Financial Management

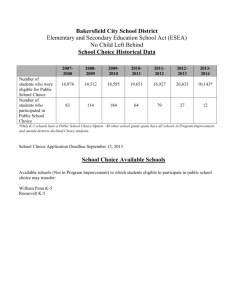

advertisement

Chapter 7 - Valuation and Characteristics of Bonds Chapter 8 - Stock Valuation IIS 1 Tujuan Pembelajaran 1 Mahasiswa mampu untuk: Membedakan berbagai jenis obligasi dan menjelaskan beberapa karakteristik obligasi yang populer Menjelaskan definisi nilai untuk berbagai penggunaan Menjelaskan faktor-faktor yang menentukan nilai Menjelaskan proses dasar penilaian aset Menghitung nilai obligasi dan yield to maturity Menjelaskan lima hubungan penting pada penilaian obligasi IIS 2 Pokok Bahasan 1 Jenis-jenis obligasi Terminologi dan karakterisitik obligasi Definisi nilai Penentu nilai Proses dasar penilaian Penilaian obligasi Yield to maturity Lima hubungan penting pada penilaian obligasi IIS 3 Tujuan Pembelajaran 2 Mahasiswa mampu untuk: Menguraikan karakterisitik dan ciri saham preferen Menghitung nilai saham preferen Menjelaskan karakteristik dan ciri saham biasa Menghitung nilai saham biasa Menghitung tingkat imbal hasil yang diharapkan dari saham IIS 4 Pokok Bahasan 2 Jenis dan ciri saham preferen Me nilai saham preferen Karakteristik saham biasa Menilai saham biasa Menghitung tingkat imbal hasil yang diharapkan pemegang saham IIS 5 Characteristics of Bonds Bonds pay fixed coupon (interest) payments at fixed intervals (usually every six months) and pay the par value at maturity. $I 0 IIS $I 1 $I $I $I $I+$M 2 ... n 6 Example: AT&T 6 ½ 32 Par value = $1,000 Coupon = 6.5% or par value per year, or $65 per year ($32.50 every six months). Maturity = 28 years (matures in 2032). Issued by AT&T. IIS 7 Example: AT&T 6 ½ 32 Par value = $1,000 Coupon = 6.5% or par value per year, or $65 per year ($32.50 every six months). Maturity = 28 years (matures in 2032). Issued by AT&T. $32.50 0 IIS $32.50 $32.50 $32.50 $32.50 $32.50+$1000 1 2 … 28 8 Types of Bonds Debentures - unsecured bonds. Subordinated debentures - unsecured “junior” debt. Mortgage bonds - secured bonds. Zeros - bonds that pay only par value at maturity; no coupons. Junk bonds - speculative or belowinvestment grade bonds; rated BB and below. High-yield bonds. IIS 9 Types of Bonds Eurobonds - bonds denominated in one currency and sold in another country. (Borrowing overseas.) example - suppose Disney decides to sell $1,000 bonds in France. These are U.S. denominated bonds trading in a foreign country. Why do this? IIS 10 Types of Bonds Eurobonds - bonds denominated in one currency and sold in another country. (Borrowing overseas). example - suppose Disney decides to sell $1,000 bonds in France. These are U.S. denominated bonds trading in a foreign country. Why do this? If borrowing rates are lower in France. To avoid SEC regulations. IIS 11 The Bond Indenture The bond contract between the firm and the trustee representing the bondholders. Lists all of the bond’s features: coupon, par value, maturity, etc. Lists restrictive provisions which are designed to protect bondholders. Describes repayment provisions. IIS 12 Value IIS Book value: value of an asset as shown on a firm’s balance sheet; historical cost. Liquidation value: amount that could be received if an asset were sold individually. Market value: observed value of an asset in the marketplace; determined by supply and demand. Intrinsic value: economic or fair value of an asset; the present value of the asset’s expected future cash flows. 13 Security Valuation In general, the intrinsic value of an asset = the present value of the stream of expected cash flows discounted at an appropriate required rate of return. Can the intrinsic value of an asset differ from its market value? IIS 14 Valuation n V = S t=1 $Ct (1 + k)t Ct = cash flow to be received at time t. k = the investor’s required rate of return. V = the intrinsic value of the asset. IIS 15 Bond Valuation Discount the bond’s cash flows at the investor’s required rate of return. The coupon payment stream (an annuity). The par value payment (a single sum). IIS 16 Bond Valuation S n Vb = t=1 $It (1 + kb)t + $M (1 + kb)n Vb = $It (PVIFA kb, n) + $M (PVIF kb, n) IIS 17 Bond Example Suppose our firm decides to issue 20-year bonds with a par value of $1,000 and annual coupon payments. The return on other corporate bonds of similar risk is currently 12%, so we decide to offer a 12% coupon interest rate. What would be a fair price for these bonds? IIS 18 0 120 120 120 ... 