Economics of the Arab Spring

advertisement

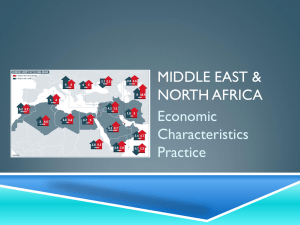

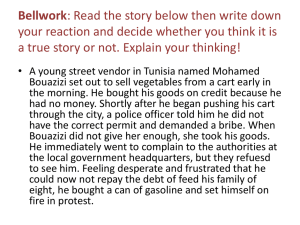

NS4053 Winter Term 2014 Economics of the Arab Spring Outline • Part I – Economics of the Arab Spring • Overview • Economic Impacts • • Challenges Ahead Part II – The Arab Spring Transition Countries • Patterns of Governance, Economic Reforms • Country Case Studies • Tunisia • Libya • Egypt • Yemen • Syria • • Jordan Part III Lessons Learned/Overall Assessment 2 Arab Spring Overview • Arab spring resulted in increased political pluralism and new democratic institutions but led to: • Instability • Setbacks in the transition towards democracy • Mass protests • Clashes among former revolutionary allies and • The rise of political Islam • Instability taken a toll on the region’s economies • Sharp slowdown in economic activity • Deteriorating external and fiscal accounts • Decreasing reserves • Inflationary pressures in some countries 3 Economic Impact of Arab Spring 4 Arab Spring Impacts I • Long term challenges remain as pressing as ever: • High unemployment (especially among youth) • Inefficient subsidy regimes • Low trade diversification • Main impacts of Arab Spring • Sharp drop in growth, slow recovery underway • Average real growth in region fell from 4.2% in 2010 to 2.2% in 2011 – lowest in a decade • Making matters worse, • global economy sluggish • Eurozone crisis hit region hard given tight economic links 5 Effects of Domestic and External Shocks 6 Arab Spring Impacts II • Slowdown affected all countries • Hardest hit initially were those countries at center of the Arab Spring • Libya • Tunisia • Egypt • Syria, and • Yemen • Morocco was only country were GDP strengthened in 2011 • Economic recovery subdued in 2012 • Average real GDP growth increased slightly to 2.4% • In 2013 should increase to 3.5% but remain below prerevolutionary growth rates. 7 Political Turmoil/External Pressures Take Toll 8 Arab Spring Impacts III • Production stoppages caused by political upheaval were severe. • In Libya oil production decreased from 1.65 m bpd in 2010 to only 0.47 m bpd in 2011 • In Egypt widespread demonstrations and strickes paralyzed production process and deterred investments for months • In Tunisia labor unrest lead to a substantial decline in mining sector (-40% va) and oil and phosphate production. • In Syria oil production declined by 60% from level at end of 2010 to 0.16 m bpd in September 2012 – sanctions and ongoing civil war • In Yemen economic activity hit by attacks on electricity facilities and pipeline sabotage – led to severe energy 9 shortages. Arab Spring Impacts IV • Sharp drop in tourism • Have recovered but remain well below pre revolution levels • Given tourism accounts for 20%GDP in Lebanon, 12% in Jordan and between 5% and 8% in Morocco Tunisia and Egypt, decline had a significant effect on growth. 10 Arab Spring Impacts V • Foreign direct investment (FDI) flows down sharply • Accelerates a trend that started with financial crisis 200809 • Between 2010 and 2011 FDI inflows fell by 46% 11 Arab Spring Impacts VI • Weakening of currencies • Strongest depreciation experienced by Tunisian dinar. 12 Arab Spring Impacts VII • Foreign exchange reserves (FX) • Stronger depreciation in many cases could only be averted by substantial interventions of national central banks – sold FX and bought local currency • Relative stability in FX came at the expense of reserves • Fall most dramatic in Egypt 13 Arab Spring Impacts VIII • Aid-Assistance • To avoid a balance of payments crisis, international community stepped in to support the region • G8 and the international financial organizations founded the “Deauville Partnership” in May 2011 to coordinate aid to afflicted countries • Members pledged up to USD 70 billion • To date only a fraction of promised aid has been disbursed • IMF has also committed to provide loans to Morocco ($6.2bn), Jordan ($2bn), Yemen($93mn) and Egypt ($4.8bn). 