Capital Budgeting I

advertisement

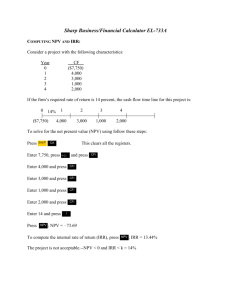

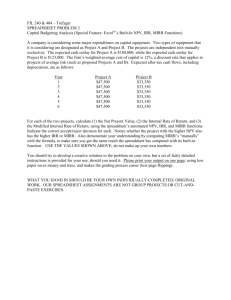

1 Chapter 11 Capital Budgeting and Net Present Value Should we build this plant? Ch 13: Capital Budgeting Techniques Payback period rule Discounted Cash Flow Approaches Discounted payback period Net present value (NPV) Internal rate of return (IRR) • Modified internal rate of return (MIRR) Profitability index (PI) Why is the NPV the best? NPV vs. Payback period NPV vs. IRR • Mutually exclusive projects • Multiple IRRs NPV vs. PI The practice of capital budgeting 2 3 What is capital budgeting? Capital budgeting: Total process of planning, evaluating, and selecting on capital expenditures for long-lived assets. Usually requires a large amount of capital expenditures. It could be anything that requires lots of money. “In February 2000, Corning, Inc., announced plans to spend $170 million to expand by 50 percent its manufacturing capacity of optical fiber, a crucial component of today’s high-speed communications networks.” To do or not to do? That is the question! Is there any financial method that Corning can use to make this investment decision? 4 Capital Budgeting: Steps 1. Estimate CFs (inflows & outflows). 2. Assess riskiness of CFs. 3. Determine r = WACC for project. 4. Find NPV, IRR and/or others. 5. Accept or reject project based on the results from sep 4. 5 Example 1 Coca Cola and Procter & Gamble just announced that they will consider a joint venture (JV) for new beverage and snack business. The new idea is to form a limitedliability company, with 50-50 ownership, that will develop and market juice-based drinks and snacks. Coca-Cola will invest $2 billions and the investments will be deprecated on a straight-line basis with zero salvage value for four-year investment period. You are a CFO of Coca Cola and just created a pro forma income statement for this project. Previously, Coca Cola hired the consulting company to study market research for new beverage and snack business, and paid $300,000. The tax rate is 30 percent. The similar project with a similar risk level yields 10%. Your job is to evaluate this project. Is this project acceptable? 6 Coca Cola Pro Forma Income Statement Year Sales Cost of Goods Sold Gross Profit Operating Expenses 2002 $2,000 1,000 2003 $2,000 1,000 2004 $2,000 1,000 2005 $2,000 1,000 1,000 50 1,000 50 1,000 50 1,000 50 Depreciation EBT Taxes (30%) 500 450 135 500 450 135 500 450 135 500 450 135 Net Income 315 315 315 315 What is a pro forma income statement? 7 Q1. What is the operating cash flow (OCF)? Operating Cash Flow (OCF) = EBIT (1 – T) + Depreciation = - Why operating cash flow, instead of accounting income? Q2. Is the consulting fee of $300,000 relevant in capital budgeting decision? What is the sunk cost? 8 9 Time Line for the Joint Venture 0 1 r = 10% -2,000 815 2 3 4 815 815 815 10 Q3. Is this project acceptable? We will use several capital budgeting techniques to evaluate new projects. Payback period Discounted cash flow (DCF) approaches • Discounted payback period • Net Present Value (NPV) - most important • Internal rate of return (IRR) – most popular Modified Internal Rate of Return • Profitability index (PI) 11 Q3. Is this project acceptable? Payback period Payback Period: Length of time until initial investment is recovered, or “How long will it take to recover initial investments?” Computation: Subtract the future cash flows from the initial cost until the initial investment has been recovered Decision Rule: Accept if the payback period is less than some preset limit Payback period of JV = 12 Payback Period Computation 2.454 0 1 CFt -2,000 Cumulative -2,000 Payback = 2 2 815 -1,185 + 815 -370 0 3 815 370/815 = 2.454 years 4 815 13 Q3. Is this project acceptable? Discounted