1000 120 1 2 3 ... 20 Note: If the coupon rate = discount rate, the bond will sell for par value. IIS 19 Bond Example Mathematical Solution: PV = PMT (PVIFA k, n ) + FV (PVIF k, n ) PV = 120 (PVIFA .12, 20 ) + 1000 (PVIF .12, 20 ) PV = PMT 1 1 - (1 + i)n i PV = 120 1 IIS + FV / (1 + i)n 1 (1.12 )20 + 1000/ (1.12) 20 = $1000 .12 20 Suppose interest rates fall immediately after we issue the bonds. The required return on bonds of similar risk drops to 10%. What would happen to the bond’s intrinsic value? Note: If the coupon rate > discount rate, the bond will sell for a premium. IIS 21 Bond Example Mathematical Solution: PV = PMT (PVIFA k, n ) + FV (PVIF k, n ) PV = 120 (PVIFA .10, 20 ) + 1000 (PVIF .10, 20 ) PV = PMT PV = IIS 1 1 - (1 + i)n i 120 1 - + FV / (1 + i)n 1 (1.10 )20 + 1000/ (1.10) 20 = $1,170.27 .10 22 Suppose interest rates rise immediately after we issue the bonds. The required return on bonds of similar risk rises to 14%. What would happen to the bond’s intrinsic value? Note: If the coupon rate < discount rate, the bond will sell for a discount. IIS 23 Bond Example Mathematical Solution: PV = PMT (PVIFA k, n ) + FV (PVIF k, n ) PV = 120 (PVIFA .14, 20 ) + 1000 (PVIF .14, 20 ) PV = PMT PV = IIS 1 1 - (1 + i)n i 120 1 - + FV / (1 + i)n 1 (1.14 )20 + 1000/ (1.14) 20 = $867.54 .14 24 Suppose coupons are semi-annual Mathematical Solution: PV = PMT (PVIFA k, n ) + FV (PVIF k, n ) PV = 60 (PVIFA .14, 20 ) + 1000 (PVIF .14, 20 ) PV = PMT PV = IIS 1 1 - (1 + i)n i 60 1 - + FV / (1 + i)n 1 (1.07 )40 + 1000 / (1.07) 40 = $866.68 .07 25 Yield To Maturity The expected rate of return on a bond. The rate of return investors earn on a bond if they hold it to maturity. S n P0 = t=1 IIS $It (1 + kb)t + $M (1 + kb)n 26 YTM Example Suppose we paid $898.90 for a $1,000 par 10% coupon bond with 8 years to maturity and semi-annual coupon payments. What is our yield to maturity? IIS 27 Bond Example Mathematical Solution: PV = PMT (PVIFA k, n ) + FV (PVIF k, n ) 898.90 = 50 (PVIFA k, 16 ) + 1000 (PVIF k, 16 ) PV = PMT 1 1 - (1 + i)n i 1 898.90 = 50 1 - (1 + i )16 IIS i + FV / (1 + i)n + 1000 / (1 + i) 16 solve using trial and error 28 Zero Coupon Bonds No coupon interest payments. The bond holder’s return is determined entirely by the price discount. IIS 29 Zero Example Suppose you pay $508 for a zero coupon bond that has 10 years left to maturity. What is your yield to maturity? IIS 30 Zero Example Suppose you pay $508 for a zero coupon bond that has 10 years left to maturity. What is your yield to maturity? -$508 0 IIS $1000 10 31 PV = -508 0 Zero Example FV = 1000 Mathematical Solution: PV = FV (PVIF i, n ) 508 = 1000 (PVIF i, 10 ) .508 = (PVIF i, 10 ) [use PVIF table] 10 PV = FV /(1 + i) 10 508 = 1000 /(1 + i)10 1.9685 = (1 + i)10 i = 7% IIS 32 The Financial Pages: Corporate Bonds Polaroid 11 1/2 06 Cur Yld Vol 19.3 395 59 3/4 Close Net Chg ... What is the yield to maturity for this bond? P/YR = 2, N = 10, FV = 1000, PV = $-597.50, PMT = 57.50 Solve: I/YR = 26.48% IIS 33 The Financial Pages: Corporate Bonds HewlPkd zr 17 Cur Yld Vol ... 20 Close 51 1/2 Net Chg +1 What is the yield to maturity for this bond? P/YR = 1, N = 16, PV = $-515, PMT = 0 FV = 1000, Solve: I/YR = 4.24% IIS 34 The Financial Pages: Treasury Bonds Maturity Rate Mo/Yr 9 Nov 18 Bid Asked 139:14 139:20 Chg -34 Ask Yld 5.46 What is the yield to maturity for this Treasury bond? (assume 35 half years) P/YR = 2, N = 35, FV = 1000, PMT = 45, PV = - 1,396.25 (139.625% of par) IIS Solve: I/YR = 5.457% 35 Preferred Stock A hybrid security: It’s like common stock - no fixed maturity. Technically, it’s part of equity capital. It’s like debt - preferred dividends are fixed. Missing a preferred dividend does not constitute default, but preferred dividends are cumulative. IIS 36 Preferred Stock Usually sold for $25, $50, or $100 per share. Dividends are fixed either as a dollar amount or as a percentage of par