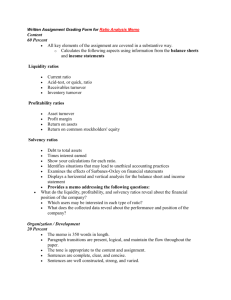

Financial Ratios Profitability Ratios

advertisement

17-1 Fundamentals of Corporate Finance Second Canadian Edition prepared by: Carol Edwards BA, MBA, CFA Instructor, Finance British Columbia Institute of Technology copyright © 2003 McGraw Hill Ryerson Limited 17-2 Chapter 17 Financial Statement Analysis Chapter Outline Financial Ratios The DuPont System Analysis of the Statement of Cash Flows Using Financial Ratios Measuring Company Performance The Role of Financial Ratios copyright © 2003 McGraw Hill Ryerson Limited 17-3 Financial Ratios • Introduction Public companies have a variety of stakeholders: Shareholders, bondholders, bankers, suppliers, employees, managers, etc. These stakeholders need to monitor how well their interests are being served. They do so by analyzing the company’s periodic financial statements. copyright © 2003 McGraw Hill Ryerson Limited 17-4 Financial Ratios • Introduction Analysts use financial ratios to summarize large volumes of accounting information. This allows them to assess the firm’s overall performance and its current financial standing. It also allows them to compare firm performance. copyright © 2003 McGraw Hill Ryerson Limited 17-5 Financial Ratios • Introduction You will discover that many of the ratios described in this chapter may be defined in several different ways. There is no law stating how they should be defined. Thus, you should never accept a ratio at face value without understanding exactly how it was calculated! copyright © 2003 McGraw Hill Ryerson Limited 17-6 Financial Ratios • Introduction This chapter will describe four types of financial ratios: 1. Leverage ratios – show how heavily a company is in debt. 2. Liquidity ratios – measure how easily a firm can lay its hands on cash. 3. Efficiency or Turnover Ratios – measure how productively a firm is using its assets. 4. Profitability Ratios – measure the firm’s return on its investments. copyright © 2003 McGraw Hill Ryerson Limited 17-7 Financial Ratios • Warning! Before diving into the numbers, make sure you do your homework first! You cannot understand a business simply by reading its financial statements and calculating a few numbers. You need to start by researching the industry, and the firm itself, so that you can put the results of your calculations into perspective. copyright © 2003 McGraw Hill Ryerson Limited 17-8 Financial Ratios • Income Statement The Income Statement summarizes the firm’s revenues and expenses and shows the difference between the two,which is the firm’s profit. You can see the Income Statement for Le Château (LC) in Table 17.1 on page 506 of your text. copyright © 2003 McGraw Hill Ryerson Limited 17-9 Financial Ratios • Income Notice that 2000 was a poor year for LC. Can Statement you see why it incurred losses? It is easier to see how a firm is performing if you look at the common-size income statement. This is an income statement which presents each of the items as a percentage of revenues. A common-size income statement for LC is shown in Table 17.2 on page 508. copyright © 2003 McGraw Hill Ryerson Limited 17-10 Financial Ratios • Balance Sheet A balance sheet is a financial statement that shows the value of the firm’s assets and liabilities at a particular time. Remember, a balance sheet shows assets at book value, not market value! LC’s Balance Sheet is in Table 17.2 on page 509. A common-size balance sheet, which shows each of the items as a percent of total assets may be seen in Table 17.4 on page 510. copyright © 2003 McGraw Hill Ryerson Limited 17-11 Financial Ratios • Leverage Ratios Leverage ratios show how much financial leverage a firm is carrying. Financial leverage adds risk to the firm. That is, the higher the level of debt in the firm, the greater the uncertainty about what earnings (and eps) will be. Also the risk of default increases. There are several different types of leverage ratios. copyright © 2003 McGraw Hill Ryerson Limited 17-12 Financial Ratios • Leverage Ratios Long Term Debt Ratio = Debt-Equity Ratio = Total Debt Ratio = LT Debt + Value of Leases LT Debt + Value of Leases + Equity LT Debt + Value of Leases Equity Total Liabilities Total Assets copyright © 2003 McGraw Hill Ryerson Limited 17-13 Financial Ratios • Leverage Ratios The higher the leverage ratio, the greater the financial