14 Arab Spring Impacts IX • Governments in region responded to political unrest and weakening of economic performance by increasing public spending • Highest increases in government expenditures relative to GDP – Tunisia and Algeria • Most fiscal measures aimed at sustaining social cohesion and mitigating effects of high food and fuel prices • Popular steps – • Increase subsidies on energy and food • Raise public sector wages and pensions • Expand unemployment benefits 15 Arab Spring Impacts X • With flat revenues, the result was rapidly growing fiscal deficits and associated debt 16 Effects of Arab Spring 2010-2013 17 Official Unemployment Rates 18 External Current Account and Fiscal Balance 19 Arab Spring: Challenges Ahead I • Youth unemployment, skills mismatch • MENA region faces structural employment gap – especially among younger workers • Regional unemployment rates around 10% • Youth unemployment closer to 30% 20 Arab Spring: Challenges Ahead II • Labor market inefficiencies a key problem in the region • MENA lowest score in the WEF Global Competitiveness Index for labor market efficiency • Region also faces widespread skill mismatches – inefficient education systems produce unprepared market entrants • Firms operating in region regularly list insufficient labor skills as a major constraint • Public sector accounts for an outsized portion of employment in region • (9.8% compared to global average of 5.4% • Taking only non-agricultural employment in 2010, public sector accounted for 70% of labor force in Egypt 21 Arab Spring: Challenges Ahead III • On average public sector salaries accounted for 35.5% of government expenses in 2009 for regional governments • Expanded government has crowded out the private sector • Most youth find a public sector job prefereable that in the private sector 22 Arab Spring: Challenges Ahead IV • Large public sector has bred a lack of economic dynamism in region – further setting back employment • World Bank found (2010) that MENA has some of the lowest firm entry density rates in the world • Suggests a lack of entrepreneurship with rate almost four times lower than of Europe and Central Asia 23 Arab Spring: Challenges Ahead V • Region generally scores very low on World Bank’ Ease of Doing Business Index – even lower after 2011 – yet the private sector will have to create most of the jobs. 24 Governance Patterns: Voice and Accountability Voice and Accountability (percentile) 40 35 30 25 20 15 10 5 0 1996 2000 2003 2005 2007 2009 Data Source: World Bank, Worldwide Governance Indicators, 1996-2011 Country/Grouping Egypt Libya 2011 Tunisia Yemen Average Monarchy Average Syria Reflects perceptions of the extent to which a country's citizens are able to participate in selecting their government, as well as freedom of expression, freedom of association, and a free media. Monarchy average = Saudi Arabia, Morocco, Jordan and Oman 25 Political Stability/Absence of Violence (percentile) Governance Patterns: Political Stability 80 70 60 50 40 30 20 10 0 1996 2000 2003 2005 2007 2009 Data Source: World Bank, Worldwide Governance Indicators, 1996-2012 Reflects pereceptions of the likelihood that the government will be destabilized or overthrown by unconstitutional or violent means, including politically-motivated violence or terrorism. Country/Grouping Egypt Libya 2011 Tunisia Yemen Average Monarchy Average Syria Monarchy average = Saudi Arabia, Morocco, Jordan and Oman 26 Government Effectiveness (percentile) Governance Patterns: Government Effectiveness 80 70 60 50 40 30 20 10 Country/Grouping Egypt 0 Libya 1996 2000 2003 2005 2007 2009 2011 Tunisia Yemen Average Data Source: World Bank, Worldwide Governance Indicators, 1996-2012 Monarchy Average SYR Reflects pereceptions of the quality of public services, the quality of the civil service and the degree of its independency from political pressures, the quality of policy formulation and implementation and the credibility of the goverment's commitment to such policies Monarchy average = Saudi Arabia, Morocco, Jordan and Oman 27 Governance Patterns: Regulatory Quality Regulatory Quality (percentile) 60 50 40 30 20 10 0 1996 2000 2003 2005 2007 2009 Data Source: World Bank, Worldwide Governance Indicators, 1996-2012 Country/Grouping Egypt Libya 2011 Tunisia Yemen Average Monarchy Average Syria Reflects pereceptions of the ability of the government to formulate and implement sound policies and regulations that permit private sector development. Monarchy average = Saudi Arabia, Morocco, Jordan and Oman 28 Governance Patterns: Rule of Law 70 Rule of Law (percentile) 60 50 40 30 20 10 Country/Grouping Egypt 0 Libya 1996 2000 2003 2005 2007 2009 2011 Tunisia Yemen Average Data Source: World Bank, Worldwide Governance Indicators, 1996-2012 Monarchy Average Syria Reflects pereceptions of the extent to which agents have confidence in and abode by the rules of society, and in particular the quality of contract enforcement, property rights, the police, and the courts, as well as the likelihood of crime and violence. Monarchy average = Saudi Arabia, Morocco, Jordan and Oman 29 Governance Patterns: Control of Corruption Control of Corruption (percentile) 80 70 60 50 40 30 20 10 0 1996 2000 2003 2005 2007 2009 Data Source: World Bank, Worldwide Governance Indicators, 1996-2012 Reflects