NYSSA Investment Challenge

advertisement

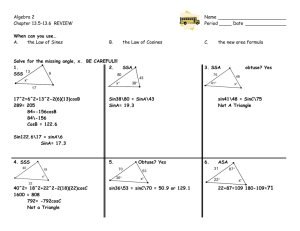

Team 5 Student Research Internet Software and Services Industry This report is published for educational purposes only by students competing in the CFA Institute Research Challenge. Sina Corporation Ticker: ● NASDAQ: SINA Price: ● $56.27 (10/26/12) Date Recommendation: ● Hold Price Target: ● $53.98 Earnings/Share Mar. Jun. Sept. Dec. Year 2008A 2009A $0.25 0.18 $0.40 0.25 $0.34 0.31 $0.45 6.55 $1.44 7.53 2010A 2011A 0.40 0.24 0.41 0.15 0.51 (5.10) (1.62) 0.14 (0.31) (4.64) P/E Ratio N/A N/A N/A N/A Highlights Sina’s revenue is driven mainly by online advertisement, with that making up about 80% of their revenue. The rest of Sinas revenue is comprised of services through MVAS. Weibo dominates the Chinese micro-blogging and social networking market with a user network of over 350 million people. Sina and Weibo boosts its revenue from advertisements, rechargeable games, rechargeable e-mail box, downloadable resource, online TV, efficient search engine, management fee from Web Log and network community, and income from renting online shops. All of these are based on the high CTR and awareness. At the same time, the convenience and quick way of payment on websites also attracts more users. GIS Daily Stock Price $60 $50 $40 $30 $20 $10 $0 Market Profile 52 Week Price Range Average Daily Volume $91.11$43.12 3,716 m Beta 1.46 Shares Outstanding 66.3m Market Capitalization 3758.5m Dividend Yield N/A Average Volume 2.49 Book Value per share 17.07 Return on Equity -24.4% UT Dallas - SMIF 2012 Business Description Sina Corporation was found in November 1998 through the merger of Beijing SINA Information Technology Co. Ltd. and California-based SINANET.com. In April 2000, Sina Corporation went public and was listed on the NASDAQ stock exchange in the United States. Sina Corporation offers differentiable Internet content and services in each of its region-specific websites to target global Chineses communities. As the result, Sina’s user bases increased tremendously becoming one of the top four online media companies. Sina Corporation provides five main online services for Chinese commities around the globe— SINA.com, SINA.cn, Weibo.com, MVAS, and other businesses and prodoucts. Among these services, Sina earns around 80% of its revenue from online advertising and the remaining from the mobile value added services. Sina’s Five Major Business Lines SINA.com is an online media platform, serving China and the global Chinese communities. The platform offers various online channels throughout the world, including SINA Sport, SINA Finance, SINA Technology and etc… Each channel consist of Chinese-language news, contents and the built-in search engine for users to experience various services. SINA.com also provides advertising services that allow business to display their advertisement on pages within the website. SINA.cn provides professional information and entertainment through its SINA portal via mobile users, which is customized with Wireless Access Protocol (WAP). The instant news brings conveniency to the people on-the-go, with key channels like SINA Finance, SINA Sport, SINA Technology and etc… Weibo.com is a microblogging service, and is considered to be one of the most popular social media sites that is used frequently by Chinese communities around the world. Since Weibo.com launched in 2009, registered users continuously increased by the millions. Unlike other social networking sites, Weibo is widely used by Chinese communites, celebrities, businesses and government entities. As a highly influential medium, Weibo users are allowed to send a maximum 140 words of Chinese characters to discuss their valuable thoughts online that were usually prohibited in the past. MVAS (Mobile value-added services) is an online subscription service that enables subscribers to enjoy its three main services— News and Information, Community, and Multimedia Download through multiple platforms such as SMS, KJAVA, MMS and etc.. Other businesses and products such as SINA’s game channel, gives access to online games, email services, which support both post office protocol 3 (POP3) and simple mail transfer protocol (SMTP) access. Plus antivirus protection, enterprise services that assist small businesses and government organization to interact with their target audience efficiently, blog, eReading and classified Advertising. Industry Overview and Competitive Positioning Macro Economic Analysis: GDP In 2011 China’s Gross Domestic Product (GDP) was 7.3 trillion dollars. It is currently maintaining a steady growth rate 2.2%, which ia indicating an above average growth rate when compared amongst other nations. China’s Gross National Product (GNP) was 11.33 trillions dollars in 2011, which suggest that in the next several years Chinas GDP has the capability of surpassing the United States. Inflation The inflation rate of China between the years of 1994 and 2012 has averaged around 4.3%. This number is quite sustainable considering the fact that in 1994 the inflation rate hit an all time high of 27%. Currently in China the inflation rate sits at about 2%, which is about the same rate the we face here in the United States. Political Restrictions Government in China controls almost all aspects of life, and political restrictions are found playing a major role in the economy. China has the largest and most vast Internet cencorship. It has over 2 UT Dallas - SMIF 2012 sixty internet regulations and is more extensive and