What is Sukuk?

advertisement

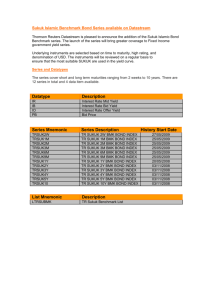

Islamic Finance: Structure and Instruments Ankara, Turkey 29 September 2011 SUKUK: SHARIAH CONTRACTS AND OPERATIONS Mohd Radzuan Tajuddin Islamic Capital Market PRESENTATION OUTLINE PART A OVERVIEW OF THE GLOBAL SUKUK MARKET PART B MAIN DRIVERS FOR SUKUK DEVELOPMENT AND GROWTH PART C BUILDING BLOCKS FOR SUCCESSFUL SUKUK MARKET PART D CONTRACTS AND STRUCTURES PART E ROLE OF THE SECURITIES COMMISSION MALAYSIA IN THE SUKUK MARKET PART D © Securities Commission CHALLENGES AND ISSUES 2 PART A OVERVIEW OF THE GLOBAL SUKUK MARKET © Securities Commission 3 Evolution and Growth of the Sukuk Market 1990s • Introduction and market familiarisation • Developments of markets, players and products • Limited growth • Confined to some countries only • Limited structures – mainly debt-based e.g. murabahah, Bai’ Bithaman Ajil © Securities Commission 2000 • Growth in market size and players • Additional product features/structures e.g. Istisna’, Ijarah, Salam • Introduction of sukuk in the global market e.g. Malaysian Global Sukuk, Qatar Global Sukuk etc • Stronger growth of Sukuk market globally 2004 • Accelerated growth in market size and players • Broader and deeper market • Better market understanding • Innovative and new product structures e.g. mudharabah, musharakah, ABS, exchangeable sukuk 2008 • Maturing and globalisation • More breadth and depth • More accelerated growth • Moving towards globally accepted and highly competitive structures • Activating the secondary market for sukuk liquidity • Unlocking new asset classes • Development of sukuk yield curve and pricing benchmark 4 Global Sukuk Issuances US$ billion • Sukuk issuances hit a record of US$47.78 billion in 2010, surpassing 2007 level (US$44.76 billion). • Growth attributed to substantial issuances by government and government-related entities. • Among notable issuances in 2010: – USD1.25bil 1Malaysia Global Sukuk – USD1.1 bil Khazanah Sukuk – USD1.34 bil Celcom Transmission Sukuk – USD750 mil QIB Sukuk – USD750 mil Abu Dhabi Islamic Bank Sukuk – USD500 mil IDB Sukuk – USD100 mil Nomura Holdings Sukuk – USD100 mil KT Turkey Sukuk Source: Islamic Finance Information Service (IFIS), Kuwait Finance House (KFH) © Securities Commission 5 Global Sukuk Market 1.34% 2.89% 2.37% 1.11% 4.71% 6.65% Malaysia accounted for 72.5% of global sukuk issuances by domicile in 2010 8.43% 72.5% 2% 2% 3% 6% 6% 8% 8% © Securities Commission 65% Malaysia accounted for 65% of global sukuk outstanding by domicile as at December 2010 Source: IFIS, KFH 6 Malaysian Sukuk Market • The Malaysian sukuk market has experienced rapid growth • Compounded annual growth rate (CAGR) of 22.2% from 2000-2010 • Sukuk market plays a key role in financing country’s economy • Growing demand for sukuk among issuers and investors 2010 USD95.35 billion 2000 USD10.42 billion • Double digit growth expected for 2010-2020 © Securities Commission 7 Malaysian Sukuk Market (cont’d) • Sukuk now constitutes more than 50% of total corporate bonds Outstanding (USD billion) Approved (USD billion) © Securities Commission Issued (USD billion) 8 PART B MAIN DRIVERS FOR SUKUK DEVELOPMENT AND GROWTH © Securities Commission 9 Main Drivers for Sukuk Development and Growth Growing preference for Shariah compliant products A wide range of products engineered to meet the requirements of investors and borrowers, including a product that performs a similar function to a bond Growing wealth Within Islamic world Enhanced by greater understanding of sukuk instruments and clarity of documentation as well as ratings from international agencies Massive liquidity looking for Shariah compliant products High levels of surplus savings and reserves in Asia and the GCC looking for Shariah-compliant instruments. Government policies Muslim and non-Muslim countries have introduced relevant legislations in their respective countries to enable sukuk issuance Economic diversification away from oil and gas Large surpluses channelled into the real estate/property, construction and Infrastructure/utilities sectors leading to increased sukuk issuances Infrastructure development © Securities Commission Infrastructure spending in Asia and GCC