leverage and the higher the level of risk in a firm’s capital structure. Notice that these measures: Make use of book value not market value. Take account only of long-term debt. copyright © 2003 McGraw Hill Ryerson Limited 17-14 Financial Ratios • Leverage Ratios Times Interest Earned (TIE) = Cash Coverage Ratio = EBIT Interest Payments EBIT + Depreciation & Amortization Interest Payments Fixed Charge Coverage Ratio = EBIT + Depreciation & Amortization Interest Pymts+(Current Debt Repymt+Current Lease Obligations) (1 - Tax Rate) copyright © 2003 McGraw Hill Ryerson Limited 17-15 Financial Ratios • Leverage The TIE Ratio is a measure of the firm’s ability to cover its interest payments with its earnings. Ratios Banks prefer to lend to firms with high TIE ratios (earnings are far in excess of interest payments). The Cash Coverage Ratio recognizes that we subtract depreciation and amortization when calculating earnings. However, no cash goes out the door for these expenses. This ratio asks if earnings plus non-cash charges are sufficient to cover the interest payments. copyright © 2003 McGraw Hill Ryerson Limited 17-16 Financial Ratios • Leverage Ratios Interest is not the only cost a firm will have to meet. There are also principal repayments on the debt and preferred dividends. The Fixed Charge Coverage Ratio measures the ability of the firm to cover its fixed charges with its earnings. Since these payments are nontax-deductible payments, you must convert them to a before-tax basis by dividing by (1 – Corporate Tax Rate). copyright © 2003 McGraw Hill Ryerson Limited 17-17 Financial Ratios • Liquidity Ratios If you are making a short-term loan to a company, you are not interested in their leverage ratio, but in their ability to comeup with the cash to repay you. Liquidity Ratios measure how much of the company’s assets are liquid. Liquid refers to an asset which can be converted to cash quickly and at low cost. copyright © 2003 McGraw Hill Ryerson Limited 17-18 Financial Ratios • Liquidity Ratios Net Working Capital = Net Working Capital as a % of Total Assets Current Ratio = Quick Ratio* = Current Assets – Current Liabilities = Net Working Capital Total Assets Current Assets Current Liabilities Cash + Marketable Securities + Receivables Current Liabilities * Also known as the Acid Test Ratio copyright © 2003 McGraw Hill Ryerson Limited 17-19 Financial Ratios • Liquidity Ratios Net Working Capital roughly measures a company’s potential reservoir of cash. Usually it is positive; however, it can be negative. Net Working Capital is often expressed as a percentage of Total Assets. The Current Ratio and Quick Ratio roughly measure a firm’s ability to cover its liabilities with its most liquid assets. copyright © 2003 McGraw Hill Ryerson Limited 17-20 Financial Ratios • Liquidity Ratios The Quick Ratio is a more stringent measure of liquidity than the Current Ratio. It excludes the inventory and prepaids from the calculation. These components of the Balance Sheet are generally the least liquid assets. copyright © 2003 McGraw Hill Ryerson Limited 17-21 Financial Ratios • Efficiency Ratios Asset Turnover Ratio = Fixed Asset Turnover Ratio = Sales Average Total Assets Sales Average Fixed Assets copyright © 2003 McGraw Hill Ryerson Limited 17-22 Financial Ratios • Efficiency Ratios These ratios measure how efficiently the firm is using its assets. Notice that since the assets are likely to change over the year, we use an average of the assets at the beginning and end of the year. Averages are often used when a flow figure (Annual Sales) is compared to a snapshot figure (Total Assets). copyright © 2003 McGraw Hill Ryerson Limited 17-23 Financial Ratios • Efficiency Ratios The Asset Turnover Ratio and Fixed Asset Turnover Ratio indicate how hard the firm’s assets are being used. For example, for LC, each $1 of assets is generating $2.36 of sales, while each $1 of fixed assets is generating $4.43 of sales. Note that a high ratio compared with other firms may indicate that a firm is working close to capacity. It could be difficult to generate further business without additional investment. copyright © 2003 McGraw Hill Ryerson Limited 17-24 Financial Ratios • Profitability Ratios Profitability ratios focus on the firm’s earnings, giving an indication of its performance. One group, called profit margins, look