more advanced than any other country. A broad overview of some of these regulations include: making falsehoods, distorting the trth, spreading rumors, destroying the order of society, promoting feudal superstitions, sexually suggestive material, gambling, violence etc… Marketing in China is another major political restriction. The Chinese government has put in place specific rules that protect their domestic industries. By not allowing companies to compare their products with domestic companies, nor should they be allowed to have any superlatives in them. Industry Analysis: Political Restrictions in China With an estimated 485 million or more Internet users, China dominates the largest Internet population in the world. Since Facebook, Twitter and most of the social networks are banned in China where media has proven insufficient, Weibo.com has widely been used in China. (Bloomberg: Janco Partners) Internet Software and Service Industry Companies in the Internet Software and Service industries, such as Sina, develop and market internet software, and provide internet services including: online databases, interactive services, web addresss registration services, database construction and internet design services. This industry belongs to the Information Technology Sector which is currently one of the largest ten sectors in the S&P 500 with a sector weight 20.13%. There are five main external factors that affect sales and profitability in the IT sector. These five factors are technology, government, social changes, demographics and foreign influence. The technology of the product is the most important factor that affects consumers demand. In other words, the tastes and preferences of consumers are an important determinant of the demand in this industry. The Internet software and service industry is the fastest growing segment of the software industry. In the short-term, economic growth encourages new companies to enter into the market; on the other hand, the firms can easily exit the industry since the fixed costs are low when economy goes downward. In the long run, the firms are making exctly zero economic profits. Therefore, Sina is within an industry that is rather unpredictable or benifitial. For instance, Google makes people easy to search information online, while sina make people easy to communicate with each other by its well-known social newtwork— Weibo. Online Advertising Industry Sina has a strong online advertising business. During the third quarter of 2012, Sina generated a stable online ad business compared to other competitors. Such success might be due to increasing contribution from Weibo, strength in FMCG, Internet and Olympic campaigns. Furthermore, video ads continued to grow 126% year over year. Overall, China’s social ad market (3.5% of online ad in 2012) is still in the early stage compared to US’s (7.6% of online ad in 2011). (Sina Corp: Weibo monetization emergin in shap) Social Network: Weibo Dominates Chinese Social Sina launched Weibo.com, which is the largest micro-blogging network within Chinese community globally. Registered users continuously increased to 368 million at the end of quarter 2, 2012. Weibo contribution and multiple monetization channels have Company expects Weibo advertiser number to double by end of 2012. Weibo’s monetization channels include promotion tweets, non-ad Weibo revenue from third party apps and games sharing, self-service ad platform, and paid membership. (Sina Corp: Weibo monetization emergin in shap) Competition Analysis: 3 UT Dallas - SMIF 2012 SWOT Analysis: By examining Sina Corporation through SWOT Analysis, Sina tends to favor Chinese social networking users with its unique and successful microblogging site called Weibo, which generate more than 10 % of its total advertising revenue and has established a strong brand image in the social networking market. Furthermore, Sina is an Internet based company with no inventory concerned, and has a continuously increasing revenue, which have built up its internal strength. However, Sina’s recent stock share price has droped dramatically that might mainly caused by an unstable management team, negative net income and earning per share. Although the revenue growth eventually have helped boost Sina’s earning per share, the company has also generated large amount of expenses that have made its net income negative since 2010. These unfavorable situations become Sina’s biggest weaknesses and slow down its business growth. As a one of the top leaders in the Internet software and services industry, Sina apparently has significant advantages over its competitors while they try to overcome with its competitive disadvantages. Indeed, Sina successfully dominates microblogging market in China and Chinese communites around the world as social network uses increased globally. As a result, Weibo becomes Sina’s opportunity to continuously stand on top of the competitive Internet market. To be able to sustain its competitive advantage, Sina must develop solutions to eliminate the external threats such as governemt controls over its online services. Yet Sina leads the trend of social network in China, however, the government regulations in China have made the Internet based business more difficult to operate under government censorship. Moreover, the threats may also come from its competitors, such as Sina appears to be less competitive in providing online games, search engines and some other services compared to the major competitors like Baidu. Porter Five Forces Analysis: