Helpful Tips for Completing the Tax Forms - Ho

advertisement

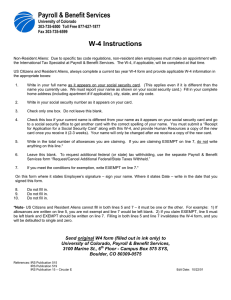

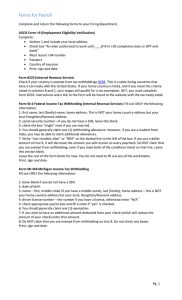

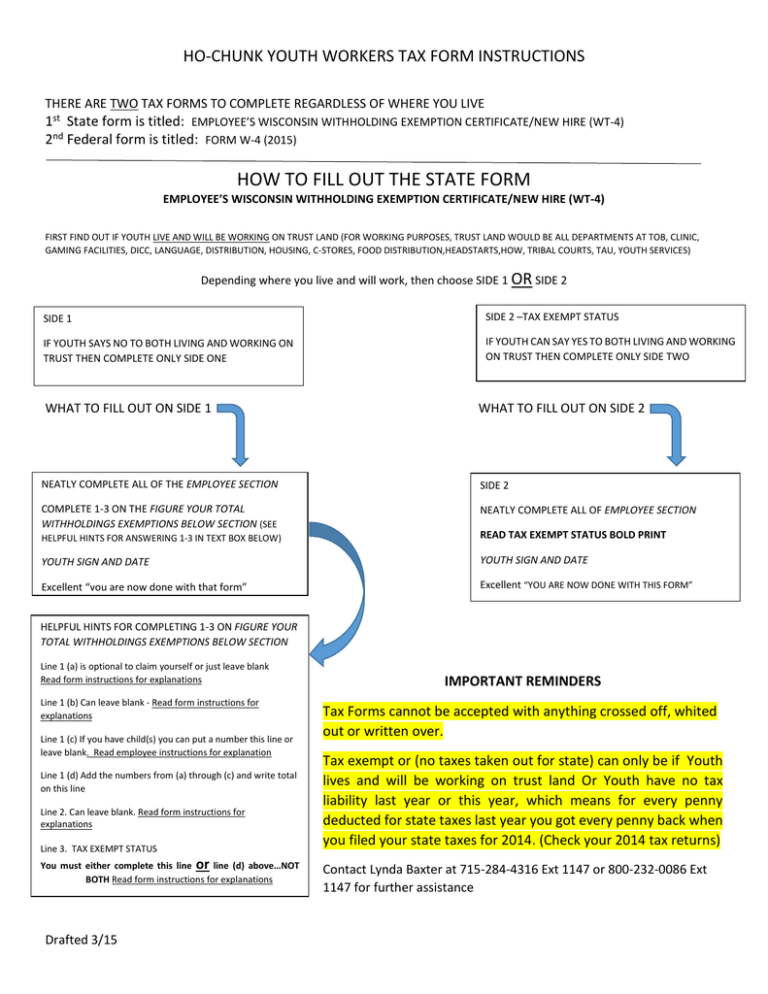

HO-CHUNK YOUTH WORKERS TAX FORM INSTRUCTIONS THERE ARE TWO TAX FORMS TO COMPLETE REGARDLESS OF WHERE YOU LIVE 1st State form is titled: EMPLOYEE’S WISCONSIN WITHHOLDING EXEMPTION CERTIFICATE/NEW HIRE (WT-4) 2nd Federal form is titled: FORM W-4 (2015) HOW TO FILL OUT THE STATE FORM EMPLOYEE’S WISCONSIN WITHHOLDING EXEMPTION CERTIFICATE/NEW HIRE (WT-4) FIRST FIND OUT IF YOUTH LIVE AND WILL BE WORKING ON TRUST LAND (FOR WORKING PURPOSES, TRUST LAND WOULD BE ALL DEPARTMENTS AT TOB, CLINIC, GAMING FACILITIES, DICC, LANGUAGE, DISTRIBUTION, HOUSING, C-STORES, FOOD DISTRIBUTION,HEADSTARTS,HOW, TRIBAL COURTS, TAU, YOUTH SERVICES) Depending where you live and will work, then choose SIDE 1 OR SIDE 2 SIDE 1 SIDE 2 –TAX EXEMPT STATUS IF YOUTH SAYS NO TO BOTH LIVING AND WORKING ON TRUST THEN COMPLETE ONLY SIDE ONE IF YOUTH CAN SAY YES TO BOTH LIVING AND WORKING ON TRUST THEN COMPLETE ONLY SIDE TWO WHAT TO FILL OUT ON SIDE 1 WHAT TO FILL OUT ON SIDE 2 NEATLY COMPLETE ALL OF THE EMPLOYEE SECTION SIDE 2 COMPLETE 1-3 ON THE FIGURE YOUR TOTAL WITHHOLDINGS EXEMPTIONS BELOW SECTION (SEE NEATLY COMPLETE ALL OF EMPLOYEE SECTION HELPFUL HINTS FOR ANSWERING 1-3 IN TEXT BOX BELOW) READ TAX EXEMPT STATUS BOLD PRINT YOUTH SIGN AND DATE YOUTH SIGN AND DATE Excellent “you are now done with that form” Excellent “YOU ARE NOW DONE WITH THIS FORM” HELPFUL HINTS FOR COMPLETING 1-3 ON FIGURE YOUR TOTAL WITHHOLDINGS EXEMPTIONS BELOW SECTION Line 1 (a) is optional to claim yourself or just leave blank Read form instructions for explanations Line 1 (b) Can leave blank - Read form instructions for explanations Line 1 (c) If you have child(s) you can put a number this line or leave blank. Read employee instructions for explanation Line 1 (d) Add the numbers from (a) through (c) and write total on this line Line 2. Can