pereceptions of the extent to which public power is exercised for private gain, including both petty and grand forms of corruption as well as the capture of the state by elites and private interests Country/Grouping Egypt Libya 2011 Tunisia Yemen Average Monarchy Average Syria Monarchy average = Saudi Arabia, Morocco, Jordan and Oman 30 Index of Economic Freedom Overall Score Overall Index of Economic Freedom 70 65 60 55 50 45 40 35 30 25 20 1995 1997 1999 2001 2003 2005 2007 2009 Data source: Heritage House, Index of Economic Freedom, 2013 2011 Country/Grouping Egypt 2013 Libya Tunisia Yemen Average Monarchy Average Note: Monarchy average = Saudi Arabia, Morocco, Jordan and Oman Note: Syria not ranked 31 Trade Freedom 90 Trade Freedom Score 80 70 60 50 40 30 20 1995 1997 1999 2001 2003 2005 2007 2009 Data source: Heritage House, Index of Economic Freedom, 2013 2011 Country/Grouping Egypt 2013 Libya Tunisia Yemen Average Monarchy Average Monarchy average = Saudi Arabia, Morocco, Jordan and Oman 32 Social Capital • There are a number of interesting patterns associated with the region’s governance. • An often neglected aspect is social capital which incorporates • Social networks and • The cohesion a society experiences when people trust one another • Empirical studies on social capital have found that societies with lower levels of social capital have experienced lower rates of economic growth • Unlike physical capital, social capital may take years to show significant increases • For the MENA region, low levels of social capital are closely associated with low levels of governance and entrepreneurship 33 Ranking -- Legatum Governance (1 highest, 142 lowest) Patterns of Governance/Social Capital 140 Iraq Yemen 120 100 Syria Egypt Morocco 80 Tunisia Jordan 60 Saudi Arabia Kuwait 40 20 0 0 20 40 60 80 100 120 140 Ranking -- Legatum Social Capital (1 highest, 142 lowest) 34 Ranking -- Legatum Social Capital (1 highest, 142 lowest) Patterns of Social Capital/Entrepreneurship 140 Syria Yemen Tunisia 120 Egypt 100 Iraq Jordan 80 60 Kuwait 40 Saudi Arabia Morocco 20 0 0 20 40 60 80 100 120 140 Ranking -- Legatum Entrepreneurship (1 highest, 142 lowest) 35 Country Assessments • Countries With Regime Change • Tunisia • Libya • Egypt • Yemen • Countries in Regime Transition • Syria • Monarchies • Jordan 36 Tunisia I • The economic crisis following the January 2011 revolution and a variety of external shocks increased the vulnerability of the Tunisian Economy • Real GDP contracted by more that 2% in 2011 • Foreign direct investment (FDI) and tourism receipts declining by more than 30% • Economic downturn – • Together with return of Tunisians from Libya brought unemployment to record levels and • Weakened an already fragile financial sector. • In response the authorities implemented an expansionary monetary and fiscal policy • Higher wages and subsidies, • Lower interest rates and bank reserve requirements • Relaxed regulatory measures 37 Tunisia II • Policies resulted in • Wider current account deficit • Instability in exchange rate • Loss of 20% reserves in 2011 alone despite important bilateral and multilateral budget support • Widespread social and economic disparities and high youth unemployment remain key challenges • Tunisia’s pursuit of relatively prudent fiscal and monetary policies and open trade regime produced the highest per capita GDP growth among MENA oil importers • Its macroeconomic management relied on extensive state intervention and fostered the development of an exportoriented low value added industry – intensive in unskilled labor 38 Tunisia III • The country’s economic model also characterized by: • An inefficient banking sector • Pervasive price and capital controls • Directed lending • Weak governance, and • Rigid labor markets • The result was • High structural unemployment particularly among the youth where it averaged 30 percent in 2010 • Unfair distribution of economic gains among the population and • Widespread disparities across regions • The country’s pursuit of reforms in the middle of a political transition process faces important risks 39 Tunisia IV • Comprehensive economic reforms needed in the immediate future to overcome Tunisia’s structural rigidities and promote inclusive growth • Many reforms will generate resistance from vested interests • Will require time and effort for building broad political support • Reforms may not yield benefits immediately despite high aspirations of the population • As a result reform process faces both risk of delayed implementation and social tensions • Other sources of risk: • Escalation of domestic tensions from political