Monetary Policy-Making Around the World - St. Louis Fed

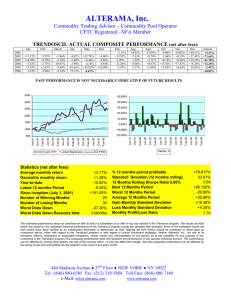

advertisement

Monetary Policy-Making Around the World: Different Approaches from Different Central Banks February 25, 2004 A Professor’s Guide to Economic Data and Monetary Policy Making Patricia Pollard Research Officer and Economist Federal Reserve Bank of St. Louis The views expressed do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis nor the Federal Reserve System Basic Data on Central Banks Number of Central Banks 200 171 173 172 173 173 173 173 162 149 150 136 109 100 75 55 50 36 18 20 1900 1910 40 24 0 1920 1930 1940 1950 1960 1970 1980 1990 1995 1996 1997 1998 1999 2000 2001 2002 Central Banks by Staff Size: 2002 5 Largest 5 Smallest Country Number of Workers Country Number of Workers China 150,000 Nauru 26 Russia 82,000 Brunei 28 Euro System 56,538 Comoros 37 India 29,922 San Marino 43 United States 23,438 Djibouti 51 Mean 3,304 Median 614 Source: Robert Pringle, editor, The Morgan Stanley Dean Witter Central Bank Directory, (London: Central Banking Publications), 2003. Monetary Policy Framework Instruments - Reserve Requirements - Official interest Rates - Open Market Operations - Direct Controls Operating Targets Intermediate Targets - Short-term Interest Rate - Reserve Aggregates - Monetary Aggregates - Inflation - Exchange Rate Goals - Price stability - Sustainable Growth - High Employment - Financial Stability Tactics Strategy Monetary Policy Framework • • • • • Institutional Arrangement Goals/Objectives Targets Instruments Policy making Process Institutional Arrangement • Who Determines the Framework? – Government – Central Bank – Interaction • Goal versus instrument independence Goals of Monetary Policy • What Can Monetary Policy Achieve? – Price Stability – Employment – Economic Growth Statutory Objectives of Central Banks (Bank of England Survey of 94 Central Banks) No statutory goals (3%) Monetary stability & conflicting (13%) Only non-monetary stability (1%) Only monetary stability (26%) Monetary stability & other non-conflicting (57%) Source: Mahadeva and Sterne (2000) Targets of Monetary Policy • What Do Central Banks Target? – Inflation Rate – Exchange Rate – Monetary Aggregates • Who Sets the Target? – Central Bank – Government – Both Explicit Targets and Who Sets Them: 1998 Survey of 93 Central Banks Inflation target (55) 17 Exchange rate target (49) 23 9 15 22 Monetary target (39) 14 28 4 10 1 5 No explict target (5) 0% Central Bank 20% Both Source: Mahadeva and Sterne (2000) 40% Government 60% Not Defined 80% 100% No explicit target Targets of Monetary Policy • Who Sets the Target? – U.S. – No targets set – Euro Area – ECB defines price stability • Below but close to 2 percent in medium term – England – Government • 2 percent – Canada – Government and Bank of Canada • 1 to 3 percent – Japan – Bank of Japan • Outstanding balance of current accounts at BOJ – 30 to 35 trillion yen Targets of Monetary Policy • Changes in Targets in 1990s – Increase in use of targets • In 1990 57 percent had an explicit target • In 1998 95 percent had an explicit target – Increased popularity of inflation target • 1990 – 5 countries set an inflation target – 1 country relied solely on an inflation target • 1998 – 54 countries set an inflation target – 11 countries relied solely on an inflation target Explicit Targets: 1990 and 1998 Inflation target (4) 3 Exchange rate target (31) 1990 1 17 (84 central banks) 