payback period Discounted Payback Period: Use discounted CFs rather than raw CFs. Computation: Subtract the future discounted cash flows from the initial cost until the initial investment has been recovered Decision Rule: Accept if the discounted payback period is less than some preset limit Discounted payback period of JV = 14 Discounted Payback Period 0 10% 1 2 3 4 815 815 CFt -2000 815 815 PVCFt -2000 741 674 612 Cumulative -2000 -1259 -586 27 Discounted = payback + 586 / 612 = 2.96 yrs 2 Still this method requires arbitrary cut-off point and ignores cash flows occurring later than cut-off point 15 Q3. Is this project acceptable? Net present value (NPV) Net Present Value (NPV) = PVs of inflows – PVs of outflows, or = PVs of inflows – Initial Investment (usually occurs in year 0) = Decision criteria: If the NPV is positive, accept the project A positive NPV means that the project is expected to add value to the firm and will therefore increase the wealth of the owners. Since our goal is to increase owner’s wealth, NPV is a direct measure of how well this project will meet our goal. Should we accept or reject new joint venture proposal? 16 NPV (continued) n CFt NPV . t t 0 1 r Cost often is CF0 and is negative. n CFt NPV t 1 1 r t CF0 . 17 What’s JV’s NPV? Project JV: 0 1 2 3 4 815 815 815 815 r =10% -2,000 741 674 612 557 $584 = NPV Since NPV > 0, Accept! 18 NPV (continued) Calculator Solution Enter in CFj for JV: -2,000 CF0 815 CF1 815 CF2 815 CF3 815 CF4 10 I/YR NPV = 583.44 19 Q3. Is this project acceptable? Internal rate of return (IRR) Definition: IRR is the return that makes the NPV = 0 Decision Rule: Accept the project if the IRR is greater than the required return Internal Rate of Return (IRR) of JV = Should we accept or reject new joint venture proposal? 20 Internal Rate of Return (IRR) 0 1 2 3 CF0 Cost CF1 CF2 Inflows CF3 IRR is the discount rate that forces PV inflows = cost. This is the same as forcing NPV = 0. 21 NPV: Enter r, solve for NPV. n CFt 1 r t 0 t NPV . IRR: Enter NPV = 0, solve for IRR. n CFt t 0. t 0 1 IRR 22 Coca Cola Example: IRR Sensitivity Analysis: NPV $1,400.00 $1,200.00 NPV >0 ACCEPT! $1,000.00 $800.00 IRR = 22.87% NPV $600.00 $400.00 NPV < 0 REJECT! $200.00 $0.00 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 ($200.00) ($400.00) ($600.00) Discount Rate (%) 23 Computing IRR For The Project If you do not have a financial calculator, then this becomes a trial and error process Calculator Enter the cash flows as you did with NPV Press IRR If IRR > 10%, required return, then accept the project. Should we accept or reject the new JV? 24 Rationale for the IRR Method If IRR > WACC, then the project’s rate of return is greater than its cost-- some return is left over to boost stockholders’ returns. Example: WACC = 10%, IRR = 22.87%. Profitable. 25 Q3. Is this project acceptable? Profitability Index (PI) Definition: PV of future cash flows @ R (discount rate) divided by Initial Investment “Bang for the buck” Benefit-cost ratio Decision rule: If PI > 1 then accept project PI of JV = Should we accept or reject the JV? 26 Profitability Index Measures the benefit per unit cost, based on the time value of money A profitability index of 1.1 implies that for every $1 of investment, we create an additional $0.10 in value This measure can be very useful in situations where we have limited capital 27 Q4: What are the relationships among NPV, IRR, and PI? The discount rate is 10%. Are the discount rate, opportunity cost, and cost of capital the same things? In this case, the IRR is 22.87%. When you use 22.87% as new discount rate, what is the new NPV? What if the discount rate is 20%? What is the new NPV? What if the discount rate is 24%? Does the higher discount rate means the lower NPV? If so, why ? When NPV > 0, IRR > r? When NPV > 0, PI >1? In general, if NPV > 0, then IRR > R and PI > 1. So far, We learned payback period, discounted payback period, NPV, IRR and PI to evaluate new projects. Now, we will be making a case that the NPV is the best, and We will see why it is the best. Also, we will see some cases that NPV and other criteria lead us to conflicting results. 