South Korea & Lipton

advertisement

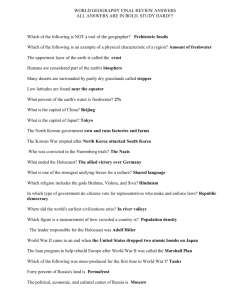

Lipton in South Korea Will their ice tea succeed? Overview • Categories: – Product – Price – Place – Promotion • Subcategories for each section further analyze the Korean market Product • The following will affect Lipton’s entrance into the S. Korean market: – Legal Issues – Consumer Behavior – Cultural Issues Legal Issues • Unilever is currently established in S. Korea – They sell mostly personal care products – This is crucial in S. Korea where a communication channel with the government is key • Legal standard of requiring Korean labels on all products – Would require Unilever to change their labels – Could possibly lead to misinterpretation of “ice tea” Consumer Behavior • Very brand loyal – Consumers are more likely to buy a product if it states that it was produced in S. Korea – They are more likely to buy a product which has a known label on it • Lipton would therefore sell under the Lipton brand name • Quality Concerns – Emphasis on health benefits of product • Shy away from additives and preservatives • The added preservatives in Lipton’s ice tea may cause hesitation among S. Korean consumers Consumer Behavior • Koreans consider themselves a “tea culture” – Tea is seen as being a stimulating and healthy beverage – Tea is seen as a tradition in Korea – Might be hesitant to try a “new age” version-ice tea • The word tea connotates a feeling of respect – Using the word “tea” on packaging could lead to consumer skepticism • Also, Korean “new age” beverage market is expected to decrease 30.1% by 2008 – Might be considered risky to venture into this market right now • Lipton would probably want to bottle their ice tea in smaller cans – Cans tend to be more popular in S. Korea than bottles – Consumer preference leads can sizes to be taller and skinnier than an American can Cultural • Refrigerators sizes tend to be the same as standard American versions – Would influence the size and quantity of product being bought – Buy packages of beverages in 250ml-330ml units • A Lipton ice tea out of a vending machine is 591 ml – Buy large units at their supermarkets which are 1.5 liter Pricing • The following will affect Lipton’s entrance into the S. Korean market: – Competition – Economic Competition • Lipton’s price should be based off of similar selling products – According to the website, ikoreaplaza.com, similar selling new age beverages sell for $.99 – Lipton would need to sell their ice tea at a similar price in order to gain competitive market share Economic • The purchasing power parity of Korea is $17,111 as opposed to a purchasing power parity of $39,000 in the U.S. – Less likely to try new products – Lipton’s price will have to be sensitive to their relatively low purchasing power Place • The following will affect Lipton’s entrance into the S. Korean market: – Consumer Behavior – Economic – Infrastructure Economic • Population distribution – Seoul: 10,331,000 – Busan: 3,786,000 – Incheon: 2,582,000 • Increase distribution in these areas because of population concentration Consumer Behavior • In big cities there is a trend to buy at larger, discount stores – Has been best method for marketing foreign products • Hypermarkets and supermarkets sell the same amount in total food sales – They are more likely to take or showcase foreign products • Traditionally, consumers prefer to shop at a supermarket within their apartment complex, or near their home, rather than travel far distances to a hypermarket – However, there the new trend is to visit a hypermarket once a week, rather than go to a smaller retail location multiple times a week Infrastructure • Unilever currently has a production facility in S. Korea – Daejeon – est. in 1993 – Currently produces: • Personal care items (shampoo, lotion, toothpaste) – Possible to set up production for ice tea – Would save on costs regarding imports • Alternate option of production: – Unilever has an existing partnership with PepsiCo – Because PepsiCo is already established in S. Korea, partnering with them could reduce manufacturing costs Infrastructure (2) • Transporting Lipton: – Established distribution methods (roadways, air, etc.) • CJ-GLS is a distribution service provider – Uses mostly trucking throughout the country – Has means to use air and ocean freight – Also takes part in distribution consultations • Unilever could partner with CJ-GLS in order to move Lipton throughout Korea efficiently – CJ-GLS has logistical expertise in Korea – They focus on lowering costs for their customers – Work individually with customers to formulate a customized plan Infrastructure (3) • Retail locations – Hypermarkets • They are being placed in larger suburban cities because there is more space • Their daily visitor counts range from 10,000- 300,000 • Sold more food than any other retailer in 2001 ($13,988,000) – Supermarkets • They typically carry a wider variety of products than smaller, family owned stores • Often carry new food and beverage products – Kiosks/Vending Machines • Convenient for consumers on the run • Ideally located in high-traffic areas Promotion • The following will affect Lipton’s entrance into the S. Korean market: – Technological – Legal – Competition Technological • Unilever currently uses the following established advertising agencies in S. Korea: – J. Walter Thompson Adventure – Lintas – McCann Erickson – Ogilvy & Mather • Unilever uses these four firms no matter the country – Consistent message across countries for one brand image Technological (2) • Key media vehicles – TV is most popular medium • 100% of households own a television • Average adult watches 106 minutes of TV per day • Aligns with current promotional strategy – Newspapers • They are second most popular form of advertising • Newspaper ads account for 31% of all advertising expenditures • Would require Lipton to slightly change current strategy – “Outdoor” • Lipton could be promoted on vending machines • Efficient because product is promoted at the point of purchase – Sponsorships Legal • The pre-established advertising firms operating in S. Korea would help guarantee that Lipton promotions followed the rules and regulations of Korea – Some examples of these restrictions include: • Advertising should not contain exaggerated statements and visual presentations • Different or exaggerated presentations of ingredients and content • Indications or presentations of health improvement, longevity, and youth maintenance capabilities • Portrayal of product as natural food rather than artificial food • Presentations of food being consumed in an unrefined manner of being handled Competition • The following would be direct ice tea competitors: – Lotte Chilsung Beverage Co, Ltd. • Largest beverage company in S. Korea • Lotte produces carbonates, juices, and health drinks – Nestle – Other beverage competitors in S. Korea: • Iced coffee (44.3% market share) • Other (31.10%) • Herb-based (13.20%) • Malt-based (6.0%) • Knowledge of competition is crucial for product positioning Brought to you by: • Allison Bennett • Nicole Curtner • Ryan Hoban • Jennifer Jacobs • Jennifer Sorin