at profits or earnings as a fraction of sales. The other group, called return ratios, measure profits earned as a fraction of the assets used. The definition of profits, or earnings, depends on the ratio being used. copyright © 2003 McGraw Hill Ryerson Limited 17-25 Financial Ratios • Profitability Gross Profit Margin Ratios – Profit Margins = Sales – Cost of Goods Sold Sales Operating Profit Margin* = Net Profit Margin = EBIT – Taxes Sales Net Income Sales or Net Income + Interest Sales` * Also known as Basic Earning Power copyright © 2003 McGraw Hill Ryerson Limited 17-26 Financial Ratios Ratios – Profit Margins Other things held constant, a firm would prefer high profit margins. • Profitability However, there is a conflict between high prices and high turnover. Think of, for example, Walmart’s margins as compared to those of Holt Renfrew. Both are profitable, but use different strategies: Holt Renfrew has a high margin strategy, but with lower lower sales or turnover. Walmart has low margins, but compensates with higher volume or turnover. copyright © 2003 McGraw Hill Ryerson Limited 17-27 Financial Ratios • Profitability Ratios – Return Ratios Return on Assets (ROA) = Net Income + Interest Average Total Assets Net Income + Interest - Interest Tax Shields Adjusted ROA = Average Total Assets Return on Invested Capital = Net Income + Interest - Interest Tax Shields Average Total Debt + Preferred & Common Equity Return on Equity = Net Income Average Equity copyright © 2003 McGraw Hill Ryerson Limited 17-28 Financial Ratios • Profitability Ratios The Payout Ratio measures the proportion of earnings which are paid out as dividends. The Plowback Ratio shows the percentage of earnings which are retained in the business. Payout Ratio = Dividends Earnings Plowback Ratio = 1 – Payout Ratio = Earnings - Dividends Earnings copyright © 2003 McGraw Hill Ryerson Limited 17-29 Financial Ratios • Profitability Ratios If you multiply the Plowback Ratio by the Return on Equity, you can calculate how fast shareholders’ equity is growing as a result of plowing back part of earnings every year. Growth in Equity from Plowback = Earnings - Dividends Earnings x = Earnings Earnings - Dividends Earnings = Plowback x ROE Equity copyright © 2003 McGraw Hill Ryerson Limited 17-30 Financial Ratios • DuPont System - ROA Some profitability and efficiency measures can be linked in useful ways. These relationships are referred to as the DuPont System, in recognition of the company which popularized them. ROA = = Net Income + Interest Assets Sales Assets x Net Income + Interest Sales Asset Turnover x Profit Margin copyright © 2003 McGraw Hill Ryerson Limited 17-31 Financial Ratios • DuPont System – Margin vs Turnover All firms would like to earn a high ROA, but their ability to do so is limited by competition. In general, most firms must make a trade-off between turnover and margin. To get high turnover, prices generally have to be low, meaning low margins as well. (Walmart’s strategy.) To have high margins, prices generally have to be high as well, which reduces the firm’s turnover. (Holt Renfrew’s strategy.) copyright © 2003 McGraw Hill Ryerson Limited 17-32 Financial Ratios • DuPont System – Margin vs Turnover For example, fast-food chains tend to have low margins, which they offset by high turnover. Hotels tend to have low turnover, but they offset it with high margins. The result: both can have identical ROA’s while their margins and turnover ratios are entirely different: Asset Turnover x Fast Food 2.0 x Hotels 0.5 x Profit Margin = ROA 5% = 10% 20% = 10% copyright © 2003 McGraw Hill Ryerson Limited 17-33 Financial Ratios • DuPont We can also break down the ROE into its component parts: Net Income Equity ROE = = System - ROE Assets Equity x Leverage Sales Assets x Net Income+Interest Sales Asset Turnover Net Income x Net Income+Interest Profit Margin Debt Burden copyright © 2003 McGraw Hill Ryerson Limited 17-34 Financial Ratios • Analysis of the Statement of Cash Flows The Cash Flow Statement tracks the cash coming into and flowing out of a corporation over a specific time period. Analysis of this statement can tell you a lot about the financial health of a firm. By contrast, the Income Statement gives a better sense of the long-run profitability of the firm. But its focus on accruals means a healthy looking