28 29 Example 2: NPV vs. Payback period Discount rate, r = 10% 0 1 2 3 4 Payback NPV A -100 20 30 50 60 3 yr 21.52 B -100 50 30 20 60 3 yr 26.26 C -100 50 30 20 6,000 3 yr ? Advantages and Disadvantages of Payback Advantages Easy to understand Provides an indication of a project’s liquidity. Disadvantages Ignores the time value of money Requires an arbitrary cutoff point Ignores cash flows beyond the cutoff date Biased against long-term projects, such as research and development, and new projects 30 31 Special cases: What is the difference between independent and mutually exclusive projects? Projects are: independent, if the cash flows of one are unaffected by the acceptance of the other. mutually exclusive, if the cash flows of one can be adversely impacted by the acceptance of the other. 32 An Example of Mutually Exclusive Projects BRIDGE vs. BOAT to get products across a river. 33 Example 3: NPV vs. IRR (Mutually Exclusive Projects) Option #1: You give me $1 now and I’ll give you $1.50 back at the end of the class period. Option #2: You give me $10 now and I’ll give you $11 back at the end of the class period. You can choose only one of two options. Assume a zero rate of interest because our class lasts only 2 hours. Which option would you choose? 34 Example 4: NPV vs. IRR (Mutually Exclusive Projects) Suppose r = 5%. Project 0 1 2 3 IRR NPV @5% $33 Higher $29 Long -100 10 60 80 18.1% Short -100 70 50 20 23.6% Higher Which one should we take? 35 Construct NPV Profiles Enter CFs in CFj and find NPVL and NPVS at different discount rates: r 0 5 10 15 20 NPVL 50 33 19 7 (4) NPVS 40 29 20 12 5 36 NPV ($) Double click on the icon 60 50 Crossover Point = 8.7% 40 30 20 IRRS = 23.6% 10 Discount Rate (%) 0 0 -10 5 10 15 20 23.6 IRRL = 18.1% 37 To Find the Crossover Rate 1. Find cash flow differences between the projects. See data at beginning of the case. 2. Enter these differences in CFj register, then press IRR. Crossover rate = 8.68%, rounded to 8.7%. 3. Can subtract S from L or vice versa, but better to have first CF negative. 4. If profiles don’t cross, one project dominates the other. 38 Which project(s) should be accepted at r=5%? If S and L are independent, accept both. NPV > 0. IRRS and IRRL > r = 5%. If Projects S and L are mutually exclusive, accept L because NPVS < NPVL at r = 5%, although IRRS > IRRL . Conflict!!! Choose between mutually exclusive projects on basis of higher NPV. Adds most value in dollar. 39 NPV and IRR always lead to the same accept/reject decision for independent projects: NPV ($) IRR > r and NPV > 0 Accept. r > IRR and NPV < 0. Reject. r (%) IRR 40 Mutually Exclusive Projects r < 8.7: NPVL> NPVS , IRRS > IRRL CONFLICT r> 8.7: NPVS> NPVL , IRRS > IRRL NO CONFLICT NPV L S r 8.7 r IRRS % IRRL 41 Reinvestment Rate Assumptions NPV assumes reinvest at r (opportunity cost of capital). IRR assumes reinvest at IRR. Reinvest at opportunity cost, r, is more realistic, so NPV method is best. NPV should be used to choose between mutually exclusive projects. Another Problem with IRR IRR has another problem so-called “Multiple IRRs.” 42 43 Two kinds of Cash Flows Normal Cash Flow Project: Cost (negative CF) followed by a series of positive cash inflows. One change of signs. Nonnormal Cash Flow Project: Two or more changes of signs. Most common: Cost (negative CF), then string of positive CFs, then cost to close project. Nuclear power plant, strip