INTERMEDIATE

ACCOUNTING

Seventh Canadian Edition

KIESO, WEYGANDT, WARFIELD, YOUNG, WIECEK

Prepared by:

Gabriela H. Schneider, CMA

Northern Alberta Institute of Technology

CHAPTER

2

Conceptual Framework

Underlying Financial Reporting

Learning Objectives

1. Describe the usefulness of a conceptual

framework.

2. Describe the main components of the

conceptual framework for financial reporting.

3. Understand the objective of financial reporting.

4. Identify the qualitative characteristics of

accounting information.

Learning Objectives

5. Define the basic elements of financial

statements.

6. Describe the basic assumptions of accounting.

7. Explain the application of the basic principles of

accounting.

8. Describe the impact that constraints have on

reporting accounting information.

Learning Objectives

9. Explain the factors that contribute to choice

in financial reporting decisions.

10. Identify the four types of financial reporting

issues and what makes certain issues more

important than others.

11. Explain the practice of financial engineering.

12. Identify factors that contribute to fraudulent

financial reporting.

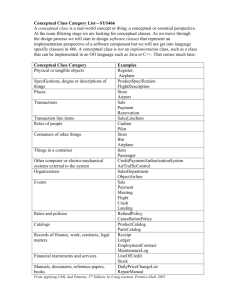

Conceptual Framework Underlying

Financial Reporting

Conceptual First Level:

Framework Basic

Rationale Objectives

Development

Second Level:

Fundamental

Concepts

Qualitative

characteristics

Basic elements

Third Level:

Foundational

Principles and

Conventions

Basic

assumptions

Basic principles

Constraints

Financial

Reporting

Issues

Making

Accounting

Choices

Issue

Identification

Financial

Engineering

Fraudulent

Financial

Reporting

Conceptual Framework

• Users of financial statements need relevant

and reliable information

• To provide such information, the profession

has developed a set of principles and

guidelines

• These principles and guidelines are

collectively called the Conceptual

Framework

• In short, the Framework is like a constitution

for the profession

Objectives of the Conceptual

Framework

• The Framework is the foundation for

building a set of coherent accounting

standards and rules

• The Framework is a reference of basic

accounting theory for solving emerging

practical problems of reporting

• This framework can be illustrated as follows

Conceptual Framework for

Financial Reporting

1st Level: Answers the ‘Why’ Question

Objectives

2nd Level:

Qualitative

The ‘Bridge’

Elements

3rd Level: Answers the ‘How’ Question

Foundation Principles and Conventions

Conceptual Framework–Objectives

To provide information:

• useful to those making investment and credit

decisions

• useful in making resource allocation decisions

• useful in assessing management stewardship

• to individuals who reasonably understand

business and economic activities

Conceptual Framework–Qualitative

Characteristics

• Understandability

• Relevance

• Reliability

• Comparability

• Consistency

Conceptual Framework–Qualitative

Characteristics

• Information is Relevant if it:

– has predictive value

– has feedback value

– is timely

• Information is Reliable if it:

– is verifiable; independent

users can arrive at the

same conclusion

– is a faithful representation

of what actually happened

– is neutral; free from bias

• Information is Comparable

if it:

– allows users to identify

real economic similarities

and differences

• Information is Consistent if:

– similar events have the

same accounting

treatment from period to

period

– when the treatment

changes, full disclosure is

made

Conceptual Framework–

Basic Elements

• Section 1000 of the CICA

Handbook defines seven

elements directly related to the

measurement of performance of

financial status of an enterprise

• These elements can be traced to

the Balance Sheet and Income

Statement

Conceptual Framework–

Basic Elements

Balance Sheet

Assets: probable future economic

benefit

Liabilities: probable future sacrifice

of economic benefits

Equity/Net Assets: residual interest

(Assets – Liabilities)

Conceptual Framework–

Basic Elements

Income Statement

Revenues: increases in economic

resources

Expenses: decreases in economic

resources

Gains: increases in equity

Losses: decreases in equity

Other comprehensive income

Conceptual Framework–Foundational

Principles and Conventions

• Explain which, when, and how financial

elements and events should be

recognized, measured, and presented

• These concepts are categorized as:

• basic assumptions

• principles

• constraints

Conceptual Framework–Foundational

Principles and Conventions

Basic

Assumptions

Principles of

Accounting

1. Economic

entity

2. Going

concern

3. Monetary unit

4. Periodicity

1. Historical cost

2. Revenue

recognition

3. Matching

4. Full

disclosure

Constraints

1.

