Variable of Study Population Cohorts in 2000 (N=531) CDHP (N=1551) HMO (N=1544) PPO Sample Mean Sample Mean Sample Mean Employe age (in years) 40.9 39.5 41.6 Percent male 62% 57% 51% Case-mix index of entire employee's contract 6.493 6.831 7.136 Case-mix index of each person covered under the employee's contract 2.691 2.961 3.221 <25th percentile or below of employer 12% 28% 27% Between 25th and 75th pecentile of employer 52% 53% 47% >75th percentile of employer 36% 20% 27% Income Distribution Employee's health insurance premium contribution Employee's healthcare flexible spending account contribution $ 4,228.56 $ 407.84 $ 3,524.84 $ 203.52 $ 4,395.14 $ 236.42 Estimated number of covered lives including the employee 2.58 2.60 2.49 Reported number of dependents excluding employee 1.81 1.82 1.68 Case-mix Differences based on a Weighted ADG Index Health Plan Cohorts Year 2000 Year 2001 Year 2002 Sample Mean Sample Mean Sample Mean CDHP Cohort N=531 Case-mix index of entire employee's contract 6.49 7.45 7.94 Case-mix index of each person covered under the employee's contract 2.69 3.14 3.38 Case-mix index of entire employee's contract 6.83 7.47 7.29 Case-mix index of each person covered under the employee's contract 2.96 3.20 3.09 Case-mix index of entire employee's contract 7.14 7.84 8.16 Case-mix index of each person covered under the employee's contract 3.22 3.48 3.64 HMO Cohort N=1,551 PPO Cohort N=1,554 CDHP, HMO versus PPO CDHP HMO PPO 2000 $ 116.56 $ $ 144.99 $ $ 138.82 $ 2001 156.13 $ 157.97 $ 170.53 $ PMPM Differences for Continuously enrolled sample 2002 238.84 169.44 242.97 What was the ADJUSTED impact on provider and patient payment? 2000 Mean 2001 Mean 2002 Mean CDHP Cohort N=531 Total Expenditure Employer Expenditure Employee Expenditure $ 4,396.22 $ 4,005.28 $ 416.51 $ 6,154.36 $ 5,903.61 $ 634.38 $ 8,149.26 $ 7,807.39 $ 792.01 HMO Cohort N=1,551 Total Expenditure Employer Expenditure Employee Expenditure $ 5,284.53 $ 4,895.75 $ 394.70 $ 6,773.62 $ 6,227.81 $ 549.32 $ 7,197.50 $ 6,428.83 $ 702.49 PPO Cohort N=1,554 Total Expenditure Employer Expenditure Employee Expenditure $ 5,228.42 $ 4,688.28 $ 511.84 $ 7,050.59 $ 6,349.99 $ 657.16 $ 8,377.78 $ 7,330.94 $ 881.47 Health Plan Cohorts NOTE: These are results from a restricted continuously enrolled sample of 50% to 60% of the total employee population and are not a reflection of the plans’ full PMPM expenditures. Also note: 1) Patient expenditures from the Personal Care Account (PCA) are included in the employer payment category. 2) Consumer payment reflects deductibles, copayments, and coinsurance expenses. What was the ADJUSTED impact on provider & patient payment by different services? Health Plan Cohorts Year 2000 Year 2001 MeanDeviationMean Year 2002 Mean CDHP Cohort N=531 Hospital Expenditure Physician Expenditure Pharmacy Expenditure $ $ $ 1,369.97 2,093.70 935.29 $ 1,999.25 $ 2,935.84 $ 1,103.72 $ 3,468.53 $ 3,510.83 $ 1,341.78 HMO Cohort N=1,551 Hospital Expenditure Physician Expenditure Pharmacy Expenditure $ $ $ 1,842.80 2,381.08 1,107.64 $ 1,796.37 $ 2,959.90 $ 1,498.54 $ 1,956.83 $ 3,088.22 $ 1,640.25 PPO Cohort N=1,554 Hospital Expenditure Physician Expenditure Pharmacy Expenditure $ $ $ 1,779.06 2,245.22 1,007.95 $ 2,049.76 $ 2,834.32 $ 1,484.91 $ 2,367.17 $ 3,294.47 $ 1,789.26 NOTE: These are results from a restricted continuously enrolled sample of 50% to 60% of the total employee population and are not a reflection of the plans’ full PMPM expenditures. Was ADJUSTED service use different for CDHPs? Health Plan Cohorts 2000 Mean 2001 Mean 2002 Mean CDHP Cohort N=531 Physician Visits Hospital Admission Rate Prescriptions Filled 5.74 0.05 18.89 7.49 0.10 22.23 7.15 0.16 22.23 HMO Cohort N=1,551 Physician Visits Hospital Admission Rate Prescriptions Filled 6.75 0.07 22.23 7.56 0.06 22.59 7.29 0.09 30.89 PPO Cohort N=1,554 Physician Visits Hospital Admission Rate Prescriptions Filled 5.78 0.07 20.63 6.54 0.07 23.79 6.95 0.11 24.50 NOTE: These are results from a restricted continuously enrolled sample of 50% to 60% of the total employee population and are not a reflection of the plans’ full admissions and prescription drug experience. Distribution of CDHP Population by PCA Usage Levels PCA MAP Under PCA Limit Ended Within Gap Above Deductible Continuously enrolled population 2001 40% 13% 47% 2002 28% 15% 57% Conclusions • The most important factor affecting choice is income. • The consumer drive health plan was not disproportionately chosen by the young and the healthy (for the U of MN