Additionally, we use Porter Five Forces to analyze Sina Corporation in order to determine profibility level of the company. “Moderate” Threat of New Entrants In the Internet software and services industry, the companies are able to reach customers (or in other words, the online users) in any distance easily without large costs, that indicates low economic of scale to the new entrants. Since Sina Corp. mainly operates within Internet industry in China, there will be other concerns over government regulation barriers, which make it harder to enter the Internet market. “Low” Bargining power of suppliers Suppliers in the Internet software and servies market are large in numbers, and offer smiliar enterprise solutions that are substitutable; moreover, the switching costs of suppliers are relatively low, so they have low bargaining power over Sina. “Low” Bargining power of Buyers Buyers in this industry are considered the Internet users. Although the switching cost from Sina to other Internet service providers are almost zero, Sina still holds huge power over the buyers (or Internet users) since they have a high customer loyalty on its social networking service— Weibo. “Moderate to High” Threat of Substitutes Internet users have the power to choose the online services and sites that are most attractive and benifitial to them with low or zero cost of switiching between the services. One of the biggest advantages Sina has is that millions of Sina Weibo users have already adopted to its uniqe microblogging services. Therefore, it’s unusual for them to look for substitutes. “Moderate” Intensity of rival Among numerous competitors in the Internet software and service industry, Sina has sustained competitive advantage by its Weibo, which highly differentiate from other social networking sites and possess majority of the social network users in China. Look into Sina’s internal business, however, they tend to Numerous competitors *Moderate expenses and zero storage cost *High differentiation for certain products but low switching costs. Investment Summary Sustainable business model The business model of Sina is the information model. It is mainly through different kinds of free 4 UT Dallas - SMIF 2012 information, hot news and the service to attract a lot of visitors and then form a fixed customer base. Sina keeps a high CTR and awareness so that it attracts enterprises to advertise on Sina to advertise their products continuously. And the great income of advertisements is far more than the cost of free information, news and the service. This business model causes the three win situation including Sina’s profit, the enterprises’ increasing awareness and the viewers’ free service. China is rapidly growing The GDP in China increases continuously, from 39,798,300 millions in 2010 to 47,288,200 millions in 2011. The increasing in economics in China allows more enterprises to advertise their products by using internet. It is a huge chance for Sina to increase its clients and income. In the end, Sina increases its profitability from the rapidly growing economics indirectly. Revenue boosted Sina and Weibo boosts its revenue from advertisements, rechargeable games, rechargeable e-mail box, downloadable resource, online TV, efficient search engine, management fee from Web Log and network community, and income from renting online shops. All of these are based on the high CTR and awareness. At the same time, the convenience and quick way of payment on websites also attracts more users. Losing money Although Sina has a high total revenue, its investment impairment is 281,548,000 USD. The major of the investments is the company restructured its real estate and home decoration channels and related business into a new subsidiary. Government role and political restrictions All of the companies in China can be controlled by the government besides Sina. Now Chinese government does not allow people to use facebook and twitter in mainland. So, Sina has few competitors. If the government changes the rule, Sina will face a difficult change because facebook and twitter are used by people all over the world and only Chinese use Sina Weibo. Now Sina operates its main businesses through companies with which it has contractual relationshi ps but in which it does not have controlling ownership. If the government determines that Sina’s agreements with these companies are not in compliance with applicable regulations, Sina’sb usiness in could be adversely affected. SINA Corporation-Share Pricing Source: www.capitaliq.com 5 UT Dallas - SMIF 2012 Etiam id commodo tellus. Sed tortor magna, sodales sit amet vestibulum in, ultricies at est. Sed sagittis viverra ante, eu euismod arcu accumsan sit amet. Etiam volutpat auctor turpis id rutrum. Maecenas convallis aliquam pharetra. Duis elit odio, iaculis id fringilla ac, dapibus sed purus. Sed ornare consectetur nibh eu fermentum. Quisque quis elit justo, non pulvinar quam. Valuation Five-Year Projected Cash Flow Assumptions EPS is forecasted to be positive as a result of increasing sales, increasing margins, and the losses of investments may not as large as the losses in 2011. Sales forecast The five-year projected cash flows are derived from increasing sales, from its increasing Weibo ad revenue. The number of people who use Weibo grows from 100 million in 2011 to 300 million in 2012. The large amount of users will attract more companies’ investments which lead to the rising of Sina ad revenue. And the number of people who use Weibo users may grow slow down