leave blank. Read form instructions for explanations Line 3. TAX EXEMPT STATUS You must either complete this line or line (d) above…NOT BOTH Read form instructions for explanations Drafted 3/15 IMPORTANT REMINDERS Tax Forms cannot be accepted with anything crossed off, whited out or written over. Tax exempt or (no taxes taken out for state) can only be if Youth lives and will be working on trust land Or Youth have no tax liability last year or this year, which means for every penny deducted for state taxes last year you got every penny back when you filed your state taxes for 2014. (Check your 2014 tax returns) Contact Lynda Baxter at 715-284-4316 Ext 1147 or 800-232-0086 Ext 1147 for further assistance HO-CHUNK YOUTH WORKERS TAX FORM INSTRUCTIONS THERE ARE TWO TAX FORMS TO COMPLETE REGARDLESS OF WHERE YOU LIVE 1st State form is titled: EMPLOYEE’S WISCONSIN WITHHOLDING EXEMPTION CERTIFICATE/NEW HIRE (WT-4) 2nd Federal form is titled: FORM W-4 (2015) HOW TO FILL OUT THE FEDERAL FORM FORM W-4 (2015) ONLY THE SECTION BELOW THE DASHED LINE TITLED THE W-4 EMPOYEE’S WITHHOLDING ALLOWANCE CERTIFICATE 2015 IS REQUIRED TO BE COMPLETED AND SUBMITTED WITH YOUR APPLICATION COMPLETE NUMBERS 1-10 NON TAX EXEMPT On Line 5 you will enter a number of exemptions from A-G (can be zero, and the lower the number the more taxes will be taken from your weekly check) ADDITIONAL DEDUCTIONS On Line 6 – Optional leave blank if nothing TAX EXEMPT The only way to claim tax exempt on #7 is with “No tax liability last year and you anticipate not tax liability this year”- which means for every penny deducted from your federal taxes last year you got every penny back. (Check your 2014 tax returns) If not Exempt leave blank YOUTH SIGNATURE AND DATE EXCELLENT “YOU ARE NOW DONE WITH THIS FORM” IMPORTANT REMINDERS Tax Forms cannot be accepted with anything crossed off, whited out or written over. Contact Lynda Baxter at 715-284-4316 Ext 1147 or 800-232-0086 Ext 1147 for further assistance . Drafted 3/15