14 Developing Advanced Monetary target (14) 4 10 No explict target (36) 32 0% Inflation target (54) 20% 40% 25 4 60% 80% 16 100% 1998 13 (93 central banks) Exchange rate target (50) 22 Monetary target (40) 18 0% 20% Source: Mahadeva and Sterne (2000) 13 14 40% Developing Transitional Advanced 15 60% 8 80% 100% Explicit Targets: 1998 and 2004 Inflation target (54) 25 Exchange rate target (50) 22 Monetary target (40) 18 16 13 15 14 No explict target (5) Inflation target (52) 20% 1 40% 60% 27 Exchange rate target (41) 80% 16 23 Monetary target (38) 19 100% 9 13 2004 5 14 No explict target (1) Developing Transitional Advanced 8 4 0% 1998 13 5 1 0% 20% 40% 60% 80% 100% Developing Transitional Advanced Instruments of Monetary Policy • Direct Controls – Set or limit prices (interest rates) – Set or limit quantities (amount of credit outstanding) • Indirect Controls – Adjust the underlying demand and supply of bank reserves Instruments of Monetary Policy • Reserve Requirements – Not used as a policy instrument in most countries – Bank of Canada does not set reserve requirements – Bank of England sets a cash ratio deposit, not for policy purposes. – Federal Reserve, ECB and BOJ all set reserve requirements Instruments of Monetary Policy • Open Market Operations – Federal Reserve • Uses open market operations to meet the target for fed funds rate • Once a day • Repurchases – overnight to 3 months – European Central Bank • Minimum refinancing rate sets lower bound for repurchases • Once a week • Repurchases – 14 days – Bank of England • Repo rate is the rate at which BOE provides liquidity to the interbank market, sets the Sterling Overnight Interbank Average Rate (SONIA) • Several times a day • Repurchases – 14 days Instruments of Monetary Policy • Open Market Operations – Bank of Japan • Uses open market operations to meet target for the outstanding balance of current accounts held at the Bank of Japan • Two to three times a day • Repurchases and outright purchases • Repos range from 7 days to 6 months – Bank of Canada • Uses open market operations to keep the target for overnight rate within a 50 basis point band • Once a day if rate is straying from the target • Repurchases – overnight Instruments of Monetary Policy • Standing Facilities – Facilities that allow financial institutions to borrow directly from the central bank • Provide upper bound for official interest rate target – May allow for lending to the central bank • Provide lower bound for official interest rate target – Activated on demand by market participants – Typically overnight loans only Instruments of Monetary Policy • Standing Facilities: Central Bank Lending – Federal Reserve • Primary Discount Rate – Penalty rate, set at 100 basis points above fed funds rate target – European Central Bank • Marginal Lending Rate – Penalty rate, since April 1999 has been set at 100 basis points above the main refinancing minimum bid rate – Bank of England • No typical lending rate • Late overnight repo facility, penalty rate set at 100 basis points above the repo rate Instruments of Monetary Policy • Standing Facilities: Central Bank Lending – Bank of Japan • Basic Loan Rate (Discount Rate) – Penalty rate, with additional penalties for frequent borrowers – Bank of Canada • Bank Rate – Penalty rate, set at 25 basis points above the target for the overnight rate Instruments of Monetary Policy • Standing Facilities: Central Bank Deposits – Federal Reserve • No interest on