in the next several years. Therefore growth is expected to continue, albeit may more quickly from 2012 and more slowly from 2013-2016. The risk of Sina comes from the competitors because they can vie for the investors. As a result, sales are expected to grow at the rate of 28.03% CAGR over the next five years. SG&A Decline while Sales Growth SG&A to sales revenue is expected to decline within the next 5 years. This is possible because Sina’s revenue is growing with a 12-13% growth rate, and expenses will remain stable and may even decrease. This is possible because Sina is a web based company. Gross margins Gross profit exhibits a steady and stable strong fundamental. Because of the huge number of users, the Gross profit may increase over the next five years. At the part of advertising, the changes in advertising gross margin in 2011 and 2010 were due to increases in advertising revenues without proportional changes in costs. Sina expects to increase its investment in absolute dollars terms in web content, Internet connection and production costs to maintain its market position. At the part of non-advertising, non-advertising gross margin decreased as a result of declining MVAS gross margin, which decreased 6% in 2011 and 10% in 2010. The year-over-year declines in MVAS gross margin in 2011 and 2010 were due to decreases in MVAS revenues. But, MVAS providers are willing to accept lower revenue shares to acquire marketing channels and MVAS content and operators are increasing their revenue share for new MVAS offerings. Cost of Equity To measure the Cost of Equity, we use CAPM model with 20 years government bond risk-free rate of 2.55% (Data from Bloomberg), risk premium of 6.35% (Data from Damodaran) and the company’s beta of 1.46 (Data from Capital IQ). The Cost of Equity will be approximately 11.82%. Financial Analysis Earnings E 2009 2010 2011 a Gross profit 55.86% 58.32% 55.41% r Earning is considered to be of high quality if it is likely to be persistant in the future. One method of assessing earning quality is the comparison of earnings with cash flow from operations. High reported earnings that is not accompanied by high cash flow from operations is in general unlikely to persist; Comparing with 3 years, the highest cash flow from operations appears in 2010 and the lowest cash flow from operations appears in 2011. In 2011, the major reason of low cash flow from operations is the buildup in its accounts receivables and the decline in its net income. In 2010, the major reason of high cash flow from operations is the decline in prepaid expenses and other assets and the buildup in Income taxes payable. Sina would have to be highly profitable if the company had been able to grow is net revenues without high Operating expenses and investment impairment. 6 UT Dallas - SMIF 2012 Cash Flow Operating In Millions Net cash flow from operating activities Influences: -industry features -stage of development -business strategy -related transactions 2009 2010 2011 98.1 116.6 66.5 2009 2010 2011 111.7 -235.9 -218.2 Investing In Millions Net cash flow from investing activities The Net cash flow from investing activities decrease. The major reason is high Purchases of short-term investments and Investments and high prepayments on equity investments. The Influences of cash flow from investing activities are: -The change of the market share -The processing of fixed assets Financing In Millions 2009 2010 2011 Net cash flow from 155.3 12.0 13.5 financing activities The Net cash flow from investing activities decrease. The major reason is Repurchase of ordinary shares and Proceeds from issuance of ordinary shares pursuant to private equity placement are zero. The Influences of cash flow from investing activities are: -Financing environment -Financial ability Balance Sheet & Financing 2009 2010 2011 Crrunt ratio 4.09492 4.065296 4.125561 Quike ratio 4.09492 4.065296 4.125561 Total liability/total assets ratio 24.23% 24.19% 23.64% ROE=Net income/SH 33.70% -1.54% -28.43% Profit margin 1.15 -0.05 -0.6 Totle Assets Turnover 0.247131 0.318932 The ROE of Sina has declined significantly in 2010 and 2011. On examining the three component ratios of ROE(profit margin, assets turnover and financial leverage), we see that the decline in profit margin seems to be the biggest contributor to the decline in ROE. This decline in profit margin is most likely due to the investment impairment. Sina net revenues had been growing rapidly in the prior years, and so the management may have expected that the sales would grow at the same rate in 2012. Since Sina does not have debt, the buildup in assert turnover may be a result more efficiently. Potential Competitive Advantages of Sina Corporation Sina contracts with many partners for rights to display their content on Sina websites. Some of Sina’s leading providers include the International Olympics Committee, NBA, English Premier League, National Football League, PGA Tour, Associated Press, and many more. Sina has also established partnerships with certain International record companies to provide image and music downloads. 