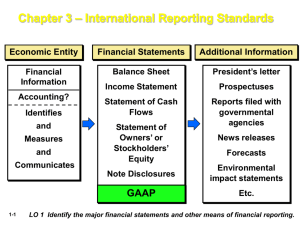

GAAP Presentation

advertisement

Private Company Financial Reporting LITTLE GAAP The Standard Setting Dilemma 15,000 issuers vs. 28.5 million private companies but GAAP driven by public company issues. Small businesses employ more than half of all private sector workers. Private companies and their financial statement users have information needs different from public companies. Canadian Accounting Standards Board decided one size does not fit all and published Accounting Standards for Private Enterprises in Dec. 2009 Not Just a US Problem UK Accounting Standards Board proposing three-tier system of financial reporting. Germany has become first major country to have two standard setters. Not Just a US Problem Council on Accounting for Unlisted Companies formed in Japan to determine if changes should be made to standard-setting process for unlisted companies IFRS for SMEs – being used in many areas of the world and being considered in some others What U.S. Constituents Say about GAAP for Private Company Financial Reporting Too many GAAP-specific requirements not useful or relevant for private companies’ financial statement users Greater FASB emphasis on equity/public company investors Most important problem: relevance Increased complexity is burdensome, time-consuming What this means for GAAP in Practice Today? Private companies incurring significant unnecessary cost for financial statement preparation and audit, review or compilation services. Private companies are increasingly taking GAAP exceptions. Current system is not attuned to the needs of private company financial statement preparers and users Key Events For Standard-setting For Private Companies Private Company Financial Reporting Committee (PCFRC) In 2006, the FASB created the PCFRC in an effort to further improve its ability to incorporate the views of private company constituents in its standard-setting process. The mission of the PCFRC was to provide recommendations to the FASB on issues related to standard setting for private companies and to focus on how standard setting affects day-to-day technical activities at private companies. Key Events For Standard-setting For Private Companies The FAF Oversight Committee In 2008 the FAF created the Standard-Setting Process Oversight Committee, which conducts, on behalf of the Board of Trustees, ongoing oversight and evaluation of the adequacy, transparency, independence, and efficiency of the standard-setting processes employed by the FASB and GASB in establishing and improving financial accounting and reporting standards. The Committee does not interfere with technical standard-setting. Key Events For Standard-setting For Private Companies FAF Listening Tour In 2009 the FAF Board of Trustees undertook a nationwide “listening tour.” During the tour, the Trustees learned that many constituents continued to be concerned about the cost and complexity of standards for private companies and not-for-profit organizations and were not satisfied with the results of the collaboration between the FASB and the PCFRC. A major issue cited by constituents was that the FASB and the PCFRC did not develop and agree upon a framework for considering exceptions or modifications to U.S. GAAP for private companies. Key Events For Standard-setting For Private Companies Blue -Ribbon Panel on Standard Setting for Private Companies The FAF Trustees collaborated with the American Institute of Certified Public Accountants (AICPA) and the National Association of State Boards of Accountancy (NASBA) to create the Blue-Ribbon Panel on Standard Setting for Private Companies. The panel was charged with studying the needs of users of private company financial statements and making recommendations to the Trustees about how the standard setting process can best meet those needs. Establishment of the Private Company Council The Private Company Council (PCC), will be overseen by the Trustees and will replace the existing Private Company Financial Reporting Committee (PCFRC). The PCC will comprise 9 to 12 members, including a Chair. The PCC Chair will not be affiliated with the FASB and will have had substantial experience with and exposure to private companies during the course of their career. PCC members will include users, preparers, and practitioners who have significant experience using, preparing, and auditing (and/or compiling and reviewing) private company financial statements. Private Company Council The PCC has two principal responsibilities: 1. The PCC will determine whether exceptions or modifications to existing non-governmental U.S. Generally Accepted Accounting Principles (U.S. GAAP) are required to address the needs of users of private company financial statements. 2. The PCC will serve as the primary advisory body to the Financial Accounting Standards Board (FASB) on the appropriate treatment for private companies for items under active consideration on the FASB’s technical agenda. Private Company Council During its first three years of operation, the PCC will hold at least five meetings each year, with additional meetings if determined necessary by the PCC Chair. A FASB board member will be assigned as a liaison to the PCC, similar to other FASB group arrangements. FASB technical and administrative staff will be assigned to support and work closely with the PCC to leverage the FASB’s resources and avoid duplication of efforts. All FASB members will be expected to attend and participate in all deliberative meetings of the PCC, but closed educational and administrative meetings may be held with or without FASB members present. PCC Agenda Setting and Due Process for existing U.S. GAAP The PCC will conduct a review of existing U.S. GAAP and identify standards that it will consider for possible exceptions or modifications. The PCC will develop, deliberate, and vote on proposed exceptions or modifications, which must be approved by a two-thirds vote of all PCC members (super majority). Proposed modifications or exceptions to U.S. GAAP approved by the PCC will be provided to the FASB for a decision on endorsement. If endorsed by a simple majority of FASB members, the