population). • For the non-U of MN pop, in adjusted dollars, the patterns remains, despite the likely event that the CDHP experienced favorable expenditure selection. • Year 3 of CDHP experience will reveal if they can stem high cost growth trajectory from years 1 & 2. Critical Caveat: Benefit Design will Drive Expenditure Results ‘Draconian’ benefit design for family contract: • $1,0000 PCA, $4,000 Deductible, 20% co-insurance after deductible Current industry standard design for family contract: • $2,000 PCA, $4,000 Deductible, 10% to 15% co-insurance after deductible Generous benefit design for family contract: • $2,000 PCA, $3,000 Deductible, 0% co-insurance after deductible Policy Opportunities What is the Upside to CDHPs? • Innovative means to bring consumer choice into the medical marketplace as well as consumer awareness of the trade-offs of liberal medical insurance coverage policies. • Creates infrastructure for personal, portable health care coverage. • Hybrid variants could be crafted to serve low income, part time workers and possibly the uninsured through tax credits and vouchers. Policy Conundrums What is the Downside to CDHPs? • What if CDHPs accelerate the consumer’s burden of health care spending ‘too’ quickly? • Not much incentives for managed care’s proven assets (e.g., disease management) to play a role. Next Steps within the RWJ Grant Period 2nd Year U of M Survey Examination of switching behavior Multi-employer/multi-year results Examine the effect of online tools on medical care demand • More detailed examination of service use differences from claims data • • • • Next Steps in a (soon to be) Proposed RWJ Grant Extending the Analysis • Involve 12 employers – 6 original employers in study – 6 new employers using non-Definity CDHPs • Three year continuation grant • Develop five year cohorts for six original employers to see long terms effects on plan selection and the resulting cost and utilization impact. • Develop optimal choice model of plan selection for a consumer. • Empirically test optimal choice to examine rationality of consumers as the market evolves. CDHP’s Legislative Cousins: Health Savings Accounts Introduced in the 2003 Medicare Reform Law What it enables: • • • Any U.S. citizen can create a ‘qualified’ HSA account. Must have ‘catastrophic health insurance’ with minimum deductible of $2,000. Max is $10,000 for a family contract. Individuals or employers can make annual pre-tax contribution to an HSA, separate from the insurance policy, of 100% of the deductible (max of $5,150). Compare & Contrast: The CDHP Model versus…. Health Tools and Resources $$ Health Coverage • Preventive care covered 100% • Annual deductible Definity • Expenses beyond the PCA Health Care • Nationwide provider access Advantage • No referrals required Health Tools and Resources • Care management program • Extensive easy-to-use information and services 1 2 Annual Deductible PCA Employer selects which expense apply toward the Health Coverage annual deductible. Paid out of employer’s general assets. Preventive Care 100% Health Coverage Annual Deductible Personal Care Account (PCA) • Employer allocates PCA1 • Member directs PCA • Section 213(d) “scope” • Roll over at year-end • Apply toward deductible2 Web- and PhoneBased Tools …The HSA Model Annual Deductible Health Coverage • Purchased by ‘Qualified’ Plans • Annual deductible • Expenses beyond the HSA • No managed care provisions • Nationwide provider access • No referrals required Health Coverage Annual Deductible HSA Preventive Care 100% Health Care Account (HSA) • Consumer/Employer allocates HSA • Consumer directs HSA • Owned by consumer and portable • Roll over at year-end $$ • Many deposited pre-tax • Consumer can withdrawal with penalty • Can apply toward deductible Why Would Anyone Want such a Wacky Thing? Compare & Contrast Old Way for Family to Buy Coverage: Buy family policy from BCBS Policy cost: $8,460 Plan has $500 deductible Deductible applied per person Deductible capped at $1,000 Cost if healthy: $8,460 Cost if 1 person sick: $8,960 Cost if 2+ people sick: $9,460 The New HSA Way: Buy ‘qualified’ plan from BCBS Qualified plans costs: $3,936 Plan has $2,500 deductible Deductible applied per person Deductible capped at $5,000 Cost of healthy: $3,936 Cost if 1 person sick: $6,436 Cost if 2+ people sick: $8,936 HSA Policy Questions we can answer • What type of person chooses the plans? • If they save money, how? • What would be the cost of filling the uninsured gap with this type of plan? What unique data