mine. 44 Inflow (+) or Outflow (-) in Year 0 1 2 3 4 5 N - + + + + + N - + + + + - - - - + + + N + + + - - - N - + + - + - NN NN NN 45 Example 5: NPV vs. IRR (Multiple IRRs) Greenspan Mining Co. is considering a project to strip mine coal. The project requires an investment of $22 million and is expected to produce a cash inflow of $15 million in each Year 1 through 4. However, the Company is obligated to pay $40 million in Year 5 to restore the terrain. The Company’s opportunity cost of capital is 10%. What are the IRR(s) and NPV? 0 1 2 3 4 5 NPV NPV NPV @5.62% @27.78% @10% -22 15 15 15 15 -40 ? ? $0.7M 46 Multiple IRRs $1.50 $1.00 NPV $0.50 $0.00 1.00% 4.00% 7.00% 10.00% 13.00% 16.00% 19.00% ($0.50) ($1.00) ($1.50) ($2.00) Discount Rate 22.00% 25.00% 28.00% 31.00% 47 Could find IRR with calculator: 1. Enter CFs as before. 2. Enter a “guess” as to IRR by storing the guess. Try 10%: 10 STO IRR = 6% = lower IRR Now guess large IRR, say, 30%: 30 STO IRR = 28% = upper IRR 48 Multiple IRRs (continued) The previous slides shows that there are two IRRs Multiple IRRs You need to recognize that there are nonconventional cash flows and look at the NPV profile Rely on NPV instead of IRR in this case 49 Managers like rates--prefer IRR to NPV comparisons. Can we give them a better IRR? Yes, MIRR is the discount rate which causes the PV of a project’s terminal value (TV) to equal the PV of costs. TV is found by compounding inflows at WACC. Thus, MIRR assumes cash inflows are reinvested at WACC. Example 6: Starbucks estimates the cash flows for the new project, “Mocha.” Find MIRR. r = 10%. 0 1 2 3 10.0 60.0 80.0 10% -100.0 10% 10% MIRR = 16.5% -100.0 PV outflows $158.1 $100 = (1+MIRRL)3 MIRRL = 16.5% 66.0 12.1 158.1 TV inflows 50 51 To find TV with a calculator, enter in CFj: CF0 = 0, CF1 = 10, CF2 = 60, CF3 = 80 I = 10 NPV = 118.78 = PV of inflows. Enter PV = -118.78, N = 3, I = 10, PMT = 0. Press FV = 158.10 = FV of inflows. Enter FV = 158.10, PV = -100, PMT = 0, N = 3. Press I = 16.50% = MIRR. 52 Accept Project ? YES. Reject because MIRR = 16.50% > r= 10%. Also, if MIRR > r, NPV will be positive: NPV = +$18.78. 53 Why use MIRR rather than IRR? MIRR correctly assumes reinvestment at opportunity cost = WACC. MIRR also avoids the problem of multiple IRRs. Managers like rate of return comparisons, and MIRR is better for this than IRR. 54 Advantages and Disadvantages of IRR Advantages closely related to NPV, often leading to identical decisions Knowing a return is intuitively appealing It is a simple way to communicate the value of a project to someone who doesn’t know all the estimation details Disadvantages may lead to incorrect decisions in comparisons of mutually exclusive investments – to be explained later May result in multiple answers (so-called, Multiple IRRs) 55 Summary: NPV vs. IRR NPV and IRR will generally give us the same decision Exceptions: IRR is unreliable in the following situations Non-conventional cash flows – cash flow signs change more than once Mutually exclusive projects • Initial investments are substantially different • Timing of cash flows is substantially different Whenever there is a conflict between NPV and another decision rule, you should always use NPV 56 NPV (continued) Does the NPV rule account for the time value of money? Does the NPV rule provide an indication about the increase in value? Should we consider the NPV rule for our primary decision criteria? Does the NPV have serious flaws? 57 Example 7: NPV vs. PI Mutually Exclusive Projects Suppose Project A and B are mutually exclusive. 