Capital Guarantee and Protection

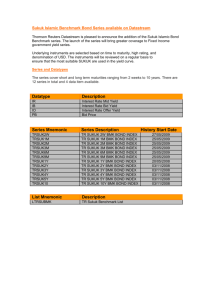

advertisement

Wan Abdul Rahim Kamil Consultant , Islamic Capital Markets Securities Commission Malaysia rahim@seccom.com.my; wark06@gmail.com Capital Guarantee & Capital Protection Capital Guarantee is derived from a separate third party Guarantees in the form of a financial instrument (such as bank guarantee), corporate guarantees or other collaterals to ensure that the investor will not suffer any loss at all on the amount of the invested capital even if the underlying investment did not perform well. Capital Protection is the feature of a specific structured product wherein is embedded a derivative securities, that have the capability to ensure that the investor will get back at maturity a part or the totality of the money he has invested in the purchase of the product on day one. Why Capital Guarantee is disallowed in Contracts of Musharakah or Mudharabah Contracts of participations such as Musharakah or Mudharabah demands risk participations by way of: Profit & loss sharing (Musharakah), or Profit sharing (Mudharabah) In both cases guarantees are only allowed on the capital for recovering losses from misconducts by the managing musharik or the mudharib Guarantee on performances are disallowed As an investment strategy, structured products invest in low-risk securities such as Shariah compliant Government Securities or ‘zero-coupon’ Sukuk Shariah Rulings : AAOIFI ( Shari’ah Standard No.13) The capital provider is permitted to obtain guarantees from the mudharib that are adequate and enforceable. This is circumscribed with a condition that the capital provider will not enforce these guarantees except in cases of misconduct, negligence or breach of contract on the part of mudharib. [6/0] Dallah Al Baraka • It is not permissible for an investor to demand from the entrepreneur (mudharib) to pay him a fixed percentage of the value of the contract, besides the capital sum, irrespective of the amount of investment involved or whether the project is profitable or in loss. Such a contract is unlawful because it involves a guarantee from the entrepreneur respecting the capital sum, whereas a mudharib is a trustee and cannot be held responsible for the capital sum except in cases of transgression or negligence. [ al-Baraka first symposium, Fatwa No.2] Majelis Ulama Indonesia In principle, the capital should not be guarantees unless the loss of capital is caused by the negligence of the entrepreneur. [Fatwa No : 07/DSN-MUI/IV/2000] Capital Guarantee on Various Sukuk Structures Capital Guarantee on sukuk can be seen in light of the purchase undertaking of sukuk by the issuer. This kind of purchase undertaking is considered as capital guarantee to the investors. Therefore, the purchase undertaking at face value is not permitted in the investments sukuk such as sukuk Musharakah and sukuk Mudharabah as this impermissibility is in line with Hadith Rasullullah: أن الخراج بالضمان “We have to face the risks in order to get the profit from investments” Sukuk Al-Ijarah: AAOIFI resolution in 2008, purchase undertaking at face value is permitted under sukuk Ijarah. Example of Capital Protection The most common capital protected fund under Shariah compliant structured products structure is whereby: the fund invest a portion of their assets in fixed income Shariah compliant securities likened in feature to a ‘zero-coupon ‘Sukuk or Shariah Compliant (SC) Government Securities designed to pay out the total amount invested at a fixed maturity date. This date is naturally dependent on the prevailing profit rate environment and the amount of capital the fund can set aside for this purpose without hampering performance. For example a USD 100 portfolio could purchase for example USD 60 worth of ‘zero-coupon’ Sukuk in the expectation that in 10 years the value of those sukuk would be USD 100. The remaining USD 40 would then be invested in other investments that have more attractive returns or in profit locked-in products such as in Tawarruq contracts. CAPITAL PROTECTION STRUCTURED PRODUCTS: Strategy 1 Tawarruq Contracts with locked-in profits Initial Investment USD100 USD 40 USD 60 ‘Zero Coupon Sukuk’ or SC Government Securities INVESTMENT LIFE OF THE PRODUCT Profit Locked in feature to ensure more returns to investor 100% Capital Protection CAPITAL PROTECTION STRUCTURED PRODUCTS: Strategy 2 Profit Locked in feature to ensure additional returns to investor Once the Capital Protected component has matured, the portion is reinvested in other profit locked-in feature investments e.g. Tawarruq. USD 60 Initial Investment USD100 Tawarruq Contracts with locked-in profits USD 40 USD 60 ‘Zero Coupon Sukuk’ or SC Government Securities Profit Locked in feature to ensure more returns to investor 100% Capital Protection INVESTMENT LIFE OF THE PRODUCT In this alternative, the capital protection matures before the life of the product. To enhance earnings the USD60 is reinvested in other profit locked in investments. Derived profits will ensure additional income to investors rahim@seccom.com.my wark06@gmail.com