uncertainty • Security concerns 40 Tunisia V • In past two years the country has experienced • A slowing economy (although a modest recovery is underway) • Continued unemployment and periodic labor disturbances • However opportunities are emerging in select sectors of the economy as a result of: • Increased transparency and • Improving legal frameworks which will attract interest from foreign and local investors • Still investors may opt to stay away at least until the elections looking for increased political stability • The sale of assets from the Ben Ali family, could provide the state with some important financial support • However weak economic conditions in Europe a problem: • Normally accounts for 80% of Tunisian exports and • Is an important source of foreign investment and workers’ remittances 41 Tunisia VI • Main opportunities • Due to location, good scope for “near shoring” arising as European companies seek to limit the size of their inventories • Tourism sector picking up although revenues have yet to reach 2010 levels • Reconstruction in Libia could generate contracts and employment for Tunisians although these have been slow to materialize • Main challenges ahead • 1. Fiscal Pressures – 2012 fiscal deficit around 7% of GDP – increased public sector wage bill • Current account widening into double digits – modest recovery in tourism and continued weakness in Europe. • Options – financing from IMF, Islamic bonds, bilateral 42 financing from the Gulf Tunisia VII • 2. Unemployment – high and still rising unemployment main risk to economic and political stability • Immediate outcome of 2010 revolution – increase in unemployment to 19% due to downturn in economy • Declined to 17.6% in 2012 but job creation still a major challenge • Government hoping improvements in investor climate will create jobs – also expanding number of public sector jobs • 3. Underdevelopment – big problem in te interior reions given most of Tunisia’s wealth and jobs are on he coast. • Government focus in more on regional development with infrastructure and schools • Main question – how long can the government maintain stability without delivering significant economic and 43 employment gains? Unions increasingly impatient. Tunisia Drop in Creditworthiness 44 Tunisia: High Twin-Deficits 45 Libya I • Libya is at a crossroads. Decisions taken today will have profound implications for the future. • The country could follow • A roadmap for sustainable inclusive growth or • Face deepening hydrocarbon dependency • In the short term sustainable growth would require • Managing the political transition and addressing security challenges while • Maintaining budget discipline and macroeconomic stability • Severe institutional capacity constraints need to be addressed, particularly in the areas of economic management and statistics 46 Libya II • Over the medium term, structural challenges include improving: • The quality of education • Rebuilding infrastructure • Putting in place an efficient social safety net and • Developing domestic financial markets • Private sector-led growth is a precondition for sustainable job creation • Reducing regulatory uncertainty and establishing a wellfunctioning financial sector are essential to foster private sector development 47 Libya III • Outlook and Risks • Hydrocarbon output should reach pre-conflict levels in 2013 while • Reconstruction and private demand should facilitate an improvement in the non-hydrocarbon sectors. • Oil price volatility makes economic performance vulnerable and complements fiscal management • Necessary reconstruction and development spending will eventually push the budget into deficit in the absence of a curb on current spending • The hasty legislation prohibiting interest poses risks to the financial sector • Until Libya generates private employment and makes progress in curbing corruption it will not address the key 48 causes of the revolution Libya IV • On-Going Issues • 1. Energy exploration and supply • After the 2011 conflict oil and gas production resumed and returned rapidly to pre-revolution levels • However various militias and groups have been using oil installations to manipulate negotiations with central authorities • Causes significant disruptions • 2. Mobility and migration • Government is eager to enhance Libyan mobility through visa facilitation and exchange programs • However EU– with Italy and Malta in the lead wants to curb (irregular) migration from Libya • 3. Trade and investment • Around 70% of Libya’s oil and gas exports go to Europe and around 35% of its imports are from Europe • Some European companies are seeking payment for