2.

3.

4.

Uncertainty

Cost benefit

Materiality

Industry

Practice

Basic Assumptions

• Economic Entity Assumption

– The economic entity can be identified with

a particular unit of accountability

– The business activity is separate and

distinct from its owners

– The entity’s assets and other financial

elements are not commingled with those of

the owners

– The economic entity assumption is an

accounting concept and not a legal

construct

– Departments or divisions of an entity may

be considered separate entities

Basic Assumptions

• Going Concern Assumption

– The business is assumed to continue indefinitely

unless terminated by owners

– Expectation of continuing long enough to meet

their objectives and commitments

– The basis of recording financial elements is

historical accounting

– If liquidation of the enterprise is assumed to occur,

then liquidation accounting is more appropriate

– Liquidation accounting (net realizable value) is not

followed unless liquidation of the enterprise

appears imminent

Basic Assumptions

• Monetary Unit

– Money is the common unit of measure of

economic transactions

– Use of a monetary unit is relevant, simple and

understandable, universally available, and

useful

– The dollar is assumed to remain relatively

stable in value (effects of inflation/deflation are

ignored)

– Monetary unit is relevant only as long as it is

assumed that quantitative data is the driving

force behind users’ decision making

Basic Assumptions

• Periodicity (Time Period) Assumption

– Economic activity of an entity may be

artificially divided into time periods for

reporting purposes

– Shorter time periods are subject to errors but

may be more timely

• Trade-off between relevance and reliability

– Technology, accountability, and investors who

are more aware are driving the demand for

more on-line, real-time financial information

Basic Principles of Accounting

•

Historical Cost Principle

– Three basic presumptions of historical cost

1. Represents a value at a point in time

2. Results from a reciprocal exchange

3. Exchange includes an outside party

– Assets and liabilities are recorded at

acquisition price

– Financial information is reliable

Basic Principles of Accounting

Historical Cost Principle (continued)

– Recording transactions at other than historical

cost results in a net income materially affected

by opinion

– A “mixed attribute” system reports historical

cost, fair value, and lower of cost or market

values

Basic Principles of Accounting

• Revenue Recognition Principle

– Revenue is recognized when:

• It is performance achieved (earned)

• Measurability is reasonably certain and

• Collectibility reasonably assured (realizability)

– Basic presumptions of Revenue Recognition

• Result from a reciprocal exchange

• Exchange includes an outside party

Basic Principles of Accounting

Revenue Recognition Principle (continued)

– Revenue is recognized at the date of sale

(objective test)

– Date of sale provides an objective and verifiable

measure of revenue

– Applicable with a discrete earnings process and

one critical event

Basic Principles of Accounting

Revenue Recognition Principle (continued)

– There are exceptions; revenue may be recognized:

1

During Production: revenue is recognized prior to

contract completion in certain long-term

construction contracts

• Considered as a continuous earnings process

• Reliable cost and progress estimates must be

achieved

Basic Principles of Accounting

Revenue Recognition Principle

– Exceptions (continued)

2

3

End of Production: revenue is recognized end of

production and before sale occurs

• Sale and price are certain

Receipt of cash: when sales figure cannot be

established due to collection uncertainty

• An example - instalment sales contracts

(revenue is recognized only on receipt of cash)

Basic Principles of Accounting

• Matching Principle

– Expenses in one period are matched to

revenues recognized in the same period

– There should be a logical, rational association

of revenues and expenses

– If the expense benefits the current and future

periods, it is recorded as an asset

– This asset cost is then systematically and

rationally matched to future revenues

Basic Principles of Accounting

• Full Disclosure Principle

– Financial statements must report any information

that could reasonably be seen to affect the

judgement or decision of an informed user

– Disclosure may be made:

