Chapter 7

advertisement

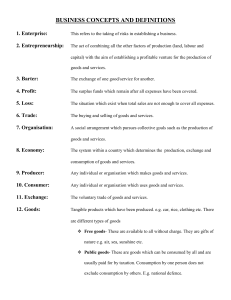

Chapter 7 The Business of Free Enterprise Anticipatory Set Have you ever heard the phrase you don’t have to reinvent the wheel? What does it mean to you? Objective Our objective today is Learn what an Entrepreneur is and what types of businesses exist. Entrepreneur Someone who not only starts their own business, but invents or introduces a new product or idea. A) they are usually a risk taker B) Examples Henry Ford Ray Krock Bill gates Who becomes an Entrepreneur? A) Improve a product or process by finding new ways to sell or use a product (kitty litter) Ed Lowe B) Unexpected opportunities (Post-itNote) C) Spotting New Markets (Kinko’s Fed Ex) D) Start at an early age (babysitting) E) Identifying population trends Small Business Most entrepreneurs start with a small business A small business is a business earning 3.5 million or less and employing no more than 500 people. But they do have some key advantages… Advantages 1) ability to satisfy small markets 2) their ability to adapt to change 3) imagination and flexibility are welcomed 4) you are the boss 5) job security Disadvantages **Most fail within a few weeks of getting started 1) Poor Management Most people are unprepared for the heavy workload 2) Inadequate finances A) don’t have enough money when getting started 1. insufficient capital, 2) slow sales, 3) heavy debt Day two Where To Start Anticipatory set: If you had to start a business tomorrow what would it be? Where to Start Objective: today we are going to talk about how small businesses get started and how they contrast with other types of businesses Where to Start You can go to Small Business Administration They provide counseling, literature, advice There are entrepreneurial programs offered by colleges You can get on the job training (getting paid while you learn)Steamfitters Local Union 420 Website Apprenticeship You can learn from successful family members Forms of Business Organizations 1) Sole proprietors- When 1 Person owns & operates a business A. most common type of business (73% of all businesses) B. Oldest form of business C. Most simple to form (fewest government restrictions) Advantages of Sole Proprietors 1. You are your own boss 2. Keep all of the profits 3. Tax advantage over corporations 4. Make all the decisions 5. You can establish a personal relationship with your customers Disadvantages Unlimited Liability Total business responsibilities One source of capital Limited life Tough to achieve specialization Partnerships 1. When 2 or more people own a business (roughly 7%) 2. Two types of partners A. Active partner-contributes both time & money B. Silent partner-contributes money only Advantages 1. Two or more sources of capital & better fund raising ability 2. Share the business responsibilities 3. Easy to organize with a better chance to specialize Disadvantages 1. Unlimited liability 2. Limited life 3. Dishonest partner 4. You are responsible for your partners mistakes 5. Must split the profits 6. Finances are still very limited Student Input Answer the questions on page 106 and 111 in your JA Economics textbook Corporations A corporation is an artificial being permitted by Government to carry out a business A corporate charter-A written grant of authority from the Government giving you permission to exist. state charter is easier to obtain Federal charter is more difficult and can be an expensive process Owners-Stockholders Paid dividends-how the corporate profits are shared Proxy-written permission transferring your voting rights This is the most dominant type of business in modern U.S. capitalism Makes up 20%of all businesses Generates 90% of all business sales & revenue Advantages Most effective way to raise capital Sell new stocks, bonds, lenders, dispose of holdings *Usually easier to access bank credit Advantages *Limited Liability owners risk only what they paid for stock Easier to expand in size and scope Mass production & specialization A life separate from its owners (legally immortal) Disadvantages Very, Very had to establish Expensive and time consuming Lots of “Red-Tape” all of the papers and documents that must be completed before legally beginning Double Taxation Corporate profits are taxed (usually 35%) Stockholders are taxed on dividends Separation of Ownership & Business Corporate officers can avoid responsibility for questionable business decisions Officers can vote themselves large pay raises & bonuses Most shareholders do not exercise voting rights