pre-2011 49 contracts in Libya that they claim not to have been paid for. Libya V • 4. Constitutional delays hurting business climate • The uncertainty surrounding the political process and the rule of law is impacting negatively on the economy • A particular concern for foreign investors. • The inability or unwillingness of the Libyan General National Congress (GNC) to review old laws and pass new legislation means investment climate not likely to improve for a year or two (until after elections) • GNC has yet to revoke a law inherited from Gadhafi regime which limits foreign ownership in a Libyan company to 49%. • Recent government efforts to induce foreign contractors to resume work by threatening to void old contracts without offering security and investment guarantees – very unattractive to companies. 50 Egypt I • Deteriorating economic conditions contributed to the 2011 uprising and remain an important element in the current political upheaval. • Widespread frustration with the government’s failure to create jobs, revive growth and address gaping inequalities • Led to overthrow of governments in 2011 and July 2013 • The risk of further disappointment remains high. • Several developments already likely; • Markets are very likely to remain on edge despite aid offers from several Gulf countries • Egypt’s credit rating unlikely to improve so long as external financing remains dependent on oil rich neighbors • A scarcity of foreign exchange is likely to lead to further 51 fuel and electricity shortages Egypt II • Toxic combination of economic distress and frustration with leaders’ inability to address poor living standards continues to be at heart of protest movements around world • Nowhere more evident than Egypt • While many of opposition’s complaints centered on Morsi’s perceived undemocratic governing style, the deteriorating economy has shared some of the spotlight • Power cuts, fuel shortages, and soaring food prices put pressure on the population • Tentative prospects for faster growth that had emerged earlier in the year now appear endangered • Morsi government had been predicting growth of 2% -now looks overly ambitious. 52 Egypt III • Economy struggling: • Power cuts still affecting production • Investment plans for both domestic and international players likely to remain on hold • Weak consumer confidence and hesitant tourists also factor into weaker growth outlook • Economy will have a hard time remaining in above zero growth. • At the same time • Unemployment a major challenge with jobless rate at 13% • New leaders will be challenged to provide support for the neediest • With a budget deficit that has not reached 12% of GDP little room for improving social safety nets 53 Egypt IV • External accounts which have been under pressure since 2011 uprising also likely to suffer • Capital flight likely to continue, draining international reserves. • Current account deficit had actually begun to show some improvement in early 2013 • However some of the improved tourism revenues could weaken once again if instability persists • International reserves dropped to 14.9 billion dollars in June – less than half their pre-uprising level • Continued downward pressure on reserves from capital flight may be mitigated by financial assistance from the Gulf States • Still Egypt’s continued reliance on one-off solutions is likely to continue to make markets nervous about the 54 country’s debt servicing capability. Egypt V • Many of Egypt’s current financial difficulties can be traced to subsidies • The country devotes around 10% of its GDP to subsidies for food and fuel – both of which it must import. • The subsidies as constructed are inefficient – do not just help the poor but also the middle class and businesses • Country has tried to remove subsidies before. Sadat tried and the result was riots in which 160 people died. • Subsidy reforms are also critical for attracting back private investment – • Will not happen unless IMF gives country a seal of approval which they insist require reforms • There are successful models – Iran substituted directed cash payments to the poor and let prices rise. • Egypt can’t afford cash payments, but ration coupons to the poor to purchase food at the subsidy price would be a good 55 alternative Egypt VI • Assessment; • Selection of Beblawi as interim prime minister signals the military’s understanding of the urgency of economic policy making • Beblawi is a strong component of phasing out subsidies and more free market policies • Progress in these areas could accelerate Egypt’s negotiations with the IMF • The proposed 4.8 billion dollar loan (and further 10.0 