helped push the demand for sukuk Given the growing preference for sukuk as a source of cash flow and Financing for companies 10 PART C BUILDING BLOCKS FOR SUCCESSFUL SUKUK MARKET © Securities Commission 11 Building Blocks for Successful Sukuk Market 1. Tax Framework 2. Legal and Regulatory Framework 4. Government Support © Securities Commission 3. Shariah Governance Framework 5. Diverse pool of players 12 Building Blocks for Successful Sukuk Market (cont’d) 1. Tax Framework (a) Tax neutrality provisions – for tax purposes: Profits (in relation to Shariah transactions) are treated similar to that of interest. Implications: © Securities Commission Profits associated with Islamic finance will be taxable, just like interest income under conventional financing; Profits will be deductible if the funding has been used to generate business income or to purchase asset to generate income; All other tax rules relating to “interest” such as withholding tax on interest and tax exemption will also equally apply to profits. Sale of assets or leases to be ignored – any additional tax as a result of the underlying transaction would not arise; Exemption of stamp duty to ensure that any additional stamp duty as a result of underlying asset transaction will be exempted. 13 Building Blocks for Successful Sukuk Market (cont’d) 1. Tax Framework (cont’d) (b) Tax incentives Issuers: Investors © Securities Commission Tax deduction on expenses incurred in the issuance of sukuk Tax exemption on income received by SPV and tax deduction on issuing costs incurred by the SPV Institutional - tax exemption and withholding tax exemption on profits received by non-resident investors from investment in sukuk Individuals- tax exemption and withholding tax exemption on profits received by non-resident investors from investment in sukuk, stamp duty exemption on investing and trading of sukuk 14 Building Blocks for Successful Sukuk Market (cont’d) 2. Legal and Regulatory Framework Established legal and regulatory framework in accordance with international standards and best practices. 2-tier regulatory approach: Single legislation to govern the issuance of both conventional bonds and sukuk. The issuance of sukuk is governed by specific guidelines i.e. Islamic Securities Guidelines (Sukuk Guidelines) Common regulatory approach to regulating sukuk e.g. same liability on the part of intermediaries (due diligence, representation) Disclosure, transparency and governance apply equally to conventional bonds and sukuk, hence same legal and regulatory protection © Securities Commission 15 Building Blocks for Successful Sukuk Market (cont’d) 3. Shariah Governance Framework National Shariah Advisory Council (SAC) Established under legislation Acts as a reference point for the industry Resolutions and rulings provide certainty, clarity and consistency to market participants Resolutions and rulings published for the benefit of the industry Shariah Committee/Adviser at the industry level Mandated by regulations To advise, review and endorse compliance of sukuk (structure and documentation) to Shariah requirements © Securities Commission 16 Building Blocks for Successful Sukuk Market 4. Government Support The government being a regular issuer providing market with benchmark sukuk (tenure, pricing) Facilitates the administrative, infrastructure and fiscal policies Continuous liberalisation policies – participation from foreign corporations, multinational corporations and multilateral agencies 5. Diverse pool of players and instruments Diversity of issuers – local and foreign issuers Local and international players - conventional and Islamic Experience and proven track record in structuring and advising Money market products, short, medium and long-term tenured sukuk © Securities Commission 17 PART D CONTRACTS AND STRUCTURES © Securities Commission 18 What is Sukuk? • صكوكSukuk, plural of صكSakk is the Arabic term for certificates. • Sukuk are instruments issued with the purpose of raising capital. • Sukuk evidence ownership and/or investment in the underlying asset using Shariah principles. • In Malaysia, the concepts and Shariah principles in structuring sukuk must be approved by the Shariah Advisory Council of the SC • Sukuk