value. Example: In 1988, Xerox issued $75 million of 8.25% preferred stock at $50 per share. $4.125 is the fixed, annual dividend per share. IIS 37 Preferred Stock Features Firms may have multiple classes of preferreds, each with different features. Priority: lower than debt, higher than common stock. Cumulative feature: all past unpaid preferred stock dividends must be paid before any common stock dividends are declared. IIS 38 Preferred Stock Features Protective provisions are common. Convertibility: many preferreds are convertible into common shares. Adjustable rate preferreds have dividends tied to interest rates. Participation: some (very few) preferreds have dividends tied to the firm’s earnings. IIS 39 Preferred Stock Features PIK Preferred: Pay-in-kind preferred stocks pay additional preferred shares to investors rather than cash dividends. Retirement: Most preferreds are callable, and many include a sinking fund provision to set cash aside for the purpose of retiring preferred shares. IIS 40 Preferred Stock Valuation A preferred stock can usually be valued like a perpetuity: Vps = IIS D k ps 41 Example: Xerox preferred pays an 8.25% dividend on a $50 par value. Suppose our required rate of return on Xerox preferred is 9.5%. Vps = IIS 4.125 .095 = $43.42 42 Expected Rate of Return on Preferred Just adjust the valuation model: kps = IIS D Po 43 Example If we know the preferred stock price is $40, and the preferred dividend is $4.125, the expected return is: kps IIS D = Po 4.125 = = .1031 40 44 The Financial Pages: Preferred Stocks 52 weeks Yld Hi Lo Sym Div % 2788 2506 GenMotor pfG 2.28 8.9 Vol PE 100s Close … 86 25 53 Dividend: $2.28 on $25 par value = 9.12% dividend rate. Expected return: 2.28 / 25.53 = 8.9%. IIS 45 Common Stock Is a variable-income security. Dividends may be increased or decreased, depending on earnings. Represents equity or ownership. Includes voting rights. Limited liability: liability is limited to amount of owners’ investment. Priority: lower than debt and preferred. IIS 46 Common Stock Characteristics IIS Claim on Income - a stockholder has a claim on the firm’s residual income. Claim on Assets - a stockholder has a residual claim on the firm’s assets in case of liquidation. Preemptive Rights - stockholders may share proportionally in any new stock issues. Voting Rights - right to vote for the firm’s board of directors. 47 Common Stock Valuation (Single Holding Period) You expect XYZ stock to pay a $5.50 dividend at the end of the year. The stock price is expected to be $120 at that time. If you require a 15% rate of return, what would you pay for the stock now? IIS ? 5.50 + 120 0 1 48 Common Stock Valuation (Single Holding Period) Solution: Vcs = (5.50/1.15) + (120/1.15) = 4.783 + 104.348 = $109.13 IIS 49 The Financial Pages: Common Stocks 52 weeks Yld Vol Net Hi Lo Sym Div % PE 100s Hi Lo Close Chg 135 80 IBM .52 .5 21 142349 99 93 9496 -343 82 18 CiscoSys IIS … 47 1189057 21 19 2025 -113 50 Common Stock Valuation (Multiple Holding Periods) Constant Growth Model Assumes common stock dividends will grow at a constant rate into the future. Vcs = IIS D1 kcs - g 51 Constant Growth Model Assumes common stock dividends will grow at a constant rate into the future. Vcs = IIS D1 kcs - g D1 = the dividend at the end of period 1. kcs = the required return on the common stock. g = the constant, annual dividend growth rate. 52 Example XYZ stock recently paid a $5.00 dividend. The dividend is expected to grow at 10% per year indefinitely. What would we be willing to pay if our required return on XYZ stock is 15%? D0 = $5, so D1 = 5 (1.10) = $5.50 IIS 53 Example XYZ stock recently paid a $5.00 dividend. The dividend is expected to grow at 10% per year indefinitely. What would we be willing to pay if our required return on XYZ stock is 15%? Vcs = IIS D1 kcs - g = 5.50 .15 - .10 = $110 54 Expected Return on Common Stock Just adjust the valuation model Vcs = k = IIS ( D kcs - g D1 Po ) + g 55 Example We know a stock will pay a $3.00 dividend at time 1, has a price of $27 and an expected growth rate of 5%. kcs = kcs = ( IIS ( 3.00 27 D1 Po ) + g ) + .05 = 16.11% 56