0 1 2 A $-20M 70M 10M PV@12% PI@ 12% $70.5M $3.52 B $-10M 15M 40M $45.3M $4.53 Higher NPV@ 12% $50.5 Higher $35.3 58 Advantages and Disadvantages of Profitability Index Advantages Disadvantages Closely related to NPV, May lead to incorrect generally leading to decisions in identical decisions comparisons of mutually exclusive Easy to understand and investments (To be communicate explained later) May be useful when available investment funds are limited (socalled, capital rationing, to be explained later) 59 Capital Rationing: “imposing maximum capital expenditures” Capital rationing occurs when a company chooses not to fund all positive NPV projects. The company typically sets an upper limit on the total amount of capital expenditures that it will make in the upcoming year. 60 Reason: Companies want to avoid the direct costs (i.e., flotation costs) and the indirect costs of issuing new capital. Or companies avoid a high debt ratio or earnings dilution. Solution: Increase the cost of capital by enough to reflect all of these costs, and then accept all projects that still have a positive NPV with the higher cost of capital. Or, Use profitability index, instead of NPVs. 61 Capital Rationing Example Projects A B C D E Total Required 0 -100 -200 -300 -400 -500 -1500 1 50 100 100 100 100 2 60 80 200 200 200 3 r 50 10% 100 10% 120 10% 250 10% 410 10% Total NPV NPV $ 33 $ 32 $ 46 $ 44 $ 64 $ 97 $ $ $ $ $ $ PI 1.33 1.16 1.15 1.11 1.13 111 Rank Rank NPV PI 4 1 5 2 2 3 3 5 1 4 What if the company has only $700 million? Which project(s) should you choose? 62 Capital Budgeting In Practice We should consider several investment criteria when making decisions. NPV and IRR are the most commonly used primary investment criteria. Payback is a commonly used secondary investment criteria. Use more than one Also exercise qualitative judgments in conjunction with quantitative analysis. Summary – Discounted Cash Flow Criteria 63 Net present value Difference between PV of future cash flows and cost Take the project if the NPV is positive Has no serious problems Preferred decision criterion Internal rate of return Discount rate that makes NPV = 0 Take the project if the IRR is greater than required return Same decision as NPV with conventional cash flows IRR is unreliable with non-conventional cash flows or mutually exclusive projects Profitability Index Benefit-cost ratio Take investment if PI > 1 Cannot be used to rank mutually exclusive projects May be useful to rank projects in the presence of capital rationing A challenging problem incorporating beta, WACC, and capital budgeting. Returns on the market and Company Y's stock during the last 3 years are shown below: Year Market Company Y 2001 –24% – 22% 2002 10 13 2003 22 36 The risk-free rate is 5 percent, and the required return on the market is 11 percent. You are considering a low-risk project whose project beta is 0.5 less than the company's overall corporate beta. You finance only with equity, all of which comes from retained earnings. The project has a cost of $500 million, and it is expected to provide cash flows of $100 million per year at the end of Years 1 through 5 and then $50 million per year at the end of Years 6 through 10. What is the project's NPV (in millions of dollars)? 64 65 Market Mean SD VAR Y M-mean Y-mean Product Weight Product*weight -24% -22% -26.67% -31.00% 8.27% 33.33% 2.76% 10% 13% 7.33% 4.00% 0.29% 33.33% 0.10% 22% 36% 19.33% 27.00% 5.22% 33.33% 1.74% 2.67% 9.00% 19.48% 4.59% 4.59% COV 3.80% COV 1.21 BETA Regression Statistics Multiple R 0.9886929 R Square 0.9775136 Adjusted R Square 0.9550272 Standard Error 0.0619369 Observations 3 ANOVA df SS MS Regression 1 0.166764 0.166764 Residual 1 0.003836 0.003836 Total 2 0.1706 CoefficientsStandard Error t Stat Intercept X Variable 1 F Significance F 43.47129 0.0958256 P-value Lower 95% Upper 95%Lower 95.0% Upper 95.0 0.0577283 0.036093 1.599445 0.355715 -0.400871 0.516328 -0.40087 0.516328 1.2102 0.183549 6.593276 0.095826 3.542385 -1.12201 3.542385 -1.12201