holders each hold an undivided beneficial ownership in the underlying assets. • Consequently, sukuk holders are entitled to share in the revenues generated by the sukuk assets as well as being entitled to share in the proceeds of the realization of the sukuk assets. © Securities Commission 19 Comparison between Sukuk and conventional bonds Sukuk Conventional Bonds Asset in exchange for monies Paper in exchange of monies Profit/income from assets Interest Ownership of undivided share in asset Creditor’s right against issuer Trade – sale of asset No sale of asset Utilisation of proceeds for Shariah compliant purposes No restriction on utilisation of proceeds Typical requirement of investors in bond Fixed Rate Can be structured by way } of Islamic contract i.e. by Floating Rate Typical requirement of investors in bond Fixed Rate Floating Rate using Murabahah, Ijarah Value added Islamic structure Ownership of underlying asset Partnership features Distribution of risk © Securities Commission 20 Application of Shariah Contracts and Principles Application of Shariah contracts and principles Contract of Exchange • Bai ajil bithaman Contract of Participation • Musharakah Contract of Agency Wakalah • Mudharabah • Murabahah • Istisna’ • Ijarah • Salam © Securities Commission 21 Types of sukuk Types of sukuk Normal (Asset-based) Sale-based Lease-based BBA Ijarah Murabahah Ijarah Muntahiyah Bi Tamlik Salam Istisna’ Asset-backed Partnershipbased Musharakah Mudharabah Agencybased Hybrid Convertible Exchangeable Wakalah Bi Istithmar Ijarah Mawsufah Fi Dhimmah © Securities Commission 22 Sukuk Murabahah A contract that refers to the sale and purchase transaction for the financing of an asset whereby the cost and profit margin are made known and agreed by all parties involved. The settlement for the purchase can either be on a deferred lump-sum basis or on installment basis, and is specified in the agreement. Murabahah in simple terms means cost plus profit. © Securities Commission Sukuk Murabahah Sale of assets to investors at purchase price on cash basis 1 Payment of proceeds (equivalent to purchase price) Issuer Investors 2 Investors resell asset to issuer at selling price (purchase price + profit) on deferred basis 3 Issuer issues sukuk to evidence the indebtedness of the issuer arising from step 3 Murabahah Sukuk © Securities Commission 4 24 Sukuk Ijarah Ijarah is a manfaah (usufruct) type of contract whereby a lessor (owner) leases out an asset or an equipment to its client at an agreed rental fee and pre-determined lease period upon the ‘aqad (contract). The ownership of the leased equipment remains with the lessor. Sukuk Ijarah is a certificate that shows the ownership of the investors on the leased asset and the rights to receive the income/rental from the leased assets. © Securities Commission Sukuk Ijarah SPV issues sukuk to investors that represent beneficial ownership of the assets Sells assets to SPV at purchase price on cash basis 2 1 Proceeds Originator 3 SPV (Issuer) Ijarah Sukuk Proceeds 3 Investors Distribution of rental payment (profit to sukuk holders – investors) Leases the asset to originator 4 6 Rental payment 5 At maturity : SPV sells the asset back to the originator 7 Proceeds from the sale of the asset will be used to repay the investors, in term of the principal amount of the sukuk 8 © Securities Commission 26 Sukuk Musharakah Musharakah is a partnership arrangement between two parties or more to finance a business venture whereby all parties contribute capital either in the form of cash or inkind. Any profit derived from the venture will be distributed based on a pre-agreed profit sharing ratio, but a loss will be shared on the basis of equity participation. In simple terms, Musharakah means profit and loss sharing. © Securities Commission Sukuk Musharakah Upon maturity : issuer repurchase musharakah sukuk/musharakah asset (exercise purchase undertaking) 7 Profit payment to investors 6 Purchase undertaking – promise to buy back the sukuk or asset upon maturity of the sukuk 4 Partner 1 (Issuer) Issuer issues sukuk musharakah to evidence participations in the musharakah venture 3 Musharakah Sukuk Capital contribution 1 Return Partner 2 (Investors) Capital