billion dollars in assistance contingent on the deal) remains on hold • The IMF will need to judge the government’s ability to implement and stick to subsidy reform • With an IMF program in place, the country would have the credibility and financing to begin reviving growth and job 56 creation. Egypt: RGE Forecast June 2013 57 RGE Risk Assessment June 2013 58 Yemen I • In 2011 Yemen experienced a serious political crisis that resulted in shortages of basic commodities • With the help of the GCC a national unity government was formed in December 2011 • Unlike other post-uprising countries, Yemen had no clear break with the former regime. • Instead of being overthrown, President Saleh agreed to step down in a transitional agreement • Effectively reduced his faction to same level as political rivals. • His continued presence and the political elite’s inability to settle long-standing grievances have created an atmosphere of uncertainty and crisis • Still, the IMF along with donor assistance from Saudi Arabia helped the authorities achieve macroeconomic 59 stabilization Yemen II • After contracting by more than 10 percent in 2011, the economy regained growth in 2012 (2.4%) • Inflation decelerated sharply, foreign exchange reserves increase and the exchange rate stabilized. • However fiscal deficit increased to 6.3% of GDP due to revenue loss caused by frequent sabotage of oil pipelines. • Despite progress made in macroeconomic stabilization Yemen continues to face serious challenges • The political consensus and security situation remain fragile • Poverty, malnutrition and unemployment are very high. • Social and environmental problems, notably water scarcity and food security will become more pressing in the next three to five years. • A failure to address these issues adequately and swiftly will shackle the government’s attempts to build a stable and secure Yemen • International aid organizations will face increased security problems – risk of kidnappings in delivering aid to local communities. 60 Yemen III • Complicating matters, as part of their Saudization process, 200,000 Yemeni workers were forced to leave the Kingdom in early July 2013 • Under Saleh, development was used as a political favor to be distributed to his allies and withheld from his foes • Created a policy of permanent crisis • Opened up space for alternative sources of authority to build up their own support networks • Government failure to provide adequate services has also exacerbated numerous problems • 1. Refugees • • • Rise of rebel groups has created hundreds of displaced persons (IDPs) with many moving toward Sana’a and others toward Aden Both cities are incapable of withstanding the stress Many IDPs housed in Aden schools preventing classes from being held 61 Yemen IV • 2. Power Outages • Capital’s residence continually frustrated by repeated electricity outages • Often stemming from attacks on power lines by tribesmen • Government appears powerless to bring the tribes under control • 3. Water scarcity • Yemen’s water situation, critical for years is growing more serious • Depletion has been gradual and people have been able to adapt to now. • Will be increasingly difficult in medium term • Already private companies and charitable organizing are providing water more frequently than the central government. • Water and land-related disputes result in about 4,000 deaths a year 62 Yemen V • 4. Food Security • Food security along with rising prices major problem across the country • Cost of basic foodstuffs such as flour and sugar rapidly pushing many Yemenis below poverty line • Malnutrition is further complicated by lack of adequate healthcare in most parts of country • 5. Fragile Economy • Underlying many of these problems is Yemen’s fragile economy • Economy has struggled to recover from protests that forced Saleh to step down in 2012 • Protests artificially inflated expectations to point that many in Yemen expected Saleh’s removal with a renewed economy • Disappointing of those hopes over past year has resulted in a growing disillusionment with the current government 63 Yemen VI • Assessment • Clearly the government will not be able to govern the country if it is unable to deal with these challenges. • Likely to grow more acute the longer they are left untreated • Already drift has set in as different regions of the country slip beyond government control • Even as the government attempts to reclaim territory its legitimacy is being undermined by its inability to provide and act as a sole source of authority. • Concerned with establishing itself politically government unlikely to adequately respond to challenges