do we have? • For all CDHP-offered employees, a combination of: – – – – – Plan choice Benefit design Income and other demographics FSA election Claims history (medical, hospital, pharmacy) • For CDHP enrollees: – Use of Internet tools – Use of preventive service benefit – Behavior at ‘key’ points of inflection What We Want to Do if Someone Pays the Tab • Combine our data with MEPS to cost out HSA plan for different segments of the population through micro-simulation. – Focus on low-income because we could price a voucher/tax credit. – We know how much low-income people would spend because they are present in our data. – We know how preventive care in HSA would work with actual data for this population too. Could We Estimate a Choice Model to Look at Possible Take-Up? • What we know: – Choices of individuals in firms with multiple health plans – Their consumption given their choices • What we don’t know: – Probability of uninsured choosing an HSA – If employers will offer HSAs as a choice with other plans or as a replacement – Individual insurance market take-up rate Econometric Issues • How to group health plan choices? • Ideally, estimate separate choice models for: 1. Single employees with no dependents 2. Families who have no other source of health insurance 3. Families who have multiple choices of health insurance • • • Practically, we can’t identify (2) and (3), so we combine single and family contracts into one choice model through the use of planinteracted dummy variables (Feldman & Schultz, 2001). Considered a nested logit, but the Definity next, if weighted, was not large enough. Correction for oversampling Definity and undersampling the other plans. Lerman-Manski correction was used obtain appropriate standard errors. Impact of price, employee characteristics and health plan feature preferences on health plan choice Variable Description Coefficient Standard Deviation T-Statistic Marginal Effect Medical Insurance Tax-Adjusted Premium ADJPREM Employee Medical Insurance Premium-Adjsuted -0.002 0.0007 -2.265 CHR_PREM Premium Price & Chronic Interaction -0.001 0.0001 -7.878 FAM_PREM Premium Price & Family Contract Interaction 0.001 0.0007 1.749 Plan Choices Intercepts (The HMO Health Partners is the reference category) DF_INT CDP - Definity Intercept -2.572 0.887 -2.899 PC_INT PTC - Patient Choice Intercept -4.061 0.348 -11.668 P1_INT PPO - Preferred One Intercept -7.003 0.859 -8.151 0.409 0.271 1.507 5.911 Employee Chararacteristics DF_CHR CDP CP_CHR PTC -0.109 0.117 -0.936 -1.819 P1_CHR PPO 1.818 0.219 8.301 11.792 DF_FAM CDP -0.418 0.319 -1.31 -6.038 CP_FAM PTC 0.368 0.114 3.233 6.126 P1_FAM PPO 0.083 0.649 0.129 0.541 DF_INC CDP 0.013 0.005 2.404 0.187 CP_INC PTC 0.007 0.003 2.524 0.109 P1_INC PPO -0.004 0.003 -1.664 -0.029 DF_FEM CDP -0.013 0.251 -0.05 -0.181 CP_FEM PTC -0.324 0.114 -2.856 -5.396 P1_FEM PPO -0.203 0.119 -1.7 -0.608 DF_AGE CDP 0.008 0.012 0.621 0.111 CP_AGE P1_AGE PTC 0.030 0.006 PPO 0.036 0.006 5.279 6.574 0.503 0.235 Chronic Patient or Family Member Family Contract=1, Single=0 After tax income (in thousands) Gender, Female=1, Male=0 Employee Age Continued: Impact of employee characteristics and health plan feature preferences on health plan choice Variable Description Coefficient Standard Deviation T-Statistic Marginal Effect Employee Chararacteristics DF_KND CDP -0.132 0.248 -0.534 CP_KND PTC 0.282 0.119 2.374 4.689 P1_KND PPO -0.636 0.116 -5.48 -4.123 0.811 0.322 2.515 11.723 Employee Benefit Knowledge -1.912 Employee Health Plan Feature Preferences DF_NPL CDP CP_NPL PTC 0.132 0.147 0.9 2.203 P1_NPL PPO 0.687 0.146 4.699 4.456 DF_PRV CDP 0.406 0.310 1.311 5.869 CP_PRV PTC 0.204 0.127 1.608 3.397 P1_PRV PPO 0.037 0.138 0.266 0.238 DF_MDR CP_MDR P1_MDR DF_NRF CP_NRF P1_NRF DF_NCP CP_NCP P1_NCP DF_ROL CP_ROL P1_ROL DF_ONL CP_ONL P1_ONL CDP 0.822 0.324 PTC 1.777 0.140 PPO 5.396 0.398 2.539 12.727 13.561 2.58 2.430 7.828 -0.185 2.567 -1.443 0.585 -0.671 -7.068 1.696 5.587 -4.446 11.889 29.558 35.002 11.535 5.013 6.219 -0.978 6.206 -1.351 2.785 -1.522 -7.292 12.776 20.193 -18.143 Number of observations Log-L for Choice model Adjusted R-square CDP National Provider Panel Preventive Services Covered My Doctor is in the Panel No Referrals or Pre-Authorization PTC PPO 0.80 0.31 0.301 0.124 0.96 0.122 -0.07 0.365 PTC 0.373 0.145 PPO -0.208 0.144 0.193 0.329 PTC -0.092 0.136 PPO -1.124 0.159 0.884 0.521 PTC 1.214 0.217 PPO -2.797 0.629 CDP CDP CDP 915 -897.19 0.30 Health Plan has No Copayments Personal Care Account Rolls Over Use of On-line Tools