File - Exam Attack

advertisement

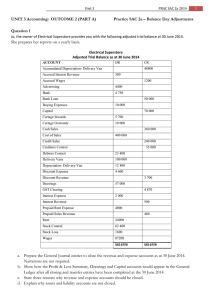

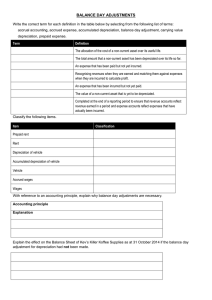

Y11 Accounting Income Statement for a Service Firm Income Statement for a Trading Firm A Balance Sheet A Cash Budget Perform Balance Day Adjustments Being able to classify accounts Knowing the order and layout of each statement- memorise these layouts Appropriate headings MUST be used Writing a PPE note- know the headings and labels Knowing how to write the title for each statement Any item on the left hand side of a Trial Balance is either: Any item on the right hand side of a Trial Balance is either: ◦ An expense (Distribution/Administration/Finance) ◦ Cost of Goods Sold (Opening inventory, Purchases, Freight in, Customs duty) ◦ An asset (Current, PPE, Intangible or Investment) ◦ Drawings ◦ OR a negative account of anything from the other side e.g. Sales Returns ◦ ◦ ◦ ◦ Income (including other) Liability (Current and Non-current) Capital OR a negative account of anything from the other side e.g. Purchase Returns The inventory figure for the Current Asset section and Closing Capital is always given in the notes and starts with 31st Always classify the items in the trial balance and put a line through them when you have put them into the statements to ensure you have dealt with all items If you cannot do a particular adjustment move on to the others. Always put an account and a figure if you have done the adjustment or not under a heading When classifying expenses ask the following questions: ◦ If the expense can be directly linked to selling the product it a distribution/selling expense e.g. Advertising ◦ If it is a necessary expense, but cannot be linked to selling the product it is an Administration Expense e.g. Accountancy fees ◦ If it is an Interest Expense it always goes under Finance Costs- The ONLY thing that goes under finance costs is Interest Office Wages = Administration Sales Wages = Distribution Expense Deprecation on Office Equipment = Administration Depreciation on Delivery Van = Distribution Office always implies Administration Cost Prepayments- Current Asset = Left Accrued Income- Current Asset = Left Accrued Expense- Current Liability = Right Income in advance- Current Liability = Right If it says ‘invoices’ it means it is either Accounts Receivable or Accounts Payable and GST must be calculated GST for any item purchased makes GST Payable go down or GST Receivable go up GST for income makes GST Payable go up or GST Receivable go down It is states the word ‘owing’ it is either Accrued income or Accrued Expense One account name is always given to you in the question e.g. Invoice on hand for salesSales is the account name given For any of the adjustments (Prepayment, Accrued Income, Accrued Expenses and Income in Advance, Depreciation expense) you will need to hand write these onto the Trial Balance When calculating depreciation there are only ever two accounts affected- Accumulated Depreciation and Depreciation expenseNEVER abbreviate Never include an item into the cash budget where ‘actual’ cash is not changing hands e.g. Depreciation, Drawings of inventory, Invoices, any Liabilities or Assets. Always circle if there is a surplus or a deficit