prior to parliamentary and presidential elections scheduled for February 2014 64 Yemen VII • To help overcome the country’s economic problems donors have pledged about $8 billion over the 2012-2014 period, including a $1 billion Saudi deposit at the Central Bank of Yemen • Main downside risks include • Deterioration in the political and security situation • Heightened social unrest, and • An unraveling in the country’s macroeconomic stance • While the upside risks -• Further progress made in terms of a national dialogue • An acceleration of donor disbursements including budget support to assist economic policies and reforms • Possible that an improvement in the oil and gas sectors could eventually boost production above projected rates 65 Syria I Destruction of the Economy • UN Estimates that 23,000 people have been killed • Economic losses estimated at $84.4 billion • Economy contracted by 31.4% in 2012; Unemployment more than 37.5% • Syrian economy traditionally been based on oil and agriculture • Both sectors seriously crippled and in disarray • The Syrian economy has been reliant for years on the state for coordination and economic management • All produce, both oil and agriculture is sold by individuals or companies to the state. • The State then exports or redistributes it amongst the Syrian people • With the on-going war, the Syrian government no longer fulfilling its distributional role • The distribution system has completely broken down 66 Syria II • Uncertainty rife and the population no longer trust the state to supply sufficient food • Hoarding of food is increasing • Caused food shortages • Significant inflation – Alepppo hyper inflation of 327% • Wide-spread starvation and deprivation amongst non-food producing element of the population • Oil industry also drastically affected by war • Western countries imposed sanctions on oil exports • Traditionally oil and gas revenues account for 20% of GDP and 25% of government revenues • Sanctions have dramatically reduced both • Estimates are the sanctions have cost the government $4 billion in low revenue 67 Syria III • Has led to a severe foreign currency crisis and suspension of debt servicing • The macroeconomic environment has essentially broken down • Sanctions also impacted economy by reducing imports • Syria net importer of gas and energy • Energy shortage worsened by destruction of infrastructure • Electricity and heating blackouts common • Taking a heavy toll on economic activity • While massive destruction of physical capital has occurred, greater loss may be in human capital • In addition to massive deaths, 311,000 have left the country – UN estimates this could increase to 710,000 by the end of 2013 • All this leaves Syria’s long-term economic future very bleak even if Assad is removed in the near future. 68 Syria IV As for the future: • More than half of the population will be dependent on aid by the end of 2013 • Increased government management of the war economy will have an adverse impact on the private sector • The regime will be forced to introduce more unpopular economic policies to reduce its increasing expenditure • The Syrian pound will keep declining rapidly • Financial support from Iran and other allies will provide life support to the economy in government controlled areas • Growing economic dependence on allies will • Improve economy’s ability to withstand further major shocks • Become a necessity for the regime’s survival 69 Syria V 70 Jordan I • In contrast to the other countries discussed above, Jordan has not had a regime change • In part, the country’s stability has been linked to the economy’s good performance • Jordan experienced a period of robust growth during 2000-09 (averaging about 6.5% per annum) • The economy is among the most open in the Middle East • Tourism receipts, remittances, FDI flows and external grants play an important role • Still there are problems • While the authorities have implemented structural reforms to develop the private sector, unemployment remains persistently high (13.7% over 2000-2012) • Unemployment is concentrated among the youth – ages 15-24 • This group accounts for about half the unemployed and their rate 71 of unemployment reached 29 percent in 2012 Jordan II • As elsewhere in the region discontent about the economy has contributed to protests in Jordan since the start of Arab Spring uprising • In 2011, King Abdullah responded by offering handouts and promising political reform • Since then several changes in prime minister but political reforms have made little progress. • The economy does have a number of vulnerabilities which create considerable