contribution Musharakah venture 2 5 Proceeds from the sale of musharakah sukuk/asset will be used to repay the investors (principal of sukuk) © Securities Commission 8 28 Sukuk Mudharabah Mudharabah is a contract which is made between two parties to finance a business venture. The parties are an investor who solely provides the capital (rabb al-mal) and an entrepreneur who solely manages the project (mudharib). If the venture is profitable, the profit will be distributed based on a pre-agreed ratio. In the event of a loss, the loss shall be borne solely by the provider of the capital. A Mudharabah contract may involve two or more parties. The difference between a Mudharabah and Musharakah contract is that, in the latter all parties contribute capital and services. © Securities Commission Sukuk Mudharabah Upon maturity : issuer repurchase mudharabah sukuk/mudharabah asset (exercise purchase undertaking) 7 Profit payment to investors 6 Purchase undertaking – promise to buy back the sukuk or asset upon maturity of the sukuk 4 Mudharib (Issuer) Issuer issues sukuk mudharabah to evidence participations in the mudharabah venture 3 Mudharabah Sukuk Entrepreneurship 1 Return Rabb al-mal (Investors) Capital contribution Mudharabah venture 2 5 Proceeds from the sale of mudharabah sukuk/asset will Be used to repay the investors (principal of sukuk) © Securities Commission 8 30 Global Sukuk Issuances by Structure (2010) Wakalah (9.03%) Combination (2.81%) Musharakah Others (6.25%) (1.53%) Ijarah (27.33%) Murabahah (53.05%) Source: IFIS, KFH © Securities Commission 31 PART E ROLE OF THE SC IN THE SUKUK MARKET © Securities Commission 32 Role of the SC in the Sukuk market • The sole approving authority for corporate sukuk issuances by local and foreign entities • Formulates the legal and regulatory framework governing the corporate sukuk market • Supervises other relevant market intermediaries such as rating agencies, trustees and pricing agencies • Supervises primary and secondary market activities © Securities Commission 33 Role of the SC in the Sukuk market (cont’d) A comprehensive set of issuance guidelines for the corporate sukuk market • Private Debt Securities Guidelines – 2011 (revised) • Islamic Securities Guidelines (Sukuk Guidelines) – 2011 (revised) • Trust Deed Guidelines – 2011 (revised) • Guidelines on the Offering of Asset-Backed Securities – 2002 Prior to 2000 Facilitate access to sukuk market via clear and transparent guidelines Post 1 July 2000 Type of Submission Merit based Disclosure based Utilisation of proceeds Subject to internal criteria on productive purposes No restriction on utilisation of proceeds, but disclosure must be made Underwriting requirement Must be fully underwritten Decided by issuer and adviser Minimum credit rating requirement BBB and P3/MARC3 No minimum rating requirement, but ratings remain mandatory Disclosure requirements - Stringent due diligence for investor protection Posting of PTC, IM and TD on the SC website Time frame for approval 1 to 3 months Deemed approval for qualified issues Otherwise, 14 working days for PDS/ABS issues © Securities Commission 34 Other regulators for the Sukuk market Bank Negara Malaysia (Central Bank) • Manages public debt and issues Malaysian Government Securities (MGS) and Government Investment Issues (GII) on behalf of the Government • Operates and maintains the market infrastructure • Fully Automated System for Issuing/Tendering (FAST) – issuing and tendering system • Real Time Electronic Transfer of Funds System (RENTAS) – clearing and settlement system Bursa Malaysia (stock exchange) • Regulates and monitors listed bonds and sukuk • Operates and maintains Electronic Trading Platform system – trading and reporting platform • Provides liquidity management infrastructure i.e. Commodity trading platform © Securities Commission 35 PART F CHALLENGES AND ISSUES © Securities Commission 36 Challenges and Issues 1. Legal certainty and rights of sukukholders 2. Asset-backed versus asset-based 4. Fixed-income framework © Securities Commission 3. Differing Shariah views/opinions 5. Human capital 37 Thank you Securities Commission Malaysia Tel: 60.3.62048718 | Fax: 60.3.62015082 | www.sc.com.my © Securities Commission 38