7 UT Dallas - SMIF 2012 Sina Corp. has also made an agreement with Apple as of 2012 providing that Sina Weibo be integrated in Apple’s new iOS 6 software. This is a big move considering Sina is not thought to be common among English speakers, even though SINA does have an English setting. Investment Risks Operational Risks: Internet system and potential risks of disasters Since Sina Weibo became one of the powerful social networking services within Chinese community, any technical problem and disrupted system may cause serious losses to Sina corp. and other businesses that depend on its Weibo ads. Security measure of confidential personal information While Internet security and privacy are always two biggest concerns from Internet users, potential risk of Sina may be leak of users’ online information. With over 300 millions of Weibo user accounts in the system, Sina is responsible for safeguarding personal information. Once Sina’s databases get hacked, millions of users’ information may leak out; and may result in losing trust by Sina’s users. Competition Risks: Rising social networking companies Sina has competitors across different areas of Internet service providers. Every competitor tends to provide similar online services in such competitive industry. Fortunately, Sina dominates social networking market within Chinese communities by its successful microblogging services called Weibo. Registered users of Weibo have increased dramatically, and other rivals started to imitate and unveil their own social networking services. One of the biggest competitors of Sina Weibo is Tencent’s Weibo. Since Tencent is known as the largest provider of messaging computer program in China who currently holds over 771.7 million active user accounts, they try to link its messaging computer program with the new Tencent Weibo to inform millions of users about its new microblogging site. As a result, Sina Web users who also have a messaging program account with Tencent may switch to Tencent Weibo, due to convenient purpose and zero switching costs. Regulatory Risk: On the Index of Economic Freedom China has a score of 51.2 for 2012, ranking as the 138th freest economy in the world. Its overall score is down .8 points since 2011 reflecting worsening performance because of business freedoms. It is ranked 30th out of all 41 Asia-Pacific nations, and is ranked lower than their global and domestic counterparts score averages. In China the Judicial system is very vulnerable to political influences and Communist party directives. Because of this vulnerability, intellectual property rights are not protected effectively, and infringements on copyrights, patents and trademarks are quite common. The government in China also owns all financial institutions which allow the government to monitor and control all transactions that take place with any business. They also favor lending according to state priorities, directives and large state enterprises. Macro Risks: Chinas economy is growing rapidly with a 10 percent growth rate, but is unstable at times because of government interventions. Macro-control is a policy introduced in 1993 by Zhu Rongji and refers to the use of direct government intervention by the control of direct government to cool down the overheated economy. The policies include constrains to monetary policies, suppress real estate and stock markets, control inflation, lower supplies of raw materials and reduce domestic consumption. 8 UT Dallas - SMIF 2012 Appendix: Appendix 1: Revenue Growth Rate Appendix 2:WACC Appendix 3: Ebitda Multiple Method 9 UT Dallas - SMIF 2012 Appendix 4: Perpetuity Growth Method Appendix 5: Implied EBITDA Terminal Multiple Appendix 6: Implied Perpertuity Growth Rate Appendix 7: Five Major Business Lines 10 UT Dallas - SMIF 2012 11 UT Dallas - SMIF 2012 12 UT Dallas - SMIF 2012 13 UT Dallas - SMIF 2012 14 UT Dallas - SMIF 2012 15 UT Dallas - SMIF 2012 16 UT Dallas - SMIF 2012 Disclosures: Ownership and material conflicts of interest: The author(s), or a member of their household, of this report [holds/does not hold] a financial interest in the securities of this company. The author(s), or a member of their household, of this report [knows/does not know] of the existence of any conflicts of interest that might bias the content or publication of this report. [The conflict of interest is…] Receipt of compensation: Compensation of the author(s) of this report is not based on investment banking revenue. Position as a officer or director: The author(s), or a member of their household, does [not] serves as an officer, director or advisory board member of the subject company. Market making: The author(s) does [not] act as a market maker in the subject company’s securities. Ratings guide: Banks rate companies as either a BUY, HOLD or SELL. A BUY rating is given when the security is expected to deliver absolute returns of 15% or greater over the next twelve month period, and recommends that investors take a position above the security’s weight in the S&P 500, or any other relevant index. A SELL rating is given when the security is expected to deliver negative returns over the next twelve months, while a HOLD rating implies flat returns over the next twelve months. Disclaimer: The information set forth herein has been obtained or derived from sources generally available to the public and believed by the author(s) to be reliable, but the author(s) does not make any representation or warranty, express or implied, as to its accuracy or completeness. The information is not intended to be used as the basis of any investment decisions by any person or entity. This information does not constitute investment advice, nor is it an offer or a solicitation of an offer to buy or sell any security. This report should not be considered to be a recommendation by any individual affiliated with [Society Name], CFA Institute or the CFA Institute Research Challenge with regard to this company’s stock. 17