uncertainty and tension. • Remittances 600,000 Jordanian working abroad bring in about 3.3 billion dollars a year (13% of GDP). -- Dependent largely on external conditions • Aid Jordan depends heavily on budget support from Saudi Arabia and the Gulf. Starting in a billion dollars a year for five years. U.S. aid about $660 million annually 72 Jordan III • Discontent amplified by anger about widening inequlity and perception privitaziations have enriched a few at expense of the many • Increasing doubt aboutgovernment’s sincerity over reform as it holds back from addressing core issues: • Corruption. Although the country compares favorably with most regional countries, public discontent has increased • Unemployment. Official data putit at 12.9% but the true level may be twice as high. • Public discontent about unemployment grown especially in rural areas where levels are higher and public sector salaries have stagnated relative to rising prices. • Dominance and success of Jordanian Palestinians in some parts of private sectors resented by some other Jordanians 73 Jordan IV • Assessment • Public discontent about the economy may feed into discontent about politics • The government will try to keep public attention on political reforms but it may also promise new increases in public sector salaries or spending if protests escalate. • However these are only sustainable with Gulf aid • • May not suffice to head off protests in the absence of credible reforms. Main problems • Country lacks the domestic revenue to sustain its institutions and has become entirely economically dependent on foreign aid. • Without any method of self sustaining growth, Jordan often forced to make unpopular decisions (subsidy reform) imposed by creditors (IMF). • Bouts of protests and uprisings show how vulnerable the state has 74 become Jordan III • Other Vulnerabilities • Energy Jordan imports almost all of its oil and gas needs. Gas imports from Egypt have been disrupted by attacks on the Siani pipeline • Forces Jordan to import more oil, country had to raise electricity prices • Syria Although Jordan has not imposed sanctions on Syria conflict causing problems by increasing cost of goods normally transited through Syria from Turkey • Country has been flooded with Syrian refugees • Discontent • Public discontent about economy and limited degree of democracy has caused protests from time to time along with demands for reform 75 Overall Assessment I At this point in time a number of generalizations are possible concerning the Arab Spring phenomenon: • 1. The Arab Spring was caused in part by economic underperformance and exclusion • 2. The uprisings ushered in new hope that • The economies of the region could be transformed • In ways that would provide greater and more widely shared opportunities for their people • Economic Performance • 3. Most transition countries have experienced a deterioration or stagnation in economic performance • 4. The extent and duration of such deterioration has varied by country • Libya recovered more rapidly due to oil revenues • Yemen supported by grants from Saudi Arabia stabilized quickly, 76 but with many problems remaining Overall Assessment II • 5. The economic conditions in transition countries have been and will continue to be affected to different degrees by combination of domestic and external factors • Political uncertainties and tensions – investment, tourism • Weak global growth and Eurozone crisis -- exports • Increases in global commodity prices -- food • Regional spillovers -- refugees • Reform Agenda • 6. A number of reforms needed to stabilize economies and deliver grater economic opportunities • Progress in the critical governance area slow or non-existent • More progress in macroeconomic stabilization but wealth created at micro level and little reforms in areas like labor markets, business environment 77 Overall Assessment III • 7. Progress on economic reforms needed to stabilize transition economies has been limited in view of challenging political conditions • Political rather than economic reforms have tended to dominate • Lack of focus on the urgency of economic challenges faced – Egypt • Where to go from here • 8. Influencing reform agenda remains main lever available to U.S. and international community. Priority areas: • Support and encourage IMF Stabilization Reforms • Strengthen investment climate (Doing Business)and inclusive private sector development • Focus on social protection as component of any reform • Encourage subsidy reforms • Governance reforms critical – anti-corruption, increased transparency critical to stronger economy 78 End • THANK YOU -- 79