deposits at the Federal Reserve – European Central Bank • Deposit Rate – Since April 1999 has been set at 100 basis points below the main refinancing minimum bid rate – Bank of England • No interest on deposits at the Bank of England – Bank of Japan • No interest on deposits – Bank of Canada • Deposit rate set at 25 basis point below the target for the overnight rate ECB Key Interest Rates January 1, 1999 – February 23, 2004 Percent 5.50 Marginal Lending Rate 5.00 4.50 4.00 3.50 3.00 2.50 2.00 Refinancing Rate Deposit Rate 1.50 1.00 0.50 Apr-04 Jan-04 Oct-03 Jul-03 Apr-03 Jan-03 Oct-02 Jul-02 Apr-02 Jan-02 Oct-01 Jul-01 Apr-01 Jan-01 Oct-00 Jul-00 Apr-00 Jan-00 Oct-99 Jul-99 Apr-99 Jan-99 Bank of Canada Key Interest Rates January 1, 1999 – February 23, 2004 Percent 6.00 Bank Rate 5.50 5.00 4.50 4.00 Deposit Rate 3.50 3.00 Overnight Rate Target 2.50 2.00 1.50 Apr-04 Jan-04 Oct-03 Jul-03 Apr-03 Jan-03 Oct-02 Jul-02 Apr-02 Jan-02 Oct-01 Jul-01 Apr-01 Jan-01 Oct-00 Jul-00 Apr-00 Jan-00 Oct-99 Jul-99 Apr-99 Jan-99 Federal Reserve Key Interest Rates January 1, 1999 – February 20, 2004 Percent 7.00 6.50 6.00 5.50 5.00 4.50 Discount Rate 4.00 3.50 3.00 Fed funds target 2.50 2.00 1.50 1.00 0.50 Apr-04 Jan-04 Oct-03 Jul-03 Apr-03 Jan-03 Oct-02 Jul-02 Apr-02 Jan-02 Oct-01 Jul-01 Apr-01 Jan-01 Oct-00 Jul-00 Apr-00 Jan-00 Oct-99 Jul-99 Apr-99 Jan-99 ECB Key Interest Rates January 1, 1999 – February 23, 2004 Percent 5.50 Marginal Lending Rate 5.00 4.50 4.00 3.50 3.00 EONIA Refinancing Rate 2.50 2.00 Deposit Rate 1.50 1.00 0.50 Apr-04 Jan-04 Oct-03 Jul-03 Apr-03 Jan-03 Oct-02 Jul-02 Apr-02 Jan-02 Oct-01 Jul-01 Apr-01 Jan-01 Oct-00 Jul-00 Apr-00 Jan-00 Oct-99 Jul-99 Apr-99 Jan-99 Bank of Canada Key Interest Rates January 1, 1999 – February 23, 2004 Percent 6.00 Bank Rate 5.50 Overnight Repo rate 5.00 4.50 4.00 Deposit Rate 3.50 3.00 Overnight Rate Target 2.50 2.00 1.50 Apr-04 Jan-04 Oct-03 Jul-03 Apr-03 Jan-03 Oct-02 Jul-02 Apr-02 Jan-02 Oct-01 Jul-01 Apr-01 Jan-01 Oct-00 Jul-00 Apr-00 Jan-00 Oct-99 Jul-99 Apr-99 Jan-99 Federal Reserve Key Interest Rates January 1, 1999 – February 20, 2004 Percent 7.50 7.00 6.50 Fed funds target 6.00 5.50 5.00 4.50 Fed funds rate 4.00 3.50 Discount Rate 3.00 2.50 2.00 1.50 1.00 0.50 Apr-04 Jan-04 Oct-03 Jul-03 Apr-03 Jan-03 Oct-02 Jul-02 Apr-02 Jan-02 Oct-01 Jul-01 Apr-01 Jan-01 Oct-00 Jul-00 Apr-00 Jan-00 Oct-99 Jul-99 Apr-99 Jan-99 Monetary Policy Process • Who Makes the Policy Decisions? – Individual (9) – Committee (79) • Consensus (43) • Formal Vote (36) – Individual votes published (6) » Japan, Korea, Poland, Sweden, United Kingdom, United States Monetary Policy Process • Who Makes the Policy Decisions? – Number of People on Policy Board/Committee • • • • • • Most common is between 5 and 10 members FOMC -- 12 members (19 participants) ECB -- 18 members Bank of England -- 9 members BOJ -- 9 members Bank of Canada -- 6 members Members of Policy Board 60 50 40 55 30 20 10 0 19 Less than 5 5 to 10 8 More than 10 Monetary Policy Process • How Frequent Are the Policy Meetings? – – – – – – – 40 percent meet monthly 34 percent meet weekly FOMC – 8 times a year ECB -- Monthly Bank of England -- Monthly BOJ – 15 times a year? Bank of Canada – 8 times a year Frequency of Policy Board Meetings Frequency # of CBs Less than quarterly 1 Quarterly 4 More than quarterly 2 Monthly 36 Fortnightly 8 Weekly 30 Twice per week 4 Daily 4 Source: Mahadeva and Sterne(2000) Monetary Policy Process • How Frequent Is the