income statement can miss a current cash crunch. copyright © 2003 McGraw Hill Ryerson Limited 17-35 Financial Ratios • Analysis of the Statement of Cash Flows You can see a Statement of Cash Flows for LC in Table 17.7 on page 523 of your text. In Chapter 2, you learned how to calculate the Free Cash Flow from the firm by rearranging the statement of cash flows: Cash Flow from Operating Activities - Cash Flow from Investing Activities = Cash Flows from Assets (Free Cash Flows) copyright © 2003 McGraw Hill Ryerson Limited 17-36 Using Financial Ratios • Finance in Action Companies have considerable discretion in calculating profits. They also have a great deal of leeway in deciding what to record on the Balance Sheet. Thus, when you calculate financial ratios, you need to look below the surface and understand the some of the pitfalls of accounting data. Check the Finance in Action boxes on pages 526 and 527 of your text. copyright © 2003 McGraw Hill Ryerson Limited 17-37 Using Financial Ratios • Choosing a Benchmark Once you select and calculate the important ratios for a firm, you must still find some way to judge whether the results are high or low. Do this by comparing them to a benchmark. The simplest comparison is to the firm’s performance in prior years. But you can also compare the numbers to those calculated for another firm(s). When making your comparisons, don’t forget to dig behind the numbers! copyright © 2003 McGraw Hill Ryerson Limited 17-38 Measuring Company Performance • MVA and EVA Market Value Added is the difference between the market value of a firm’s equity and its book value. A table which ranks MVA for a number of large Canadian companies is published by Stern Stewart. You can see a sample of this data (plus EVA) in Table 17.10 on page 530 of your text. Economic Value Added (EVA or Residual Income) measures the net profit of a firm after deducting the cost of the capital employed. copyright © 2003 McGraw Hill Ryerson Limited 17-39 Measuring Company Performance • EVA EVA or residual income is a better measure of company performance than accounting profits. Profits are calculated after deducting all costs except the cost of capital. EVA recognizes that companies need to cover their cost of capital before they can add value. If a plant or division is not earning a positive EVA, the financial managers are likely to face some pointed questions about whether assets could be better employed elsewhere. copyright © 2003 McGraw Hill Ryerson Limited 17-40 The Role of Financial Ratios • Helping Financial Managers Make Decisions Whenever financial managers discuss the state of business, you can bet that ratios will enter into the discussion. Ratios can help you understand, and improve, your company’s financial health by making sure that its leverage, liquidity, efficiency and profitability are kept at optimal levels. copyright © 2003 McGraw Hill Ryerson Limited 17-41 Summary of Chapter 17 As a financial manager, you will be responsible for analyzing your company’s financial statements. You will be looking at its income statement, balance sheet and statement of cash flows. You will use financial ratios to summarize the firm’s leverage, liquidity, profitability and efficiency. You may combine these measures with other data to measure the esteem in which investors hold your company and its performance. copyright © 2003 McGraw Hill Ryerson Limited 17-42 Summary of Chapter 17 The DuPont System provides a useful way to link ratios to explain the firm’s return on assets and equity. ROE is a function of the firm’s leverage ratio, asset turnover, profit margin and debt burden. ROA is a function of asset turnover and profit margin. Financial ratios will rarely be useful if applied mechanically. You need an understanding of the business and good judgment to make good decisions using ratios. copyright © 2003 McGraw Hill Ryerson Limited 17-43 Summary of Chapter 17 You need a benchmark for assessing a ratio. Typically you compare ratios with the company’s ratios in prior years and/or with the ratios of other firms in the same business. Other measures, such as Market Value Added (MVA) and Economic Value Added (EVA) are available to help you assess a firm’s performance. Managers of divisions or plants are often judged and rewarded by their business’s EVA. copyright © 2003 McGraw Hill Ryerson Limited