proposed modifications will be exposed for public comment. PCC Agenda Setting and Due Process for existing U.S. GAAP PCC FASB • Following receipt of public comment, the PCC will consider changes to the original recommendation and take a final vote. If approved, the final recommendation then will be provided to the FASB for a final decision on endorsement. • If the FASB does not endorse a proposed or final modification or exception, the FASB Chairman will provide to the PCC Chair, within a reasonable period of time, a written document describing the reason(s) for the nonendorsement. PCC Role in Projects on FASB Agenda PCC PCC • For projects under active consideration on the FASB’s technical agenda, the PCC is the primary advisory body to the FASB about the implications for private companies. • The PCC may vote to reach a consensus about recommendations to the FASB for appropriate treatment for private companies on active FASB projects. Those recommendations will be considered by the FASB in its deliberations, and the FASB will be responsible for documenting, in the basis for conclusions of its proposed and final Accounting Standards Updates, how it separately considered the needs of private companies and the recommendations from the PCC. PCC Roster Mr. Billy M. Atkinson – Chair Mr. Daryl E. Buck – FASB Liasion Mr. Michael K. Cheng – FASB Staff Mr. George Beckwith National Gypsum Company Mr. Steven Brown - US Bank Mr. Jeffery Bryan Dixon Hughes Goodman LLP Mr. Mark Ellis PetCareRx Inc. Mr. Lawrence Weinstock Mr. Thomas Mr. Neville Mr. Carleton Ms. Diane Mana Groskopf Grusd Olmanson Rubin Products, Barnes, Merchant GMB Novogradac Inc. Dennig & Financial Mezzanine & Company Co., Ltd. Corporation Capital LLP 2013 PCC Meeting Dates February May • February 12, 2013 • Norwalk • May 7, 2013 • Norwalk July • July 16, 2013 • Location TBD October November • October 1, 2013 • Norwalk • November 12, 2013 • Norwalk Current PCC Agenda Issue 2 –Private Company Accounting for Variable Interest Entities Issue 4 – Accounting for Uncertain Tax Positions Issue 1- Accounting for Identifiable Intangible Assets in a Business Combination Issue 3 – Accounting for Receive Variable – Pay Fixed Interest Rate Swaps Non-GAAP Developments AICPA FRAMEWORK FOR SMES The AICPA's financial reporting framework for small- and medium-sized entities (FRF for SMEs) is designed for privately owned, for-profit smaller enterprises that are not required to produce financial statements in accordance with U.S. GAAP. An exposure draft of this proposed financial reporting option was released on Nov. 1, 2012, to obtain input from stakeholders. The comment period has closed and letters received are available to the public. The AICPA expects to issue the final framework in late spring 2013. AICPA FRAMEWORK FOR SMES The Financial Reporting Framework for Small- and Medium-sized Entities (FRF for SMEs) is a self-contained special purpose framework intended for use by privately held small-to-medium-sized entities (SMEs) in preparing their financial statements. The FRF for SMEs draws upon a blend of traditional methods of accounting with some accrual income tax methods. The framework is being developed by a working group of CPA professionals and AICPA staff who have years of experience serving smaller-tomedium-sized private entities. The FRF for SMEs has been exposed for public comment to solicit broad stakeholder input. AICPA FRAMEWORK FOR SMES The FRF for SMEs will be a less complicated and less costly system of accounting for SMEs that are not required to produce U.S. GAAP-based financial statements. The FRF for SMEs will be a cost-beneficial solution for owner-managers and others who need financial statements that are prepared in a consistent and reliable manner in accordance with a framework that has undergone public comment and professional scrutiny. Accounting principles in the FRF for SMEs will be responsive to the well-documented issues and concerns stakeholders currently encounter when preparing financial statements for SMEs. AICPA FRAMEWORK FOR SMES The FRF for SMEs is being developed for smaller- to medium-sized, ownermanaged, for-profit entities that need reliable financial statements where internal or external users have direct access to the owner-manager and GAAP financial statements are not required. The FRF for SMEs may be used by entities in most industry groups and by unincorporated and incorporated entities. The AICPA has no authority to require the use of the FRF for SMEs for any entity. Therefore, the FRF for SMEs will have no effective date and an owner-manager can decide to use the FRF for SMEs once it is released. An ownermanager should make that decision in conjunction with those who may use the entity’s financial statements. AICPA FRAMEWORK FOR SMES The AICPA cannot preclude an entity from preparing its financial statements under the FRF for SMEs. The FRF for SMEs is intended to be used by smalland medium-sized for-profit entities. Typically, the FRF for SMEs would be used by owner-managers who rely on a set of financial statements to confirm their assessments of performance, and of what they own and what they owe and the entity’s cash flows. AICPA FRAMEWORK FOR SMES The AICPA and the Financial Accounting Foundation (FAF) are both committed to the private company financial reporting constituency, however, the objectives of these two efforts are different. The new FAF Private Company Council will focus on modifications to U.S. GAAP for private companies that need or are required to have financial statements prepared in accordance with GAAP. The FRF for SMEs is a concise, highly relevant framework for owner-managers of SMEs and their external stakeholders where U.S. GAAP financial statements are not required or necessary. AICPA FRAMEWORK FOR SMES Implementation guidance, in the form of application examples, illustrative financial statements, a disclosure checklist, and similar tools will be offered by the AICPA to complement the FRF for SMEs. In addition, toolkits will be available to help CPA firms introduce and explain the FRF for SMEs and its advantages to clients and financial statement users. ? Questions ? THANK YOU