Main Instrument Changed? – Much variation in the frequency with which the main policy instrument is changed. – Average changes per year 1999-2003 • • • • FOMC – 3.8 ECB – 3.0 Bank of England -- 3.6 Bank of Canada – 4.6 Number of changes per year 25 20 15 10 18 15 5 0 18 23 3 0-1 2 3-4 12 or less > 12 Monetary Policy Process Number of Changes in Main Policy Instrument 1999-2003 Year FOMC ECB BOC BOE 1999 3 2 3 6 2000 3 6 3 2 2001 11 4 9 7 2002 1 1 4 0 2003 1 2 4 3 Total 19 15 23 18 Source: Federal Reserve Board Oct-03 Jul-03 Apr-03 Jan-03 Oct-02 Jul-02 Apr-02 Jan-02 Oct-01 Jul-01 Apr-01 Jan-01 Oct-00 Jul-00 Apr-00 Jan-00 Oct-99 Jul-99 Apr-99 Jan-99 Changes in the Main Policy Instrument FOMC – Federal Funds Rate Target 7 6 5 4 3 2 1 0 Source: Bank of England Oct-03 Jul-03 Apr-03 Jan-03 Oct-02 Jul-02 Apr-02 Jan-02 Oct-01 Jul-01 Apr-01 Jan-01 Oct-00 Jul-00 Apr-00 Jan-00 Oct-99 Jul-99 Apr-99 Jan-99 Changes in the Main Policy Instrument Bank of England – Repo Rate 7 6 5 4 3 2 1 0 Source: Bank of Canada Oct-03 Jul-03 Apr-03 Jan-03 Oct-02 Jul-02 Apr-02 Jan-02 Oct-01 Jul-01 Apr-01 Jan-01 Oct-00 Jul-00 Apr-00 Jan-00 Oct-99 Jul-99 Apr-99 Jan-99 Changes in the Main Policy Instrument Bank of Canada – Bank Rate 7 6 5 4 3 2 1 0 Source: Eurostat Oct-03 Jul-03 Apr-03 Jan-03 Oct-02 Jul-02 Apr-02 Jan-02 Oct-01 Jul-01 Apr-01 Jan-01 Oct-00 Jul-00 Apr-00 Jan-00 Oct-99 Jul-99 Apr-99 Jan-99 Changes in the Main Policy Instrument European Central Bank – Main Refinancing Rate 7 6 5 4 3 2 1 0 Monetary Policy Process • Transparency – Are changes in policy announced? – Is the vote published? – Are minutes of the policy meeting released? Monetary Policy Process Indicators of Transparency FOMC Announcement Immediately Vote Published Immediately Minutes Released •No vote is taken. Thursday after next scheduled meeting ECB BOC Immediately Immediately No* No BOE Immediately No With minutes No Two weeks after meeting Want to Learn More? • Central Bank Websites – Bank of Canada • www.bankofcanada.ca/en – Bank of England • www.bankofengland.co.uk – Bank of Japan • www.boj.or.jp/en – European Central Bank • www.ecb.int – Federal Reserve System (Board of Governors) • www.federalreserve.gov – Links to the website of most central banks can be found on the website of the Bank for International Settlements • www.bis.org/cbanks.htm Want to Learn More? • Books and Articles – Alexander, William E., Tomas J.T. Balino, and Charles Enoch, “The Adoption of Indirect Instruments of Monetary Policy, IMF Occasional Paper No. 126. – Bank for International Settlements, “Comparing Monetary Policy Operating Procedures Across the United States, Japan and the Euro Area,” BIS Papers No. 9, December 2001. – Mahadeva, Lavan and Gabriel Sterne, editors. Monetary Policy Frameworks in a Global Context. Routledge Publishers: New York, 2000. (http://www.bankofengland.co.uk/ccbs/publication/pdf/mpfagcabstra ct.htm – Paulin, Graydon, “The Changing Face of Central Banking in the 1990s,” Bank of Canada Review, Summer 2001. Want to Learn More? • Books and Articles – Pollard, Patricia S. “A Look Inside Two Central Banks: The European Central Bank and the Federal Reserve.” Federal Reserve Bank of St. Louis Review. January/February 2003. (research.stlouisfed.org/publications/review/03/01/Pollard.pdf) – “Central Banking in Other Industrialized Countries, Federal Reserve Bank of Boston, New England Economic Review, Second Quarter 2002. (http://www.bos.frb.org/economic/neer/neer2002/index.htm#2)