• Within the main body of the financial statements

• As notes to those statements

• As supplementary information, including

Management Discussion and Analysis (MD&A)

Basic Principles of Accounting

Full Disclosure Principle (continued)

– Disclosed information should:

• Provide sufficient detail of the occurrence; and at the

same time

• Be sufficiently brief enough to remain understandable

– Full disclosure is not a replacement for wellfounded accounting practice

Management Discussion and

Analysis (MD&A)

•

•

Management’s explanation of the

financial information and its

significance

Publicly traded corporations are now

required to include MD&A in their

annual reports

Management Discussion and

Analysis (MD&A)

• Six general principles (CICA MD&A Guidance

on Preparation and Disclosure)

1. Allows readers to view company through

management eyes

2. Complement and supplement financial

statements

3. Be reliable, complete, fair, and balanced

4. Have a forward-looking perspective

5. Focus on management’s strategy for

increasing investor value

6. Be written in plain language

Management Discussion and

Analysis (MD&A)

•

Five key elements to be included (CICA

MD&A Guidance on Preparation and

Disclosure)

1. Company’s vision, core businesses, and

strategy

2. Key performance indicators

3. Resources (capabilities) to reach targets

4. Results

5. Outline of risks

Constraints

• Uncertainty

– Recognition becomes difficult (or impossible)

when there is uncertainty

– Information reported is less likely to be

uncertain if:

• Events reported are likely or probably, and

• They are measurable

– Measurement Uncertainty

• Difference between the recognized amount and

another reasonably possible amount

Constraints

• Cost-Benefit Relationship

– The cost of providing information should not

outweigh the benefit derived

– Costs and benefits are not always obvious or

quantifiable

– Sound judgement must be used in providing

information

Constraints

• Materiality

– Refers to an item’s impact on a user’s decision

• An item must make a difference to be material and be

disclosed

• It is a matter of the relative significance of the element

• Both quantitative and qualitative factors are to be

considered in determining relative significance

– General rule of thumb: If the item is 5% of income

from continuing operations, it is considered

material

– Determination of materiality requires professional

judgement and expertise

Constraints

• Industry Practices

– The nature of some industries may sometimes

require departures from basic accounting

theory

– Must be consistent with primary sources of

GAAP and conceptual framework

Conceptual Framework Summary

Objectives

-Useful in investment & credit decisions

-Useful in making resource allocation decisions

-Useful in assessing management stewardship

Qualitative

Primary:

-Relevance

-Reliability

Secondary:

-Comparability

-Consistency

Elements

Assets and Liabilities

Equity/Net Assets

Revenues

Expenses

Gains and Losses

Other Comprehensive Income

Foundational Principles and Conventions

Assumptions

Economic entity

Going concern

Monetary unit

Periodicity

Principles

Historical cost

Revenue

recognition

Matching

Full disclosure

Constraints

Uncertainty

Cost-benefit

Materiality

Industry practice

Financial Reporting Choices

•

Factors contributing to reporting choices:

1. Principles-based GAAP, use of professional

judgement

2. Measurement uncertainty

3. Business transaction complexity

Issue Identification

•

•

•

•

Recognition

Measurement

Presentation

Disclosure

Financial Engineering and

Fraudulent Financial Reporting

• Various shades of grey

• Well reasoned and supported analysis

paramount

COPYRIGHT

Copyright © 2005 John Wiley & Sons Canada, Ltd.

All rights reserved. Reproduction or translation of

this work beyond that permitted by Access Copyright

(The Canadian Copyright Licensing Agency) is

unlawful. Requests for further information should be

addressed to the Permissions Department, John

Wiley & Sons Canada, Ltd. The purchaser may make

back-up copies for his or her own use only and not

for distribution or resale. The author and the

publisher assume no responsibility for errors,

omissions, or damages caused by the use of these

programs or from the use of the information

contained herein.